Investment management software offers investors multiple benefits:

- more efficient recognition and management of investments’ performance and risks

- greater transparency in investments

- on-demand access to planning reports

- an improved decision-making process

- real-time analytics for investment management

- facilitated data management

- improved operational efficiency

- ensured compliance and traceability, etc.

Are you looking for a reliable software development partner? To make your decision easier, we’ve shortlisted the top 10 investment software development companies with solid experience in developing solutions for the financial services industry. Go check them out!

Top 10 Investment Software Development Companies to Keep Track of in 2026

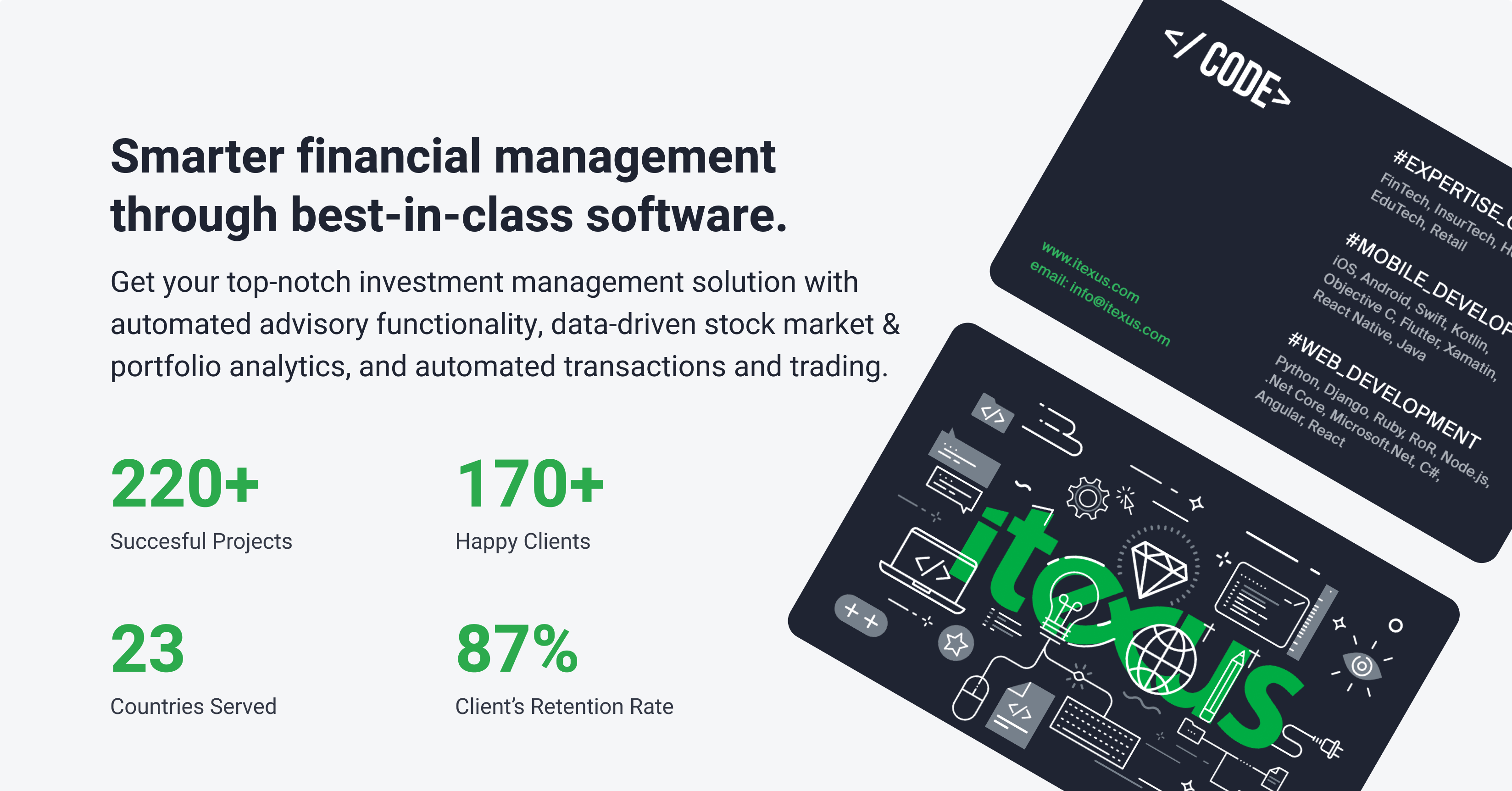

1. Itexus

If you’re on the hunt for top-tier investment software development companies, you’re in the right place. Let’s add a human touch to this list so you can truly understand what makes these firms standout players in their field.

💡 “Where innovation meets proven expertise.”

Since 2013, Itexus has delivered exceptional fintech and investment solutions for over 170 clients worldwide. From stock market analysis tools to portfolio optimization systems, their expertise knows no bounds. Imagine having legacy systems revamped, processes automated, and AI-powered insights at your fingertips—all while maintaining compliance and security standards. With Itexus, it’s not just about building software; it’s about driving growth and cutting costs seamlessly.

Why It Stands Out: They blend technology with business strategy, ensuring your solutions aren’t just functional—they’re transformative.

2. Paxent

💡 “Redefining digital transformation, one project at a time.”

Paxent prioritizes user-centric design and rapid validation through agile development. They’re the team you want when you need to align your software with customer expectations—seamlessly and with flair.

Pro Tip: They’re all about innovation that feels effortless, making your digital transformation journey smooth and rewarding.

3. Merixstudio

💡 “High-quality apps, tailor-made for your success.”

Need end-to-end product development or a boost to your existing engineering team? Merixstudio has your back. Whether it’s web or mobile applications, they’ll craft something that not only works but wows.

What’s Cool: They’re pros at blending into your in-house team to make collaboration feel natural and friction-free.

4. Code&Pepper

💡 “Your go-to fintech partner.”

Think of Code&Pepper as the team that doesn’t just develop your fintech product but also provides a full framework for success. If you lack in-house expertise, this crew will fill the gap—and then some.

Why You’ll Love Them: They focus on the entire product lifecycle, ensuring every aspect is polished and effective.

5. Spire Digital

💡 “Turning ideas into innovations.”

Spire is all about crafting business-critical applications that not only perform but excel. With a focus on operational efficiency, increased revenue, and market share, they’re the partner you didn’t know you needed.

Insider Insight: Their knack for aligning with your business goals makes them a standout.

6. Saritasa

💡 “Innovation without limits.”

From mobile apps to IoT solutions, Saritasa integrates complex technologies effortlessly. Picture VR, AR, and AI solutions tailored to your investment needs—delivered with speed and precision.

Why It Matters: Their versatility ensures they can adapt to virtually any challenge.

7. BairesDev

💡 “Outsourcing with a personal touch.”

Whether you’re a startup or a multinational corporation, BairesDev provides end-to-end solutions. They specialize in building managed teams that fit seamlessly into your projects.

Standout Factor: Their operational support and testing services make them a trusted partner for scaling businesses.

8. DOOR3

💡 “Where strategy meets technology.”

DOOR3 goes beyond software development—they’re your strategic partner. Their expertise spans development, UI/UX design, and robust technology strategies.

Why Pick Them: They’re reliable, delivering projects on time and within budget, every time.

9. The Software House

💡 “Efficient, reliable, innovative.”

Hailing from Poland, The Software House excels in custom application development. Their team of experts ensures your product is done right—and on schedule.

Pro Tip: They’re particularly great for CTOs who need a trustworthy extension of their own teams.

10. Capital Numbers

💡 “Award-winning expertise at scale.”

With a massive team of over 500 experts, Capital Numbers helps global brands grow and innovate cost-effectively. From software development to team scaling, they handle it all.

Highlight: Their extensive track record with reputable global brands ensures you’re in good hands.

*This is, for sure, not a complete list of seasoned Investment software development companies, but fairly enough to get the concept of what the software service market looks like.

How to Choose an Investment Management Solution Development Company?

Another question is how to choose a vendor, as finding the right partner is crucial to the success of the project. What should be considered? What are the most important points? What do you need to pay attention to? You may have asked yourself all these questions while searching the Internet for a reliable development partner. Luckily, we have a list of some essential points you should consider when looking for a financial software development company.

1. Industry-Wise expertise

If you want your superior solution to be delivered on time and on budget, it is advisable to look for a fintech software development company that has the relevant experience in creating and launching financial solutions for different markets using the latest technologies. Inquire if the shortlisted companies have a proven track record of creating investment management solutions. You can also ask for a reference and evaluate the company’s portfolio.

2. Effective Communication Skills

It all comes down to whether or not the company can establish effective and comfortable communication to provide the necessary foundation for effective collaboration in the future. Choose a company that is close to your mentality and can easily understand your concerns and doubts to address them properly.

3. Reviews on Trusted Resources

Most software development companies have reviews on third-party resources like Clutch or Designrush. Usually, all reviews on these platforms are verified by the sites’ admins, so there is no possibility of falsifying the testimonials. Checking the reviews is very helpful when it comes to deciding between shortlisted software development companies.

Examples of Investment Management Solutions

There are plenty of custom investment management solutions that your development partner can create for you. The architecture, design, and feature set will depend upon your specific needs and goals. Let’s take a few examples of investment management solutions that Itexus engineers have developed. You may find some of the ideas quite innovative, so get ready to gain some insights for your project.

✅ Investment Management Platform

The Itexus team developed a private investor portal for an established investment firm based in Atlanta (GA). Featuring automated aggregation of financial data and visualization tools, the portal provides a complete overview of an investment portfolio, generates semi-annual and year-end reports, and supports secure integration with file hosting and reporting services.

For all further details on this project, please refer to the original case study.

✅ Stock Trading Bot

Another example of investment management software is an algorithmic intraday stock trading system developed by Itexus engineers for a wealth management company with 20 years of experience and its own stock trading strategy. The system, in its essence, is a stock trading bot that allows investors to connect their brokerage account and configure trading strategy parameters such as buying power, leverage, risk level, etc. and automatically execute trading from their account for a commission and subscription fee.

All other details about this project can be found in the original case study.

✅ Centralized Platform for Trading Over-the-Counter Securities

One more interesting solution developed by the specialists at Itexus is a centralized platform for trading over-the-counter securities. The platform brings together holders and investors, allowing them to bypass intermediaries and trade assets easily and quickly. To match buy and sell orders for OTC securities within the platform, engineers have integrated the platform with the Exberry Engine.

For all other details on this project, see the original case study.

To Sum Up

As technical capabilities increase and new software emerge, investment management and alternative trading systems are becoming more precise in managing risk and increasing trading profitability. This allows users to adjust strategies and helps avoid losses before the actual investment process begins.

Itexus is always up to date with the latest trends in investment software development. Over the years, we have gained unique expertise in developing investment solutions by working with startups and established companies. Want your investment firm to benefit from the power of modern technology? Contact us to find out how our specialists can make your vision a reality.