White-Label Digital Wallet Solution – Secure & Scalable FinTech Platform

Use ready-made modules like Wallet Core, Payments, Rewards, Crypto, and AI to assemble a solution that matches your brand. Reduce time to market by 50–70% compared to custom builds.

Why Choose Our White-Label Digital Wallet Solution

Build your own solution on a modular, composable foundation. Assemble Wallet Core, Payments, Rewards, Crypto, AI, and more so the product fits your vision.

Accelerate delivery with prebuilt modules and an API-first stack. Launch a branded wallet or banking app quickly without rebuilding the core.

Apply your logo, colors, and typography tokens. Ship white-label builds for iOS, Android, and Web. Brand emails and push notifications.

Grow feature by feature with maps, loyalty, PFM, crypto, and local payment methods. Use horizontal scaling of services and ship continuous releases without platform migration.

Apply bank-grade protection and workflows out of the box. Use encryption, MFA or biometrics, device binding, fraud monitoring, PCI DSS alignment, and KYC or AML.

Leverage Itexus’ fintech delivery expertise from discovery and customization to deployment, SLAs, and continuous optimization.

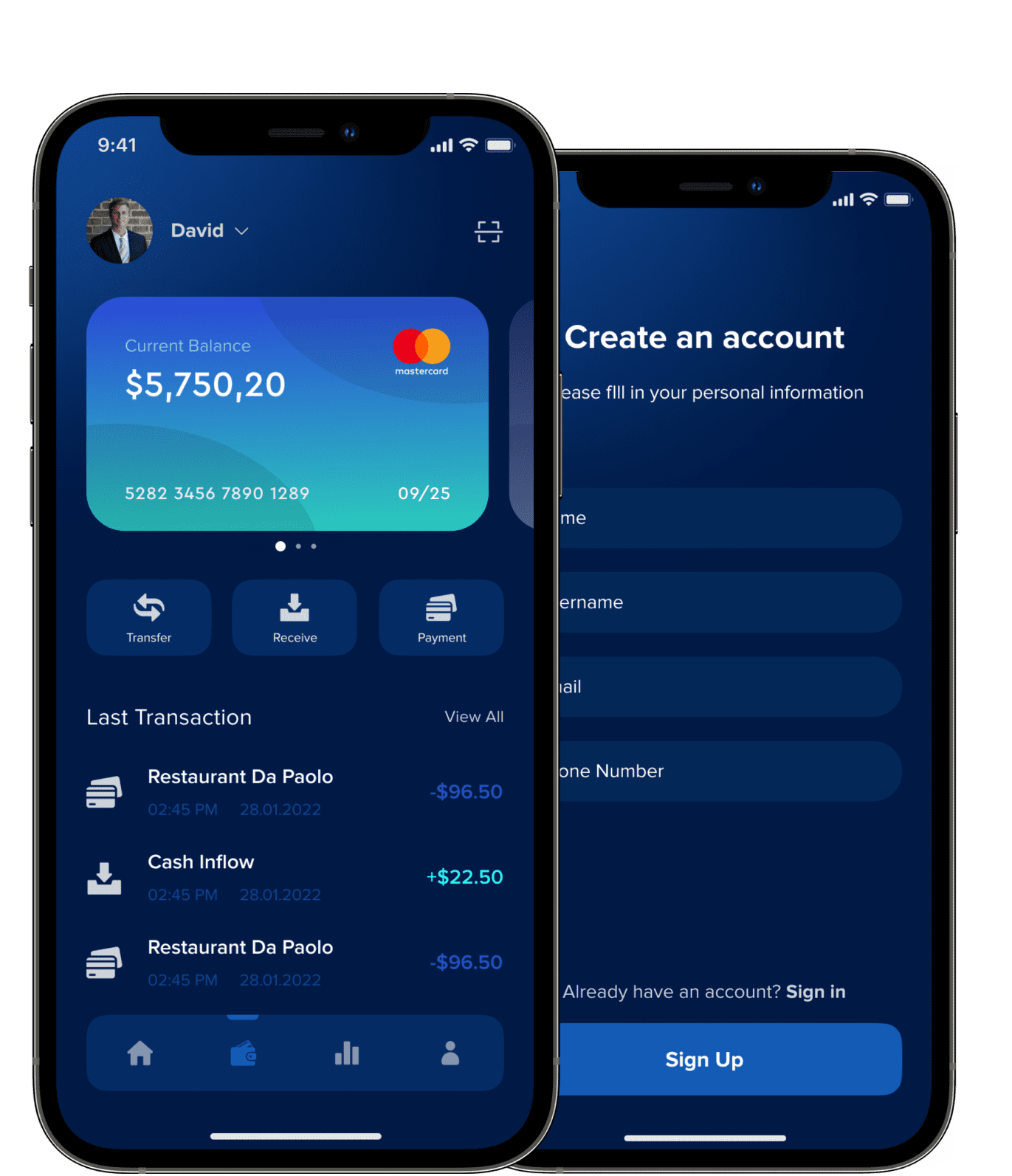

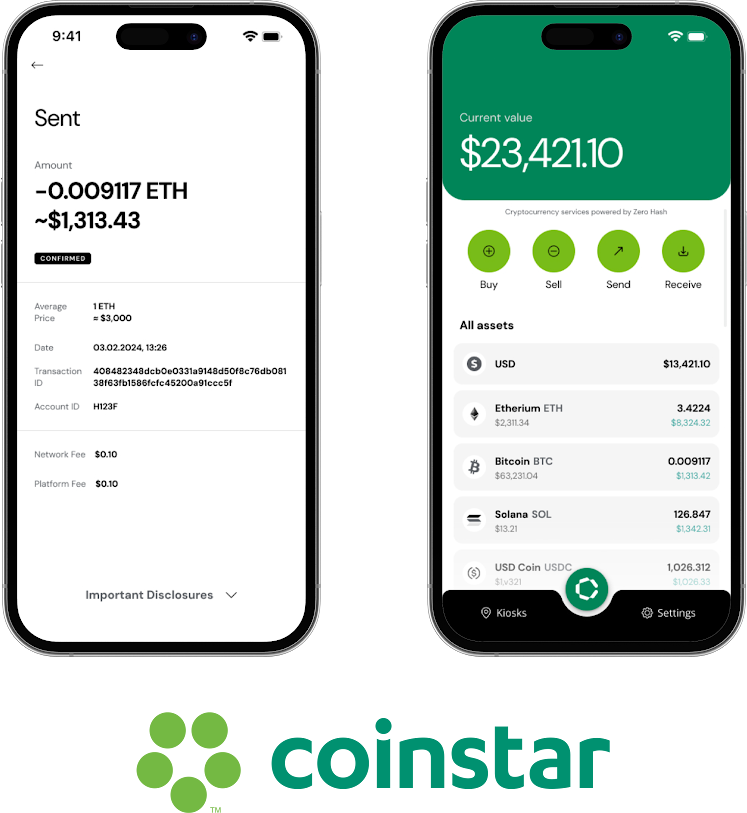

Our Digital Wallet Development Projects

PCI DSS-compliant application ecosystem for Coinstar, a leading international fintech company with $2.2 billion in annual revenue. This ecosystem features web and mobile crypto wallets, embedded kiosk software, and a cloud-based API server, enabling users to trade cryptocurrencies and over 50 digital assets, make crypto payments, and link their bank accounts for fiat-to-crypto conversions.

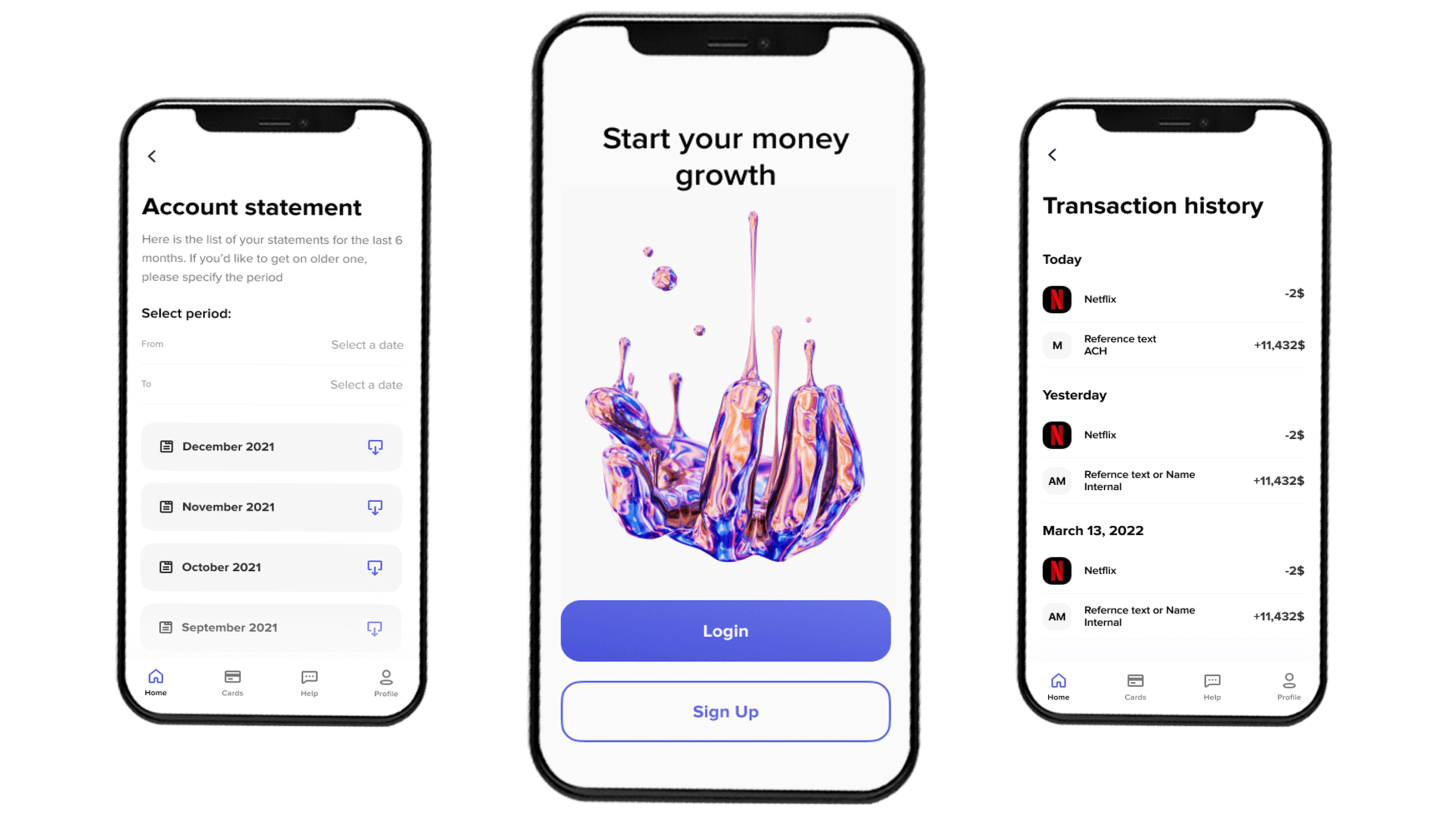

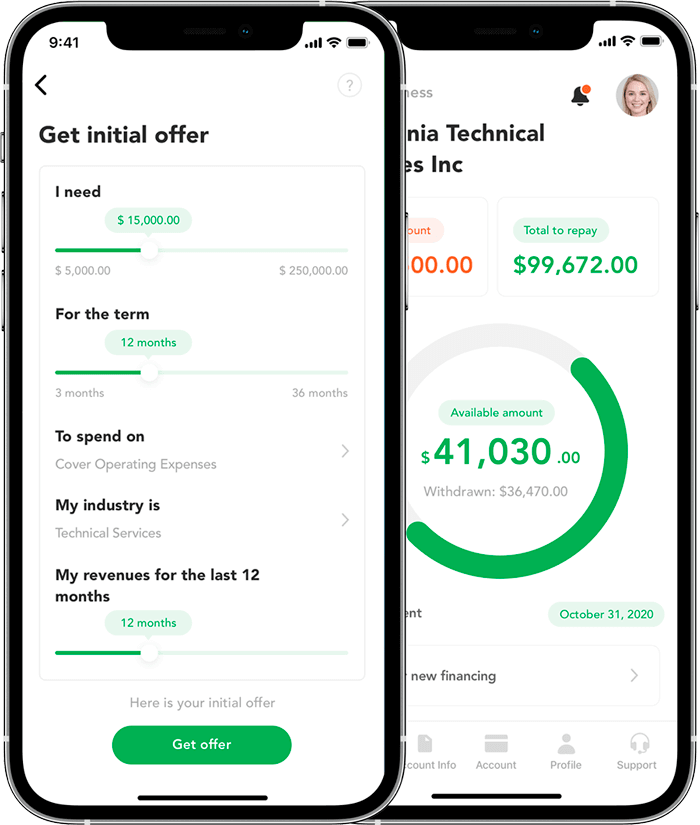

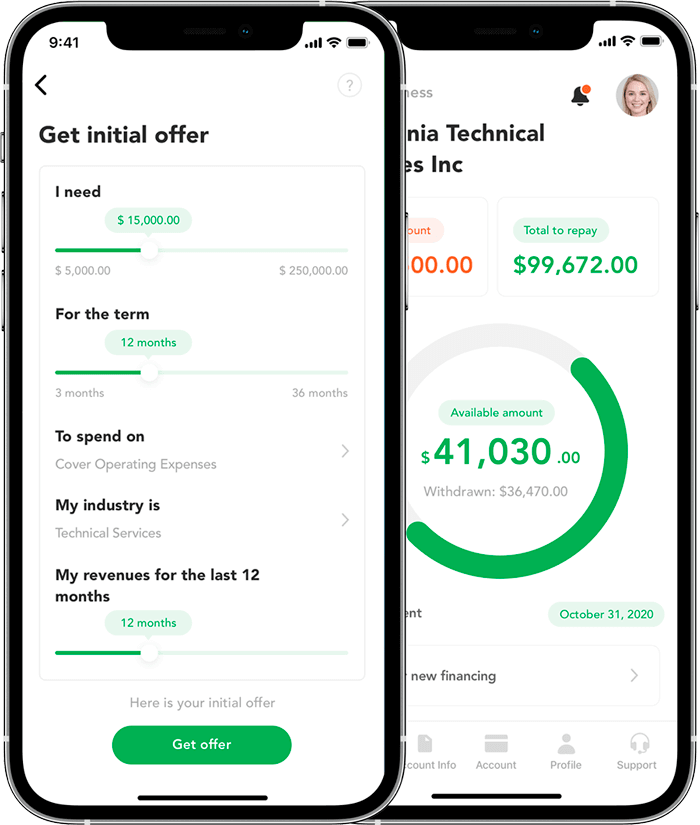

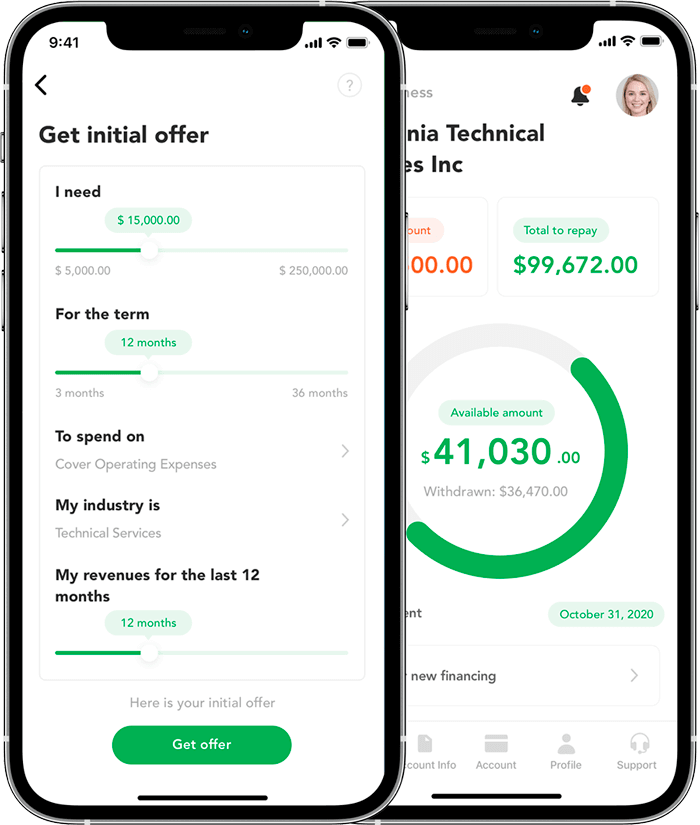

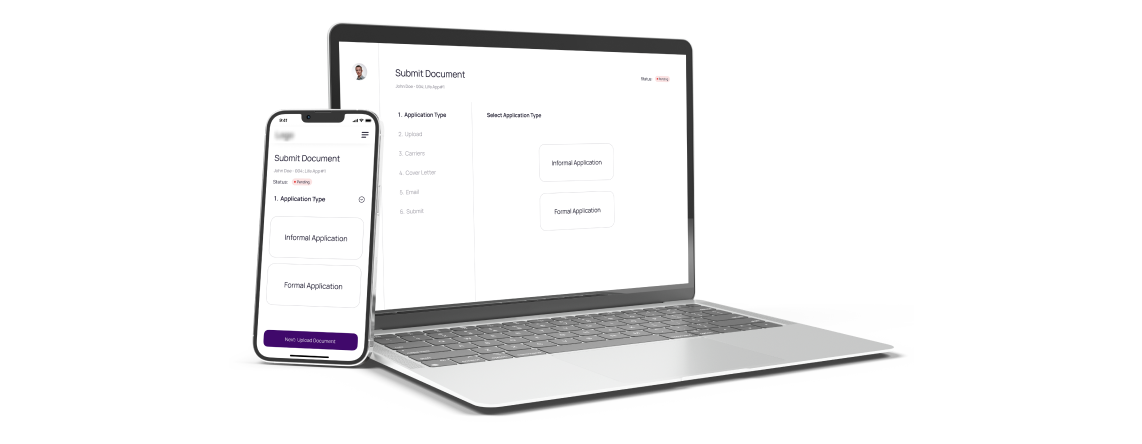

A white-label mobile banking application for a Silicon Valley-based digital banking services provider.

Features of the White-Label Digital Wallet Solution

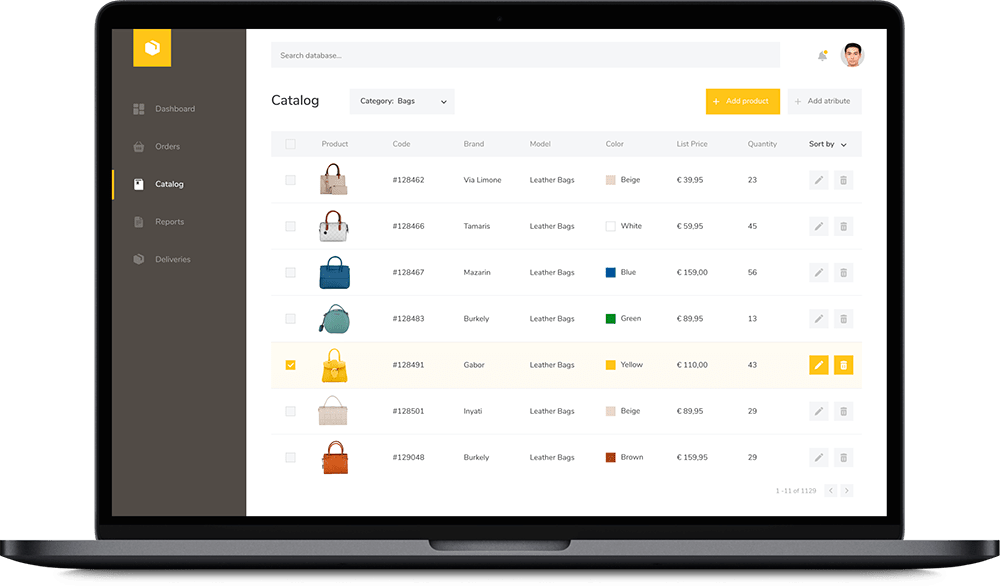

Our solution gives you a flexible set of components to create the wallet you need. Our solution includes a robust set of features to satisfy both end-users (your customers) and your business administrators.

Manage multiple fiat and crypto balances in one unified wallet. Users can view accounts at a glance, switch between currencies, and perform secure in-app transfers.

Enable seamless peer-to-peer payments, merchant transactions with QR or NFC, and bill payments. Support instant internal transfers or external rails integration.

Offer multiple on-ramp and off-ramp options such as bank transfer, card top-up, direct deposit, or mobile check capture. Users can withdraw funds to linked bank accounts, cards, or ATMs.

Integrate cashback, bonus points, and referral programs directly into your wallet. Configure rules, tiers, and campaigns from the admin console.

Give users a clear view of their spending behavior through categorized transactions, analytics, and smart budgeting tips powered by AI.

Protect every account with multi-factor authentication, biometric logins, device binding, and fraud monitoring. Built-in PCI DSS alignment, KYC or AML integration, and data encryption provide enterprise-grade security.

Let’s build the future with AI

Development

Leverage tools like Cursor AI for code generation, optimization, and real-time collaboration, accelerating development cycles.

Use AI-powered design tools for rapid UI/UX prototyping, style suggestions, and accessibility enhancements.

QA

Deploy AI-based test automation to detect bugs, predict failures, and optimize test coverage with machine learning.

Automate CI/CD pipelines, monitor model performance, and optimize cloud costs with AI-driven anomaly detection.

Extract insights from contracts, invoices, and PDFs using OCR and NLP, reducing manual effort by 70% (as showcased in our fintech case studies).

Build GPT-4-powered assistants for customer support, sales, and internal helpdesks with natural language understanding.

Implement ML models for demand forecasting, risk assessment, and personalized recommendations (e.g., credit scoring, trading signals).

Governance

Ensure transparency with bias detection, explainable AI (XAI), and compliance frameworks for secure, responsible deployments.

What if your branded wallet could ship in as little as 3 weeks?

With our modular white-label platform, skip heavy groundwork and go to market faster. The solution is fully customizable, compliant, and scalable.

Industry Use Cases: Versatile Solution for Various Sectors

Banks & Financial Institutions

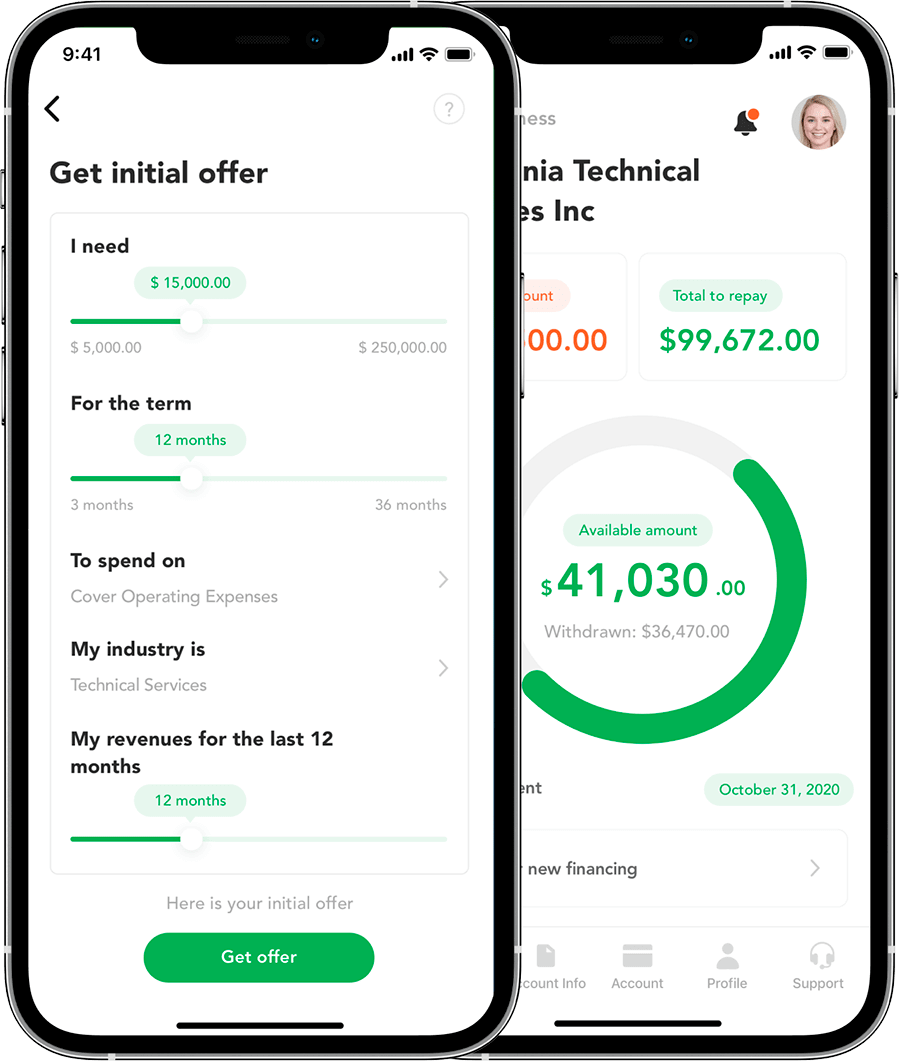

Quickly launch a bank-branded mobile wallet to enhance your digital banking services. Offer customers instant P2P transfers, contactless payments, and mobile banking features within a single app. This drives higher customer engagement and provides a modern, fintech-like experience under your trusted brand.

FinTech Startups & Neobanks

Kickstart your fintech venture with a ready-made e-wallet core. Instead of spending a year building backend infrastructure, focus on acquiring users and innovating on features. Our solution gives startups a fast, compliant foundation – from digital banking and payments to crypto – that can be customized as your product evolves.

Cryptocurrency & Digital Assets

If you’re a crypto exchange or a financial services company entering digital assets, use our wallet as a secure crypto-fiat wallet for your users.

They can manage crypto assets alongside traditional currency, enabling easy swaps and purchases.

Our proven experience with crypto wallet development ensures support for blockchain integrations and robust security measures for handling digital assets.

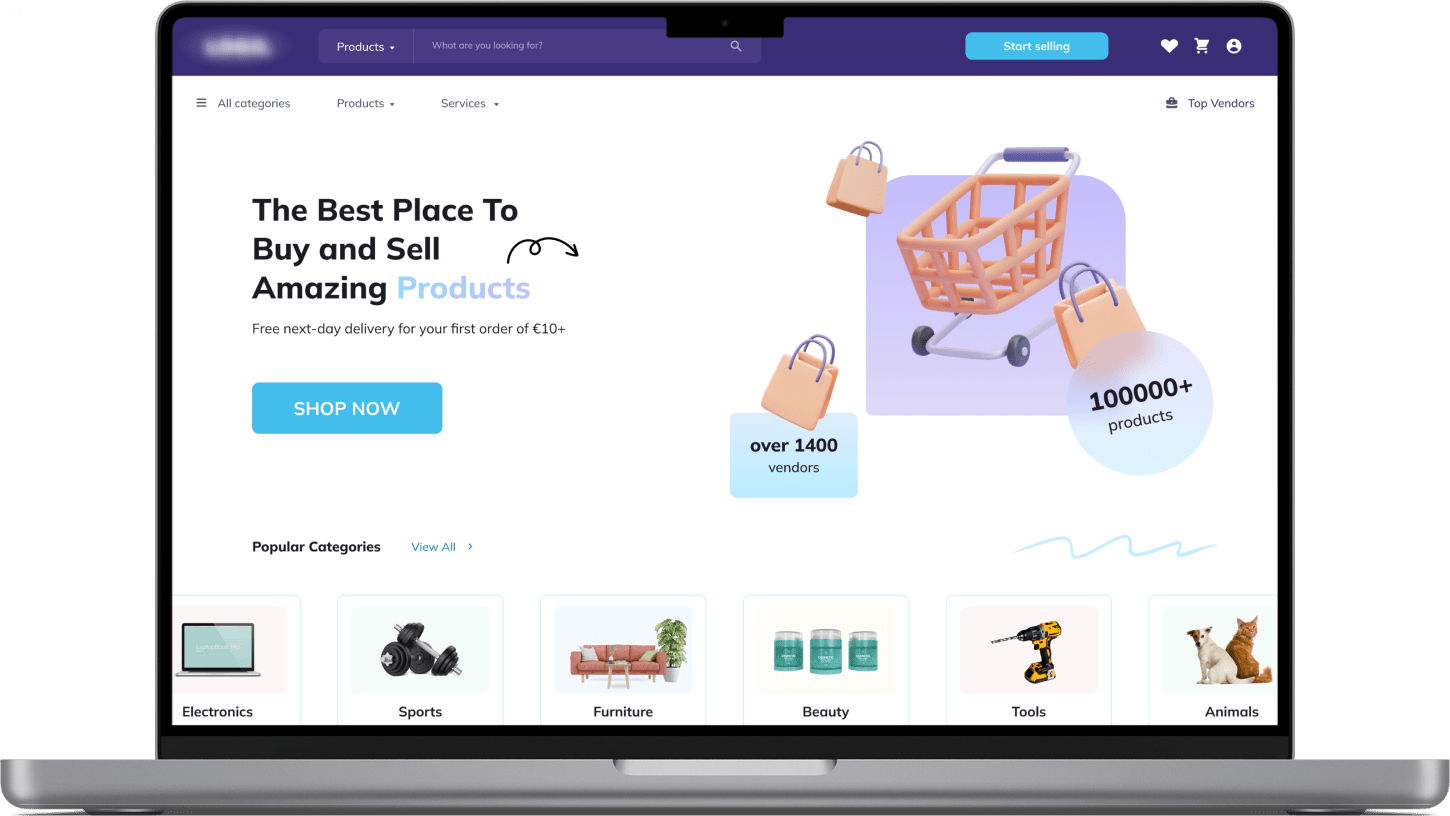

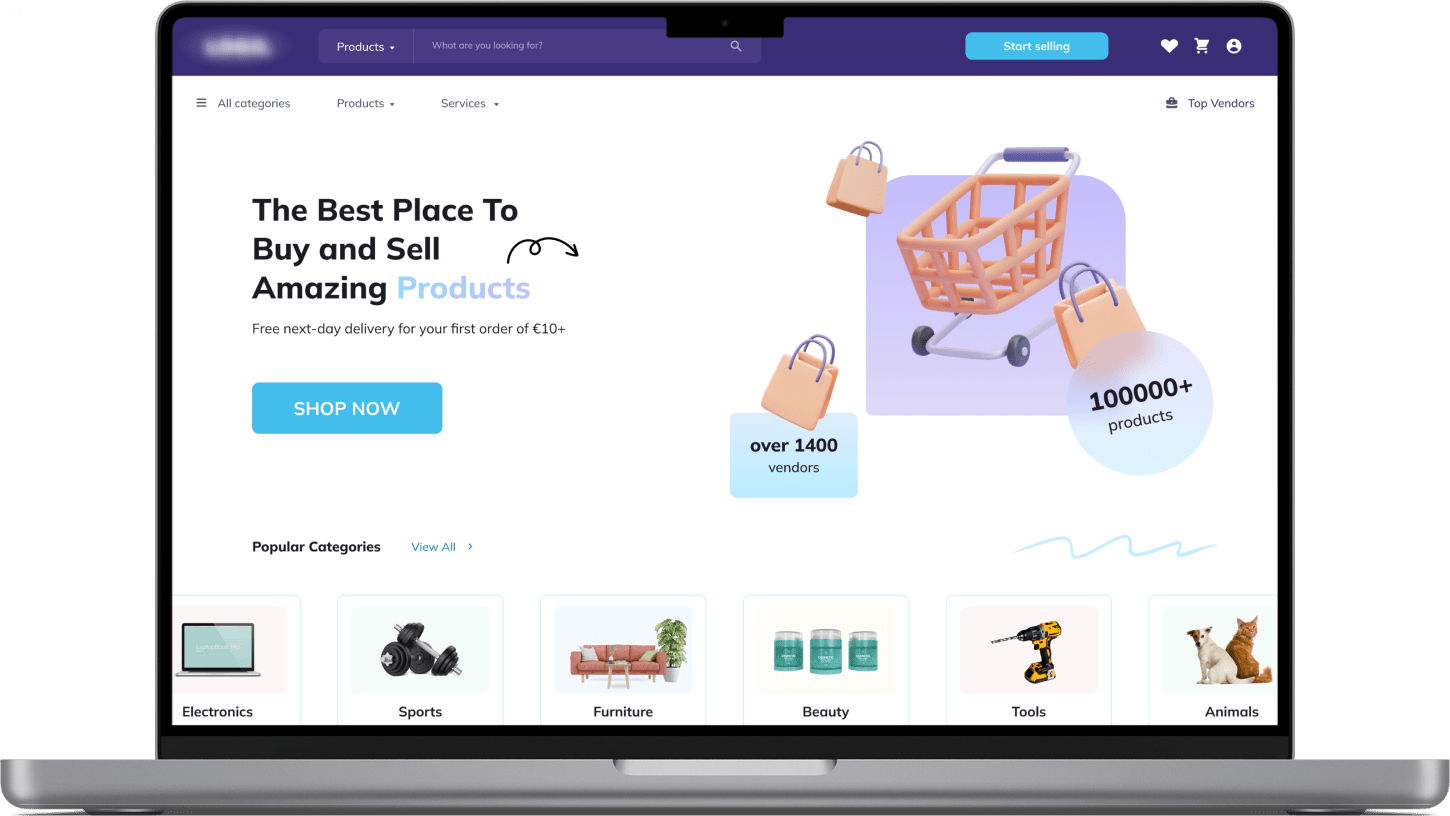

Retail & E-Commerce

Enhance your retail business or online marketplace with an integrated wallet for payments and loyalty.

Customers can save payment methods, earn and redeem loyalty points, and checkout faster, increasing conversion rates.

A digital wallet also opens opportunities for closed-loop payments (e.g. gift cards, store credit) and deeper customer insights for your business.

Travel & Hospitality

Create a unified travel wallet for your airline, hotel chain, or travel app. Travelers can store travel credits or points, make bookings or in-destination purchases, and receive rewards.

A wallet streamlines payments for bookings, tickets, and even on-site services (like hotel upgrades or airline meals), while tying into your loyalty program to encourage repeat business.

Customizable, Compliant, and Extendable

Our white-label wallet isn’t a one-size-fits-all black box – it’s a flexible fintech ecosystem you can make your own. We ensure every deployment is fully compliant with financial regulations (e.g. PCI DSS for payments, GDPR for data privacy) and tailor it to your use case. We’ll brand, customize, and enrich your app with advanced features so that you get a tailored, seamless workflow specific to your business needs.

Offer your users branded virtual or physical cards linked to their wallet balance. This enables them to spend their funds anywhere (online or in-store) via card networks. Our platform can integrate with card processors to support instant virtual card creation, card management (freeze/unfreeze), and spend controls – expanding your wallet into a full payment solution.

Ready to ride the crypto wave? We can integrate cryptocurrency wallets and exchange features into your app. This allows users to buy, sell, and hold cryptocurrencies in the same wallet, view real-time crypto balances, and even swap between crypto and fiat. With secure blockchain integrations and compliance (KYC/AML) in place, you can tap into the digital asset market confidently.

Boost user engagement by incorporating loyalty points, cashback, and rewards. We can customize the wallet to track reward points on purchases, enable in-app redemption of offers, and integrate with your existing loyalty program or create a new one. A built-in rewards wallet keeps customers coming back and increases their lifetime value.

Differentiate your fintech app with smart features. Leverage AI-driven analytics to provide users with spending insights, savings recommendations, or even chatbot-based financial advice. For example, the wallet can notify users about unusual spending, suggest budgeting tips, or forecast their bill payments – enhancing user experience and stickiness through personalization.

Planning to launch globally or in specific regions? We can localize the app to support multiple languages and currencies, and adapt to local payment methods or regulations. Deliver a familiar experience to users across different markets, all on one platform.

We have the right one for you! Tell us about your goals, and we’ll help you achieve them with our secure white-label wallet platform. Get a Free Consultation and find out how we can tailor the solution for your business needs.

Ready to transform your idea into a cutting-edge white label digital wallet application?

Ready to transform your idea into a cutting-edge white label digital wallet application?

FAQ

What is a white-label digital wallet solution?

A white-label digital wallet solution is a ready-made fintech platform that can be branded and customized with your own company’s name, logo, and features. This lets you offer a robust wallet app quickly without building everything from scratch.

Does the Itexus wallet support both crypto and fiat currencies?

Yes. Our wallet platform can be configured to handle multiple fiat currencies and cryptocurrencies. You can enable crypto storage, exchange, and payments alongside traditional currencies depending on your business needs.

How long does it take to launch the wallet?

Most clients can launch their wallet within a few weeks, depending on how much customization and third-party integrations are required. Our rapid implementation process ensures you get to market faster than building a wallet from scratch.

Can I integrate my digital wallet with existing payment gateways?

Absolutely. Security and compliance are top priorities. Our platform supports PCI DSS compliance, robust encryption, multi-factor authentication, and KYC/AML workflows. We help you meet relevant regional and international regulations.

Can I customize the wallet’s appearance and features?

Yes. We offer full branding (logo, color scheme) and modular features. Whether you need loyalty programs, virtual card issuance, cryptocurrency support, or an AI-powered assistant, we tailor the wallet to match your unique requirements.

Does it integrate with existing systems (e.g., core banking, payment gateways)?

Yes. Our platform has flexible APIs that allow seamless integration with banking systems, payment processors, CRM tools, and other services. We’ll help you set up any needed integrations to streamline operations and data flow.