Itexus delivered the app according to the requirements. The team met all development milestones and deliverables. They were efficient, friendly, and cooperative. Itexus team was very timely with updates, a regular meeting cadence, and ad-hoc questions and answers via Slack. The team was very responsive and still is.

FinTech Consulting Services

We help fintech providers and financial companies turn business challenges into growth opportunities through smart technology and years of FinTech expertise.

As technologies dramatically reshape the financial industry, digital transformation has become a critical success factor. According to Cornerstone Advisors’ study, 3/4 of banks and financial institutions have launched a digital transformation initiative recently. Another 15% plan to develop a digital transformation strategy in the nearest time.

Investing in financial services technology consulting enables companies to meet the growing demands of their customers, increase profitability, reduce operating costs, and identify new opportunities for growth. Whatever solution you’re working on, Itexus fintech global consultants are here to help you get a tech edge.

Fintech Consulting Services We Offer

Mobility

Now, when more than half of Internet traffic comes from mobile devices and the number of active mobile Internet users has surpassed 4.4 billion, it is critical for businesses to embrace mobile technology. By developing engaging and feature-rich mobile apps, we help businesses increase their ROI, reduce customer service costs, and increase customer loyalty by enhancing their experience.

- mobile payments

- digital lending and alternative financing solutions

- digital banking

- personal finance assistants

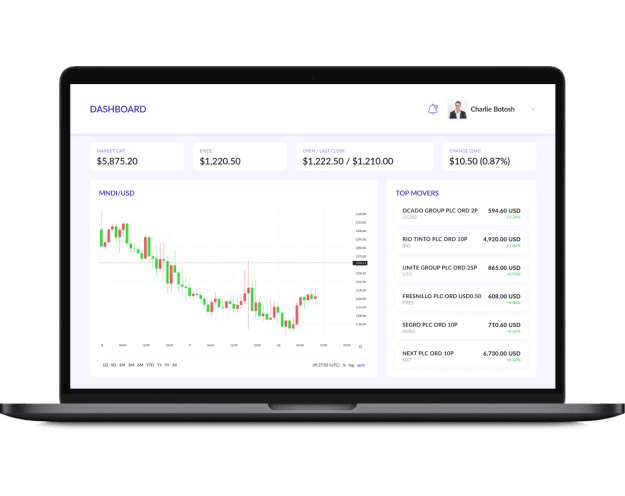

- investment & stock trading apps, robo-advisors

- insurance apps

- tax filing and management apps

Business Intelligence & Analytics

As a business intelligence consultant for fintech, we help you make data-driven decisions and gain actionable insights. Leverage your traditional operational data with advanced business intelligence and analytics to drive smarter decisions and improve your bottom line.

- data warehouse and predictive analytics solutions

- operations analysis

- risk and fraud analysis

- regulatory compliance

- dashboards and advanced reporting

- performance management

- BI platforms migrations

Security

We help financial organizations to implement high-security standards to eliminate vulnerabilities, reduce security risks, and ensure the reliability of their products and services.

- security audit & a detailed report on the security gaps

- penetration testing

- compliance audit (SOC 2, PCI DSS, GDPR, ISO 27000, etc.)

- protecting against DDoS, brute force, and SQL injection and cross-site scripting attacks

- setting up secure cloud infrastructure with Wirewalls, DMZs, encrypted connections and data etc.

- selection & integration of third-party AML/KYC/FCP solutions

Tech Integrations

Leverage third-party solutions to speed time-to-market and reduce development costs. Our fintech app consulting team can help you select the most appropriate and cost-effective integrations for your product.

- payment gateways

- account aggregators

- KYC & AML providers

- bank connectors & aggregators

- virtual card providers

- traders, etc.

- brokers and exchanges

Cloud

Having hands-on experience with all modern cloud platforms, our engineers will help to turn your transition to the cloud into a fast, smooth, and secure journey.

- Amazon Web Services

- Microsoft Azure

- Google Cloud

- IBM Cloud

- audit and optimization of existing infrastructure

- building of a secure, scalable, and cost-effective cloud infrastructure from scratch

- migration of infrastructure to the cloud or moving it to another cloud platform

- Infrastructure as a Code (IaaC) implementation

- automated monitoring and backup/restore setup

Usability Audit and UX Consulting

To help you craft a stellar user experience and ensure you get the highest conversion possible, our specialists identify usability issues and provide an A to Z guide to improving the design of your solution.

- usability audit

- UX research and consulting

- A/B testing

- identifying systemic navigation and conversion issues

- product design & redesign services

Crypto

Providing financial services technology consulting we address all specific challenges and help assess the need for crypto adoption and its value for your business.

- Wallet and crypto exchange development

- ICO & STO

- dApp development

- Smart contract logic and development

Want to bring your fintech product to market sooner?

Our FinTech consulting services will help you launch faster, stay compliant, and innovate with confidence.

Fintech Consulting Deliverables

- Vision and Scope Documents

- Software Requirements Specification Document (SRS)

- Software Architecture Document (SAD)

- UI/UX design and a clickable prototype of your future product

- Detailed work breakdown structure, workload and cost estimate, and a project plan.

Our Financial Technology Consulting Services Are Recommended to:

Banks & Credit Unions

Digital transformation and process automation consulting, digital lending, credit scoring, customer analytics, digital onboarding KYC and AML solutions, mobile banking, systems integration, fraud protection, security, customer service automation, reporting and data analytics, legacy systems upgrade, investment management.

Financial Services Companies

Digital transformation and process automation consulting, wealth management solutions, investment application, customer portals, stock trading systems, robo-advisers, personal finance management, stock broker applications.

Insurance Companies

Digitalization & insurance automation, go-mobile consulting, claims management automation, legacy systems modernization & data migration, customization and enhancement of the existing insurance platforms, InsurTech.

FinTech Product Companies (ISVs)

Fintech products development, product enhancement, systems integration, security audit & improvement, cloud migration, performance improvement, code quality analysis and refactoring, user research, usability audit etc.

FinTech Startups

MVPs, feasibility study, design of the general solution architecture, fundraising materials, prototyping, requirements analysis and documentation, product management, integration analysis, proof of concept, competitors research, etc.

Venture Capitals and Tech Investors

Feasibility study, risk assessment, technical due diligence, code and architecture audit, startup consulting, competitor analysis, market research.

FinTech Accelerators & Incubators

We offer a special package for early-stage startups. It includes part-time involvement of designers and developers and, depending on the needs of a particular startup, can include discovery phase, fundraising pack creation, MVP development, proof of concept, competitive research, website design and company branding, DevOps services, merger and acquisition support, due diligence, and so on.

FinTech Center of Competence

Since fintech is our core domain, we are constantly investing in the fintech expertise of our team ensuring the on-going improvement of our services. For years, we have been building a robust internal talent pipeline by hiring specialists with university degrees in finance and economics, training them and refining their skills, investing in research, and helping them master business and technical knowledge. Now, these experts team up in the Itexus Fintech Center of Competence. This is a separate unit of seasoned fintech consulting experts involved in each project and responsible for collecting, disseminating and managing our cumulative fintech expertise.

FAQ on Financial Technology Consulting

How much does your fintech consulting services cost?

The price is custom and depends on the project scope & complexity and specialists involved. Please reach out for precise estimation – it’s free.

How does your consulting process work?

Depending on your needs and the complexity of the project, the entire process can take anywhere from a few hours to a few months. Usually, we start with a free introductory call to clarify the project details, determine the desired outcomes, assess their feasibility, and sign NDA. Then we thoroughly analyze your current financial ecosystem and processes and provide you with a step-by-step action plan aligned with your goals, timeframes, and metrics to monitor. And finally, we assemble a team of consultants, usually Software Architects and FinTech experts with relevant experience from our past projects, who perform the research and audit and create documentation according to the agreed plan.

What are the essentials while choosing a fintech consultant?

In addition to the obvious points such as a deep understanding of the specifics of your field, a proven track record, and reasonable rates, you should look for professionals with sharp communication skills and a strong work ethic who’ll be on the same page with you. We also advise you to opt for a company that offers a full cycle of fintech consulting services, so you don’t have to hire a separate employee for each new challenge.

Difference between fintech consultants and financial advisory?

In a nutshell, financial advisors help make decisions about what to do with your money, whether it’s investments, retirement planning, etc. And fintech consultants help find the best technical solution to the business challenges of financial services companies.

Are you a financial technology consulting firm or a development agency?

We are both a fintech consulting firm and a development agency with in-depth knowledge of the specifics of the fintech industry and strong hands-on experience in software design, development, and implementation.

After fintech consulting, do I have to order software development, or can I use financial services technology consulting only?

You can use consulting services only or request a consultancy before proceeding to the development phase. With the deliverables you receive as a result of our consulting services, you can either kick off a project with Itexus, go with another vendor, or pause the project until a better time.

What do you need from me to be able to start (besides an agreement in place)?

Nothing special is required – just a positive attitude and a desire to move forward. We will begin team formation as soon as the agreement is signed by both parties and Itexus has received an agreed-upon advance payment. Shortly thereafter, our fintech consultants will come back with a plan on how we can help you and what is required of you in your particular case.

How quickly can we start the consulting process?

We can usually schedule the initial consultation within a few days. Once we understand your goals and sign an NDA, our team can begin reviewing your requirements and building your roadmap almost immediately.

Clients’ Testimonials & Awards

Contact Form

and we’ll respond within 24 hours to sign an NDA and align on next steps.

with fintech consultants, solution architects, and UI/UX experts.

includes architecture, scope, UX/UI strategy, and a cost breakdown by feature.

Once approved, we sign the agreement and start consulting within 2–5 days.