Itexus delivered the app according to the requirements. The team met all development milestones and deliverables. They were efficient, friendly, and cooperative. Itexus team was very timely with updates, a regular meeting cadence, and ad-hoc questions and answers via Slack. The team was very responsive and still is.

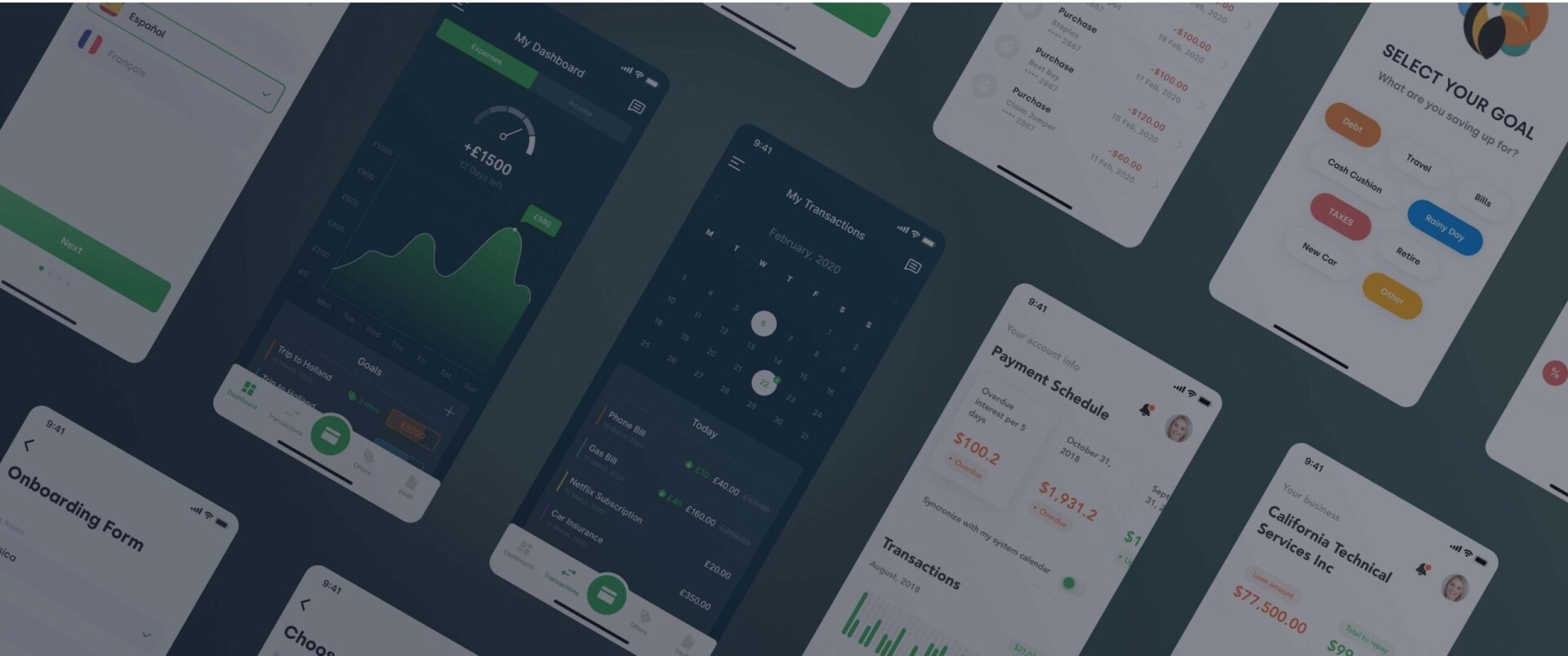

Mobile Banking App Development

Banking Apps We Build

Digital Banking Apps

Full-featured applications that provide access to traditional banking services such as checking accounts, savings, payments, and transfers via mobile or web platforms.

Crypto Banking

Apps that enable users to manage cryptocurrencies, including buying, selling, storing, and transferring digital assets securely.

Neobanking Apps

Fully digital, branchless banking apps that offer services like account management, payments, and financial planning, often with innovative features and low fees.

Custom Lending Systems

Tailored platforms for managing personal or business loans, including credit scoring, application processing, and repayment tracking.

Money Transfer Apps

Applications designed to facilitate quick and secure domestic and international money transfers with features like currency conversion and real-time tracking.

Expense Tracking Apps

Tools that help users monitor and categorize spending, set budgets, and get financial insights for better money management.

eWallets & Smart Wallets

Secure apps for storing card information and making contactless payments, peer-to-peer transfers, and online purchases with ease.

Investment & Wealth Management Apps

These apps allow users to invest in stocks, mutual funds, ETFs, or cryptocurrencies, often offering tools for portfolio tracking, risk analysis, robo-advisors, and financial planning.

Savings & Goal-Based Banking Apps

Apps focused on helping users save money toward specific goals (e.g., travel, emergency funds, education) by automating savings, setting milestones, and offering visual progress tracking.

Core Features of a Mobile Banking App

A successful mobile banking app needs a rich set of features to satisfy user expectations. Based on our fintech experience, we implement all the core features of modern mobile banking apps and can extend them with custom innovations. Below are the fundamental features you can expect in an mobile banking app developed by Itexus.

Authentication and authorization

Secure and convenient sign-in using biometric two-factor authentication (e.g., Face ID or Touch ID) for enhanced security and a seamless login experience.

Customer onboarding

Fast, convenient account setup with a digital KYC process – including personal information verification, biometrics, and ID document checks – all carried out within the app.

Account management

Enable users to open new bank accounts instantly, close accounts remotely, view account balances, perform transactions, and even share accounts (e.g., a joint family account) — all through the mobile app.

Card management

Issue virtual and physical debit/credit cards, display and share card details, and provide full control over cards (renaming, activation, blocking/unblocking, etc.). Users can also set custom spending limits or allowed merchants for their cards.

Payments & Money Transfers

Offer simple, secure, and instant payments and money transfers. Transactions are PCI DSS compliant and verified by biometrics, one-time passwords (OTP), or user passwords to ensure security. The app supports various transfer types, including peer-to-peer payments between users, ACH bank transfers, card-to-card transfers, and scheduled or recurring payments.

Transaction History & Management

Allow users to track their finances with a detailed transaction history. They can view transaction details and use advanced filters or search to quickly find specific transactions.

External payment methods management

Let users connect and manage bank accounts or credit cards from other financial institutions directly within your app. This provides a unified, convenient overview of all their finances in one place.

Bill Payments

Provide a comprehensive bill pay feature that enables users to view, organize, schedule, and pay both recurring and one-time bills right from the app. Automated reminders and notifications help users stay on top of due dates.

Personalized Dashboard

A customizable dashboard gives users an at-a-glance view of all important information. They can see real-time balances across all their accounts and cards, pending payments, recent transactions, and other key metrics in a single, convenient view.

Spending tracker

Help users monitor their spending habits with categorized transaction views and visualizations. Users can set weekly or monthly budgets and create savings goals, then track their progress directly in the app.

Digital lending

Offer an end-to-end digital loan experience with features like an in-app loan calculator and automated credit scoring. The app can handle everything from online loan applications and underwriting to data-driven decision-making, loan disbursement, and collections.

Personal manager/customer support

Integrate convenient customer support options for your users. This can include an AI-powered in-app chatbot for instant answers and a quick “request a call” feature to get help from a live representative—ensuring issues are resolved quickly and efficiently.

Notifications center

Use in-app and push notifications to boost engagement and security. Customers receive instant alerts about account activity (transactions, logins, etc.) and personalized updates or promotions. Not only do notifications keep users informed, but they also enhance security by immediately alerting users to any suspicious activity or fraud attempts.

FAQ on Mobile Banking App Development

How much does mobile banking app development cost?

How long does it take to develop a mobile banking app?

What is the technology stack for mobile banking app development?

How does the development of a mobile banking app begin?

What is your mobile banking app development process and workflow?

Can you integrate my mobile banking app with third-party services?

How do you ensure the security and data privacy of my mobile banking app?

Clients’ Testimonials & Awards

What Makes Your eWallet Successful

Ease of Use

We develop mobile banking apps with a seamless login experience, intuitive navigation, and quick access to key features like balance checks, fund transfers, and bill payments—ensuring users can manage their finances effortlessly on the go.

Secure Transactions

Security is the backbone of any banking app. Our development approach includes data encryption, biometric authentication, fraud detection, and regulatory compliance (KYC/AML), backed by regular vulnerability assessments and penetration testing to ensure trust and safety.

Superior UI/UX

A user-centric design is essential for mobile banking. We build apps that are not only visually clean and modern but also make banking tasks—like viewing statements or setting up auto-pay—simple and intuitive, leading to higher satisfaction and retention.

User Engagement

We integrate features that keep users active and loyal: real-time notifications, personal finance tools, reward programs, and chat support. These additions foster deeper user involvement and build long-term relationships with your digital banking brand.

High Discoverability

To succeed in a competitive app ecosystem, we ensure your mobile banking app is fully optimized for app store visibility. From keyword strategies to performance optimization, we help your app get noticed and downloaded by your ideal audience.