Spot Algorithmic Trading Software is a well-known application used in the financial industry to execute trades automatically based on pre-determined algorithms. This software is utilized by both institutional investors and individual traders to analyze market data, identify trends, and execute trades in a highly efficient and timely manner.

Overview

Spot Algorithmic Trading Software is designed to alleviate the need for manual trading, which can be time-consuming and prone to human error. With the use of this software, traders can automatically implement complex trading strategies without the need for constant supervision. By leveraging advanced mathematical models and real-time market data, the software can rapidly execute trades on behalf of the trader, taking advantage of even the smallest fluctuations in price.

Advantages

3.1 Increased Speed and Efficiency:

One of the primary advantages of Spot Algorithmic Trading Software is its ability to execute trades at an incredibly high speed. Unlike manual trading, which requires human intervention, this software can execute trades in a matter of milliseconds. By eliminating the need for manual order placement, the software allows traders to take advantage of market opportunities without delay, increasing overall efficiency.

3.2 Improved Accuracy and Elimination of Human Error:

Trading is a complex process that requires accuracy and precision. Humans are prone to making mistakes, especially when executing trades under time pressure. Spot Algorithmic Trading Software eliminates the possibility of human error, ensuring that trades are executed exactly as specified in the algorithm. By removing emotions and human biases from the decision-making process, the software can provide a consistent and disciplined approach to trading.

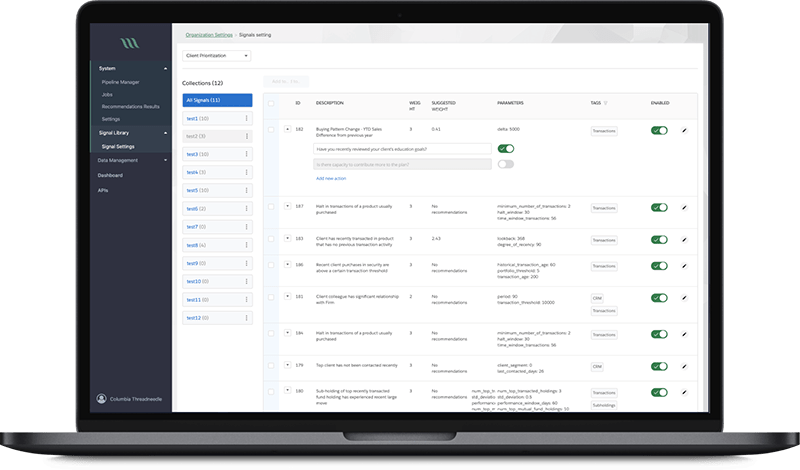

3.3 Enhanced Market Analysis and Strategy Implementation:

Spot Algorithmic Trading Software comes equipped with sophisticated algorithms capable of analyzing vast amounts of market data in real-time. By quickly identifying patterns and trends, the software can generate trading signals and execute trades accordingly. This enables traders to implement complex trading strategies, including scalping, arbitrage, and trend following, with ease. Moreover, the software can monitor multiple markets simultaneously, allowing traders to identify and act upon opportunities in different asset classes.

Applications

4.1 Institutional Trading:

Institutional investors, such as hedge funds and investment banks, heavily rely on Spot Algorithmic Trading Software to execute large-scale trades efficiently. The software’s high speed and precision make it an indispensable tool for institutional traders, who often deal with large volumes of trades across different markets simultaneously.

4.2 Individual Trading:

Individual traders, including retail investors, can also benefit from using Spot Algorithmic Trading Software. By automating their trading strategies, individual traders can avoid emotional decision-making and stick to predefined rules. This allows them to execute trades consistently and take advantage of short-term market inefficiencies.

Conclusion

Spot Algorithmic Trading Software has revolutionized the financial industry by providing traders with the ability to execute trades automatically based on pre-determined algorithms. With its increased speed, accuracy, and market analysis capabilities, this software empowers both institutional and individual traders to stay ahead in the dynamic world of financial markets. As technology continues to advance, the role of Spot Algorithmic Trading Software will undoubtedly become more prominent, shaping the future of trading in the information technology sector.