The digitalization of the modern world resulted in everyone being armored with computers and phones having the ultimate freedom to buy or order goods and services from any part of the world. We can easily send each other gift cards, pay bills for relatives and friends, pump computer game characters, get monthly or annual subscriptions, or buy sticker packs. Paying for goods and services online looks simple but in reality, any financial transactions are backed up with multiple lines of complicated code, encryption, and numerous integrations.

Stripe FinTech Development Timeline

Stripe started in 2010 as a payment platform offering its simple yet powerful API to integrate with e-commerce solutions and then matured into an international company offering multifunctional easy-to-adopt solutions for banking, insurance, loan management, and other financial spheres. During the last decade, Stripe managed to develop its own success story of multiple Stripe FinTech integration use cases with top world-leading companies like Twitter, Slack, Shopify, etc.

Nowadays, Stripe manifests itself as a payments infrastructure for the Internet and that’s what in reality it is, working with 135+ currencies and payment methods in more than 35 countries. As soon as a business integrates with the Stripe Payment system, the diverse world of other Stripe integrations helping with accounting (Stripe Invoicing), billing (Stripe Billing), tax filing (Stripe Atlas), subscription management (Stripe Dashboard), and others are opened up not to mention hundreds of Stripe custom integrations facilitating your business operations developed by the Stripe community one can find at Stripe integration marketplace. That’s why there is little space left for guessing whether businesses want to work with Stripe or not. Based on our company’s experience, the majority of inquiries for a web app or a website or platform development hold a Stripe payment integration request.

Stripe Payment Essentials

Stripe charges are flat-rated and based on the transactions only. Unlike the majority of payment gateways where fees are based on the type of card together with interchange-plus pricing, Stripe’s fee structure is transparent and easy to comprehend. It doesn’t induce annual or monthly fees. Per transaction, you pay an overall 2.9% and 30¢ in addition. The fees for business banking transactions include $5 for a received check, 1$ for an ACH credit payment, and $8 for a wire payment. Moreover, there could be some more additional charges from Stripe you’d better be ready to.

If the card is not issued by US-based banking authorities, you’ll have to pay 1% from any transaction, in case currency exchange is required, there will be an additional 1% from the sum charged. For a failed ACH direct debit transaction there is a $4 fee and a $15 fee for bounced checks, disputed transactions on Stripe-issued cards, and disputed ACH direct debit transactions.

Stripe Use Cases

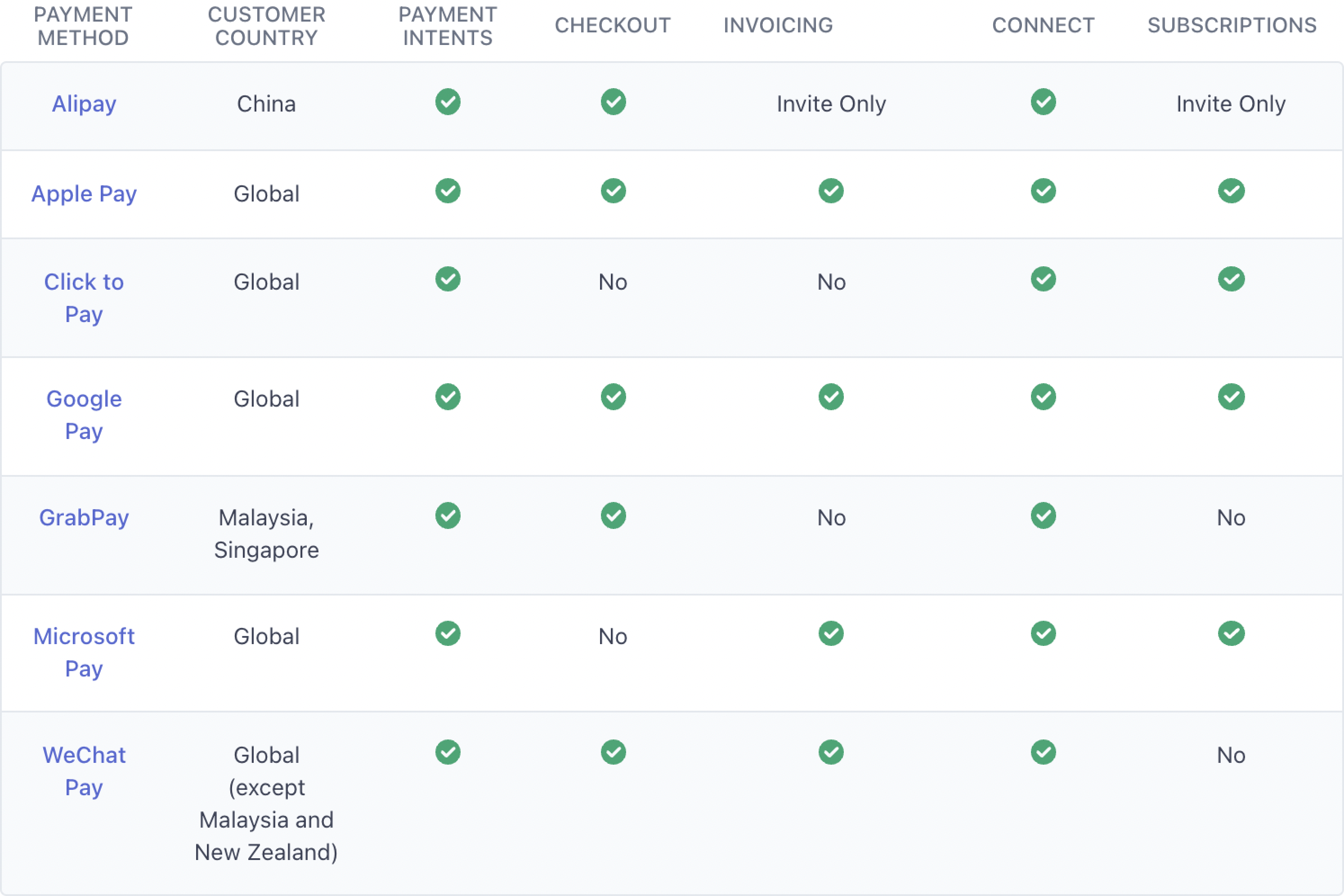

Adding Stripe Payment to Digital Wallets

Our company often gets inquiries to connect clients’ digital wallets to Stripe Payment. We can easily assist through plugin development, moreover, such Stripe fintech integration costs are not high.

In addition to the Stripe Payment integration API that is essential, Stripe comes with other useful APIs to facilitate online payments. Stripe Checkout once added helps to create a payment page and collect payments quickly which increases conversion. This is a convenient feature for companies trying to reach customers in China and other countries, where payments through e-wallets are exceptionally popular.

Stripe-Based Trading Solutions

E-commerce software owners are frequent guests in our office asking for Stripe integrations. This happens mainly due to the strong Stripe documentation and robust APIs in addition to business arrangements and partnering with the world’s leading banks allowing fast international expansion for e-commerce businesses.

In addition to standard requests for Stripe Payment integrations, our clients also ask for Stripe Connect to offer their growing audience of international clients a fast and seamless checkout experience. Although Stripe provides developers with all needed documentation and the API is powerful and easy to use, we have spotted several unexpected side effects worth mentioning.

How to Provide Smooth Integration with Stripe Connect?

- Mind cards authorization. The verification procedure takes several steps and prevents users from fraud that might result in disputes. The authorization could be done through Stripe Radar or on the stage of setup intent object construction from the backend.

- It’s better to delegate Stripe the onboarding despite the opportunity to customize it. That’s why the choice of Standard or Express versions of Connect could be the best. Note, that, unlike the Standard version that is free of charge, Express Connect charges active accounts a $2 monthly fee and 0.25% plus 25¢ for a payout sent. Also, Stripe Connect Express offers automatic tax filing for $2.99 only.

- There is never too much testing. Stemming from experience, there could be many edge cases, due to different cards, no 3D secure support, lack of enough funds, etc. All this could lead to temporary disability of users’ accounts by Stripe. To prevent this, test the system well and be attentive to users’ account updates recommended by webhooks.

To prevent fraud, we also advise our clients to consider Stripe Radar Integration. Having machine learning technologies at its core, Stripe Radar offers advanced tools against fraud and protection from disputes. It comes with 3 main plans: Radar’s machine learning with a 5¢ fee for a screened transaction, Radar Fraud Teams implying a 7¢ fee for a checked transaction, and Chargeback Protection coming with a 0.4% fee for every transaction.

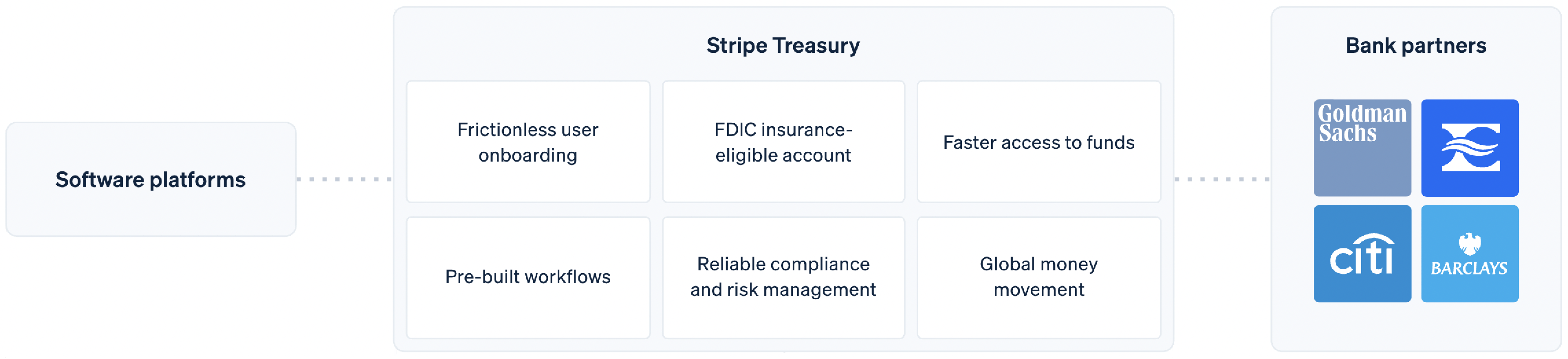

Connecting Banking-as-a-service to Platforms

Big platforms and marketplaces that are eager to increase conversion want to provide all the needed financial services right on the platform without the necessity to connect to banks.

We had an inquiry to build a platform and along the way, we suggested the client connect to Stripe Treasury which turned out to be effective and less costly because the budget for the development was quite tight. A single integration enabled platform clients with funds holding, managing cash flows, and earning interests right on the platform. Stripe provides a complete bank accounts substitution with ID verifications and KYC checks, MATCH lists checks, and sanctions screening.

Stripe Issuing integration provides the platform customers with virtual or real bank cards, that’s why our client was also interested in this option and asked to add it to the solution. Cards issued by Stripe are ideal for corporate spendings and there is no monthly fee. The creation of a virtual card costs 10¢ and the physical card being delivered to your door will cost you $3 per one card. The first 500K in card transactions included, after that you’ll have to pay 0.2% and 20¢ for a transaction. In the case of international payments, Stripe charges card owners a 1% and 30¢ for cross-border transactions, and a 1% fee additionally if currency exchange operations are required. Also, cards issued by Stripe can be easily added to digital wallets manually.

Adding Stripe End-to-end Lending API to Marketplaces

A US-based client came to us asking for a discovery phase aiming to add lending functionality to the rental marketplace they run. The platform has already been connected to Stripe Payment for over 5 years, that’s why the best solution was to empower it with a lending API through Stripe Capital. The client has asked Stripe for an invitation to use the needed lending functionality and is still on the waiting list due to the high demand for such type of service.

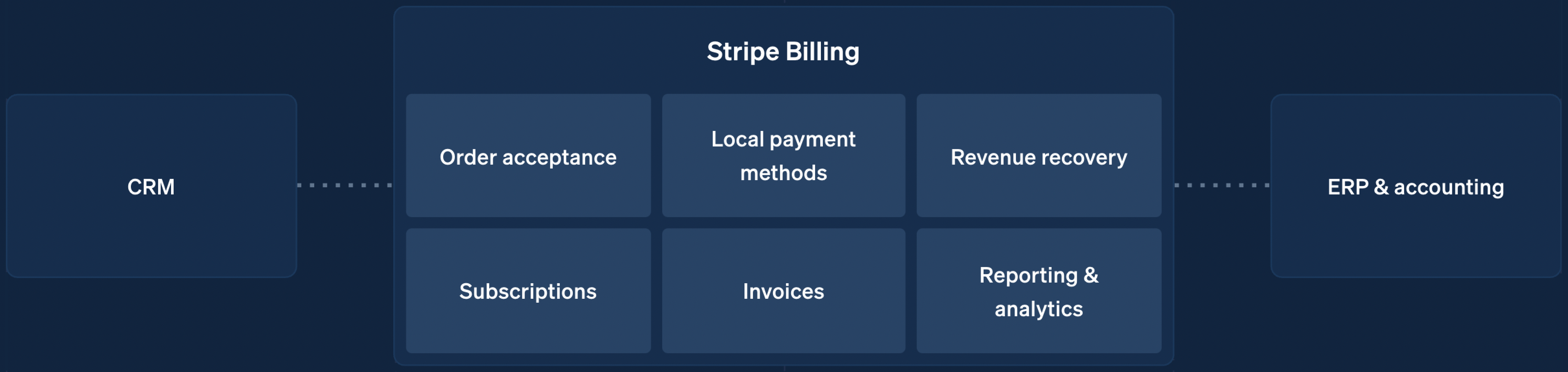

Connecting Crowdfunding Platform to Stripe

A Germany-based crowdfunding company sent us a request to optimize its functionality in terms of churn protection and increased conversion. It was quite logical to suggest our client start using Stripe, due to its strong payment API, facilitated onboarding procedure, and powerful analytics, coming with Stripe Billing. Stripe Billing allowed our client to easily set up subscriptions, recurring billing, customer portal, and automatic collection.

One of the strongest sides of Stripe Billing is machine learning targeting billing logic and customers’ behavior to prevent involuntary churn due to failed bank emails, expired cards, inability to authorize the payment with 3D Secure code, etc. Stripe takes care of it by sending automatic notifications through emails in case any other activities from the users’ side are needed. The emails could be customized to match your brand color. The fee for this integration is 0.5% on recurring payments.

3 Challenges of Stripe-Based Fintech Solutions Development

Developing Stripe-based fintech solutions can present several challenges that must be addressed to ensure a successful project outcome. Let’s explore some of the common challenges in developing Stripe-based fintech solutions:

1. Integration complexity

Integrating with Stripe APIs can be complex, especially for developers unfamiliar with the platform. Integrations can require multiple APIs, proper coordination, and configuration. Any issues with integration can lead to delays and errors in the software’s work and frustration for users.

2. Keeping up with new Stripe features

Stripe regularly adds new features and functionality to its platform. Developers need to keep up with these changes to ensure their solutions are optimized for the latest Stripe updates.

3. Technical challenges

Stripe corporate development brings complex technical challenges, including security, scalability, and performance optimization. Addressing these challenges requires specialized skills and experience that are not available in-house at some companies.

Developing Stripe-based fintech solutions requires careful planning, effective communication, and close collaboration among stakeholders to overcome these challenges and deliver a successful solution. By overcoming these challenges, companies can take advantage of Stripe’s platform and deliver innovative and user-friendly solutions to their customers.

Conclusion

Although Stripe is a revolutionary technology offering a wide range of services to businesses online, there is still much space for integration opportunities and various plug-ins creation helping companies to connect to Stripe effortlessly.

The easiest way, as well as the most cost-effective one, is to request Stripe integrations on the stage of custom software development. It leaves more time for negotiations with Stipe to get the most favorable plans and integration conditions.

Getting ready to strike the world with a handy solution operating on Stripe APIs? You are welcome to share the idea with us and we would be happy to assist you in building it.