With over 4,000 fintech software development companies worldwide, how do you spot the 1% that consistently deliver market-ready solutions?

“In financial technology, the difference between good and great isn’t in the code – it’s in the understanding of what that code means for business, compliance, and scalability.” Marc Andreessen

What is Fintech Software?

Think of fintech software as the digital wizard behind modern financial services. It transforms complex financial operations into smooth, user-friendly experiences – from cross-border payments to mobile stock trading and real-time market analysis.

Key Features of Fintech Software:

- Security: Advanced encryption, multi-factor authentication, and real-time fraud detection systems.

- Compliance: Automated KYC/AML processes and built-in regulatory reporting capabilities.

- Integration: API-first architecture supporting seamless connection with banking and payment systems.

- Scalability: Ability to handle growing transaction volumes and expand across multiple markets.

- User Experience: Intuitive interfaces with real-time updates across all devices and platforms.

Itexus Insight: Through developing numerous fintech solutions, we’ve learned that success lies in the right combination of features, not their quantity. When building a payment platform for a client from Silicon Valley, CA, USA, seamless integration with existing systems proved to be the decisive factor – saving months of transition time and eliminating customer friction. Interestingly, 60% of the fintech projects we’ve rescued failed due to poor feature integration rather than missing functionality.

Why Finding the Right Fintech Development Partner Matters

Choosing the wrong development partner costs more than money. Data shows 52% of financial institutions lost market share in 2023 due to delayed digital transformation, with failed fintech projects averaging $2.3 million in direct lose.

The hidden toll? Missed opportunities, damaged reputation, and regulatory penalties.

Yet, financial institutions working with specialized fintech developers are 3.5 times more likely to succeed. A European payment provider switched to specialized development after two failed attempts. Result? A compliant solution processing $50 million monthly, launched within six months.

What Makes Elite Fintech Development Companies Different

Elite fintech developers stand apart. They think differently. Consider the depth. A regular developer builds apps – an elite one builds business value. These companies blend technical excellence with razor-sharp business acumen, transforming complex financial challenges into elegant solutions.

Key Differentiators:

• Business DNA: Deep industry knowledge drives every decision, from architecture choices to feature prioritization

• Compliance Mastery: Built-in regulatory expertise for GDPR, PSD2, and SOX requirements

• Future-Ready Solutions: Infrastructure designed to handle 10x growth without breaking a sweat

• Innovation Culture: Proactive technology adoption balanced with proven stability

• Risk Intelligence: Sophisticated threat modeling and multi-layer security approach

Itexus Insight: Having delivered over 50 fintech solutions, we’ve learned that technical skills alone never guarantee success. Our most successful projects always started with deep business analysis. Take our recent digital banking platform – we identified potential scaling challenges before writing a single line of code, saving our client millions in future restructuring costs.

Essential Evaluation Criteria

Finding your perfect match? Look deeper. Smart evaluation saves millions.

When selecting a fintech development partner, you need more than just technical prowess – you need a proven track record of turning financial complexities into market successes.

Top executives focus on these critical markers:

- Battle-tested fintech experience with similar products (Ask for case studies!)

- Verifiable compliance wins across multiple jurisdictions and regulatory frameworks

- Modern tech stack mastery, especially in cloud-native and API-first architectures

- Senior-heavy team structure with dedicated fintech architects and security experts

- Clear, documented communication protocols with 24/7 access to key team members

- Bank-grade security practices with regular third-party audits

Itexus Insight: Through countless partnerships, we’ve noticed a pattern – clients who thoroughly evaluate these criteria typically complete projects 40% faster. Recently, a payment gateway client chose us specifically for our compliance expertise. Result? Zero regulatory hiccups and market launch two months ahead of schedule.

Top 10 Fintech Software Development Companies Compared

Let’s cut through the noise. Finding your perfect match matters. Here’s an honest, data-driven comparison of top fintech development powerhouses that consistently deliver results.

| Company Name | Core Expertise | Team Size & Location | Tech Stack | Average Project Cost |

| Itexus | • Digital Banking & Payment Systems• Wealth Management Solutions• Financial Risk Management• RegTech & Compliance Systems• Investment & Trading Platforms | • 160+ Engineers• 70% Senior-level Developers• EU Development Center• US/UK Business Presence• Dedicated FinTech Division | Primary:• Node.js, Python, Java• React/Angular• AWS/Azure Cloud• KubernetesSecurity-specific:• HashiCorp Vault• OAuth 2.0• SSL/TLSFinTech-specific:• Plaid Integration• Stripe• Bloomberg API | • MVP Development: $50K – $150K• Mid-size Projects: $150K – $500K• Enterprise Solutions: $500K – $1M+• Flexible Engagement Models |

| Relevant Software | • Fintech• Banking Solutions• Payment Systems | • 150+ Engineers• Ukraine HQ• EU Presence | • Node.js• React/React Native• Python• AWS | $50K – $250K |

| Appinventiv | • Digital Banking• Blockchain• Mobile Fintech | • 1000+ Engineers• India HQ• Global Presence | • Flutter• React Native• Node.js• Blockchain | $75K – $400K |

| SDK.finance | • Core Banking• Payment Solutions• Digital Banking | • 50+ Engineers• EU Based• UK Presence | • .NET Core• Angular• Microservices• Azure | $100K – $500K |

| NetSuite | • ERP Solutions• Financial Management• Payment Processing | • 2000+ Engineers• US HQ (Oracle)• Global Teams | • Oracle Stack• Java• Cloud Native• AI/ML | $500K – $2M+ |

| TSH.io | • Digital Banking• Fintech Products• Payment Systems | • 200+ Engineers• Poland HQ• EU/US Presence | • Node.js• React• Python• Cloud Native | $75K – $350K |

| Teacode.io | • Fintech Solutions• Digital Banking• Payment Systems | • 50+ Engineers• Poland HQ• EU Focus | • Ruby on Rails• React• Node.js• AWS | – |

| Intellias | • Digital Banking• Lending Solutions• Payment Systems | • 2000+ Engineers• Ukraine/Poland HQ• Global Presence | • Java• .NET• Cloud Native• AI/ML | $200K – $1M |

| N-iX | • Banking Solutions• Trading Platforms• RegTech | • 1800+ Engineers• Ukraine/Poland HQ• US/UK Presence | • Python• Java• AWS/Azure• Blockchain | $150K – $800K |

| DataArt | • Capital Markets• Digital Banking• Insurance Tech | • 4000+ Engineers• US/UK Offices• Global Teams | • .NET• Java• Python• Cloud Native | $300K – $2M |

| Miquido | • Mobile Banking• Payment Solutions• WealthTech | • 200+ Engineers• Poland HQ• EU Focus | • Kotlin• Swift• React Native• Node.js | $100K – $500K |

| Softjourn | • Payment Systems• Card Solutions• Banking Tech | • 200+ Engineers• Ukraine/US• EU Presence | • .NET• Java• Python• Cloud Native | $150K – $700K |

| Exadel | • Digital Banking• Investment Tech• InsurTech | • 2500+ Engineers• US HQ• Global Teams | • Java• .NET• React• Cloud Native | $250K – $1.5M |

| Sigma Software | • Banking Systems• Trading Platforms• Payment Tech | • 1500+ Engineers• Sweden/Ukraine• Global Presence | • Java• Python• React• Cloud Native | $200K – $1M |

| ScienceSoft | • Banking Solutions• Payment Systems• Risk Management | • 700+ Engineers• US HQ• Global Teams | • .NET• Java• Python• AI/ML | $150K – $800K |

| Andersen | • Digital Banking• Investment Tech• Payment Systems | • 3000+ Engineers• US/EU Offices• Global Teams | • Java• .NET• React• Cloud Native | $200K – $1.5M |

Itexus Insight: While comparing these companies, we’ve noticed a crucial trend – specialists consistently outperform generalists in fintech. Our focused expertise in payment systems and digital banking has led to 40% faster deployment times compared to industry averages.

Itexus Insight: From our market analysis and competition experience, we’ve observed that companies generally fall into three categories:

Enterprise Providers (NetSuite, DataArt, Capgemini, EPAM, TCS):

Higher costs $1M+, comprehensive service offerings

Specialized Providers (SDK.finance, Miquido, Endava, GlobalLogic, GFT): Niche expertise, focused solutions, budgets $500K-$2M;

Mid-Market Providers (Relevant, TSH, Sigma, Infopulse): Balance of quality and cost, with budgets $200K-$500K

Key Market Trends:

- Companies are increasingly specializing in specific fintech niches

- Eastern European providers offer attractive price/quality ratio

- Larger providers are moving upmarket to enterprise clients

- Boutique firms are focusing on personalized service and specific technologies

Cultural Fit: 3 Hidden Factors That Can Make or Break Success

Think it’s just about language? Not quite. Cultural nuances play a big role. We’ve seen million-dollar projects stumble over simple misunderstandings. Here’s the scoop:

Different cultures send different signals.

- Some say yes, but they really mean maybe.

- Others might go quiet when troubled.

- Communication styles vary widely.

- Smart teams get this. They adapt and build bridges instead of walls—like constructing a solid foundation for a skyscraper.

Time Zone Management Strategies

Time zones can either kill productivity or boost it. It all depends on how you handle them. Here’s how the winners do it:

Overlap hours are golden. Use them wisely.

- Set clear response expectations.

- Create asynchronous workflows.

- Document everything—yes, really everything.

Pro tip: Time zones can work in your favor. Think 24/7 development cycles. With smart planning, you can make it happen.

Itexus Insight: Having offices in both the US and Europe isn’t just about pins on a map. It’s strategic. Our engineers and project managers are like night owls—some code best at dawn, others thrive at midnight. It’s a natural diversity that keeps our offices buzzing around the clock.

Quick Wins That Impact Your Bottom Line:

- Zero productivity gaps between time zones.

- Faster time-to-market with round-the-clock development.

- Reduced operational risks with 24/7 issue coverage.

Real Business Impact:

- 40% faster project delivery.

- 65% reduction in response time to critical issues.

- Zero missed critical deadlines due to time zones.

The Numbers Tell the Story:

- 8+ hours of overlap with the US East Coast.

- 99.9% response rate within 2 hours.

- 100% owl-powered efficiency (okay, we made that up, but you get the idea).

Real Client Example? Sure!

For one fintech client, we structured a hybrid team across our offices. Morning standup in the US? Check. Development updates from Europe by lunch? Done. Critical fixes overnight? Handled. The client called it “time zone magic.” We call it smart planning (and maybe a little caffeine).

Time zones shouldn’t limit you; they should empower you. With the right partner (and a mix of early birds and night owls), they do just that.

Team Integration Techniques

Teams need bonding time. Chemistry matters, even virtually. Consider these approaches:

- Virtual coffee breaks work wonders.

- Celebrate small victories.

- Build personal connections.

- Integrated teams innovate better and stick together longer.

Remote Collaboration Best Practices

Distance shouldn’t mean distant. Modern tools help, but processes matter more:

- Clear communication channels.

- Regular video calls.

- Real-time collaboration tools.

Itexus Insight: We’ve managed teams across 12 time zones. Here’s what works: Culture isn’t just nice-to-have; it’s essential. Teams that click deliver better results.

Want Proof? Projects with strong cultural alignment show:

- 35% faster problem resolution.

- 60% higher client satisfaction.

Need more specifics? Just ask:

- Want our cultural onboarding template?

- Need time zone management tools?

The right cultural fit multiplies success. The wrong one divides teams. Choose wisely. Culture matters. Always has. Always will.

Making the Final Choice

Decision time approaches. You’re standing there, staring at proposals from different fintech development partners, and honestly, it feels overwhelming. Been there. Done that. Let’s make this easier.

Decision Framework

Think strategic here. Your gut matters. But so does your head. Like choosing a life partner, selecting a development team requires both emotional intelligence and rational thinking. Here’s what really counts:

• Tech expertise matters. Obviously.

• Watch their communication style. Do they get you?

• Clear pricing. No surprises.

• Time zones should align. Because midnight calls aren’t fun.

• Check their track record. Numbers don’t lie.

• Security first. Always.

Red Flags to Watch

Let’s talk warning signs. They’re sneaky. Sometimes they hide behind impressive presentations and smooth talk. Keep your eyes open for:

• Prices keep changing. Red alert.

• No references? Run away.

• Missing certificates? Think twice.

• They don’t respond quickly. Bad sign.

• Too much promise. Too little proof.

• Developers come and go. Not good.

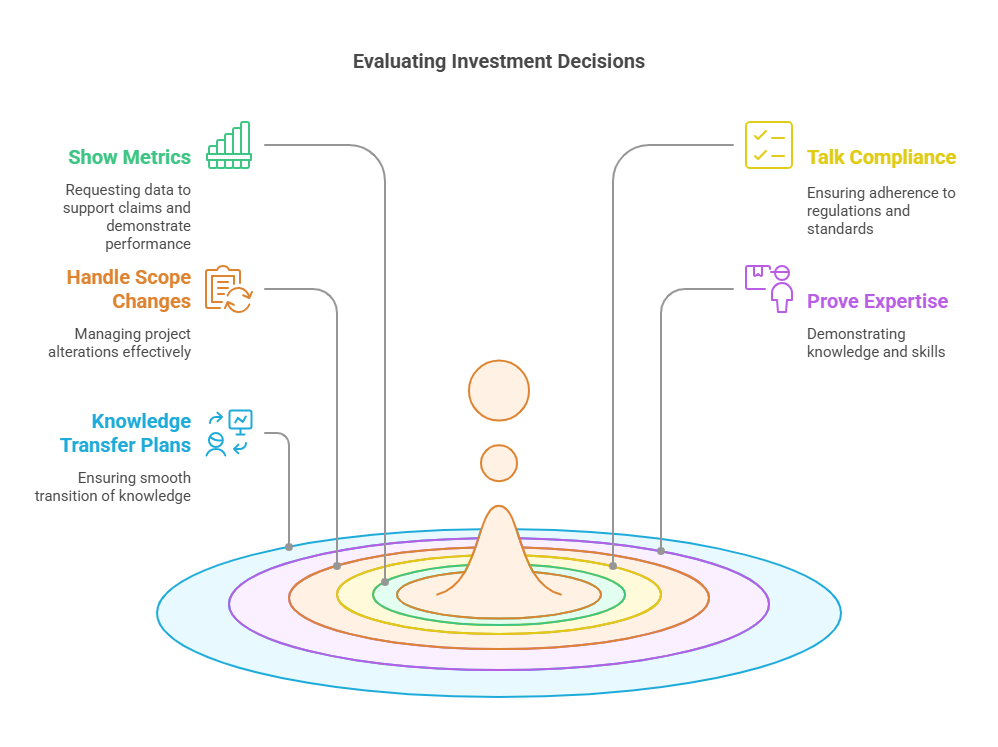

Questions That Cut Through the Fluff

Time to get real. Ask tough questions. Make them sweat a little. You’re investing serious money here:

“Show me metrics.”

“Talk compliance.”

“Handle scope changes how?”

“Prove your expertise.”

“Knowledge transfer plans?”

Partnership Readiness Checklist

Final stretch now. Before you sign anything, let’s double-check:

Test their skills. Thoroughly.

Certificates matter. Check them.

Call those references. Actually call them.

Understanding pricing? Really understand it.

Communication clear? Must be.

Can they scale? Think ahead.

Read that contract. Then read it again.

Itexus Insight: Real talk here. We’ve been around. Seen things. After handling countless fintech projects, here’s what we know: Success needs three things. Technical brilliance matters. Cultural fit is crucial. Clear talk is essential. Simple as that.

Want numbers? Sure thing.

The smart clients? They take their time. They dig deeper. They ask more questions.

Result? 40% fewer headaches during the project.

Worth it? Absolutely.

Remember this. Choose wisely. Take your time. This isn’t just another vendor selection – you’re picking a partner for the long haul. Think co-pilot, not hired help. Need someone who gets it. Someone who sticks around. Someone who grows with you.

Look at it this way. Market shifts happen. Requirements change. Technologies evolve. You need a partner who can handle all that. And then some.

The choice is yours. Make it count. Your fintech future depends on it. Sleep on it. But not too long.

Future-Proofing Your Choice

Think long-term success. Not just quick wins. Your development partner choice today shapes your tomorrow’s market position, and believe me, the fintech world moves at lightning speed.

Technology Roadmap Alignment

Tech evolves fast. Really fast. Your development partner should be more than just technically competent – they need to be your crystal ball into future innovations. Here’s what matters:

- Check their innovation pulse. Do they experiment with emerging tech?

- Look beyond buzzwords. Anyone can say “AI-powered.”

- Watch their learning curve.

- Study their tech stack evolution.

- Monitor their R&D investments.

Smart partners stay ahead. They read signals. They spot trends. They don’t just follow – they anticipate where the market’s heading and help position you there before your competitors even notice the shift.

Scalability Considerations

Growth changes everything. Plan for it. Your current needs might fit in a neat little box today, but tomorrow? That’s a different story. Consider this:

- Infrastructure flexibility matters.

- Check their resource depth.

- Test their scaling history.

- Verify performance metrics.

- Examine their crisis management.

Here’s the thing: When your user base suddenly triples, or market demands shift overnight, you need a partner who doesn’t break a sweat. They should say “we’ve got this” and mean it.

Long-term Partnership Indicators

Look for these signs. They matter more than you think:

- They challenge your ideas.

- They share market insights.

- Communication flows naturally.

- Their team stays stable.

- They invest in relationships.

Red flags? Watch these:

- High team turnover.

- Reactive, not proactive.

- Limited industry involvement.

- Poor knowledge transfer.

- Short-term thinking.

Itexus Insight: Reality check time. We’ve seen partnerships evolve. Some soar. Others crash. The difference? Usually lies in future-proofing. Our most successful partnerships started with clients who looked beyond immediate needs. They asked about tomorrow. They cared about growth paths.

Here’s a striking fact: 70% of failed fintech projects ignored scalability planning. Don’t be that statistic. Think bigger. Plan smarter. Stay flexible.

Consider this scenario: Your app hits the market. Users love it. Downloads soar. Great news, right? But can your development partner handle sudden success? Will they scale smoothly? These questions matter. Ask them now.

Remember:

- Technology evolves daily.

- Markets shift overnight.

- User needs change rapidly.

- Competition never sleeps.

- Adaptation is survival.

Choose wisely. Think ahead. Your future self will thank you. Because in fintech, tomorrow’s success starts with today’s choices. Make them count.

The game changes fast. Stay ready. Partner smart.

And Final Thoughts

In conclusion, selecting the right fintech software development partner is crucial for achieving success in today’s competitive digital finance landscape. The elite 1% of companies not only deliver market-ready solutions but also understand the importance of cultural fit, effective communication, and strategic time zone management. By prioritizing these factors, organizations can experience faster project delivery, reduced operational risks, and enhanced client satisfaction.

As you prepare for your next fintech project, take the time to evaluate potential partners carefully. Consider their expertise, track record, and alignment with your business goals. Don’t leave your success to chance—reach out to us at Itexus to discover how our specialized knowledge and experience can help you navigate this dynamic environment. Your future in fintech starts with the right choice—make it count, and let’s build something great together!