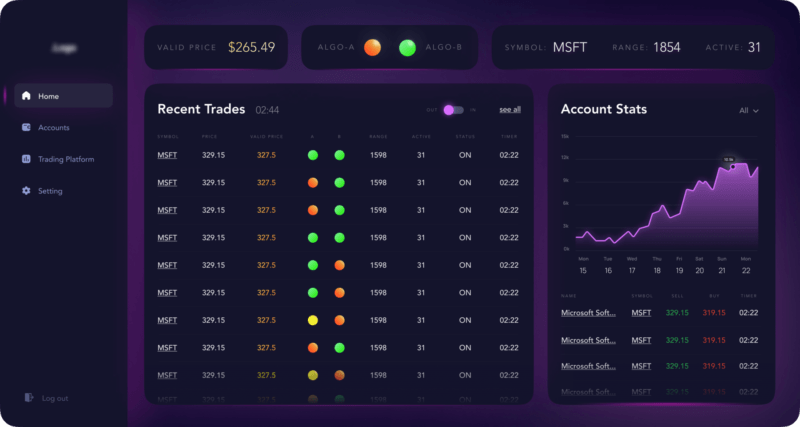

Intelligent investment assistant that performs technical analysis for a number of stocks, automatically tracks multiple indicators on stock exchanges, and generates buy/sell and risk signals for human traders.

Ever thought about how stock trading apps are reshaping the way we invest?

They’re everywhere, and for good reason!

These apps are revolutionizing the investment landscape, breaking down traditional barriers to entry. The numbers tell the story: the stock trading app market, valued at USD 24.1 billion in 2022, is projected to surge to over USD 150 billion by 2032, driven by increasing smartphone adoption and growing interest in personal investing.

High brokerage fees? Gone.

Complex interfaces? Simplified.

Modern stock trading apps have transformed the investment experience through intuitive user interfaces and real-time data access. It’s like having a personal trading floor in your pocket!

What is a Stock Trading App?

So, what exactly is a stock trading app? It’s your go-to buddy for buying and selling assets

There are different types of stock trading apps, including:

- Brokerage apps: Traditional apps that allow users to buy and sell stocks. Example: Fidelity, Webull, ETrade

- Robo-advisors: Apps that provide automated investment advice based on user preferences. Example: Wealthfront, iFlip Invest, Betterment

- Social trading platforms: Allow users to observe and replicate trades from successful investors. Example: eToro, ZuluTrade, AvaTrade.

- Fractional share apps: Enable users to buy portions of high-priced stocks, making trading accessible to those with limited Example: Robinhood, M1 Finance, Stash.

- Commission-Free Trading Apps: Allow users to trade stocks, ETFs, and options without incurring commissions. Example: Robinhood

- Full-Service Brokerage Apps: These platforms provide a comprehensive suite of services, including research tools, financial advice, and various account types. Example: Charles Schwab

- Advanced Trading Platforms: These apps cater to active traders who require sophisticated tools for analysis and execution. Examples: Ally Invest

- Mobile-First Trading Apps: Designed primarily for mobile use, these apps focus on providing a seamless trading experience through smartphones. Examples: IBKR Mobile

Stock trading apps are shaking things up. They’re redefining investing for everyone. For users, barriers are falling.

Lower fees? Yes!

Real-time market data? Absolutely!

You can start investing with just a few bucks. It’s freedom at your fingertips.

And for businesses? They’re profiting from transactions, yes, but there’s more. They build lasting connections with customers.

Personalization? Check. Educational tools? You got it!

Users get smarter with money while businesses expand their reach. It’s a win-win. Stock trading apps create the perfect financial match-up, where everyone reaps the rewards.

Sounds interesting, right? So, here’s the big question: HOW MUCH DOES IT ACTUALLY COST TO BUILD A STOCK TRADING APP?

How Much Does It Cost to Develop a Trading App?

This is a question we hear a lot. It’s normal. I’ll tell you about the price and then explain why and how to save money.

In general, the price of an app for trading stocks ranges between $10,000 and $50,000. While there’s a lot to consider when it comes to apps. Might compare apps to a car – there can be countless options. Options like ADAS and Premium Sound Systems can really increase the cost immensely.

The same goes for apps – the more features you want, the more expensive the app will be. I want to share some tips with you that will help you understand how costs are calculated and how you can save money. Think of me as a trustworthy car dealer who’s here to help you out.

In our work, we sort apps into three categories based on their complexity: basic, medium, and advanced. Here’s a table to give you an idea of how functionality affects costs:

| Features/Complexity Range | Basic | Medium | Advanced |

|---|---|---|---|

| User registration and Login | + | + | + |

| Streaming quotes | + | + | + |

| Basic charting options | + | + | + |

| Transaction history | + | + | + |

| Support stock trading | + | + | + |

| Support stock, ETFs (Exchange-Traded Funds) and option | + | + | |

| Linking to brokerage accounts | + | + | |

| Technical analysis indicators | + | + | |

| Real-time performance analytics | + | + | |

| Diverse investment opportunities (futures, cryptocurrencies) with algorithmic trading capabilities | + | + | |

| Linking multiple financial accounts | + | ||

| Biometric authentication | + | ||

| Automated rebalancing, Detailed analytics | + | ||

| High-speed updates and market indicators | + | ||

| Customizable charts and trade execution from charts | + | ||

| AI fraud detection | + | ||

| AI-based robo-advisory features | + | ||

| APIs (Application Programming Interfaces) | + | ||

| Cost | $10,000 – $20,000 | $20,000 – $50,000 | $50,000+ |

The table shows how more complex and feature-rich stock trading apps are and how their costs increase accordingly. For traders who rely on chart-based decision-making, incorporating a price action strategy in trading can be a valuable feature in medium and advanced-trading apps, as it enables users to analyze market movements without relying solely on lagging indicators.

And now, find costs based on types of stock trading apps:

| Types of Apps | Estimated Cost | Estimated Time |

| Real-Time Stock Trading App | $20,000 – $50,000 | 6 to 9 months |

| Robo-Advisory Stock Trading App | $50,000 – $100,000 | 8 to 10 months |

| Crypto & Multi-Asset Trading App | $50,000 – $110,000 | 7 to 9 months |

| Social Trading App | $30,000 – $70,000 | 5 to 7 months |

| Algorithmic Trading App | $50,000 – $100,000+ | 8 to 10 months |

So, basic stock trading apps might have simple budgeting tools or basic expense trackers.

Medium stock apps, like mobile banking with secure payment and transfer features, might have account management, bill payment, and other more advanced features.

More complex stock apps start at around $50,000 and can go even higher. These include advanced features like crypto trading platforms, robotic advisors, or AI investment tools. The cost reflects the complexity of the back-end systems and top-tier security needed.

Key Factors Influencing the Cost of Stock Trading App Development

We know that the cost can vary a lot. There are a bunch of important things that influence it. Let’s take a look at those factors. They show you what affects the final price.

| Factors Affecting Stock Trading App Development Costs | Basic | Medium | Advanced |

| Complexity of Features | Simple account management and basic transactions | Additional features like data analytics and multi-currency support requiring more sophisticated tech stacks | Advanced functionalities requiring cutting-edge technologies (e.g., AI, real-time data processing) |

| Technology Stack | Standard frameworks and technologies (e.g., basic databases, common programming languages) | A mix of standard and slightly advanced technologies tailored to medium complexities | Latest frameworks and specialized technologies suited for high-performance features |

| Choice of Platform | Single-platform development (e.g., iOS only) | Cross-platform solutions or single-platform with additional features | Native development for multiple platforms (iOS & Android) |

| Compliance and Security | Basic data protection and user authentication | Compliance with regulations (e.g., KYC, AML), with moderate security measures | Comprehensive security measures, including encryption and fraud detection |

| Integration with Third-Party Services | Minimal integration (e.g., basic payment gateway) | Moderate integrations (e.g., bank APIs, additional services), with potential for complex setups | Extensive integrations with multiple complex APIs and systems |

| Development Team’s Location | Local or offshore development team (can vary in costs) | Local, nearshore, or offshore teams, offering a mix of rates and expertise | Offshore or remote teams, which often have lower rates, with potential communication challenges |

| Testing and Quality Assurance | Basic testing for functionality | Comprehensive testing, including user acceptance testing and some performance assessments | Rigorous testing, including security audits and performance optimization |

No need to emphasize anything from the table, it’s pretty obvious. But let’s talk about a few key tech factors. They really explain why costs can be so different.

Complexity of Features

Alright, here we go: the more features we add, the crazier it gets, right? It’s like adding rooms to a house—suddenly, your budget’s inflated like a balloon! You thought you just wanted a shed, and now you’re negotiating with contractors like you’re buying a yacht! Anyhow, let’s look at these:

- Development Time: More intricate features naturally require more time for design, development, and testing.

- Resource Allocation: Projects with advanced features may require larger teams, resulting in increased labor costs.

- Risk Management: More sophisticated functionalities can introduce complexities related to security, user experience, and regulatory compliance, necessitating more thorough testing and risk mitigation efforts.

- Market Differentiation: Applications that offer advanced, unique features have the potential to capture a larger market share and provide greater value to users, justifying higher development investments.

Compliance and Security

Since financial information is highly sensitive, any application developed in this field must meet certain requirements. These requirements include adhering to various regulations such as KYC (Know Your Customer), AML (Anti-Money Laundering), GDPR (General Data Protection Regulation), and others.

Therefore, robust security and compliance are essential for any application in this field. Failure to comply with these regulations can lead to legal issues and loss of customer trust. This makes it a critical requirement that directly affects costs.

Development Team Expertise

So here’s the thing about where the team is based. It has a significant impact on the cost. Costs can vary dramatically depending on the region, which can greatly affect the overall budget of the project. Additionally, teams in different locations may have different levels of expertise, especially when it comes to technology that is crucial for projects related to stock trading.

So, after considering all that, you might be wondering how long the entire development process usually takes, right?

| Mobile app Complexity | Average timeline | Average cost |

| Basic with low level of complexity | 3 – 6 months | $10,000 – $20,000 |

| Medium level of complexity | 6 –12 months | $20,000 – $50,000 |

| Advanced with a high level of complexity | 12 – 18 months | $50,000+ |

Here’s how you could weave your company’s expertise into the tech stack section while maintaining that conversational, confident tone:

App Development Tech Stack

Let’s talk tech stack – and trust me, after 12 years of building fintech solutions, we know what works.

Here’s what we’ve learned: your tech stack can make or break your trading app. We’ve seen it all, tested it all, and narrowed down the most reliable combinations.

Backend? We’re big fans of Node.js and Python – they’ve never let us down when handling millions of real-time transactions. For databases, PostgreSQL has proven its worth time and again, especially when dealing with sensitive financial data.

Frontend? React Native and Flutter are our go-to choices. Wonder why? Because they’ve helped us deliver smooth, native-like experiences across platforms without breaking the bank.

But here’s an insider tip from our years in the trenches: it’s not just about picking the trendiest tech. It’s about choosing what scales. We’ve helped dozens of fintech startups grow from zero to millions of users, and believe me, scalability is where many apps stumble.

Need real-time market data? We’ve integrated everything from Alpha Vantage to IEX Cloud. Payment systems? We’ve got that down to a science with Stripe and Plaid.

And finally the best part. We’re not just throwing these names around – we’ve battle-tested each of these technologies in real-world applications.

These are the factors to consider:

| Features/Complexity Level | Basic | Medium | Advanced |

|---|---|---|---|

| MVP functionality | + | + | + |

| User Authentication and Security | + | + | + |

| Responsive Design | + | + | + |

| Basic CRUD (Create, Read, Update, and Delete) Functionality, | + | + | + |

| Advanced State Management | + | + | |

| RESTful and GraphQL APIs | + | + | |

| Testing and Quality Assurance | + | ||

| Microservices Architecture | + | ||

| Machine Learning Integration | + | ||

| Data Analytics and Visualization | + | ||

| Natural Language Processing (NLP) | + | ||

| Cost | $10,000 – $20,000 | $20,000 – $50,000 | $50,000+ |

As a matter of fact, our prices are 10-20% lower than the ones mentioned above.

Let us introduce some of the projects in the stock and securities sectors that may be of interest to you.

- Automated Stock Trading Platform: An automated, real-time trading system that allows administrators to configure trading strategies.

- Stock Trading Signals Platform: intelligent investment assistant that performs technical analysis for a number of stocks, automatically tracks multiple indicators on stock exchanges, and generates buy/sell and risk signals for human traders.

- Stock Trading Bot: A cloud-based trading bot that automatically trades stocks per intraday scalping strategy following pre-configured buy and sell rules.

- Automated Stock Trading Platform: An automated, real-time trading system that allows administrators to configure trading strategies based on various technical indicators, and investors to invest their money in a selected strategy.

- Algorithmic Intraday Stock Trading System: SaaS system for automated intraday stock trading, allowing investors to connect their brokerage accounts and configure a robot to trade stocks from their accounts automatically, for a commission and subscription fee.

- Trading Platform Software Development Services: Automate trading, connect to brokers/exchanges, and start generating profits for yourself and your clients with a custom trading platform services tailored to your specific needs.

- Wealth Management Platform: With Robo Advisor, Remote Portfolio Construction, and Monitoring Functionality

- Centralized Platform for Trading Over-the-Counter Securities: A centralized platform for trading over-the-counter securities that brings holders and investors together, allowing them to bypass intermediaries and trade assets – quickly and easily.

Contact us for more info, a free consultation, and an estimate for your project.

Benefits of the Stock Trading App in Investment Banking

The use of stock trading apps in investment banking has plenty of great benefits. It makes the trading experience better and more efficient. Here are some of the main advantages:

- Accessibility and Convenience: Trading can be done anytime and from anywhere through apps, which offer more flexibility than traditional methods. These apps feature user-friendly interfaces that cater to both new and experienced investors.

- Real-Time Data and Analysis: You have access to real-time market information, allowing you to monitor stock movements and prices. Additionally, analysis tools are available to assist you in making informed investment decisions.

- Cost-Effectiveness: Trading through apps typically comes with lower fees, making it more affordable than traditional services. You don’t need a large amount of capital to get started, enabling more people to engage in trading.

- Trading Options: Automated trading allows the app to execute trades on your behalf. You can also set up alerts to notify you of important market events.

- Educational Resources: A variety of learning materials are provided to enhance your trading skills. Furthermore, a community is available for you to interact with other traders.

- Portfolio Management: You can monitor your entire portfolio in one place. The app also offers various investment types, allowing you to build a diversified portfolio.

With these benefits, investors can make better decisions and improve their trading strategies.

Custom vs. Ready-made Trading App

When it comes to mobile app development, banks face a significant choice: build a custom app or go for a ready-made solution.

Developing a custom app is like hiring a personal trainer. It’s tailored to meet specific goals, ensuring a personalized experience that aligns perfectly with the bank’s unique requirements.

On the other hand, choosing a ready-made solution is akin to following a fitness video. It can be effective and convenient, but it may not fully address the unique needs of the bank or its clients.

Each option has its strengths and weaknesses. Banks must carefully consider their priorities before making a decision.

Common Features of a Trading and Investing App

A successful trading and investment app must include essential features that cater to both beginner and experienced investors. These features enhance the user experience, making trading accessible and efficient. Here are some common features that every trading app should have:

- Dashboard: A user-friendly interface displaying key account details and underlying asset performance.

- Portfolio Management: Tools to help users manage and track their investments.

- Market Data: Real-time access to trading asset prices, news, and financial reports.

- Trading Functionality: A seamless way to buy, sell, and trade assets.

- Fund Transfers: Integration with banks for easy deposits and withdrawals.

- Watchlist: Users can track the performance of assets they’re interested in.

- Notifications and Alerts: Keep users updated with market changes and investment opportunities.

- Educational Tools: Tutorials and articles for beginner investors to learn about trading.

- Security: Robust measures to protect user data and ensure secure transactions.

Hidden Costs in Trading and Investing App Development

While the factors mentioned are important, there are many other considerations to take into account. These may not have been obvious at first, and even developers often don’t discuss them much. However, we strive to be upfront with potential partners about not only the expenses involved but also the additional challenges they may face.

Let’s break down these surprise expenses for the sake of your future budget!Let’s break down these unexpected expenses for your future budget!

- Compliance with Regulations: Stock trading applications must adhere to relevant local laws and regulations.

- Integration with Third Parties: Payment gateways and application programming interfaces (APIs) often incur licensing fees and other costs.

- Maintenance after Launch: Ongoing updates and security measures can account for 15-20% of the budget.

- Scalability: As users grow, so do infrastructure needs.

- User Support: Real people need help. Support teams are essential.

To avoid those surprises, let’s discuss some ways to cut costs when developing a stock trading app.

How to Reduce Costs in Stock Trading App Development

To optimize expenses in the development of a stock trading app, developers and stakeholders should work as closely as possible. Here are some measures that may help reduce costs without jeopardizing quality.

- Begin with a Minimum Viable Product: Prioritize essential features and gather feedback for future enhancements.

- Opt for Cross-Platform Development: Utilize tools like React Native for iOS and Android applications.

- Engage Experienced Developers: Collaborate with experts such as Itexus for efficient stock trading app development.

Risks and Challenges of Stock Trading App Development

Stock Trading apps provide many advantages that highlighted above. But, they face risks and challenges. Developers and investment bankers must address them. However, it is crucial to consider the potential drawbacks of outsourcing development to these regions.

Regulatory Compliance : Stock trading apps must adhere to strict regulations to avoid penalties.

Data Security Concerns : Failure to protect user data can lead to a loss of trust and damage to the app’s reputation.

Technical Challenges : Integrating banking systems and services into apps can be a complex process.

Development Costs : Building secure stock trading applications requires significant investment in design and maintenance.

Developer Location : The location of the app developer is an important factor to consider. It can have a significant impact on the quality and cost of the stock trading application.

Now let’s talk about regions like India and Bangladesh. Yes, they offer lower development rates, which can seem tempting for businesses trying to save a buck. But, this can come with a catch.

Lower costs might mean lower quality. Why? Differences in coding standards and communication issues can lead to really shaky code. Plus, varying skill levels among developers can make things even trickier. In the end, this could result in higher long-term costs to resolve issues and ensure compliance.

That’s why it’s crucial to prioritize developers with real expertise in stock trading. Their know-how in stock trading app development can save you from a world of headaches down the line. Choose wisely!

Final Words

Sure, trading apps are totally changing the game when it comes to convenience and efficiency. But they also have some serious challenges. The costs can be all over the place, and you might not even know about all the hidden fees until it’s too late. It’s important to make sure you have strong security measures in place, because there’s always a risk of fraud.

To navigate all this complexity, it helps to understand the factors involved. At Itexus, we use our experience and strategic approach to help our clients maximize their value and minimize their costs. That way, they’re better equipped to succeed in the financial tech space.

We’ve been in the game for over 12 years, and we’ve worked with clients in all kinds of industries – from cryptocurrency investment options, AI-based solutions, digital banking services to investment asset management. We know how to develop effectively, and we know how to outsource strategically. This allows us to offer our clients a solid foundation for growth, while keeping costs low.

Check out our case studies to see how we’ve helped clients like Coinstar succeed. We’re proud of our track record, and we want to help you too. Let’s talk about your stock trading dreams and see if we can make them a reality.