With businesses going digital and the increasing popularity of online shopping, users are shifting from cash to digital payments. The latter include payments over the Internet and mobile payments at POS via smartphone applications. According to Statista, the total value of digital transactions is expected to reach $10,517,932 million by 2025, representing a compound annual growth rate of 12.01%.

The widespread adoption of digital payments has a strong impact on the increasing popularity of digital wallets, which are poised to become the most popular payment method due to their convenience, ease of use, and security, offering users a variety of financial options. According to the World Payments Report, the number of digital wallet users worldwide will reach 4 billion by 2024.

Most off-the-shelf solutions offer only a limited range of services. At the same time, businesses and individuals still have specific needs that aren’t covered by the available e-wallets features. Therefore, there’s still room for the development of new wallets that would fit into the digital payments market. Read on to understand the e-wallet app development process, learn more about the different e-wallet types, and take a step forward in developing your own digital wallet. And be sure to check out our recent blog post where we explained the cost of e-wallet app development.

Digital wallets types

We’ve categorized digital wallets based on their target audience, delivery technology, and goals. Let’s clarify what the difference between them is and look at the most widespread and in-demand e-wallet types.

Classification by target users

Depending on the target audience, e-wallets can be divided into three groups.

Closed

A closed digital wallet may be developed by a company that sells products and/or services. Its use is limited to payments for the products and/or services offered directly by the issuer of the wallet.

Semi-closed

Semi-closed e-wallets are online prepaid accounts that allow users to make transactions at listed merchants. To accept payments from semi-closed wallets, merchants must enter into a contract with the wallet issuer.

Open

Open e-wallets can only be issued by banks or by institutions partnered with banks and are used to purchase goods and services up to a certain amount.

Classification by delivery technology

This classification is based on the delivery technology used in an e-wallet.

NFC technology

NFC (Near Field Communication) is a contactless payment technology based on a radio frequency that enables data exchange between readers and payment devices through a simple touch gesture.

iBeacon and Bluetooth payment

iBeacon and Bluetooth are the most popular technologies when it comes to contactless payments. Wallets equipped with these technologies enable data transfer via proximity and peer-to-peer payment solutions within a certain distance (up to 70 meters on average).

Optical/QR code

QR code stands for Quick Response Code, a 2D barcode that can be read by smartphones. E-wallets equipped with this payment technology scan the code, decode it, and then confirm the payment information.

Digital delivery technology

Such digital wallets are designed for purchasing goods and services online and are rarely used in offline stores.

SMS-based payment

Unlike other types of digital wallets, such apps use SMS commands to confirm payments. SMS-based apps are well suited for P2P marketplaces, real-world C2B transactions, etc.

Classification by eWallet goals

Although modern digital wallets types usually combine several or all of the listed functions, narrowly targeted wallets are also in high demand.

Money management

Such apps allow users to have maximum control over their money. Managing finances in an e-wallet helps users better understand their income, categorize expenses, and stick to budgets.

Online payments

These e-wallets are suitable for all types of online payments and allow for quick transfers. Such wallets are compatible with a wide range of credit and debit cards and support a variety of devices.

Local & international money transfer

With such digital wallets, users can easily transfer money to friends or family members or pay for goods/services via their smartphones or mobile devices. This type of e-wallets makes online money transfers easier and cheaper as they don’t require the involvement of a third-party money transfer provider.

Cryptocurrency storage and exchange

These digital wallets allow users to store and exchange their cryptocurrencies securely. They can be either cold or hot. The main difference between these two types is that cold wallets aren’t connected to the internet and therefore offer more security. Cold wallets are hardware-based and hot wallets include mobile, desktop and hybrid apps.

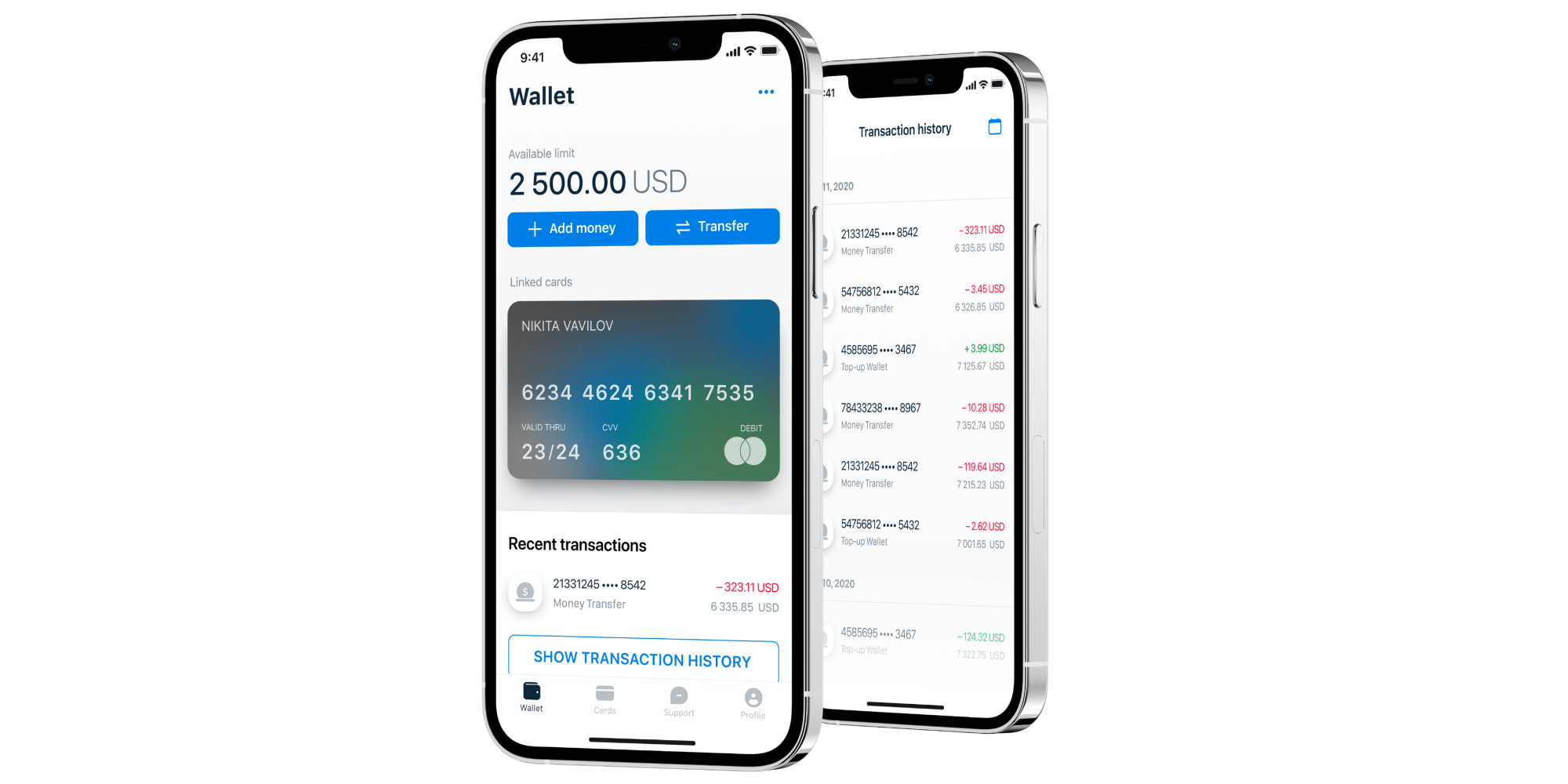

Digital wallets developed by Itexus

When it comes to selecting a company to develop a digital wallet app, it’s important that the potential provider has a proven track record for fintech solutions. Itexus has developed and delivered multiple apps for the financial services industry and has proven to be a reliable software development and fintech consulting partner. Check out our latest projects in the fintech space.

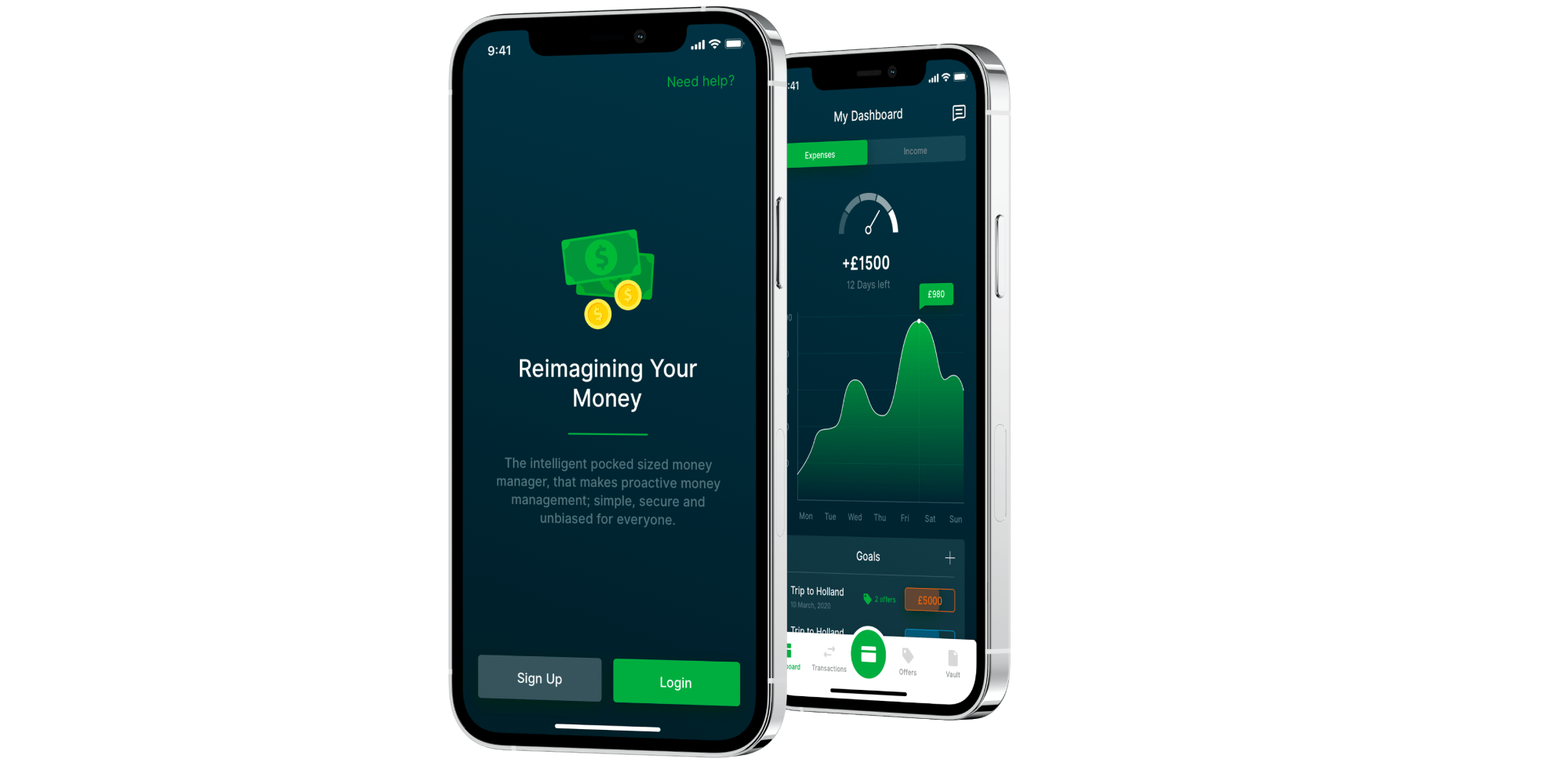

Personal finance assistant app

An intelligent money management system designed to help users make proactive and rational decisions about their finances. The application uses Machine Learning and Artificial Intelligence to predict future budget allocation by analyzing users’ spending records to better manage their current finances. To learn more about the project, please read the case study.

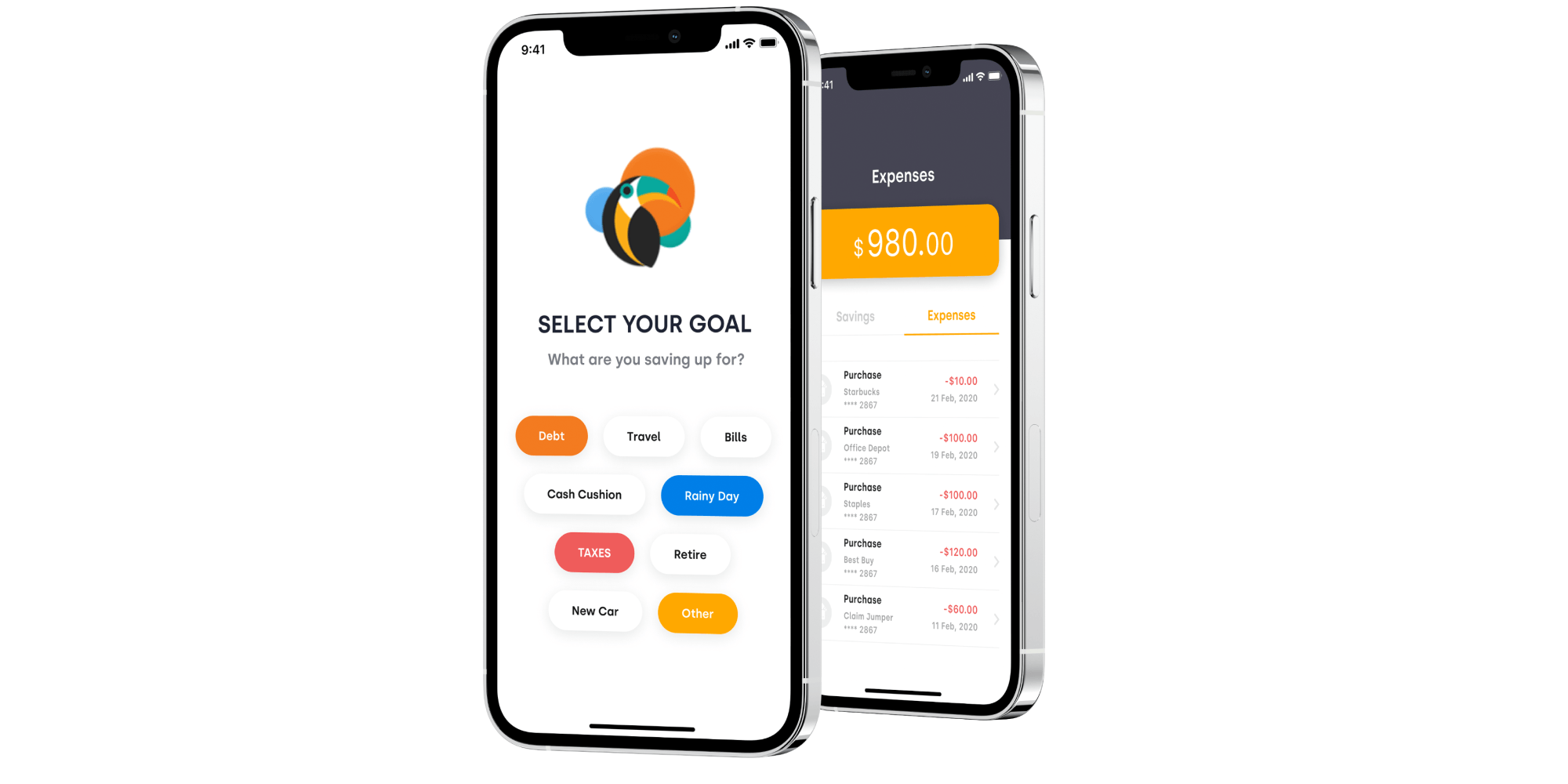

Money saving and personal finance assistant app

Created for a Silicon Valley startup, this money-saving app helps its users develop healthy financial habits with gamification features and supports viral marketing with social functionality. To learn more about the project, please read the case study.

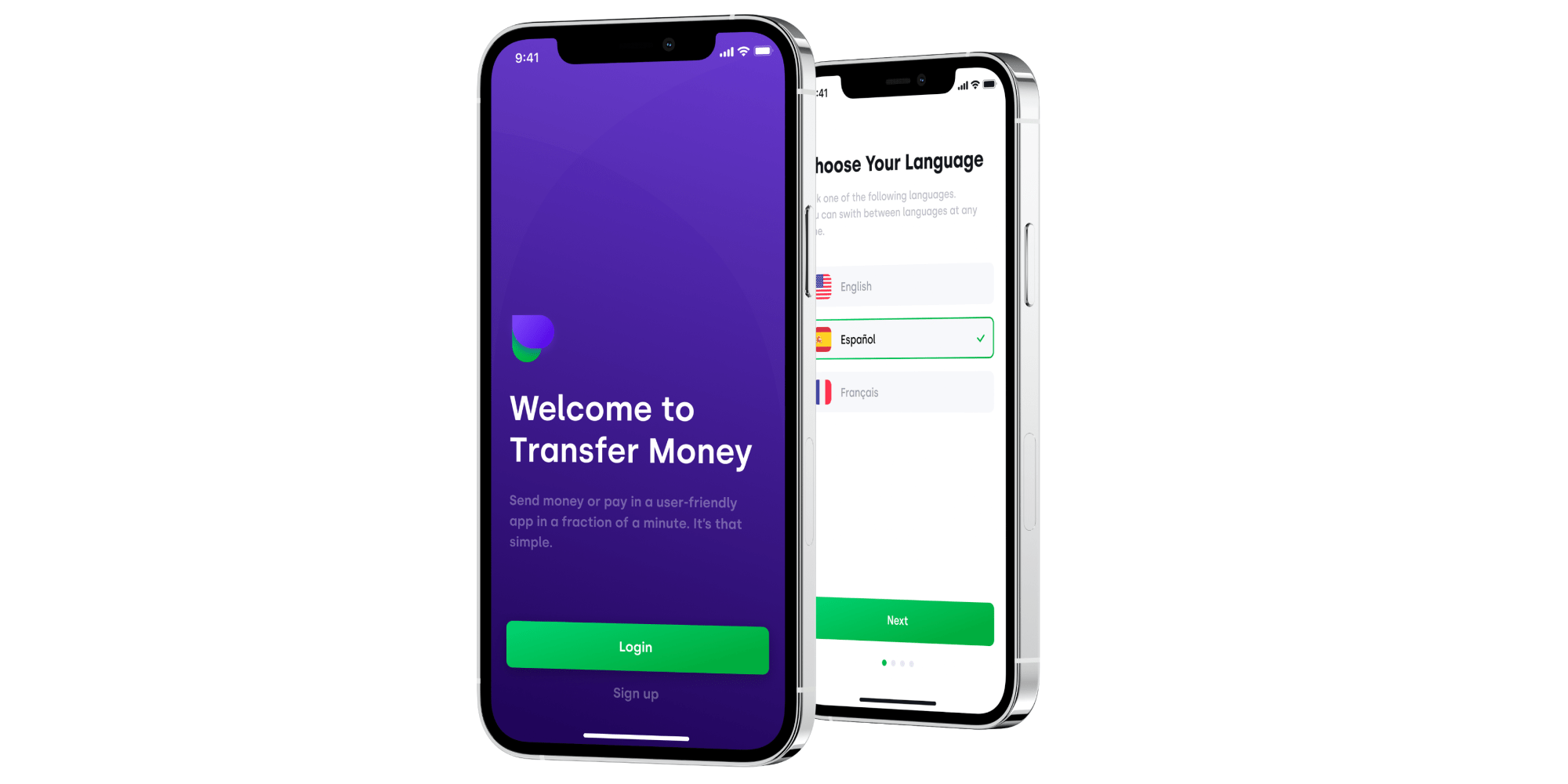

Mobile bank transfer app

A mobile app-to-bank transfer solution for a U.S. startup that allows instant money transfers from any U.S. bank card to any Nigerian bank account. It also lets users pay bills and manage multiple bank cards in one account. To learn more about the project, please read the case study.

Mobile banking app for migrants

This neobank solution is designed to facilitate monetary transactions, such as family financial aid, early paychecks, microloans, etc. To learn more about the project, please read the case study.

Digital wallet development process

First of all, you need to decide what business goals you want to achieve with the app. Based on this, it’s easy to determine the type of wallet and its target audience. Once you have a clear idea of the future app, its goals, and its unique features, you can move on to the next step.

1. Find a competent e-wallet development company

A successful app starts with an experienced team. When choosing a company for e-wallet app development, you should pay special attention to the potential provider’s background and clarify whether they have a proven track record of developing powerful and stable FinTech solutions.

2. Discovery phase

The discovery phase is the right start for your project and critical if you want your e-wallet to be feature-rich, high-performing, and delivered on time and on budget. In the discovery phase, you’ll work with the vendor’s team to set project goals, define the scope and features of your future wallet, set priorities, and create a risk mitigation plan.

Depending on the complexity and objectives of the project, you’ll receive all or some of the following deliverables:

• Vision and Scope document

• SRS (Software Requirements Specification Document)

• Software Architecture Document (SAD)

• Design concept

• Detailed work breakdown structure

As a result of the discovery phase, you’re well-prepared for the development phase.

3. Development phase

After the discovery, it’s time to start digital wallet development. This is where your e-wallet app is put together.

UI/UX Design

In this phase, UI/UX designers create the interface of the future wallet according to its goals and the needs of the target audience. The main goal of UI/UX design is to make your app intuitive, engaging, catchy, and user-friendly and to make sure that every swipe, tap, and click is convenient, rational, and valuable for the users.

Development

Developing an e-wallet involves processes such as coding or development itself, adding all the features, testing, implementing additional wallet features with improvements, and integrating all third-party vendors and databases. Ultimately, developers bring your digital wallet to life.

Testing & bug fixing

Specialists use a wide range of test design techniques and extensively test your digital wallet to verify that the app’s behavior meets business requirements, discover flaws in the code, and then fix them. Testing and bug fixing ensure that your wallet downloads and runs successfully. They’re an important factor in the development process that allow bringing a high-quality product to market.

4. Launch

The product launch is about placing the mobile wallet in the app stores and collecting initial user reviews for product analysis. It’s an important part of the overall e-wallet development process, as it gives your product visibility and helps build industry recognition and anticipation for your app. The launch should therefore be carefully planned to ensure that the market is ready for the product and the product is ready for its users.

5. Support and maintenance

This post-release phase is intended for ensuring the best possible interaction between the wallet and its users. It includes system updates, incorporation of functional enhancements, security management, app maintenance, and other activities necessary to ensure the correct work of the wallet on all devices and platforms.

How much does it cost to develop a digital wallet from scratch?

The cost of developing your digital wallet depends on many different factors, such as the platform you want to establish your e-wallet for (iOS, Android), the features and integrations required, the complexity of the app design, the hourly rates of the developers, and so on. On average, the cost of developing an e-wallet ranges from $40,000 to $100,000, depending on what you have in mind.

To get an estimate of the cost of implementing your project, contact our team. We’ll schedule a free consultation to clarify your requirements and expectations and come back with a ballpark sum needed to realize your idea.

Summary

The future of digital wallets seems bright, as the number of people preferring e-wallet payment methods for all financial transactions is rapidly increasing, and businesses are also actively using such apps. Now that you’ve learned more about the different mobile wallet types and the e-wallet app development process, it’s time to take a step further and create your own app.

To develop and launch a high-quality product, you need a well-coordinated and reliable team of professionals with solid fintech software development experience and a proven track record. Reach out to Itexus to develop a digital wallet that will lead your business to success.