Starting from 1918, when the first electronic fund transfer took place, the development of financial institutions was closely connected with the development of communications and the Internet. In early 1970, the first international digital stock was founded and the first electronic cross-country payment protocol SWIFT was used. With the worldwide adoption of computers, the era of online banking began in the 1990s. In 2009, the blockchain emerged, changing the way customers look at banks today. Big Techs are disrupting the banking industry by spawning financial startups that give end-users security and a sense of control over their finances. For their part, banks and financial institutions are under a lot of pressure to increase productivity and retain customers while optimizing costs. All these led banks to Robotic Process Automation (RPA) adoption, which stands for technological augmentation of banking operations. As an example, AI-driven chatbots only could execute a considerable amount of tasks across a plethora of bank functions allowing skilled professionals to concentrate on higher-value tasks and projects. Finding the right banking software development company can be challenging, as many companies claim expertise and quality but fail to meet expectations. If you’re searching for reliable banking software companies, look no further! Here, we have compiled a list of the top banking software development companies all over the world.

Consequently, FinTech development companies with deeper expertise and a longer record list of successful projects could ride in the avant-garde of overall banking digitization taking the realization of mundane tasks away and enabling banks to concentrate on strategies, innovations, and ways to make their customers happy.

Choosing the right partner for banking software development is crucial. Here are the top banking companies excelling in this field, with details on their location, pricing, ratings, employee count and more to help you make an informed decision.

| Company name | Location | Hourly Price | Rating (Clutch/GoodFirms) | Google Reviews Rating | Google Reviews |

| Itexus | US | $40 – 60 | 4.9/4.4 | 5.0 | Itexus reviews |

| BairesDev | US | $50 – $100 | 4.9/5.0 | 3.6 | BairesDev reviews |

| Praxent | US | $50 – $100 | 4.8/5.0 | 5.0 | Praxent reviews |

| Innowise | Poland | $50 – $100 | 4.9/5.0 | 4.9 | Innowise reviews |

| GoodCore Software | UK | $25 – $50 | 4.8/5.0 | 4.4 | GoodCore Software reviews |

| Andersen | Poland, US | $50 – $100 | 4.9 | 4.6 | Andersen reviews |

| ScienceSoft | Us, Poland | $50 – $100 | 4.8/5.0 | 4.6 | Sciencesoft reviews |

| Experion Technologies | US | $50 – $99 | 4.8 | 5.0 | Experion Tech. reviews |

| Itransition | US, Poland | $25 – $50 | 4.9/5.0 | – | Itransition reviews |

| Euvic | Poland | $50 – $99 | 4.8 | 4.8 | Euvic reviews |

Let’s run through the list of 20 banking software development companies that stand out for their innovative technological approach, impressive track record of completed projects, and, also importantly, their pricing policy that makes high-quality software development affordable.

1. Itexus (US)

- Hourly price: 50 – 100$/hr

- Rating: Clutch (4.9), GoodFirms (4.4)

- Employees: 130

- Founded: 2013

- Min project: $20,000+

Services provided:

Mobile Banking App Development, Fintech Consulting, eWallet Development, Trading Systems Development, Banking Process Automation, Fintech UX/UI Design, Banking-As-A-Service (BaaS).

About the company:

Itexus is a global software development company having vast expertise in FinTech namely banking software development. Itexus’ business analysts have profound knowledge of the mechanics of banking operations, regarding front, middle, and back-office management. One of the company’s specializations is the modernization of legacy banking solutions and the introduction of banking process automation into the bank’s ecosystem, thereby increasing back-office productivity by eliminating human error, taking over repetitive tasks, and streamlining interactions with customers. Itexus engineers are proficient in equipping Robotic Process Automation software with Optical Character Recognition technology. The company has an in-depth understanding of regulatory requirements and FCP & AML software and can either develop a bespoke solution or provide a smooth integration of existing solutions into your product. Itexus engineers are also experienced in the development of AI-driven chatbots that, being implemented into the bank support management, increase customer satisfaction and reduce costs. The company’s team leads and developers are ISO 27001 certified and make sure that the software under development meets all the required criteria for robust service, scalability, and security.

Tech Stack: Python, React, Postgresql, Plaid, Ruby, Node.js and more…

2. BairesDev (US)

- Hourly Price: 50 – 99$/hr

- Rating: Clutch (4.9), GoodFirms (5.0)

- Employees: 1,000 – 9,999

- Founded: 2009

- Min Project: $50,000+

Services Provided:

Custom Software Development, Mobile App Development, Web Development, UI/UX Design, Quality Assurance and Testing, Cloud Services, IT Consulting, AI and Machine Learning, Big Data and Analytics, Blockchain Development, IoT Solutions.

About the Company:

Bairesdev with a head office in the US offers access to 4,000+ senior engineers proficient in 100+ technologies. Their flexible engagement models include staff augmentation, software dev teams and full outsourcing. Services span custom development, QA, front/back-end and app development. With 1,200+ projects completed and famous clients satisfied by Bairesdev they have a good market reputation. Since 2009, they’ve served 100+ industries with a 91% satisfaction rating.

Tech Stack: Python, JavaScript (Node.js, React), Java, .NET, SQL, MongoDB, MySQL, PostgreSQL, AWS, Azure, Google Cloud Platform.

3. Praxent (US)

- Hourly price: 50 – 99$/hr

- Rating: Clutch (4.8), GoodFirms (5.0)

- Employees: 50 – 249

- Founded: 2000

- Min project: $25,000+

Services provided:

Mobile App Development, App Designing (UI/UX), Software Development, Web Designing (UI/UX).

About the company:

Praxent is a US-based FinTech agency that aims to build lasting and trustworthy solutions by offering team augmentation as a service. Based on their expertise, they not only build software from scratch but also actively redesign the front end, rebuild the server part and offer cloud migrations. The good news is that the company has a flexible pricing policy. If you download the Praxent Pricing Guide, you can get an idea of the company’s pricing logic.

Tech Stack: Java, Scala, React, Typescript.

4. Innowise (UK)

- Hourly Price: 50-99+$/hr

- Rating: Clutch (4.9), GoodFirms (5.0)

- Employees: 1,000 – 9,999

- Founded: 2007

- Min Project: $50,000+

Services Provided:

Custom Software Development, Mobile App Development, Web Development, UI/UX Design, Quality Assurance and Testing, Cloud Services, IT Consulting, AI and Machine Learning, Big Data and Analytics, Blockchain Development, IoT Solutions.

About the Company:

Innowise is a large company based in the United Kingdom. It boasts a team of over 1600 IT professionals dedicated to driving innovation and success for businesses worldwide. With key delivery centers in Europe and global offices, Innowise offers a full spectrum of IT services, including team extension, artificial intelligence, banking and cryptocurrency software development. Firm has achieved success with 850 and more projects in multiple sectors including FinTech, information technology, banking services, eCommerce and MedTech, thus being a nice partner for companies that demand state-of-the-art software solutions.

Tech Stack: Java, .NET, Python, JavaScript (Node.js, React), SQL, MongoDB, MySQL, PostgreSQL, AWS, Azure, Google Cloud Platform.

5. GoodCore Software (UK)

- Hourly price: 25 – 49$/hr

- Rating: Clutch (4.8), GoodFirms (5.0)

- Employees: 50 – 249

- Founded: 2005

- Min project: $10,000+

Services provided:

Mobile App Development, Web Development , Software Development, App Designing (UI/UX), Web Designing (UI/UX).

About the company:

GoodCore Software is a UK-based custom banking software development agency rendering a wide range of development services in various spheres. They have been in the FinTech market since 2005 and have developed their unique way of partnering with big enterprises, midsize businesses and startups bringing benefits for all. They are mostly concentrating on working with British financial institutions, but are open to growing abroad.

Tech Stack: Node.js, React, Angular, Vue.js, .NET, PHP, Java.

6.Andersen Inc. (US, Poland, Italy)

- Hourly Price: 50 – 99$/hr

- Rating: Clutch (4.9),

- Employees: 1,000 – 9,999

- Founded: 2007

- Min Project: $50,000+

Services Provided:

Custom Software Development, Mobile App Development, Web Development, UI/UX Design, Quality Assurance and Testing, Cloud Services, IT Consulting.

About the Company:

Andersen is a well-known firm with a long list of IT services. The agency designs customized solutions for enterprises in different industries (creation of enterprise applications and SaaS solutions, banking software development, FinTech consulting). For mobile app development, they specialize in high-performance applications made user-friendly for both iOS and Android. For web development, the company specializes in building robust, scalable and secure web applications. Andersen is also superior in the design of the UI/UX, ensuring that digital products are both visually nice and easy to use.

Tech Stack: Java, .NET, Python, JavaScript (Node.js, React, Angular), SQL, MongoDB, AWS, Azure and more.

7. ScienceSoft (US, Poland)

- Hourly Price: 50 – 99$/hr

- Rating: Clutch (4.8), GoodFirms (5.0)

- Employees: 250 – 999

- Founded: 1989

- Min Project: $5,000+

Services Provided:

Custom Software Development, Mobile App Development, Web Development, UI/UX Design, Quality Assurance and Testing, Cloud Services, Big Data and Analytics.

About the Company:

ScienceSoft is a global development company focusing on comprehensive IT services in the industry. Specializing in custom software development, service creates solutions that enhance operational effectiveness and foster growth. The company’s competencies range from desktop and web to mobile applications, such that the software fits the business needs of its clients. Another area where the company excels is mobile app development; it carries out native and cross-platform development for iOS and Android.

Tech Stack: Java, SQL, HTML, React, Typescript.

8. Experion Technologies (US)

- Hourly price: 50 – 99$/hr

- Rating: Clutch (4.9), GoodFirms (5.0)

- Employees: 1,000 – 9,999

- Founded: 2006

- Min project: $10,000+

Services provided:

Custom Software Development, Mobile App Development, Web Development, UI/UX Design, Product Engineering, Cloud Services, Quality Assurance and Testing, Digital Transformation, IoT Solutions, Analytics and Big Data.

About the company:

Experion Technologies is another US-based IT company with local offices in several countries. Apart from providing software for banks, the Experion specialists are skilled at Data Science and deep analytics which is helpful at any stage of product development, especially if for now you have an idea only. Due to quality analytics and comparative analysis of your competitors, Experion Technologies armor you with the right approach to the product. The company has a good record of several solid projects on legacy banking systems upgrades and system integrations.

Tech Stack: React, Angular, Vue.js, Node.js, Java, .NET, MongoDB, MySQL, PostgreSQL, Swift, Kotlin.

9. Itransition (US, Poland)

- Hourly Price: 25 – 49$/hr

- Rating: Clutch (4.9), GoodFirms (5.0)

- Employees: 1,000 – 9,999

- Founded: 1998

- Min Project: $25,000+

Services Provided:

Mobile Banking App Development, Fintech Consulting, eWallet Development, Trading Systems Development, Banking Process Automation, Fintech UX/UI Design, Banking-As-A-Service (BaaS).

About the Company:

Itransition is a popular firm that provides services mainly in the scope of FinTech and banking software venders. The agency works toward modernizing legacy banking solutions and introduces automation of banking processes to improve productivity in its back office. Their engineers are adept at equipping Robotic Process Automation software with Optical Character Recognition technology and Artificial Intelligence.

Tech Stack: Python, React, Postgresql, Plaid, Ruby, Node.js and others.

10. Euvic (Poland)

- Hourly price: 50 – 99$/hr

- Rating: Clutch (4.8)

- Employees: 1,000 – 9,999

- Founded: 2004

- Min project: $10,000+

Services provided:

Software Development, IT Outsourcing, Quality Assurance, Cloud Services, DevOps.

About the company:

Euvic is another agency located in Poland serving clients all over the world. Having high-skilled professionals on board, Euvic manages to develop resilient and robust back-office infrastructure for US-based financial organizations. In addition, they offer consulting services for FinTech for affordable costs.

Tech Stack: React, Angular, Vue.js, Java, .NET, Node.js.

11. Eleks (UK, Germany, Poland)

- Hourly price: 50 – 99$/hr

- Rating: Clutch (4.8), GoodFirms (5.0)

- Employees: 1,000 – 9,999

- Founded: 1991

- Min project: $50,000+

Services provided:

Custom Software Development, Mobile App Development, Web DevelopmentUI/UX Design, Quality Assurance and TestingCloud Services, Data Science and Big Data.

About the company:

Eleks is a Poland-based software development company occupying a steady place in the European IT market. They have vast expertise in several industrial spheres including finances and banking technology companies. Eleks provides Data Science services, premium MVPs creation, Big Data, and AI development, including the provision of a dedicated development team as a service. Also, they have skills in re-engineering, DevOps, and cloud migration.

Tech Stack: React, Angular, Vue.js, Node.js, .NET, Java, MongoDB, MySQL, PostgreSQL.

12. Bright Marbles (Serbia)

- Hourly price: 50 – 99$/hr

- Rating: Clutch (4.9)

- Employees: 50 – 249

- Founded: 2016

- Min project: $50,000+

Services provided:

SaaS Development, Web Development , Software Development, App Designing (UI/UX), Web Designing (UI/UX), Mobile App Development, Video Production, email Marketing, Brand Identity Establishment, Online Advertising.

About the company:

Bright Marbles is a Serbian development company that offers high-quality back-end and front-end services. The company has 10 years of expertise in different spheres of FinTech development being able to find the right approach to each client and bring the maximum value to the project. They have an in-house design team as well as quality assurance and DevOps, which makes them a sound choice as an outsourcing development partner.

Tech Stack: React, Redux, Node.js, Express.

13. SoftwareMill (Poland)

- Hourly price: 50 – 99$/hr

- Rating: Clutch (4.9)

- Employees: 50 – 249

- Founded: 2009

- Min project: $25,000+

Services provided:

Backend/Frontend Development, Platform Engineering, Kotlin Development, Rust Development, Big Data Solutions, Scala Engineering

About the company:

SoftwareMill is a custom software development and consultancy firm renowned for its expertise in custom IT systems. Founded with the goal of addressing complex IT challenges, the company leverages advanced technologies to deliver innovative solutions in banking software industry.

SoftwareMill focuses on data processing, system integration and workflow optimization. Their solutions are designed for efficiency, scalability, and maintainability, ensuring that client needs are met with the highest standards.

Firm excels in big data and machine learning, providing cutting-edge solutions that help businesses leverage their data for strategic insights. SoftwareMill serves a diverse range of industries, including finance, healthcare, telecommunications and logistics.

Tech Stack: Apache Kafka, Java, Scala, React, Elixir, Kubernetes, Typescript.

14. Ardas (US)

- Hourly price: 25 – 49$/hr

- Rating: Clutch (4.9), GoodFirms (5.0)

- Employees: 50 – 249

- Founded: 2005

- Min project: $10,000+

Services provided:

SaaS Development, Web Development , Software Development, App Designing (UI/UX), Web Designing (UI/UX), Mobile App Development.

About the company:

Ardas is a US-based FinTech software development company having local representatives in many European countries which facilitates the obtaining of customers and helps the company speak the same language with its clients. Ardas specialists are attentive to your ideas and are capable of building scalable and detailed MVPs which makes partnering with them easy and enjoyable. Also, the company has extensive expertise in banking software development providing strong intellectual property protection, clear and easy-to-understand code, and 24/7 maintenance of the products launched.

Tech Stack: Node.js, .NET, Java, PHP, React, Angular, Vue.js, Swift, Kotlin.

15. PixelCrayons (India)

- Location: India

- Hourly Price: <25$/hr

- Rating: Clutch (4.9), GoodFirms (4.7)

- Employees: 250 – 999

- Founded: 2004

- Min Project: $5,000+

Services Provided:

Custom Software Development, Mobile App Development, Web Development, UI/UX Design, Quality Assurance and Testing Cloud Services, IT Consulting.

About the Company:

PixelCrayons is a software development agency with a main office located in India. Their expertise covers a big spectrum of IT services, with a focus on creating custom software solutions finely tuned to meet the unique requirements of businesses. Also they offer valuable IT consulting services for popular banks. Through the 17+ years that PixelCrayons have been in business, they have continued to grow and have one of the best client-retention rates across the industry.

Tech Stack: PHP, .NET, Java, Node.js, Angular, React, Vue.js, MongoDB, MySQL, PostgreSQL, AWS, Azure, Google Cloud Platform.

16. Chetu (US)

- Hourly Price: Unknown

- Rating: Clutch (4.4), GoodFirms (3.0)

- Employees: 1,000 – 9,999

- Founded: 2000

- Min Project: $10,000+

Services Provided:

Custom Software Development, Mobile App Development, Web Development, UI/UX Design, Quality Assurance and Testing, Cloud Services, IT Consulting, Enterprise Software Solutions, Blockchain Development, AR/VR Development, IoT Solutions, Big Data Analytics.

About the Company:

Chetu, a leading global custom software development agency headquartered in the US, is dedicated to meeting diverse business needs through its wide range of IT services. Their specialization in custom software development, mobile app development, web development, UI/UX design and quality assurance ensures. From software development to IoT solutions, Chetu’s expertise covers a broad spectrum, making them a reliable partner for businesses worldwide.

Tech Stack: .NET, Java, PHP, Python, JavaScript (Node.js, Angular, React), SQL, MongoDB, MySQL, PostgreSQL, AWS, Azure, Google Cloud Platform.

17. STX Next (Poland)

- Hourly price: 50 – 99$/hr

- Rating: Clutch (4.7), GoodFirms (5.0)

- Employees: 250 – 999

- Founded: 2005

- Min project: $10,000+

Services provided:

Mobile App Development, Web Development , Software Development, App Designing (UI/UX), Web Designing (UI/UX).

About the company:

STX Next is another FinTech development company from Poland. Over the last 15 years, they have been not only developing premium banking software but also providing consulting services in various financial spheres. STX specialists review your idea on the highest possible level and come up with a robust plan for moving forward. Also, they offer the audit of your existing solutions in case of their limited performance, data synchronization issues, uninviting and poor UI and UX, unable to attract new customers, etc.

Tech Stack: Java, SQL, HTML, React, Typescript.

18. Luxoft (Switzerland)

- Hourly Price: 100+$/hr

- Rating: –

- Employees: 10,000+

- Founded: 2000

- Min Project: $5,000+

Services Provided:

Custom Software Development, Mobile App Development, Web Development, UI/UX Design, Quality Assurance and Testing, Cloud Services, IT Consulting, Big Data and Analytics, AI and Machine Learning, Blockchain Development, IoT Solutions.

About the Company:

Luxoft is a well-known software development firm that stands out from the crowd for its choice of IT services. Focusing on custom software development, Luxoft ensures outrunning time solutions for FinTech startups. Founded in 2000, the platform has extensive industry experience for decades, delivering top solutions worldwide. While the price is higher than average in this sphere, it points to the high-quality services that Luxoft provides.

Tech Stack: Java, .NET, Python, JavaScript (Node.js, Angular, React), SQL, MongoDB, MySQL, PostgreSQL, AWS, Azure, Google Cloud Platform.

19. Azumo (US)

- Hourly Price: 100+$/hr

- Rating: Clutch (4.9)

- Employees: 50 – 249

- Founded: 2016

- Min Project: $25,000+

Services Provided:

Custom Software Development, Mobile App Development, Web Development, UI/UX Design, Quality Assurance and Testing, Cloud Services, IT Consulting, AI and Machine Learning, Big Data and Analytics, Blockchain Development, IoT Solutions.

About the Company:

Azumo is a agency based in the United States. Their approach emphasizes planned and efficient development, consistently solving problems and artificial intelligence. Besides, Azumo gives unique solutions like staff augmentation and dedicated team, which ensures scalability and efficiency through the provision of the team required for the realization of your projects. Overall, it’s a good service with a big project succeeded.

Tech Stack: Python, JavaScript (Node.js, React), Java, SQL, MongoDB, MySQL, PostgreSQL, AWS, Azure, Google Cloud Platform.

20. Intrepid (US)

- Hourly Price: 150+$/hr

- Rating: Clutch (5.0)

- Employees: 50 – 249

- Founded: 2010

- Min Project: $25,000+

Services Provided:

Custom Software Development, Mobile App Development, Web Development, UI/UX Design, Quality Assurance and Testing, Cloud Services, IT Consulting, AI and Machine Learning, Big Data and Analytics, Blockchain Development, IoT Solutions.

About the Company:

Intrepid is a US-based custom software development agency known for its planned and efficient approach to development of retail banking software. They maintain their focus on solving problems as well as speeding up the process of the projects. Intrepid gives creative solutions similar to contingents and solely banded teams to make sure the progression and completing of the project of the institutions are met doing it on behalf of whatever group the team lacks.

Tech Stack: Python, JavaScript (Node.js, React), Java, SQL, MongoDB, MySQL, PostgreSQL, AWS, Azure, Google Cloud Platform.

FAQ on Top 20 Banking Software Development Companies

What is software development in banking?

Which programming language is best for banking software?

How to develop a banking software?

Which software is mostly used at banks?

Itexus Expertise in Banking Software Development

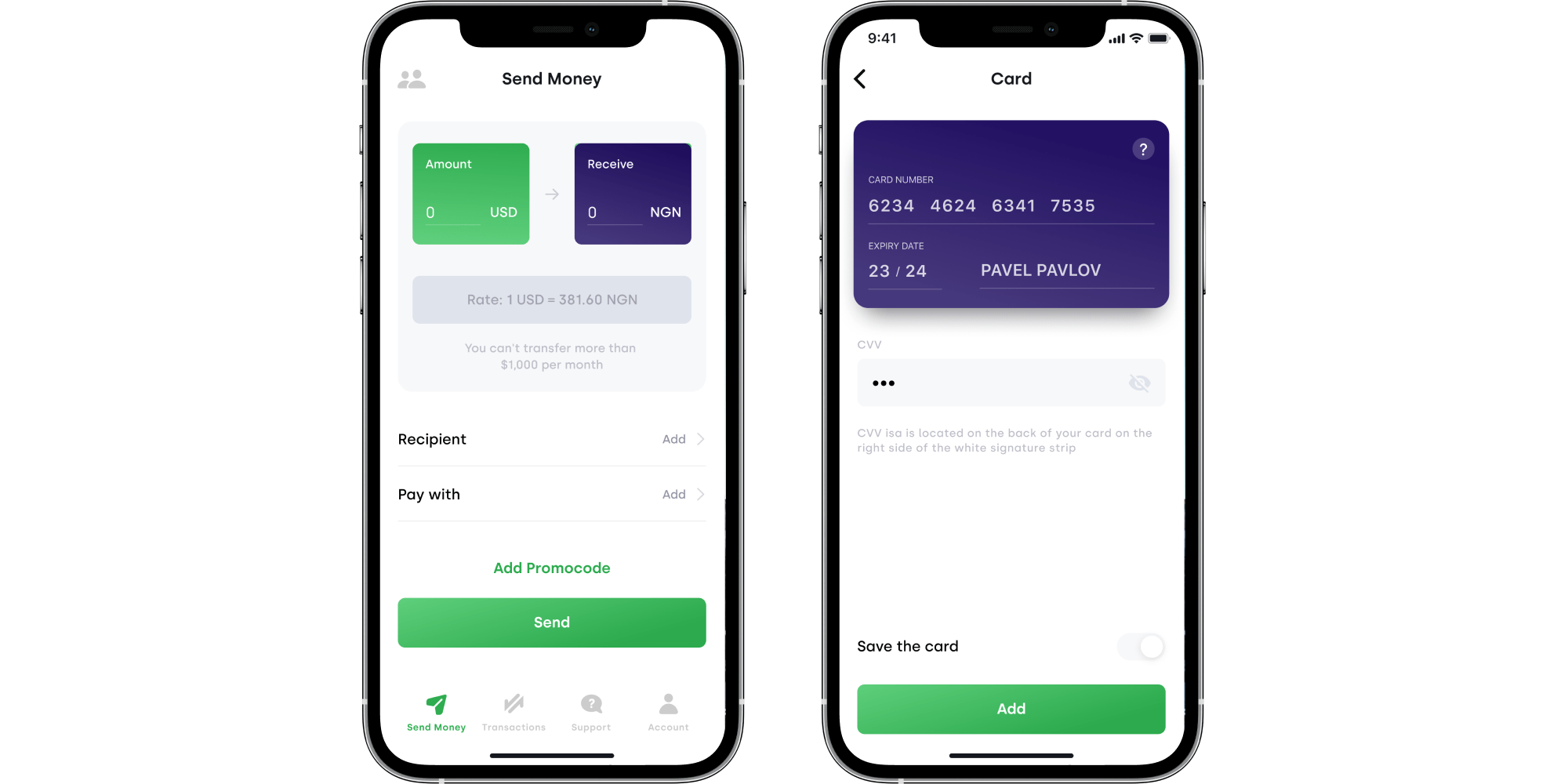

Mobile Bank Transfer App

For a U.S.-based startup, Itexus developed a mobile app-to-bank transfer solution that allows its users to transfer money from U.S.-issued bank cards to Nigerian bank accounts. In addition to transferring money, the app allows users to pay bills in Nigeria, i.e., utilities, phone bills, etc., and link several U.S. bank cards to one account. The solution has a multilingual interface (English, Spanish, and French) and is integrated with two payment service providers and a robust KYC verification system. To learn more about the project, please read the original case study.

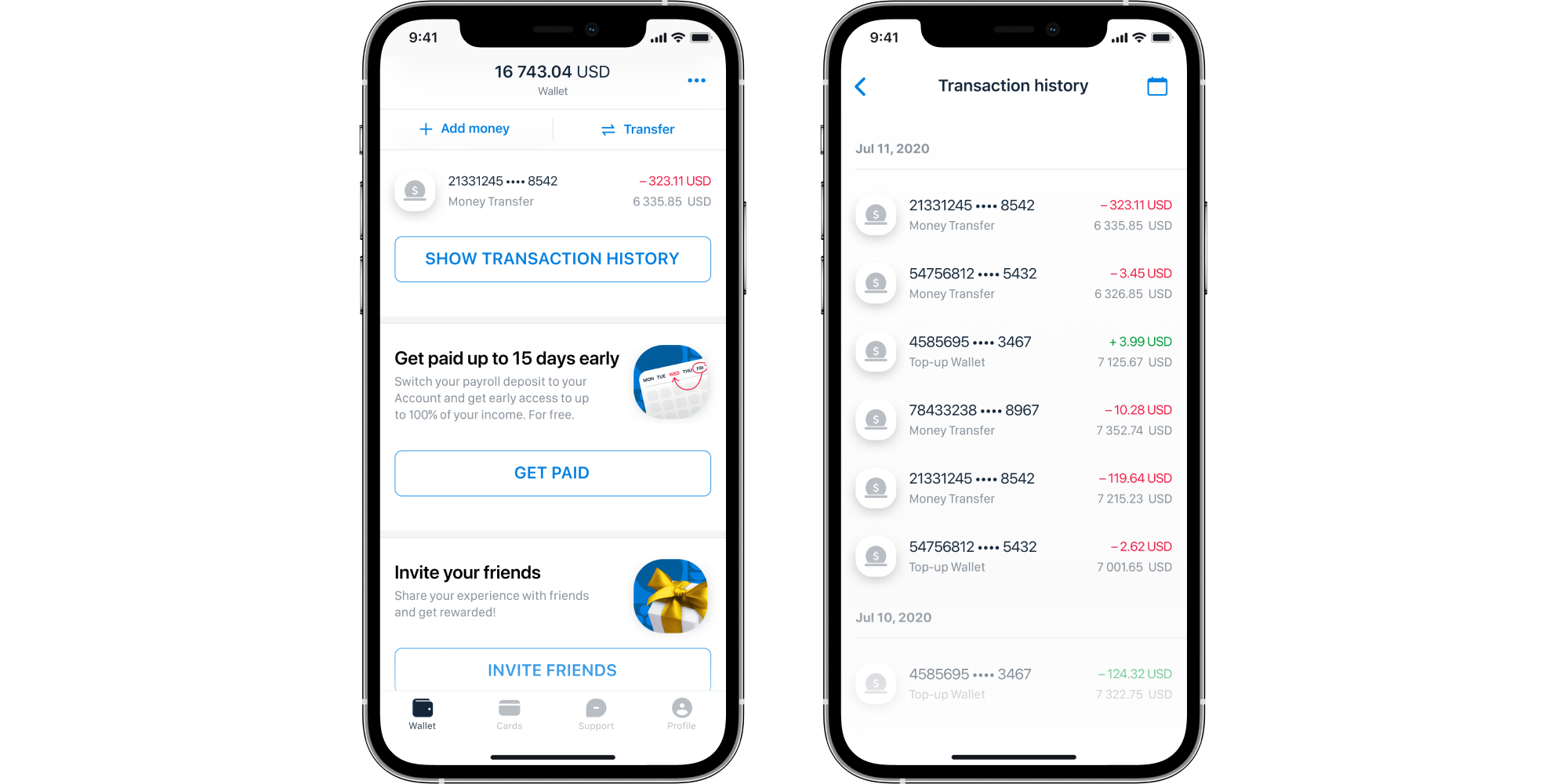

Mobile Banking App for Migrants

Another client approached Itexus to develop a neobanking solution for people who represent a large but unbanked segment of the population – migrants. Each year, many people come to the United States to earn a living and financially support their families who remain in their home country. As customers of U.S. banks, these people have unique needs and problems, but they often do not have access to some products and services of banks because of their low credit scores. The app we developed facilitates financial support for migrants’ families, enables them to get early paychecks, provides access to microloans, etc. To learn more about the project, please read the original case study.

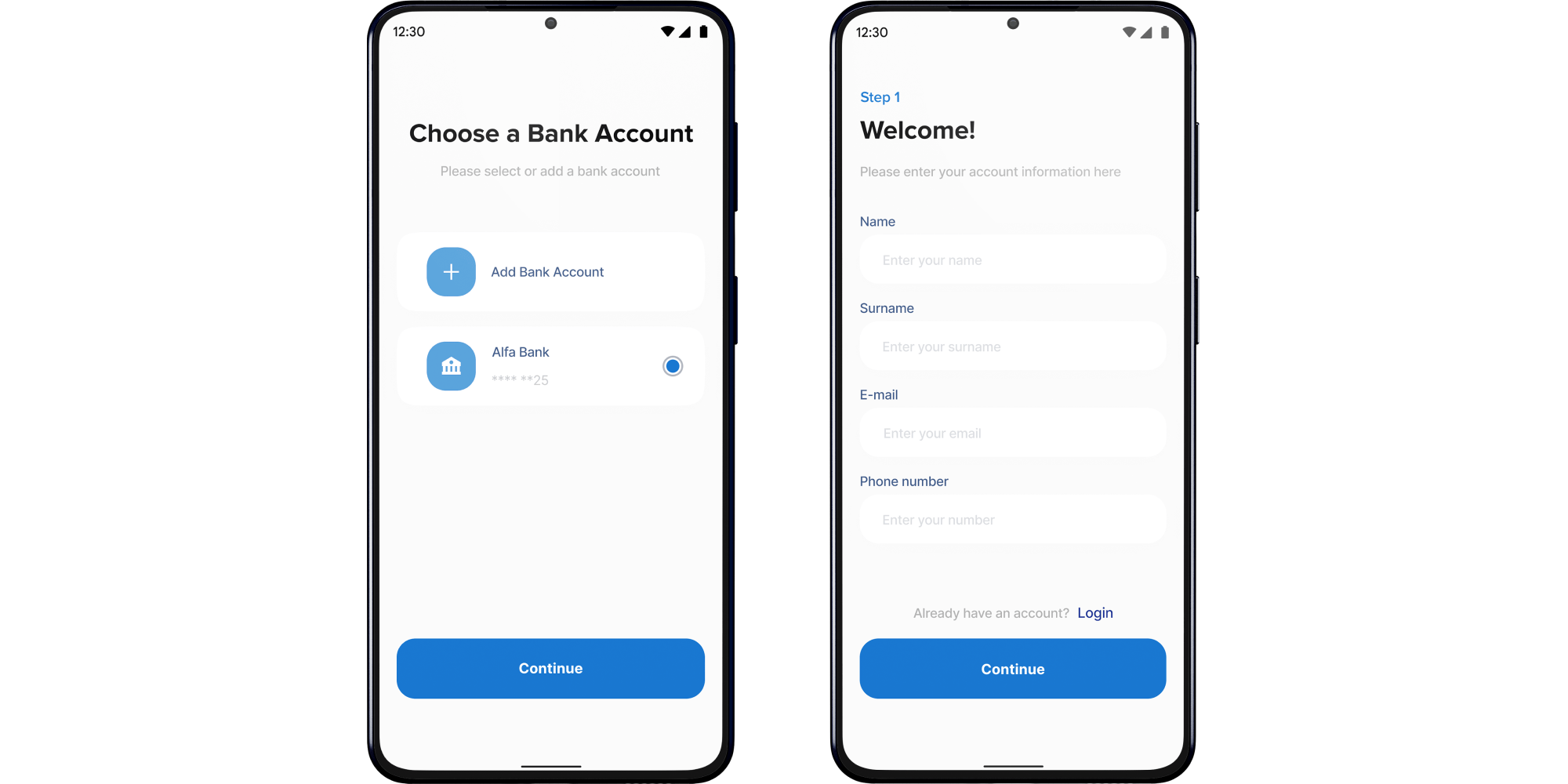

Banking App for Students

One more mobile banking app we created is targeted at U.S. and European students enrolled in college, university, or vocational school who are looking for additional sources of financing. The app provides students with unique credit, debit, and payment tools, helps build a credit score and instills financial literacy and money management habits through engaging educational content. To learn more about the project, please read the original case study.

5 Competencies Not to Overlook When Choosing a Top Banking Software Development Company

1. Banking Processes Automation

Make sure your future development partner has expertise in building robotic software to automate banking processes for the front, middle, and back offices. The operations that can be handled by robotic software are numerous including insurance, card issuance, transactions, invoicing, etc. Also, clarify whether the company is competent in recommendation engines development as integrating this tool with your services will positively affect customer experience, reduce churn, and improve ROI generally.

2. AI and ML

Find out if the banking software development company you want to work with has hands-on experience in developing AI and ML-based FinTech products. Your development team should be experts in neural networks, deep learning, and Big Data services and be able to leverage these technologies to scale your automation initiatives.

3. NLP

Natural Language Processing (NLP) software integrated with your banking solution simplifies the exploration of massive unstructured data, provides key insights and facilitates customers’ journey through the banking system. Make sure the vendor you are about to partner with has firsthand knowledge of NLP.

4. Intelligent Automation

At the stage of finding the right vendor, interview company representatives concerning their experience in building and deploying cognitive Intelligent Process Automation solutions. There are many banking procedures i.e. fraud prevention, suspicious pattern monitoring, and regulation compliance, which could be handled with the help of predictive and prescriptive analytic tools, computer vision, NLP, and text analytics. Intelligent Automation helps to process unstructured data and cope with judgment-based tasks.

5. Blockchain

Distributed ledger technology, along with cryptographic hash functions and public and private keys, is being actively used by companies to encode smart contracts and secure financial transactions and other banking operations. If you want to use the most advanced technologies for your business, you should choose a company that has expertise in developing blockchain solutions.

Conclusion

Finding the right partner for the development of your project is the most important part on the road to success. There are several competencies crucial for the creation of scalable, resilient, and secure solutions capable of providing the transformation across the banking value chain. Finely tuned solutions speed up banking operations bringing productivity and efficiency to front, middle, and back offices.

Need banking & financial software development services? Share your idea with us through this contact form and we will get back to you as soon as possible.