Money Saving and Personal Finance Assistant App

The app helps users develop healthy financial habits with gamification features and supports viral marketing with social functionality.

Project Background

The Silicon Valley startup contacted Itexus with a request to develop their core product — a personal finance assistant/money-saving app. Initially, the client had only a rough idea and was looking for a proactive partner who he could collaborate and exchange ideas with

before elaborating the concept into a solution architecture, developing the product, and launching it to market.

The client chose Itexus because of our FinTech specialization, vast experience with similar finance projects, and our proactive and thorough approach to the solution architecture.

Industry

Fintech Startup, Wealth Management

Effort and Duration

Ongoing, 6 months so far

Solution

Mobile Application

Project Team

1 iOS Developer, 1 Android Developer, 2 Backend Developers, 1 Tester, 1 Tech Lead, 1 Business Analyst, 1 Project Manager

Tech stack / Platforms

Solution Overview

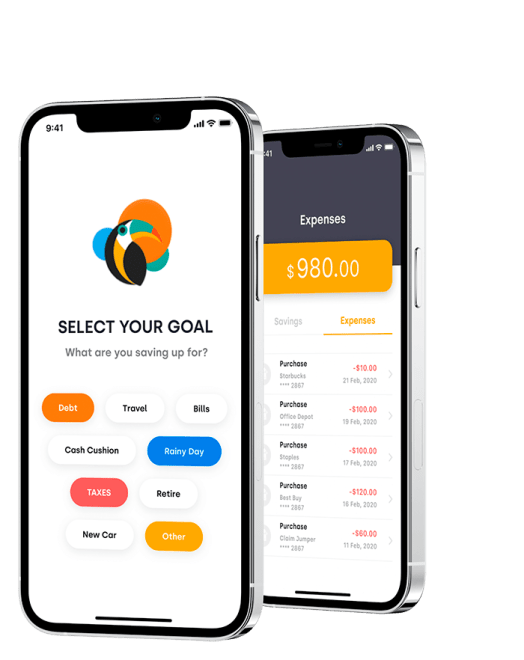

We started with building a classical expense tracker MVP. Once a user registers and links their bank and credit cards to their personal account, the app automatically starts analyzing transaction details, tracking and categorizing the user’s income and expenses, and visualizing data with graphs and charts.

The app allows users to set saving goals and track progress daily, whatever their objectives may be: budgeting for their next vacation, paying off credit card balances, saving up for a house or retirement. Users can also set up automated transfers of predetermined sums of money to specific savings and brokerage accounts.

One of the key differentiators of the app is the gamification functionality that helps users develop “good spending habits.”

The app analyzes and categorizes a user’s spending and identifies “bad” habits (e.g., smoking, junk food, etc.) in their spending. The app then invites the user to meet the challenge, for example, of “cutting down on junk food” or “setting a monthly budget for cigarettes”, which the user can either accept or decline. To keep users motivated to stick with the challenges they choose to accept, the app charges a fee when the user fails the challenge. Apart from these penalties, the app is free to use.

Monetization functionality will come in a later iteration.

The app also has a number of social features that easily enable viral marketing. Users are able to invite and challenge their friends and also have the option to share their “Challenge accepted” results.

Technical Solution Highlights

The system consists of native iOS and Android apps, along with a web-based admin panel and the backend server. The application uses the Plaid aggregator to access users’ accounts. We chose Plaid for the following reasons:

- It provides access to users’ transaction data, once they links their bank cards to an app account.

- It is supported by nearly every bank and financial institution in the United States.

- It is extremely secure, applying an advanced tokenization system for transactions and the sharing of sensitive financial data.

To comply with with Plaid’s extensive security requirements, the app uses role-based access controls, multi-factor authentication, and encryption, in addition to other security measures. Additional monitoring and data protection is provided by the AWS infrastructure, which was chosen by our team to run the app in the cloud.

Third-Party Integrations

- Plaid is the aggregator for accessing users’ bank accounts and helps to obtain information about transactions from bank accounts.

- SynapseFI is a banking platform that allows businesses to offer financial products to their customers at a fraction of the cost of traditional banks. It is used to make payments for users’ goals and challenges.

- Twilio is a single platform with flexible API used to connect with users via SMS notifications related to transactions, liabilities, or banking data.

- Django Admin is an admin panel that allows grouping merchants received from Plaid, managing the user list, etc.

Results

Itexus delivered a ready-to-use mobile app with a core set of expense tracker functions and gamification features.

The team is currently working on the second version of the app, creating a full-scale virtual personal finance assistant that includes a tax calculator and bill payment service, an investment advisor that allows users to automatically create a stock portfolio depending on their investment profile, and the ability to automatically invest savings into a 401(k) or IRA brokerage account.

Related Projects

All ProjectsFinancial Data Analytical Platform for one of top 15 Largest Asset Management

Financial Data Analytical Platform for one of top 15 Largest Asset Management

- Fintech

- Enterprise

- ML/AI

- Project Audit and Rescue

AI-based data analytical platform for wealth advisers and fund distributors that analyzes clients’ stock portfolios, transactions, quantitative market data, and uses NLP to process text data such as market news, research, CRM notes to generate personalized investment insights and recommendations.

Mobile E-Wallet Application

App for Getting Instant Loans / Online Lending Platform for Small Businesses

App for Getting Instant Loans / Online Lending Platform for Small Businesses

- Fintech

- ML/AI

- Credit Scoring

Digital lending platform with a mobile app client fully automating the loan process from origination, online loan application, KYC, credit scoring, underwriting, payments, reporting, and bad deal management. Featuring a custom AI analytics & scoring engine, virtual credit cards, and integration with major credit reporting agencies and a bank accounts aggregation platform.

Contact Form

Drop us a line and we’ll get back to you shortly.

For Quick Inquiries

Offices

8, The Green, STE road, Dover, DE 19901

Żurawia 6/12/lok 766, 00-503 Warszawa, Poland