Rescuing Wealth Management App Ecosystem for Investment Advisory Firm

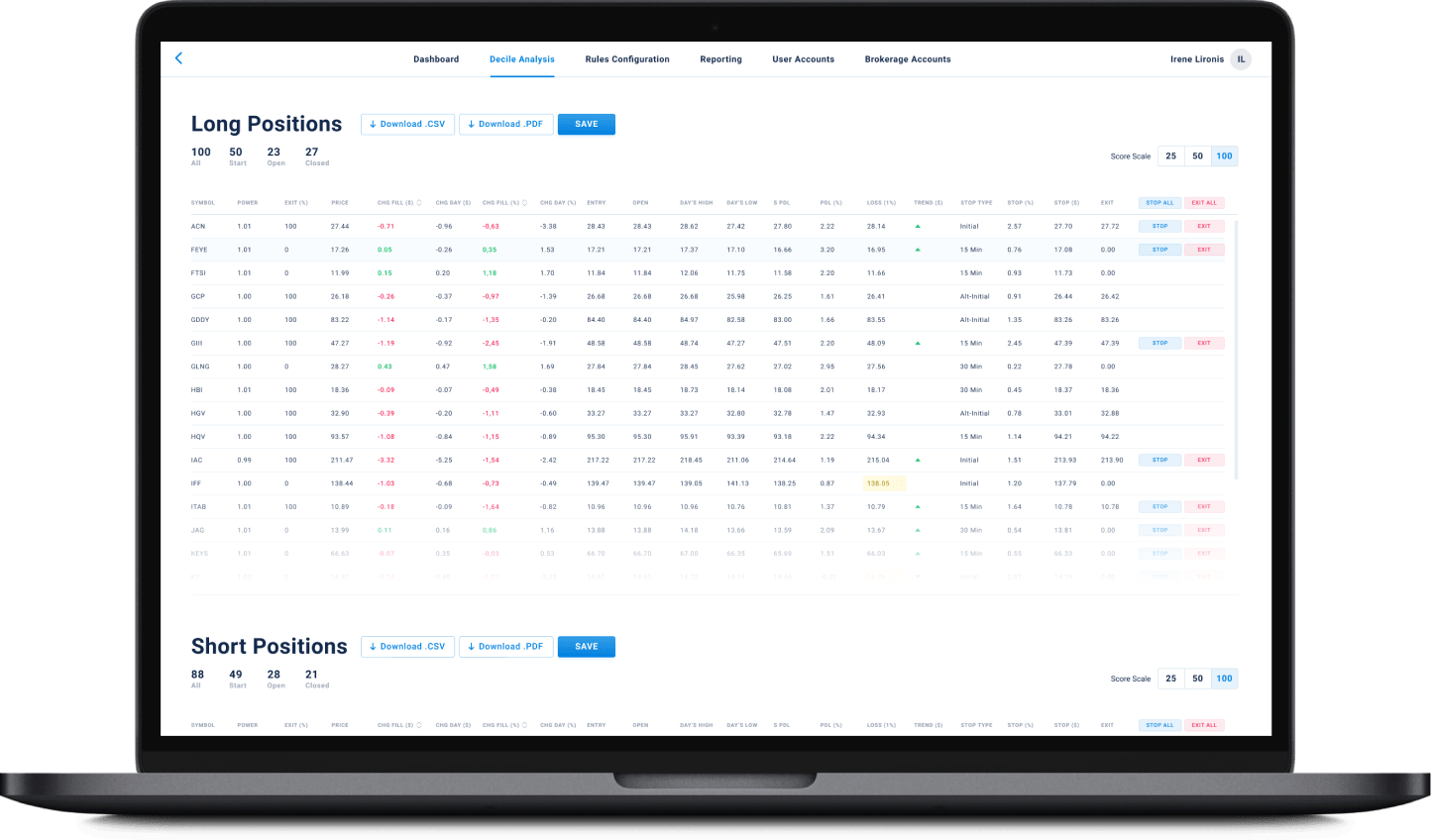

Takeover, stabilization and expansion of a troubled wealth management app ecosystem for a large investment management company consisting of mobile and web apps for investors, telegram channel and bot, market and portfolio analysis module for investment advisers, integration with SalesForce CRM, Market data and news feeds and quantitate portfolio analysis engine, allowing real-time monitoring of market events, client portfolios and delivering personalized investment recommendations and insights to investors for a subscription fee

About the Client

Founded over 20 years ago by a distinguished investment banker and economics professor, the client is a renowned investment advisory firm boasting a subscription base of over 450,000 individuals. Its primary revenue comes from subscription fees for analytical and educational materials that enhance investors’ understanding of market trends, investment strategies, and overall financial literacy. The firm’s core services include expert investment advice, comprehensive market analysis, diversified ready-made investment portfolios, and timely market insights, all offered on both free and premium tiers.

Project Background

Initial Vision. The company aims to create a financial ecosystem that simplifies investment management. To achieve this, they launched a project to develop a software platform offering diversified investment portfolios, analytical tools, market updates, webinars, and educational resources integrated with social media. Initially, the client hired a third-party vendor to create a Minimum Viable Product (MVP).

Realization of Issues. The platform’s instability prompted an audit, which Itexus conducted due to our expertise in financial software development. The audit uncovered issues with architecture, dependencies, infrastructure, security, and scalability, highlighting the need for significant improvements.

Project Transition. The client first had the current vendor try to resolve the issues, but six months passed with no progress. The client then transferred the project to Itexus, tasking us with fixing the problems and taking over development.

Engagement Model

Time and Material

Project Team

4 Backend developers, 2 Frontend developer, 2 Flutter developer, 1 Software Architect, 1 Project Manager, 2 Quality Assurance engineers, 1 Business Analyst, 2 Testers, 1 DevOps Engineer

Tech stack / Platforms

Solution Overview

This solution is a robust wealth management ecosystem designed to generate revenue and enhance user experience. It’s comprised of four core modules tailored to specific roles: Investor, Analytics Team, Accounting Team, and Admin. These modules are accessible through mobile and web applications, enabling users to access their respective functionalities. Additionally, the system is integrated with its own CRM and a Telegram channel.

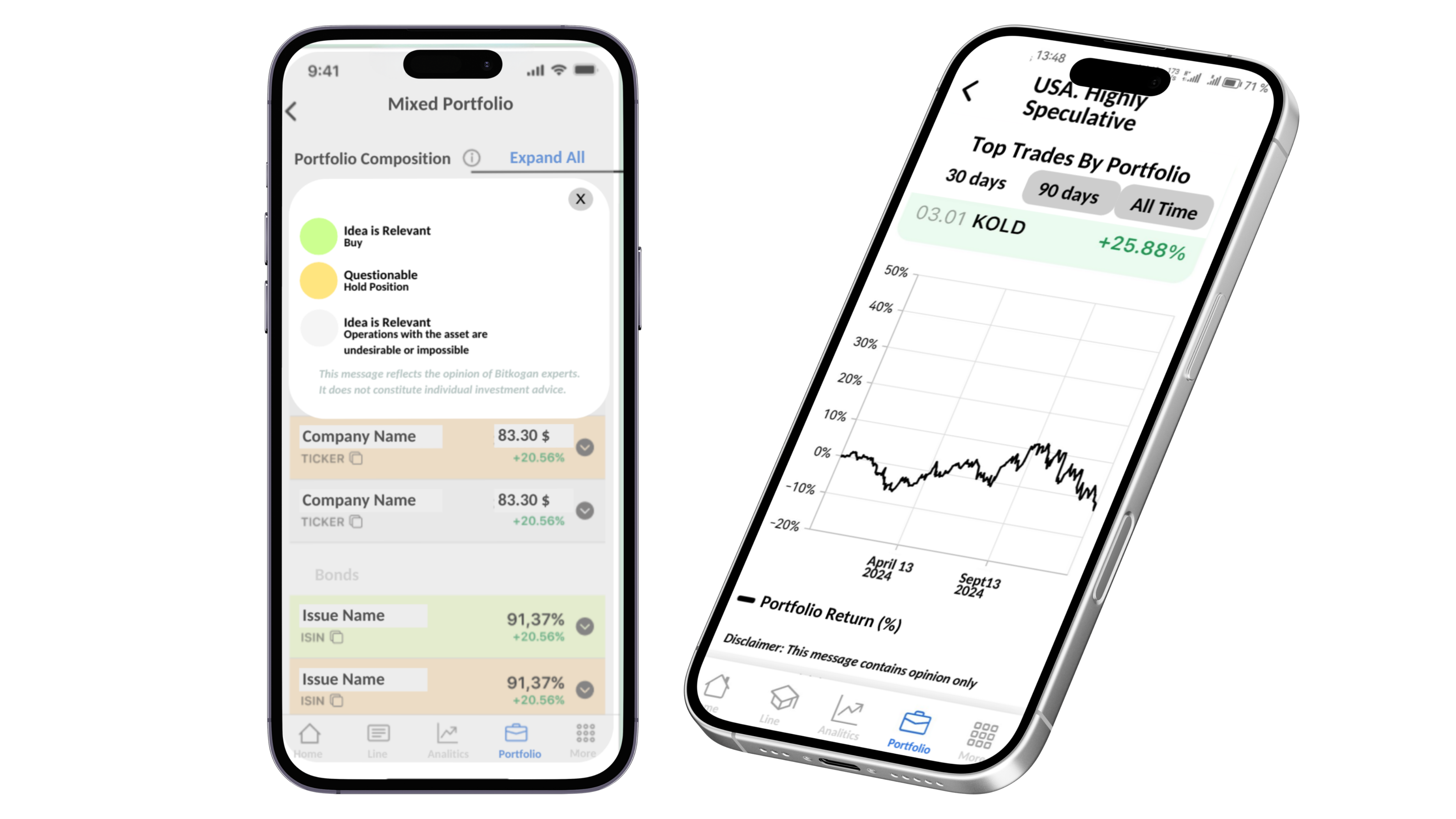

Investor Functionality

1. Access to Analytical Data.

Free and Paid Analytics: The system empowers investors with both free and premium analytical data, presented in customizable dashboards that provide a thorough portfolio overview and enable effective trend identification.

2. Portfolio Management

Multiple Portfolio Types: The system offers investors a selection of diversified portfolio types, each expertly curated by seasoned investment professionals.

3. On-Demand E-Learning

Webinars and Structured Courses: Within the system, investors can enroll in a library of on-demand video courses and live webinars covering a diverse range of investment topics.

3. Subscription & Payments

The system offers secure payment options for accessing the platform and purchasing training materials and webinars. Users can choose from the following methods:

- Credit Card Payments (secure, direct)

- Integrated Sales Platform (streamlined purchases)

4. Multi-Platform Access

Investors engage via a dedicated mobile app and web platform.

5. News, Alerts & Performance Tracking

Investors can access news, alerts, and performance tracking within the system, keeping them informed and updated on market trends, portfolio performance, and significant investment opportunities.

- Curated News: Personalized updates from analysts

- Portfolio Metrics: Performance insights, profitability, and risk tracking

- Custom Alerts: Notifications for market events and portfolio changes

6. Community & Support

Investors interact with peers and access expert guidance.

7. Telegram Integration

A Telegram bot provides real-time updates and analytics.

Analytics Team Functionality

1. Model Portfolios & Trade Recommendations

The system allows experts to create and refine model portfolios, adjusting asset compositions and pushing trade recommendations to investors in real time. Analytical notes and market news are published directly on the platform.

2. Expert Insights & Real-Time Data

The system delivers expert opinions and live market data from sources like: Bloomberg, Yahoo Finance, AlphaVantage, Investing.com, and S&P Global.

3. Market & Performance Analysis

Regular expert evaluations and real-time news integration enhance market insights, helping investors make informed decisions.

4. Analytics & Reporting

The system is highly customizable, allowing analytics to provides daily company and industry reports, tracking portfolio performance and market movements.

Accounting Team Functionality

1. Revenue & Transaction Tracking

The system empowers accountants monitor subscription revenue and track all financial transactions with precision.

2. Financial Reporting

Integrated with FinancialForce, the system generates detailed reports on payments and subscriptions.

3. IRS Tax Compliance

The integration of the system with Thomson Reuters ONESOURCE ensures efficient and compliant tax management.

Admin Functionality

1. Content & User Management

Admins manage course content, user roles, and interactions.

2. Reporting & System Configuration

Generate reports on user activity, subscriptions, and financials. Configure system settings, integrations, and performance.

3. Security & Incident Management

Maintain platform stability by responding to alerts, managing incidents, and regulating access.

4. Marketing & Promotions

Oversee marketing campaigns, track effectiveness, and provide updates on investment offers and subscription discounts.

5. User Support & Analytics

Integrated with Jira, the system streamlines issue tracking, user claims, and technical assistance. User activity analysis helps identify and resolve service gaps.

Project Challenges

Itexus undertook a full-scale overhaul of an unstable investment management platform plagued by performance bottlenecks. Our approach focused on stabilizing the system, optimizing architecture, integrating third-party services, and enhancing core functionalities for long-term success.

- System Instability: The platform suffered from performance issues due to fragmented microservices and misconfigured infrastructure. We transitioned to a modular monolith architecture, improving stability, performance, and service interactions.

- Architectural & Infrastructure Weaknesses: Inefficient microservices and cloud misconfigurations hindered scalability. We restructured the system, optimized load balancing, and improved fault tolerance for a scalable, reliable platform.

- Third-Party Integrations: We replaced outdated payment processors, integrated Cloudpayments for secure transactions, and enhanced push notifications. CRM and CMS integrations ensured seamless cross-platform experiences.

- Payment Processing Failures: Faulty payment logic caused errors and delays. We reworked the system, ensuring accurate, secure transactions with Cloudpayments integration.

- User Experience Enhancements: We developed iOS, Android, and web applications with real-time analytics, integrating Alpha Vantage and Yahoo Finance for market data insights.

- Back-Office Efficiency: A custom back-office tool automated user management, reporting, and incident response, improving operational scalability.

- Future AI Integration: Beyond stabilization, we prepared for AI-driven features to enhance automation and user support, aligning with industry trends.

Third-Party Integration

Effective third-party integrations were crucial for system stability and enhanced functionality. The existing integrations were outdated and unreliable, requiring a complete overhaul.

- Replacing Outdated Integrations: Unstable local payment providers were phased out in favor of Cloudpayments, improving security, scalability, and overall system reliability.

- Optimizing User Notifications: We replaced OneSignal with native push notifications, reducing costs, improving stability, and giving the client greater control over delivery workflows.

- Error Monitoring with Sentry: Sentry was integrated for real-time error logging, enabling proactive issue resolution, minimizing downtime, and improving user experience.

- Real-Time Market Data: Integrations with Alphavantage, Yahoo Finance, and Investing.com provided users with accurate market insights, enhancing investment decision-making.

- Salesforce CRM Integration: Implementing Salesforce streamlined customer data management, optimized sales workflows, and improved personalized user engagement.

- Future-Proofing with Automation: These integrations laid the groundwork for innovations like Telegram bots for user engagement and automated notifications, ensuring scalability and adaptability.

Project Approach

We transformed an unstable legacy system into a scalable, high-performing platform through a structured, phased approach.

- Audit & Assessment: Conducted a system-wide audit to identify instability, data inaccuracies, and inefficiencies. Despite challenges in documentation transfer, we pinpointed critical flaws for targeted improvements.

- Rebuilding & Stabilization: Replaced fragmented microservices with a modular monolith architecture, enhancing performance, scalability, and integration while reducing complexity.

- Process Optimization & Documentation: Established formal requirements, process maps, and system documentation to improve collaboration and streamline troubleshooting.

- Infrastructure Optimization: Reconfigured cloud infrastructure, implemented best practices, and introduced CI/CD pipelines, increasing system uptime by 20% and reducing deployment cycles by 30%.

- Data Migration & Management: Transitioned from MongoDB to PostgreSQL for improved data consistency, scalability, and query performance, ensuring a seamless migration.

- User Support Enhancement: Implemented a tiered support model and a knowledge base, reducing response times by 25% and improving user satisfaction.

- Continuous Improvement: Established a review process for ongoing optimizations and future scalability.

Result & Future Plans

Our collaboration stabilized and transformed the client’s financial management platform, paving the way for future innovation. Key Outcomes:

- System Stabilization: Resolved critical issues, enhancing reliability and performance.

- Optimized Infrastructure: Upgraded architecture, streamlined cloud operations, and introduced CI/CD, reducing bottlenecks.

- Enhanced User Support: Integrated back-office tools (CRM, reporting, incident management), reducing developer reliance and improving response times. Expanded Functionality: Introduced Telegram bots and advanced reporting, boosting user engagement.

- Seamless Handover: The stabilized system was transferred to the client’s in-house team for independent operations.

- Business Growth: Clientele increased by 42% within two months post-launch, reflecting regained user confidence.

Future Plans:

- AI Integration: Automating customer support, content creation, and market trend analysis.

- Ongoing Collaboration: Continued engagement with Itexus for AI and future projects.

- Feature Expansion: Enhancing capabilities to stay competitive in the fintech space.

To ensure long-term success, Itexus supported the client with candidate selection, training, and advisory services, equipping them for sustained growth and innovation in a dynamic industry.

Related Projects

All ProjectsFinancial Data Analytical Platform for one of top 15 Largest Asset Management

Financial Data Analytical Platform for one of top 15 Largest Asset Management

- Fintech

- Enterprise

- ML/AI

- Project Audit and Rescue

AI-based data analytical platform for wealth advisers and fund distributors that analyzes clients’ stock portfolios, transactions, quantitative market data, and uses NLP to process text data such as market news, research, CRM notes to generate personalized investment insights and recommendations.

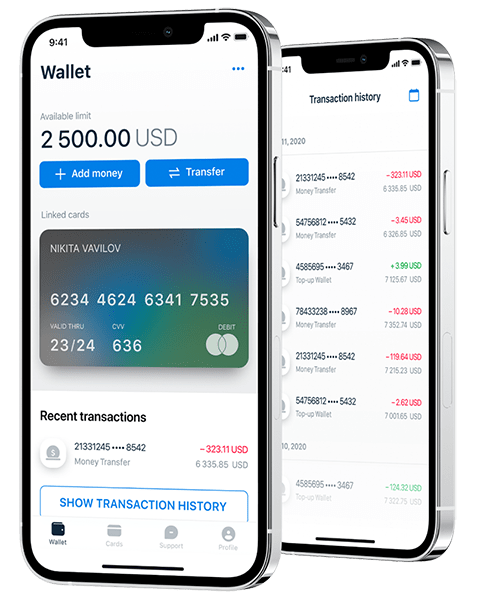

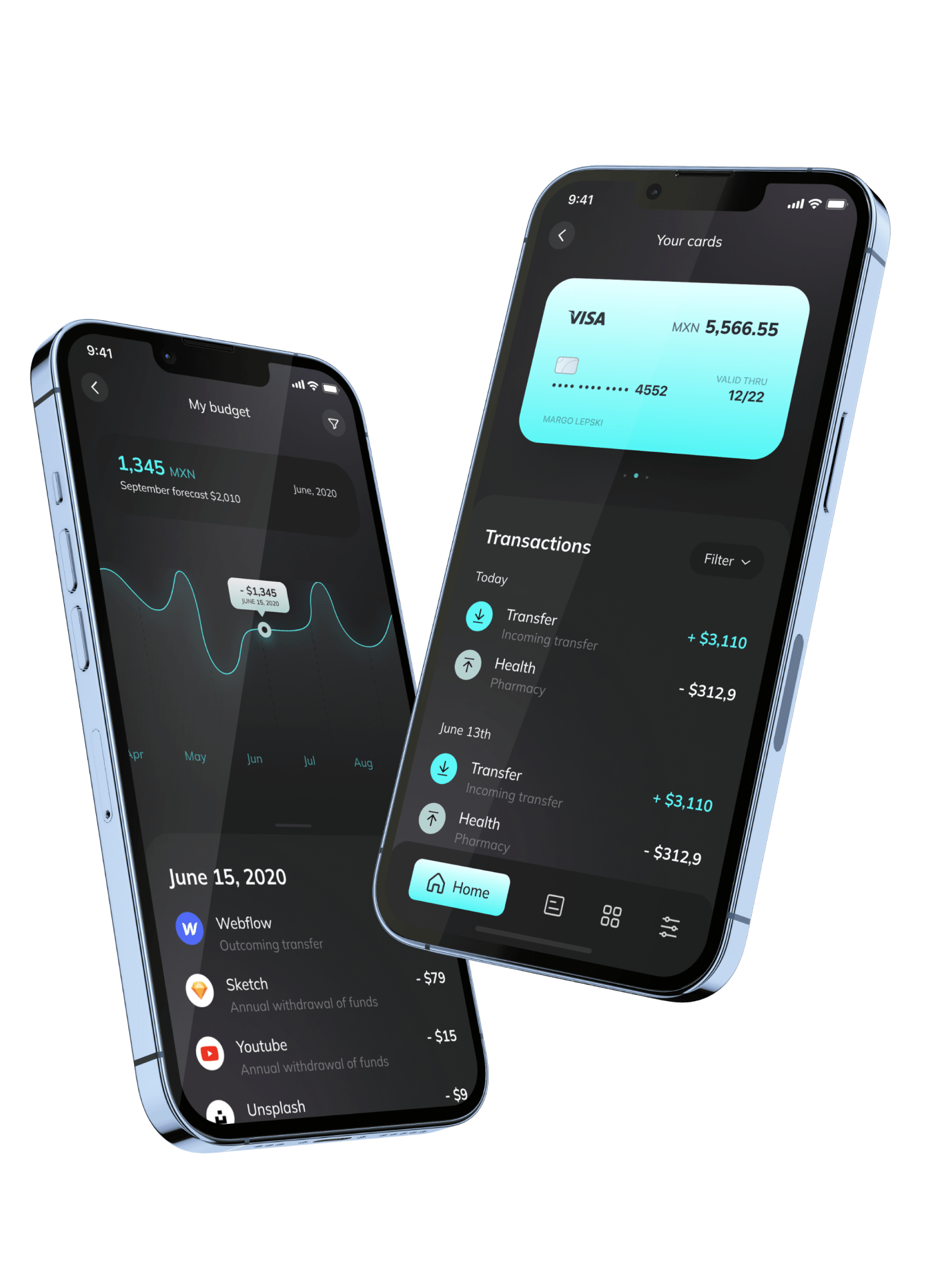

Mobile E-Wallet Application

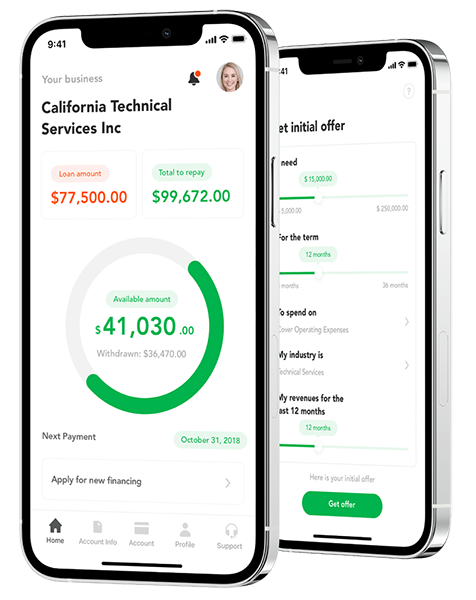

App for Getting Instant Loans / Online Lending Platform for Small Businesses

App for Getting Instant Loans / Online Lending Platform for Small Businesses

- Fintech

- ML/AI

- Credit Scoring

Digital lending platform with a mobile app client fully automating the loan process from origination, online loan application, KYC, credit scoring, underwriting, payments, reporting, and bad deal management. Featuring a custom AI analytics & scoring engine, virtual credit cards, and integration with major credit reporting agencies and a bank accounts aggregation platform.

Contact Form

Drop us a line and we’ll get back to you shortly.

For Quick Inquiries

Offices

8, The Green, STE road, Dover, DE 19901

Żurawia 6/12/lok 766, 00-503 Warszawa, Poland