White-Label Banking Platform

Build your own digital bank from modular building blocks. Itexus White-Label Banking Platform is a configurable banking constructor that lets you assemble exactly the services you need under your brand. Combine ready components, plug them into your ecosystem, and go live in weeks instead of years while keeping full control over features, UX, and roadmap.

Why Choose White-Label Banking

Use a ready technology backbone and compliance toolkit and spend your time on product and growth. Your future platform will support core banking logic and integrations so your team can focus on customer value, not on low-level infrastructure.

Start with a minimal set of modules and extend the platform as your business grows. Add new products, regions, and user segments without reengineering the entire system. Scale users, transactions, and features with predictable effort and cost.

Select only the modules you need and customize flows, limits, and interfaces to match your business model. You get a unique product on top of a proven foundation instead of another generic banking app.

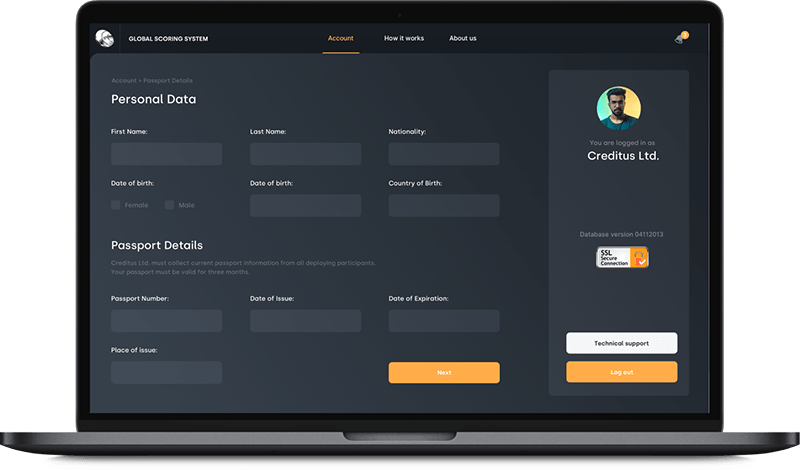

Use modules that are designed with security and regulatory requirements in mind. KYC, AML, reporting, and audit trails are implemented at the platform level. This reduces legal risk and shortens the path from idea to compliant launch.

Building banking tech from scratch is costly and time-consuming. A modular platform offers a ready-made solution at a fraction of the price, letting startups avoid heavy R&D and infrastructure costs. Free up your budget to focus on growth, not backend development.

Pre-built and tested modules shorten implementation cycles. You can assemble a first version, validate it in production, and iterate quickly. While others are still building basic functionality, you are live and collecting real customer data.

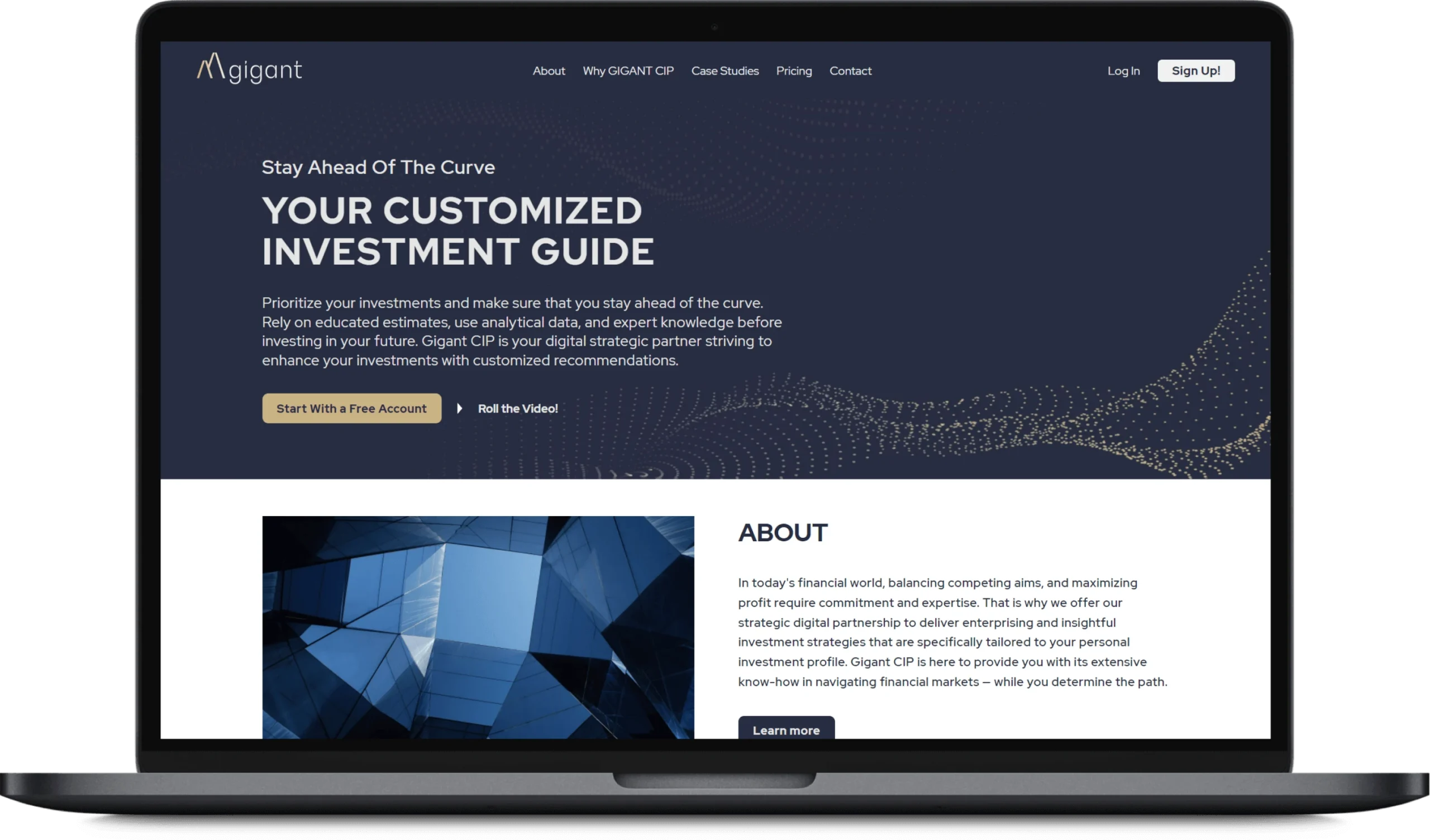

Our White-Label Projects

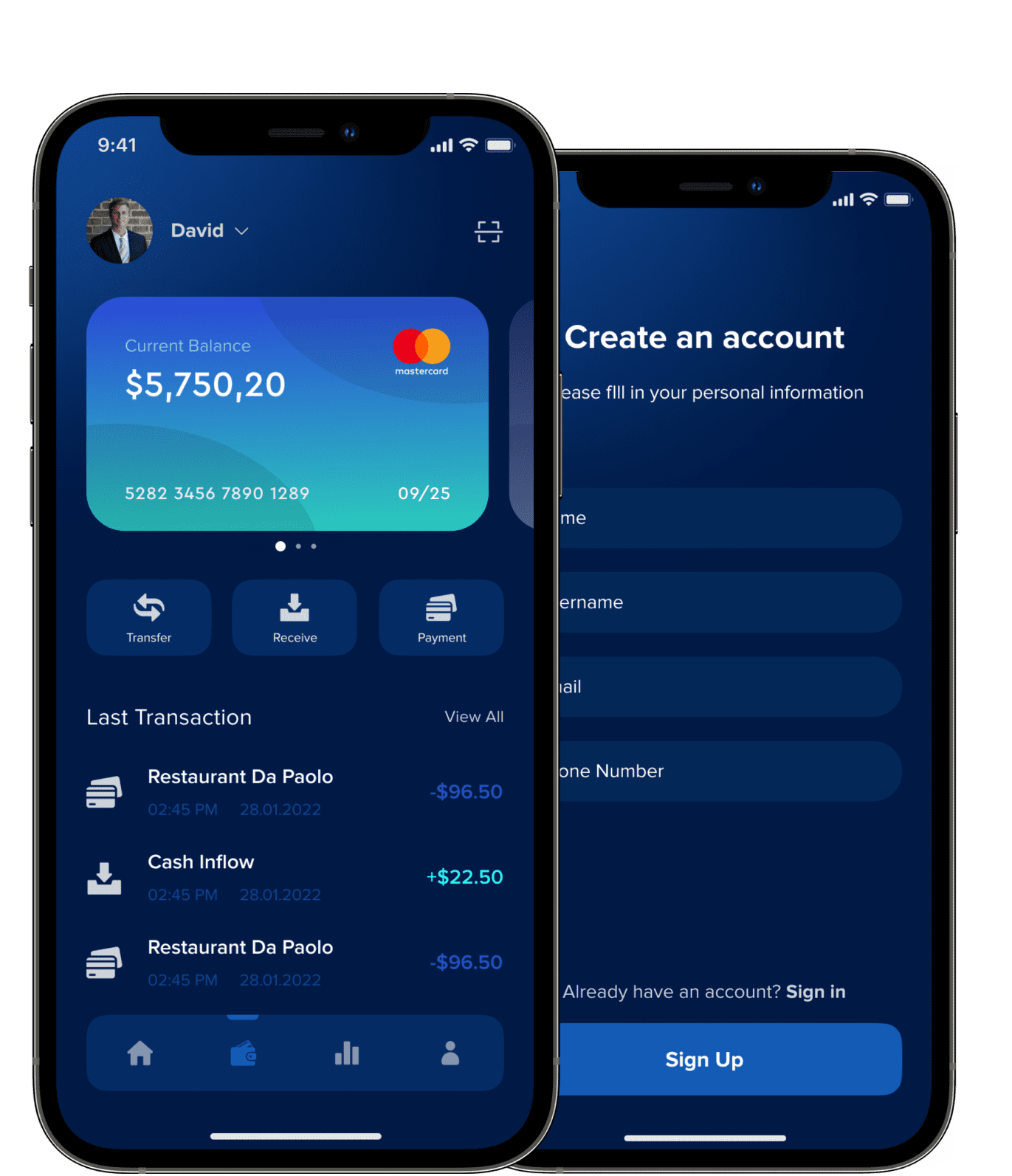

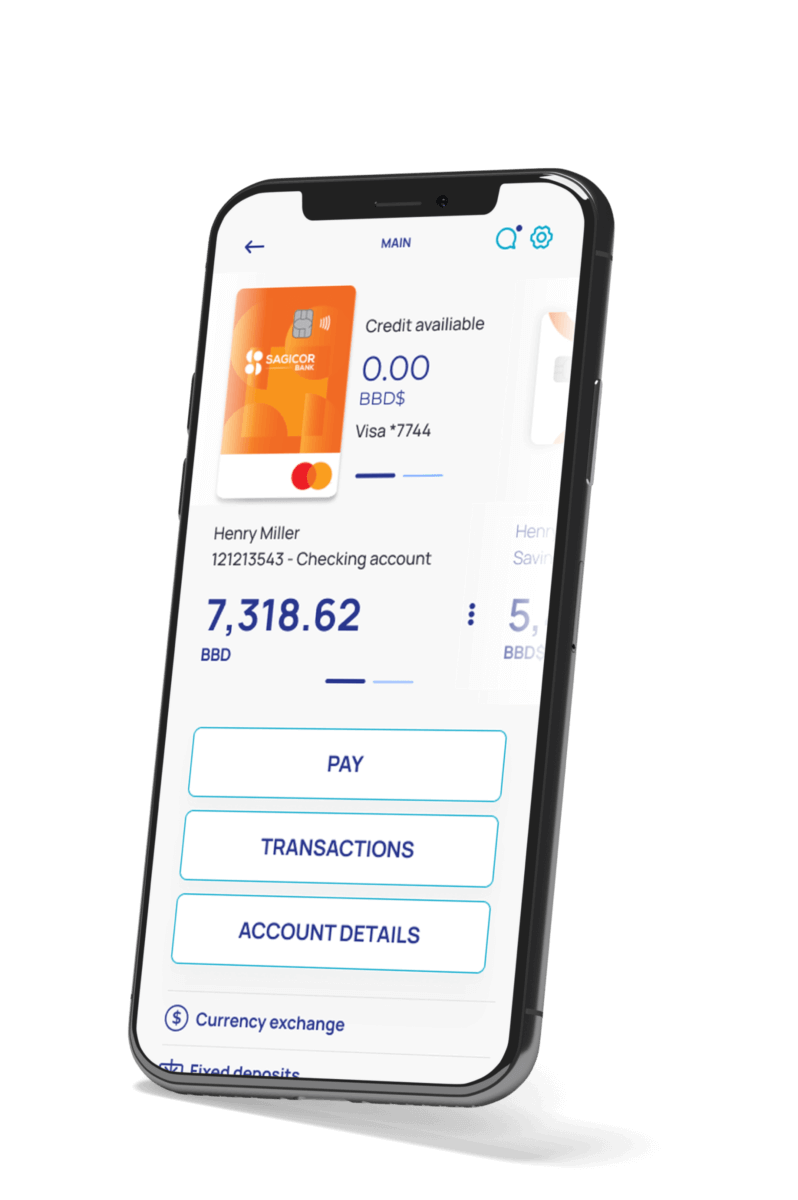

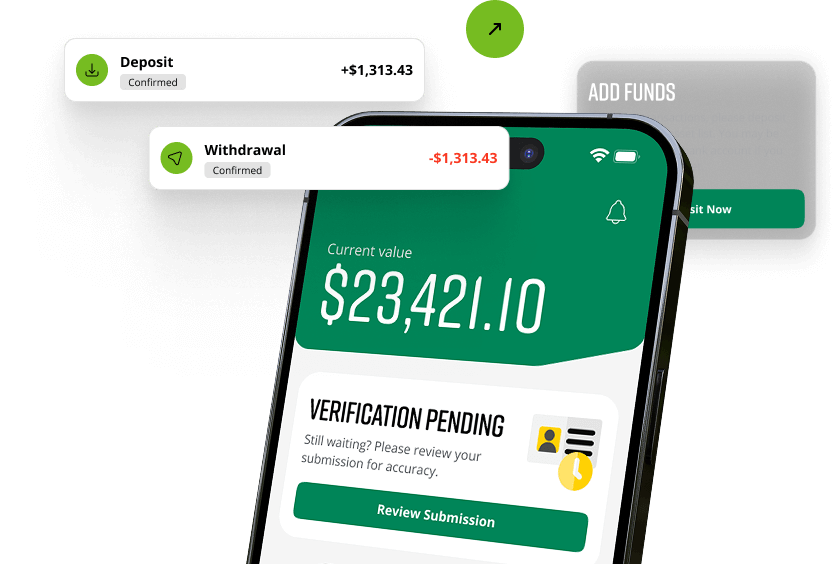

A white-label app for a Silicon Valley startup that is targeted at solutions for credit unions, fintech and financial companies in the U.S. market.

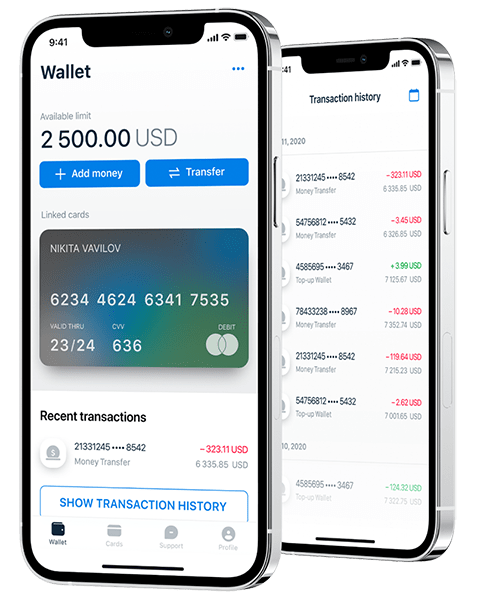

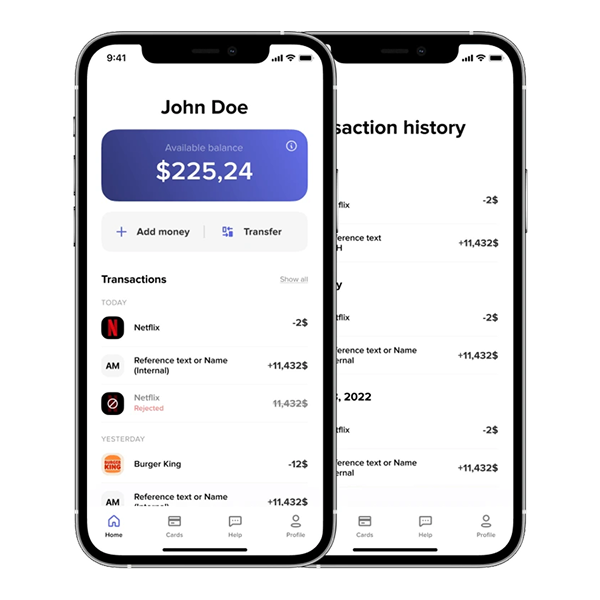

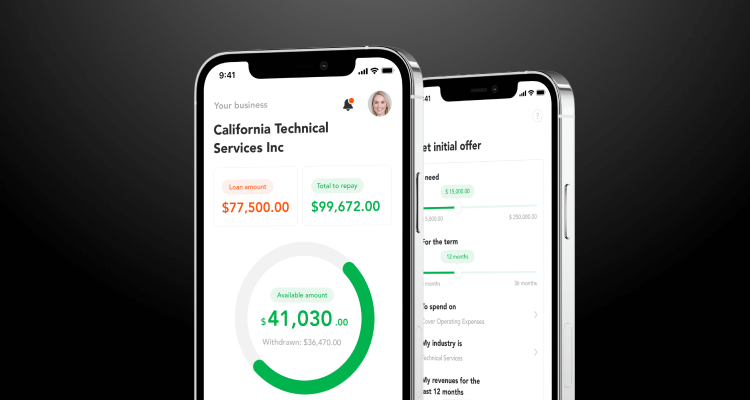

A digital wallet app ecosystem for Coinstar, a $2.2B global fintech company — including mobile digital wallet apps, ePOS kiosk software, web applications, and a cloud API server enabling cryptocurrency and

Features of White-Label Banking Platform

Everything you need to know on what makes white-label banking the best choice for you. Here’s everything you need to launch secure, modern financial services under your brand – quickly and confidently.

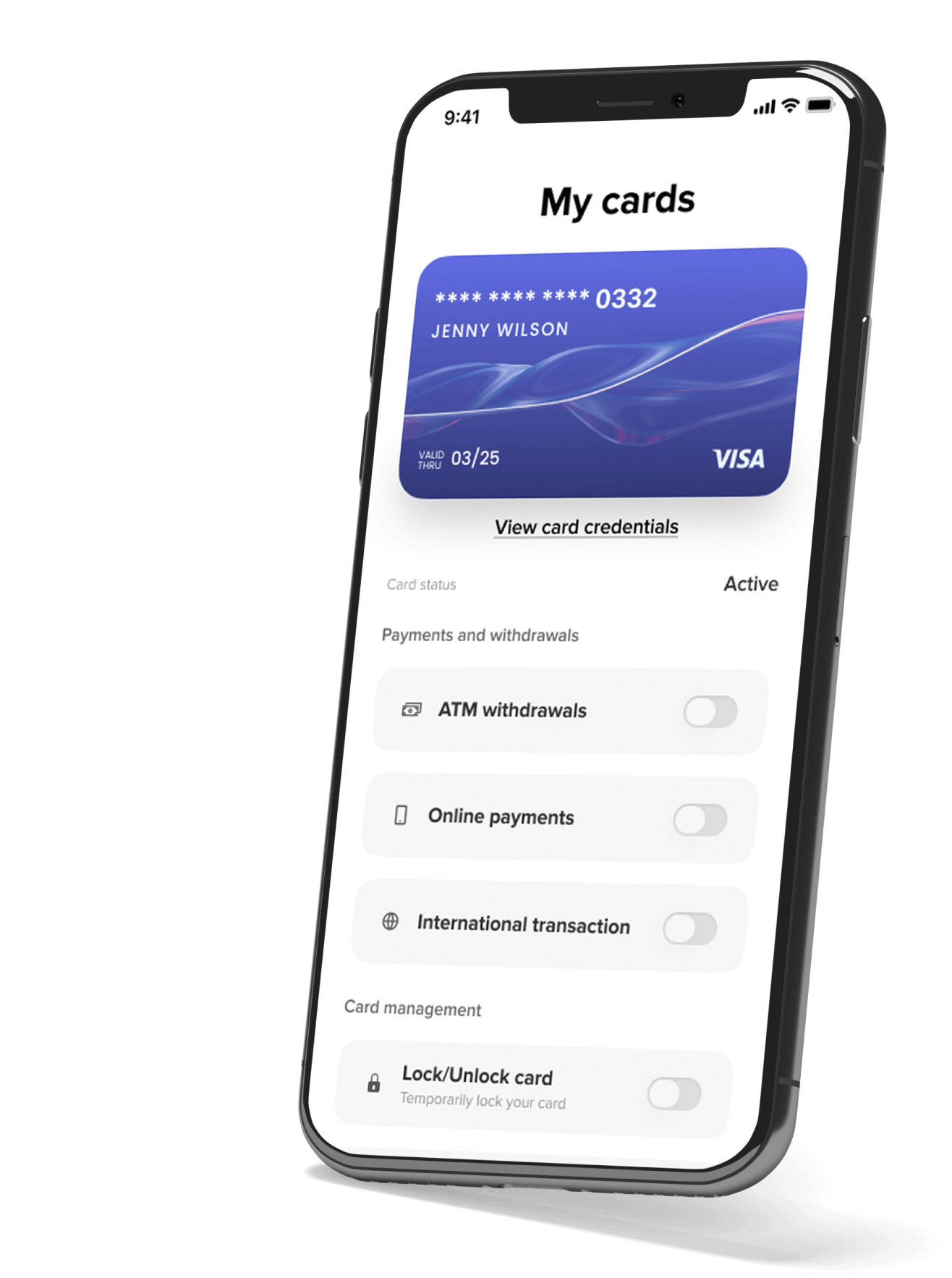

The future white-label banking platform will let you fully customize the app and website with your own logo, colors, and design. Customers experience your brand directly — building trust and loyalty without the high cost of developing your own technology.

With pre-built banking infrastructure, you can launch branded financial services in weeks. Skip lengthy development and quickly seize market opportunities to stay ahead.

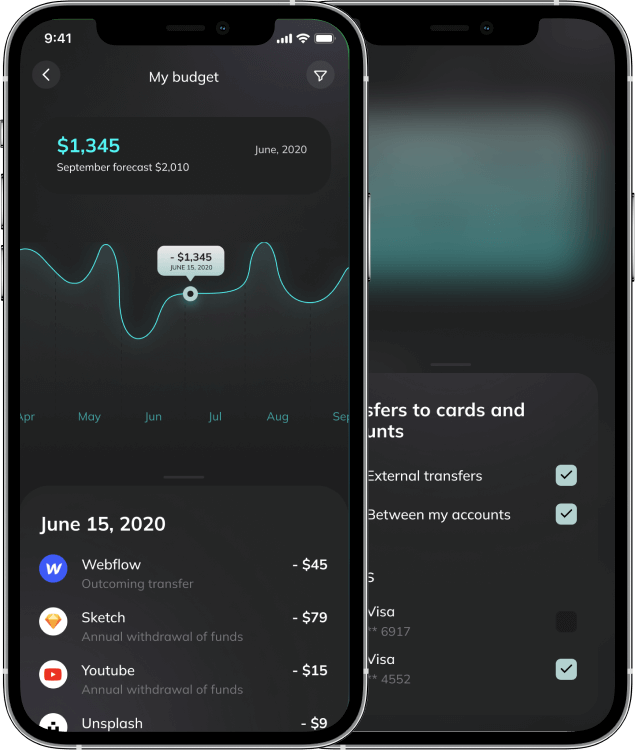

Leading white-label platforms offer intuitive, mobile-friendly interfaces for smooth, engaging banking experiences. Easy onboarding, clear navigation, and fast transactions boost customer satisfaction, loyalty, and your brand’s reputation.

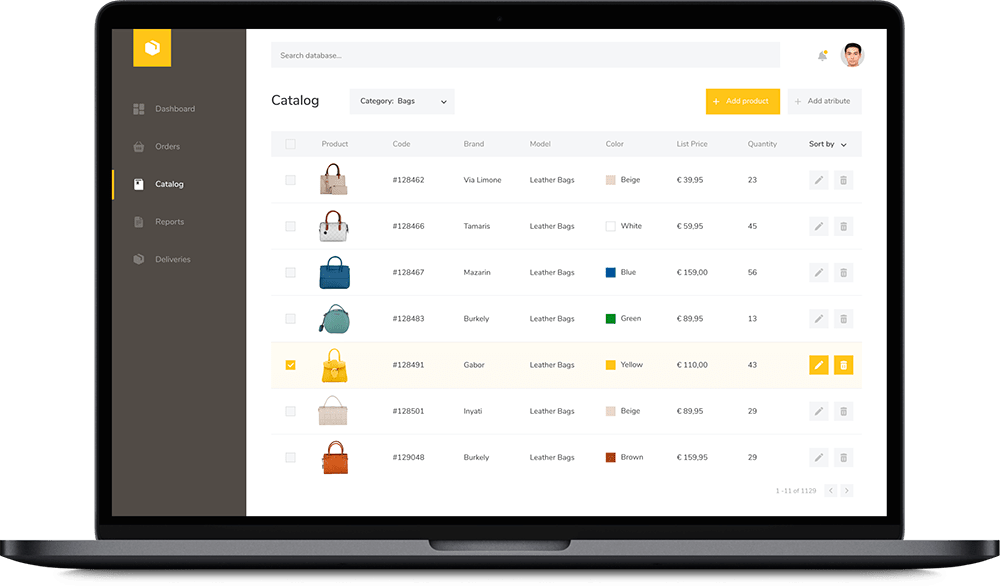

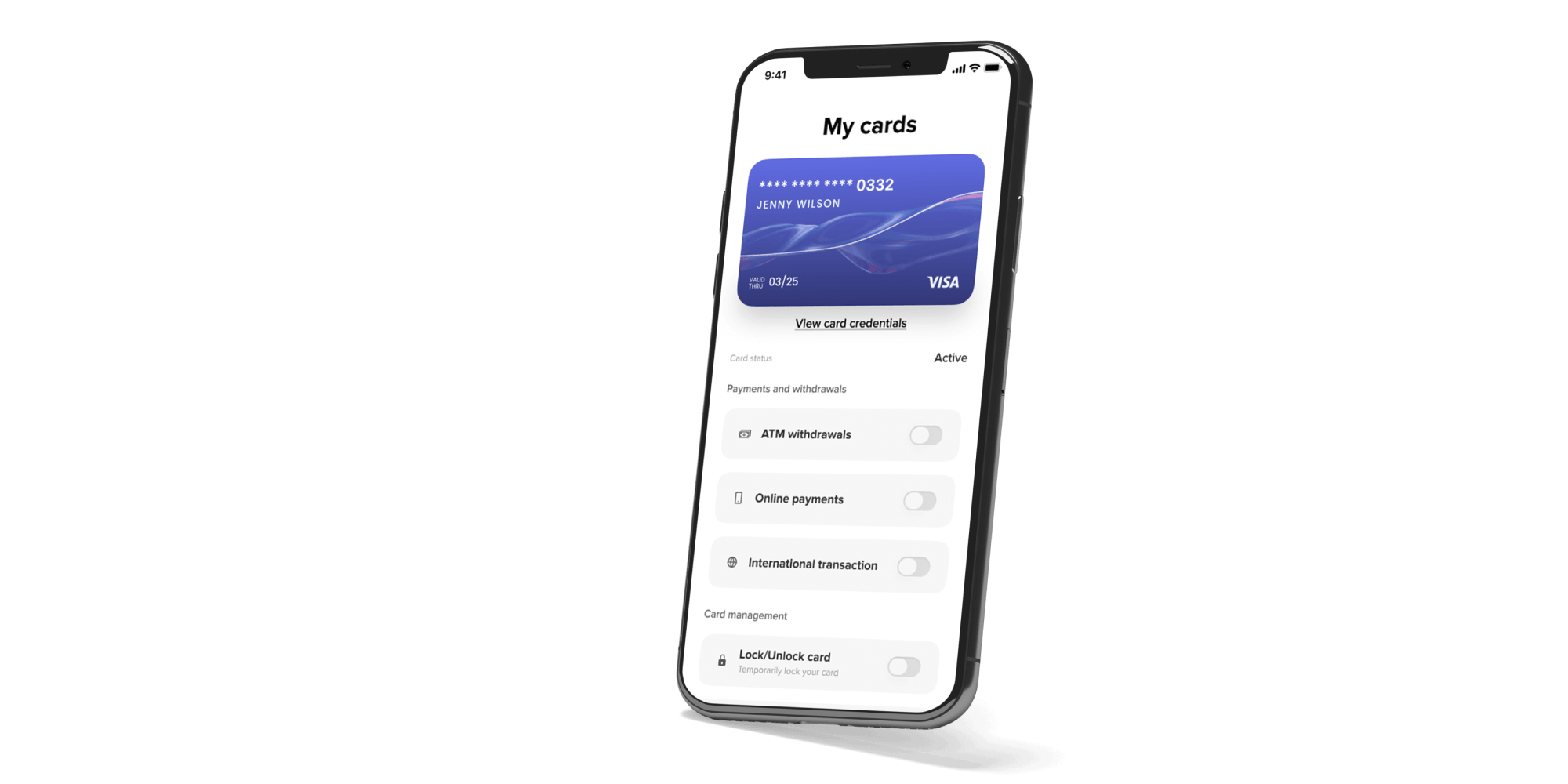

A white-label banking platform is flexible and modular, letting you select and adjust features — like payments, cards, or lending — to match your needs. Easily adapt and scale your offering as market demands change, ensuring your services stay competitive and relevant.

Third-party integrations in white-label banking platforms enable startups to launch quickly, operate smoothly, and stay flexible. Leverage ready-made solutions from trusted partners — letting you focus on innovation while easily scaling your branded financial services.

White-label banking platforms offer open APIs and easy integration with your apps, websites, and third-party tools like CRMs and analytics. Quickly add banking features, creating a seamless user experience and simplifying operations.

AI Features for Your White-Label Banking Platform

Development

Leverage tools like Cursor AI for code generation, optimization, and real-time collaboration, accelerating development cycles.

Use AI-powered design tools for rapid UI/UX prototyping, style suggestions, and accessibility enhancements.

QA

Deploy AI-based test automation to detect bugs, predict failures, and optimize test coverage with machine learning.

Automate CI/CD pipelines, monitor model performance, and optimize cloud costs with AI-driven anomaly detection.

Extract insights from contracts, invoices, and PDFs using OCR and NLP, reducing manual effort by 70% (as showcased in our fintech case studies).

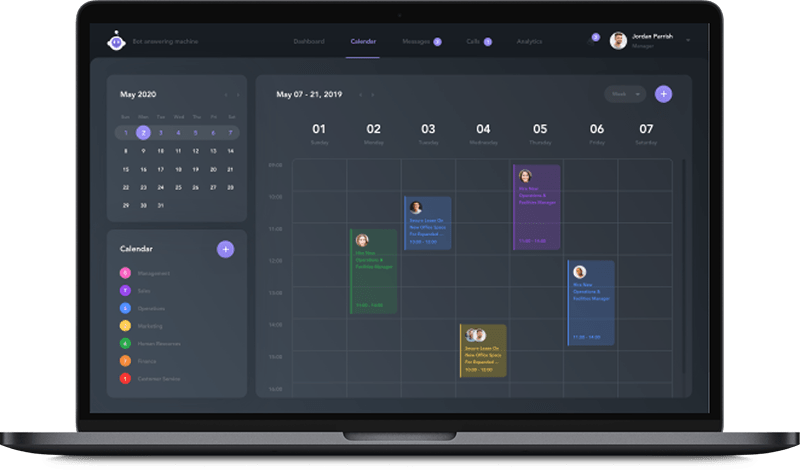

Build GPT-4-powered assistants for customer support, sales, and internal helpdesks with natural language understanding.

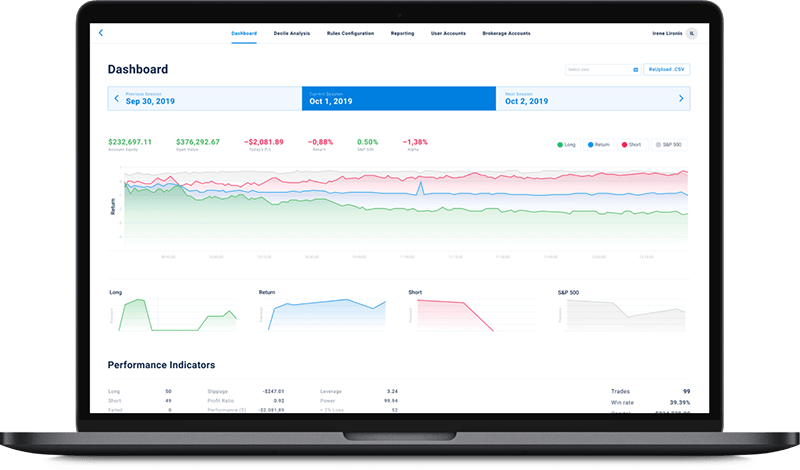

Implement ML models for demand forecasting, risk assessment, and personalized recommendations (e.g., credit scoring, trading signals).

Governance

Ensure transparency with bias detection, explainable AI (XAI), and compliance frameworks for secure, responsible deployments.

Use Cases for White-Label Banking

A modular white-label banking platform lets businesses embed financial services without building their own core systems. You choose the modules, configure them, and launch under your brand, while startups and established brands focus on core growth goals such as customer retention, revenue, and market expansion. Below are examples of how companies in different sectors use white-label banking in practice:

Fintech Startups and Neobanks

Fintech startups and challenger banks often leverage white-label banking solutions to launch quickly and cost-effectively. Instead of investing heavily to build their own banking technology, they license core systems, payment processing, or app interfaces. This allows them to enter the market faster while maintaining a distinctive branded customer experience.

Traditional Banks and Credit Unions

Established banks and credit unions use white-label banking apps to quickly modernize digital offerings or enter new markets. Partnering with fintech providers enables them to launch branded apps or digital subsidiaries efficiently — ideal for smaller banks with limited IT resources or larger institutions testing new strategies.

SaaS Platform with Embedded Banking

A software-as-a-service platform (for example, an accounting or invoicing app) integrates white-label bank accounts and payments into its product.

This enhances user convenience and engagement on the platform and opens new revenue streams (e.g. transaction fees or interest) without the SaaS company needing a banking license.

Telecom and Mobile Operators

Telecom companies increasingly use white-label banking apps to diversify offerings and reduce customer churn.

Leveraging their large subscriber bases, they provide branded mobile wallets, payment accounts, or banking services — without needing their own banking license.

Retailers and E-Commerce Brands

Retailers use white-label banking apps to boost customer loyalty and create new revenue streams. By integrating branded financial services — like cards, wallets, or payment apps — they keep customers engaged and encourage more spending within their brand ecosystem.

Technology Platforms and Other Sectors

Businesses across sectors — including tech platforms, gig economy companies, insurers, and membership groups—use white-label banking apps to embed financial services easily. Providers handle the technical and regulatory complexities, enabling companies to quickly enhance their offerings and deepen customer relationships.

Why Choose Itexus?

Tap into a partner with a track record of fintech apps that thrive in the market. Itexus has helped multiple neobanks and fintech startups launch quickly and scale – one client went live in just 4 months and attracted over 10,000 users in its first quarter – validating the impact and quality of Itexus’s solutions.

Unlike one-size-fits-all providers, Itexus offers deep customization of its white-label platform, so your banking app reflects your unique brand and vision. This flexibility means you get a tailor-made product suited to your business model and customer needs, helping you stand out in a crowded fintech market.

Enjoy a true development partner that supports you through development, launch, and beyond. Itexus provides continuous post-launch maintenance, updates, and enhancements, ensuring your platform runs smoothly and stays cutting-edge as your user base grows. You’re never alone – expert help is on hand to swiftly address issues and adapt the product to new requirements.

Work with a team devoted exclusively to fintech, bringing deep industry knowledge to your project. Itexus’s focus on banking and compliance means they understand financial regulations and user expectations inside-out, reducing project risk and smoothing the path to a compliant, user-friendly launch.

Are you ready to develop your ideas now?

Are you ready to develop your ideas now?

FAQ

What is a white-label banking app?

A white-label banking app is a ready-made banking solution that businesses can brand as their own. It enables companies to quickly offer services like accounts, payments, and cards without building their own technology or managing compliance.

How long does it take to launch a white-label banking app?

Launching a white-label banking app typically takes **4 to 12 weeks**, significantly faster than building from scratch. Exact timing varies based on customization, integrations, and regulatory needs.

What features do white-label banking apps usually include?

Common features include accounts and cards, mobile payments, digital wallets, transfers, compliance (KYC/AML), security, analytics, and third-party integrations.

Do I need a banking license to use a white-label banking app?

No — typically, the white-label provider or their banking partners hold the required licenses, allowing you to offer financial services without obtaining your own license.

Is it expensive to launch a white-label banking app?

White-label apps are typically much more cost-effective than building from scratch, saving significant upfront investment and reducing ongoing maintenance costs.

Can I integrate a white-label banking app with my existing systems?

Yes, most providers offer open APIs and flexible integration options to easily connect with your existing applications, websites, and other third-party tools.