Itexus delivered the app according to the requirements. The team met all development milestones and deliverables. They were efficient, friendly, and cooperative. Itexus team was very timely with updates, a regular meeting cadence, and ad-hoc questions and answers via Slack. The team was very responsive and still is.

Loan Lending App Development Company

As a lending software development company Itexus offers high-impact digital solutions for both non-bank digital lenders and traditional financial institutions. From online loan apps to entirely automated platforms equipped with a full suite of services, we deliver flexible, reliable, and secure financing and lending solutions that empower businesses to manage regulatory compliance requirements, shorten financial cycles and increase revenue.

Lending Software We Build

- P2P Lending Software

- Loan Origination Software

- Loan Comparison Software

- Loans Management Apps

- Digital Lending Platforms

- DeFi Lending Platforms

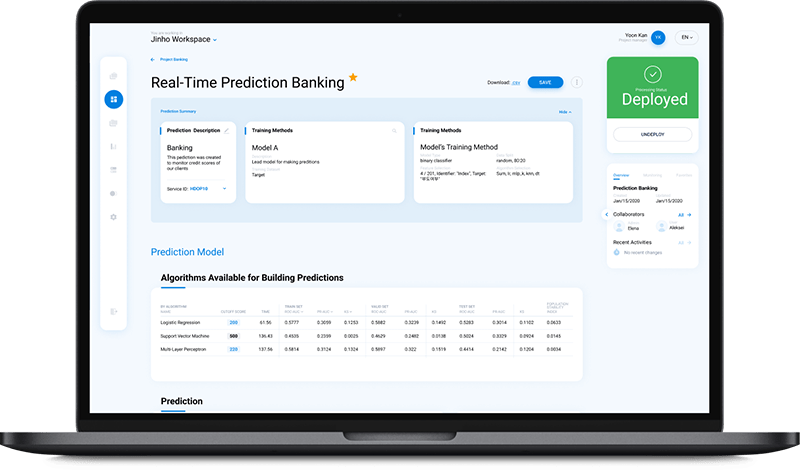

- Credit Scoring Solutions

- Crowdfunding Platforms

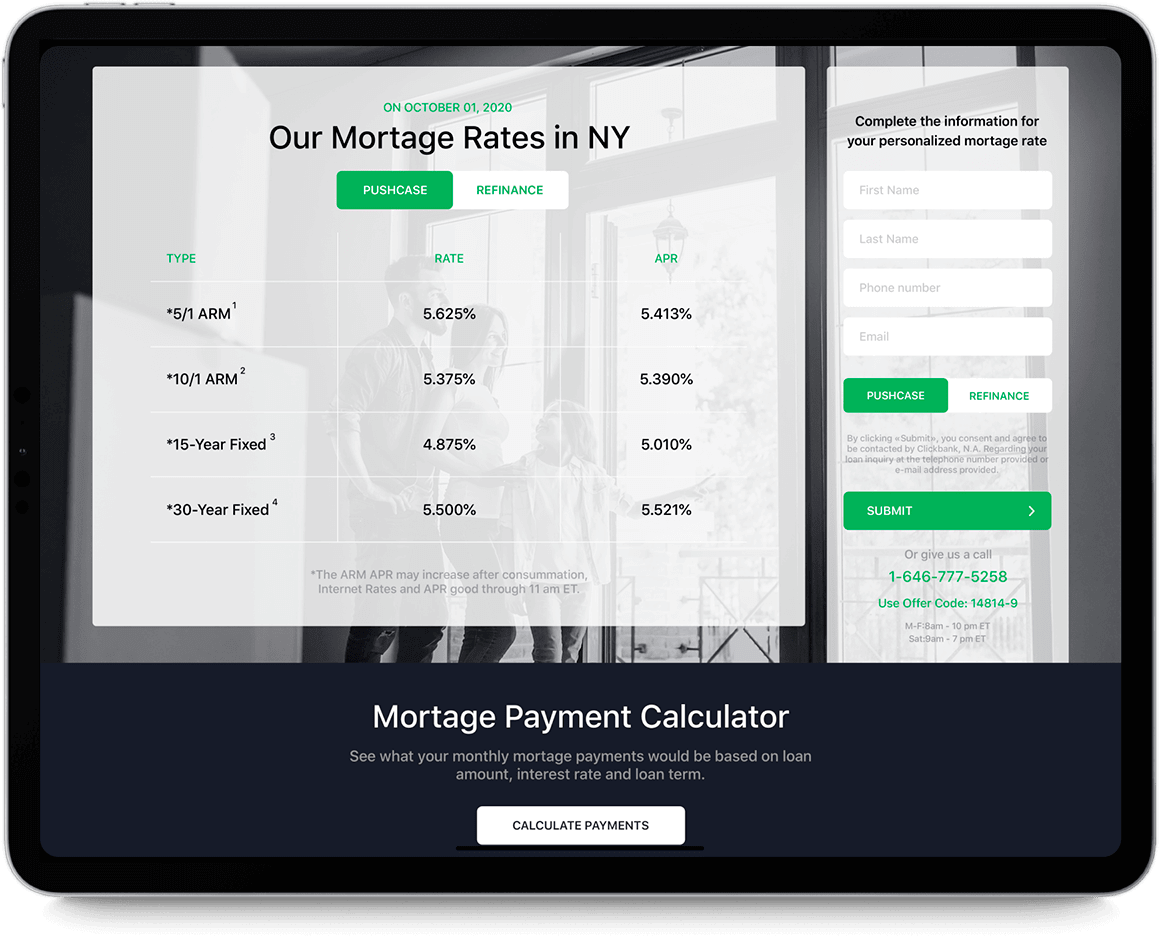

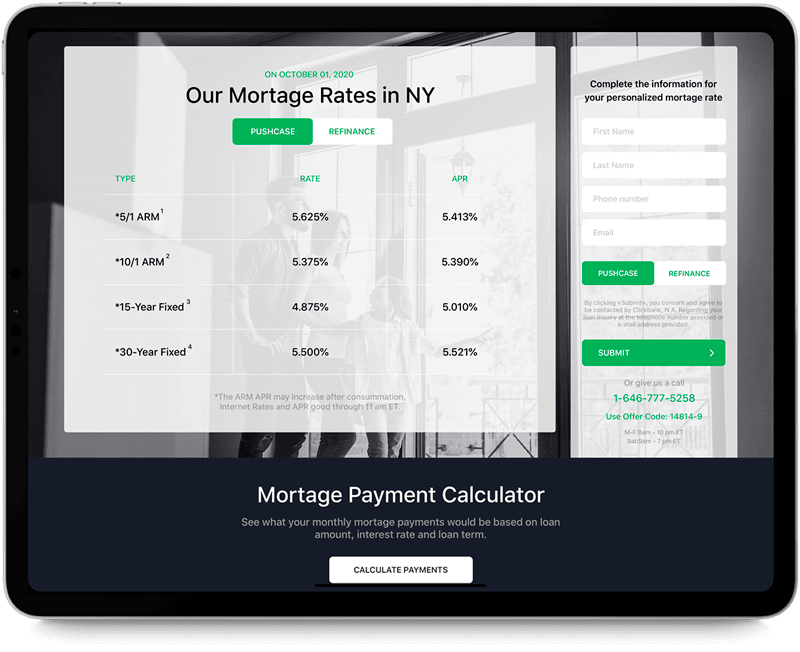

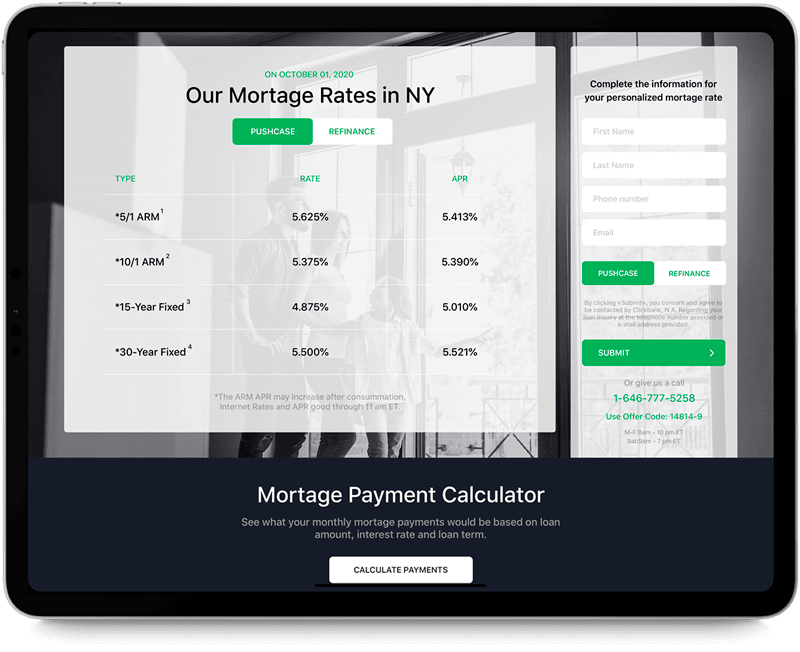

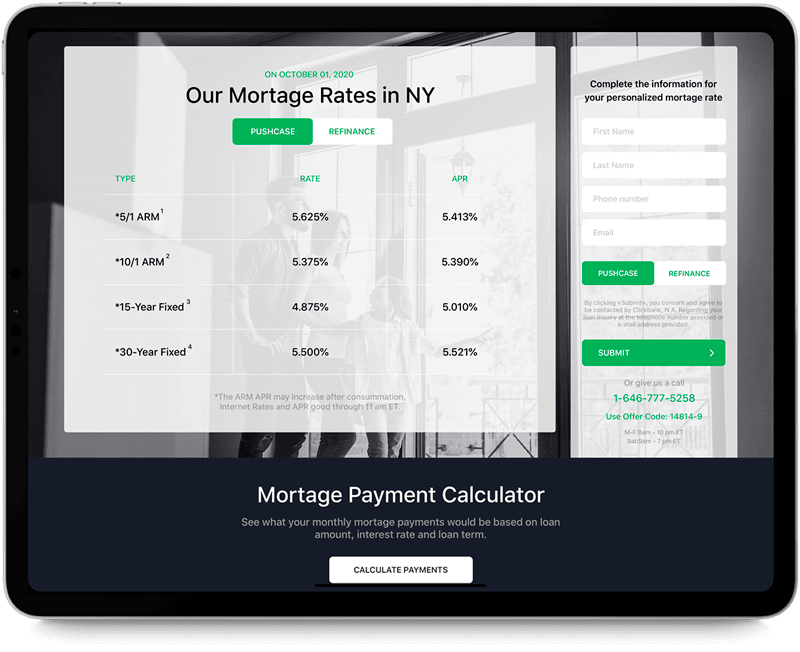

- Digital Mortgage Software

Loan Lending App Development Services

Discovery & Consulting

To ensure the success of your digital lending project, we conduct a thorough analysis of the business environment and your competitors, identify opportunities, define the project goals and scope, uncover potential risks, design the general solution architecture, estimate the development budget, and create a project plan with delivery milestones.

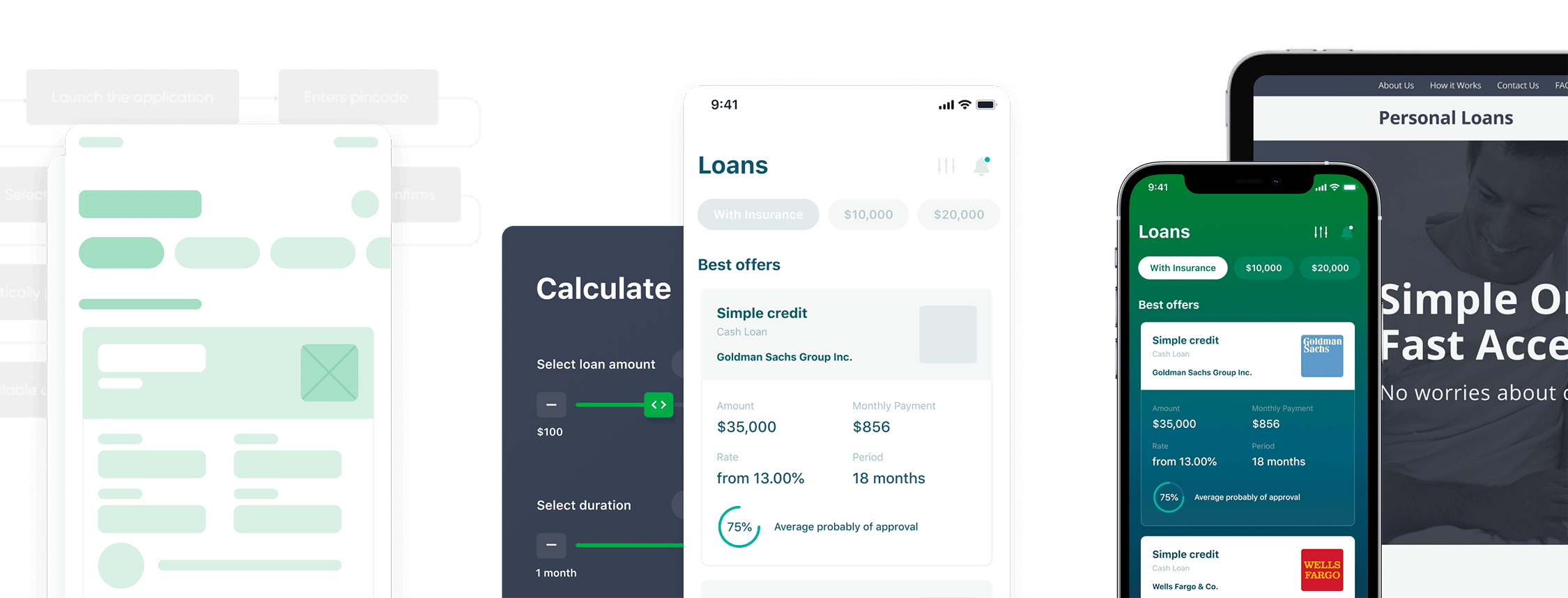

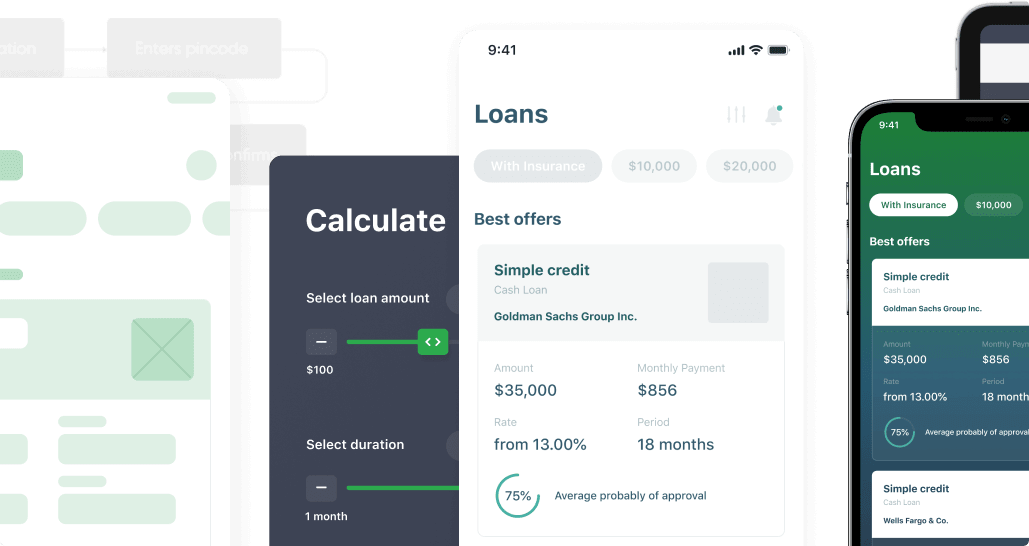

Product Design

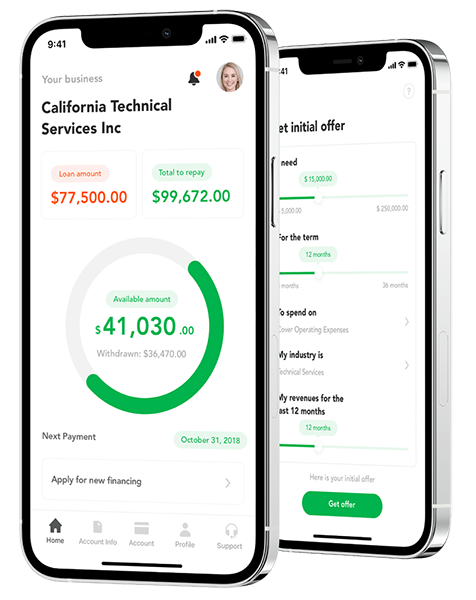

Following the customer-centric approach, we are redefining the user experience in digital lending to create user-friendly and compelling products that inspire trust. Our UI/UX designers will do their utmost to ensure that your solution perfectly blends the hard matter of money with the soft matter of human emotions, ensuring a seamless digital experience and uncompromising performance.

MVP Development

We create minimum viable products for your lending projects so you can speed time to market and test and validate hypotheses. Bringing MVP to market faster, you can extract actionable insights from user feedback, pinpoint weaknesses and areas for improvement, adjust your marketing strategy based on interim results, and implement needed improvements right away.

End-to-End Development

From initial concept to post-production support, our driven team of experts will handle every aspect of your lending solution development and deliver you a superior product that fits your needs and budget.

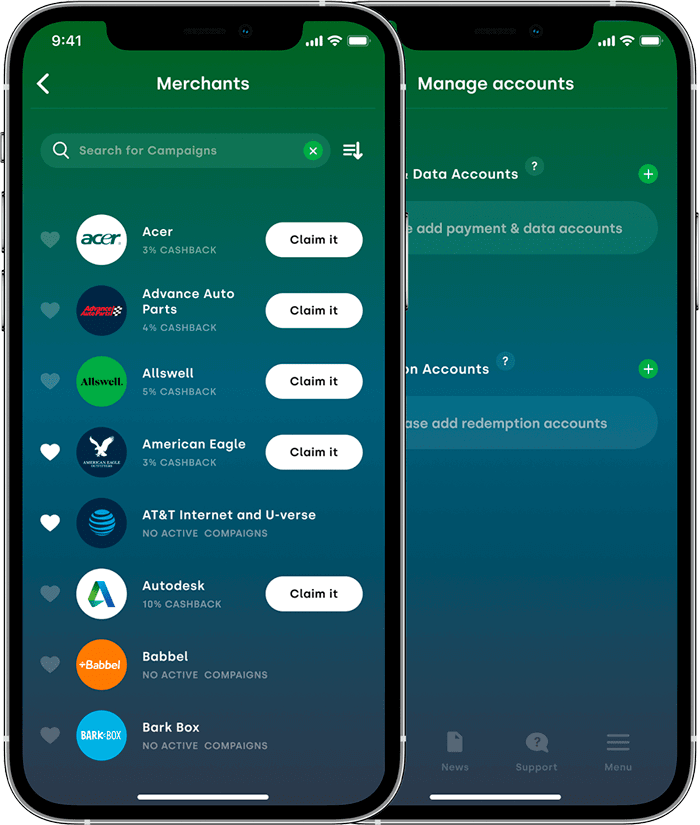

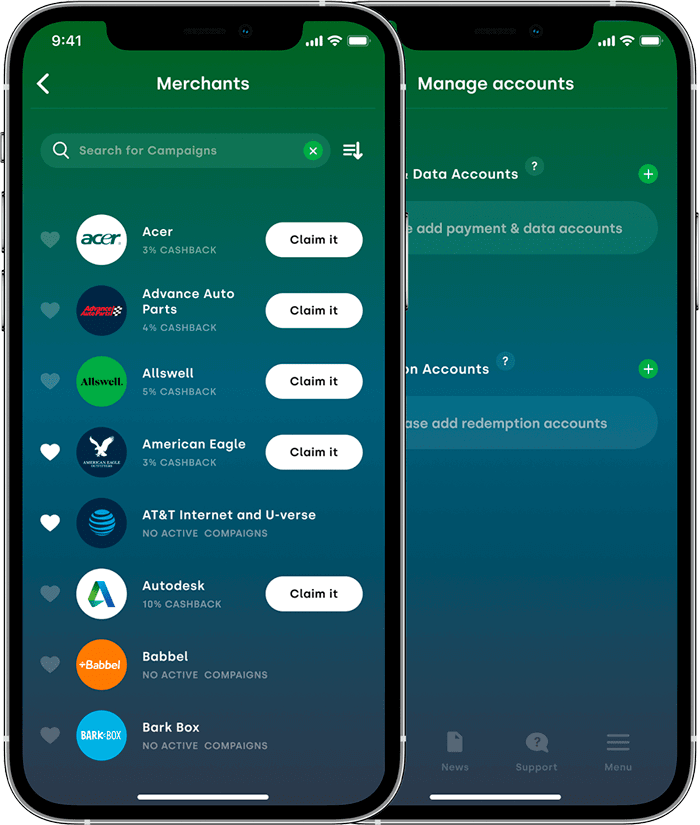

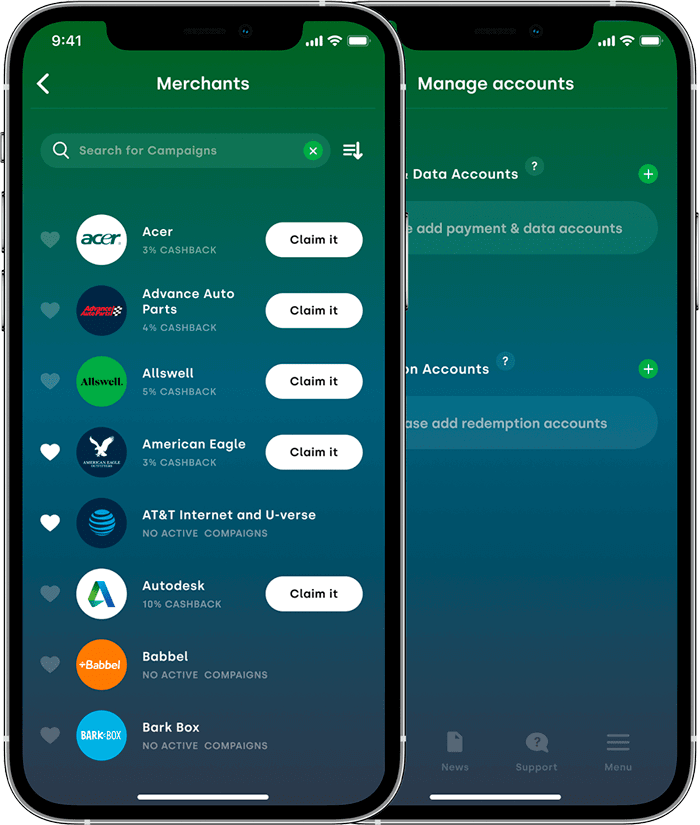

Third-Party Integrations

We have hands-on experience integrating lending solutions with third-party services, including underwriting systems, payment gateways, verification services, business intelligence tools, online wallets, and more. Consider third-party integrations to give your customers more control over their finances and improve their experience.

API Development

Create & deliver new loan products, improve their accessibility, and generate more value allowing third parties to incorporate your product into their ecosystems. We can build onboarding APIs, underwriting APIs, loan fulfillment APIs, loan collection APIs, and more.

Processes Automation

We provide the best possible automation solutions to help you expand your operational capacity, handle repetitive and time-consuming tasks more efficiently, eliminate human error, streamline the customer experience, and increase overall productivity.

Support

Once your lending solution is deployed in the production environment, our support team begins its work. We monitor the product’s performance, availability, security, and scalability, analyze and fix issues as they arise, install security updates, and deploy new features.

Loan Lending Software Core Features

Registration

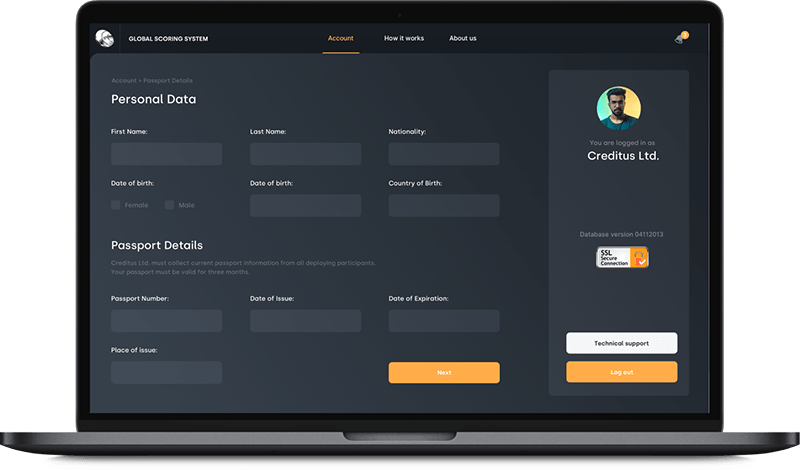

Provide a seamless sign-up experience, ensure accuracy of the information, and eliminate risks associated with illicit financial activity with a fast and easy registration process that is compliant with KYC regulations and anti-money laundering laws.

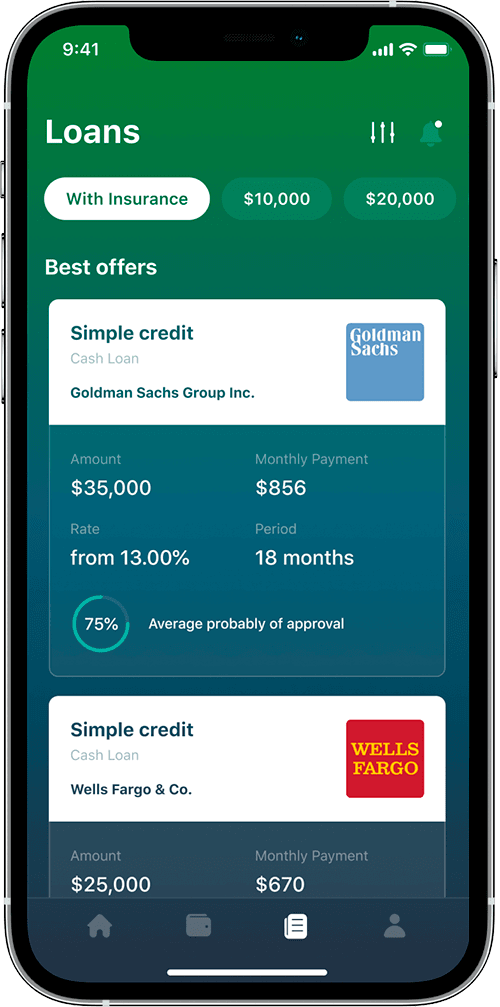

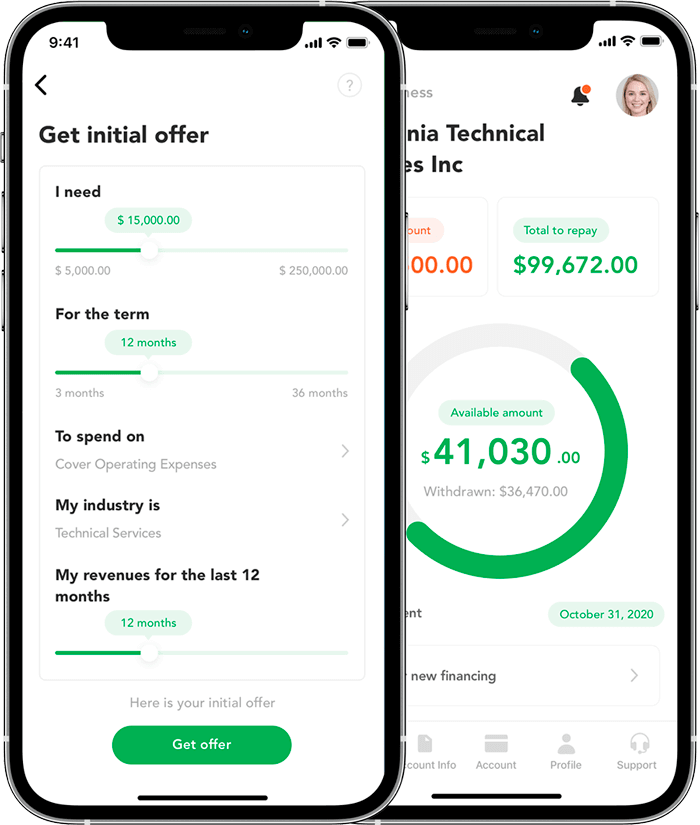

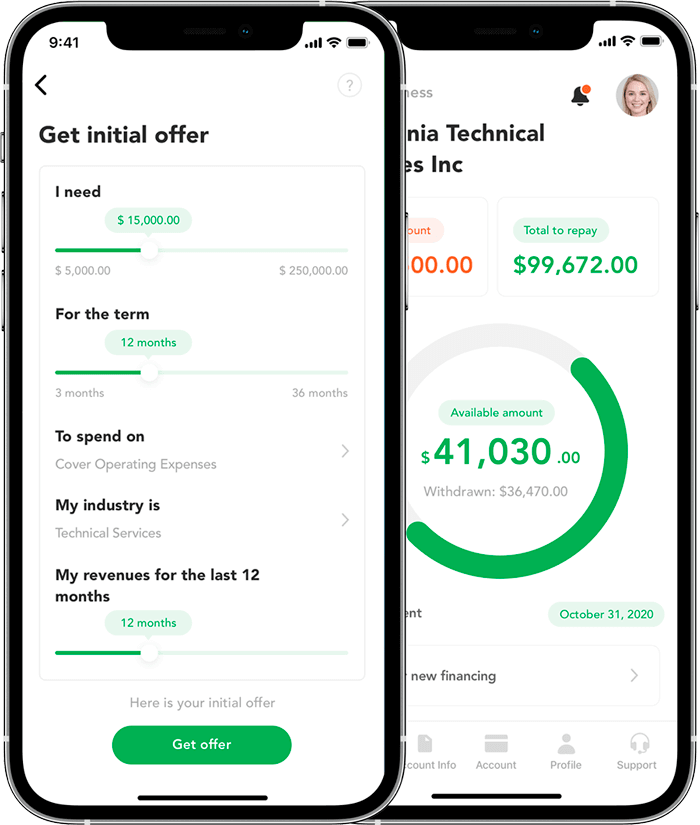

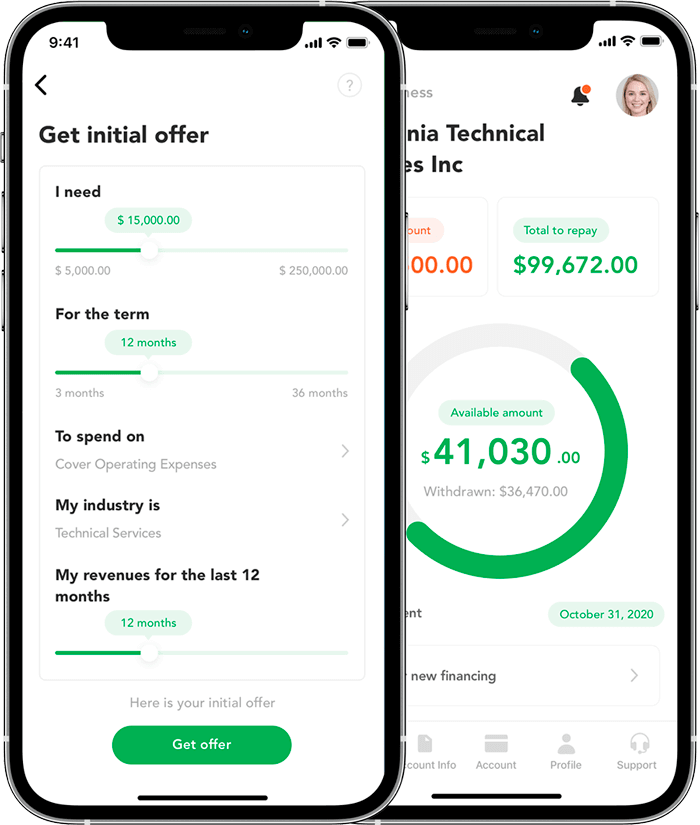

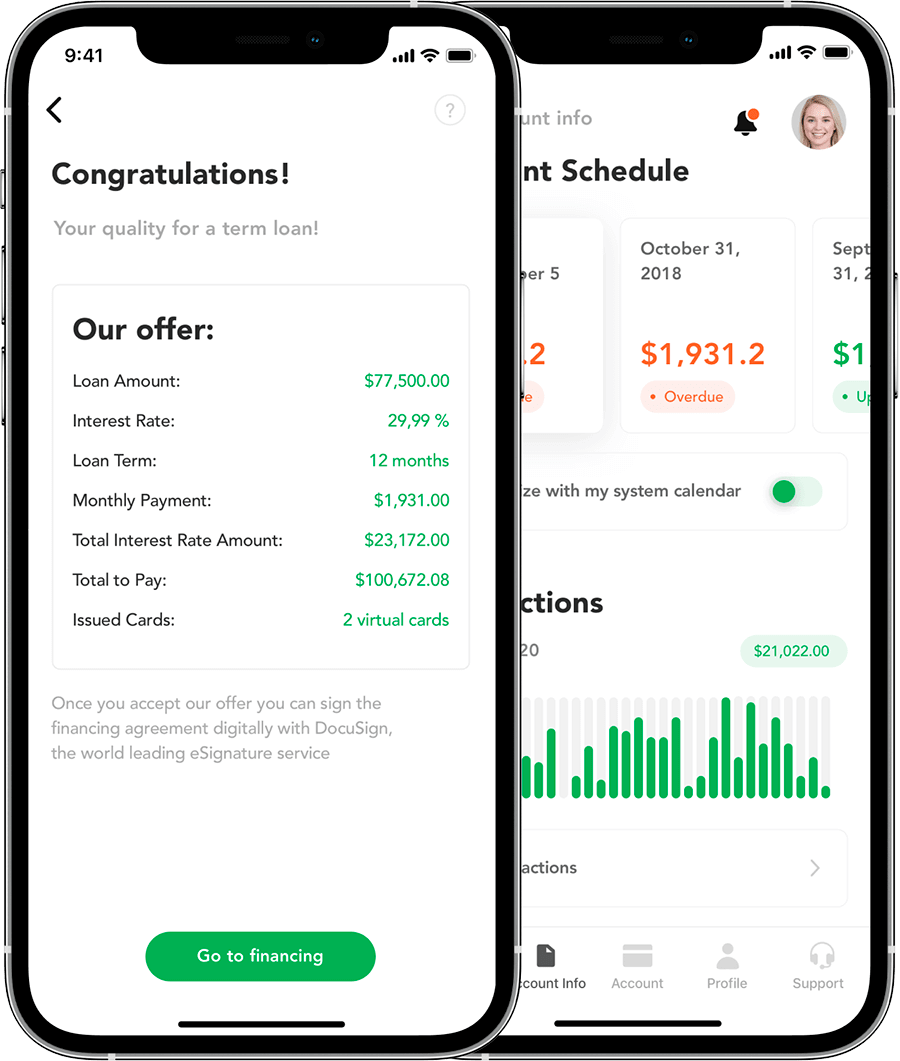

Loan Calculator

Increase sales at the beginning of the borrower’s journey with a loan calculator that helps to analyze and compare the cost of loans from different lenders, forecast future spending and adjust their loan repayment strategies.

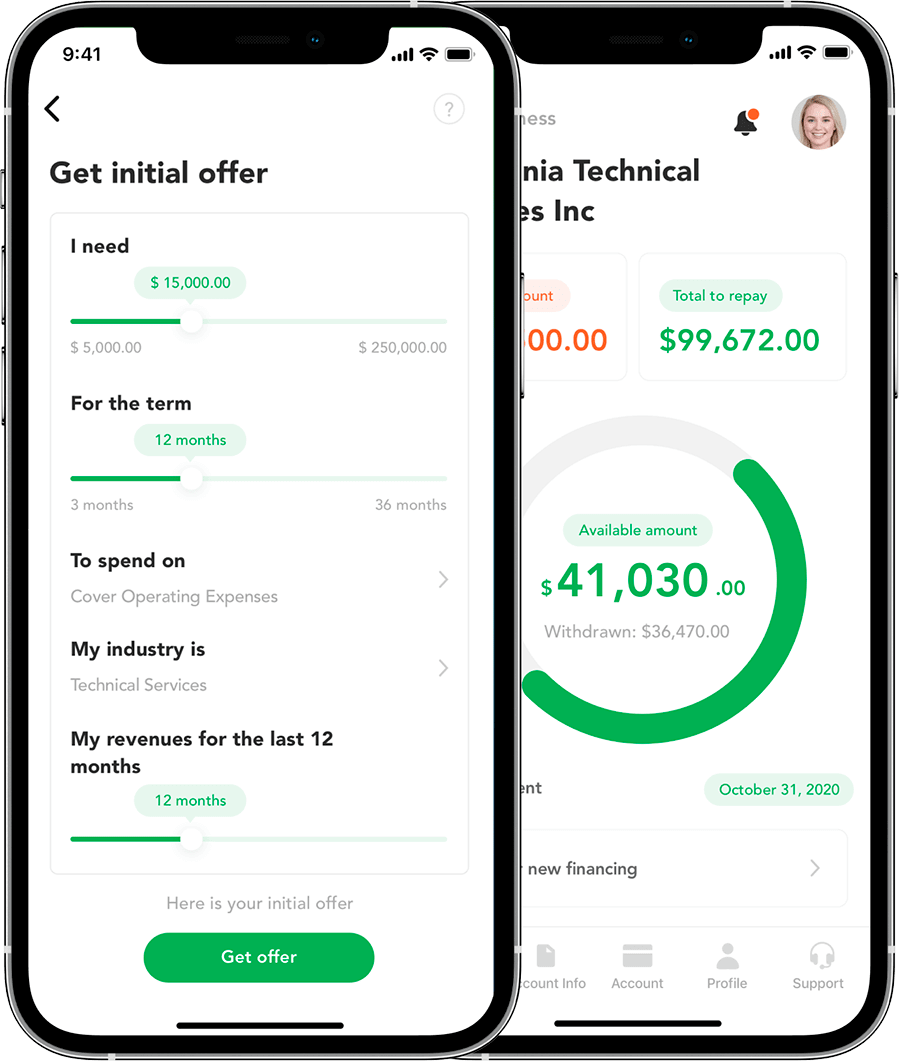

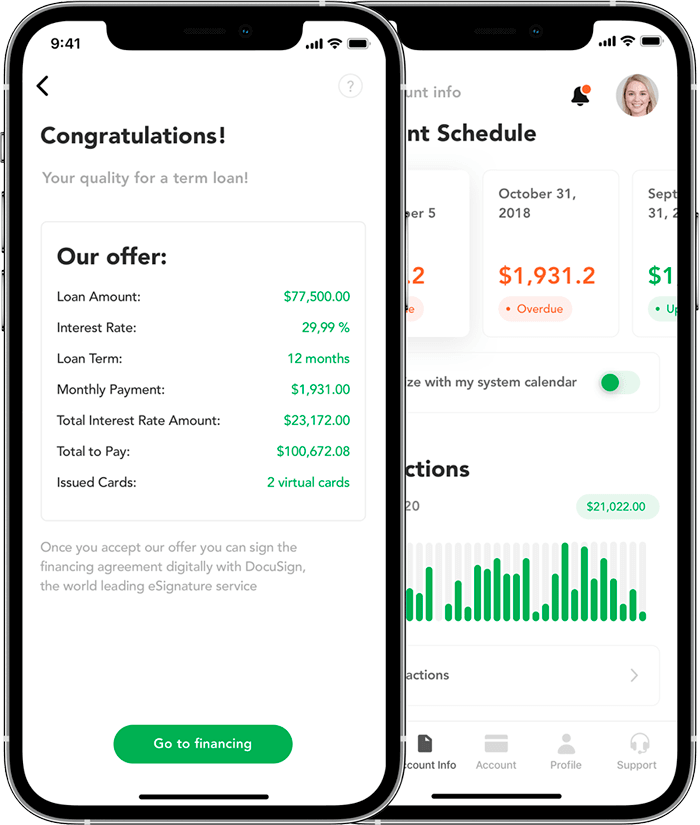

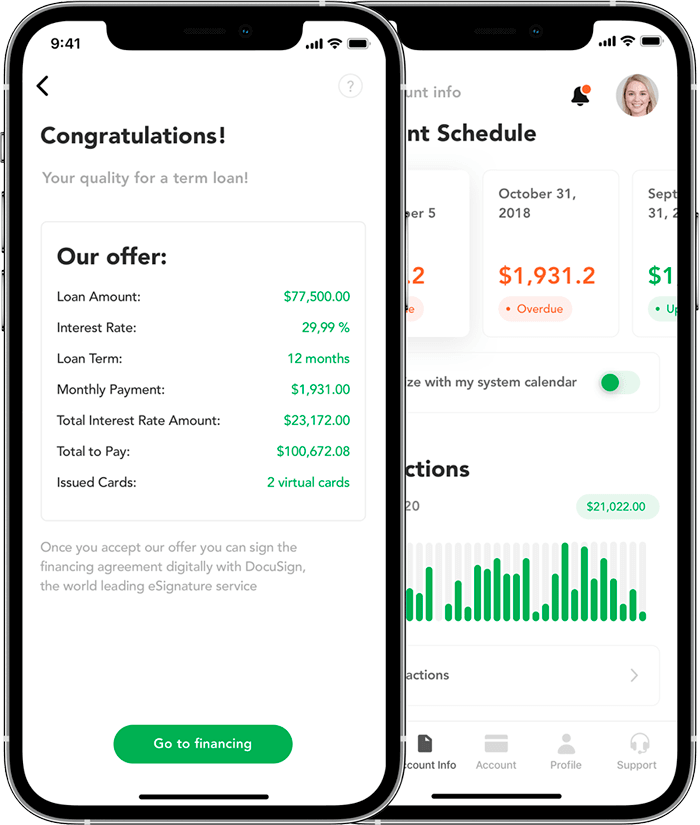

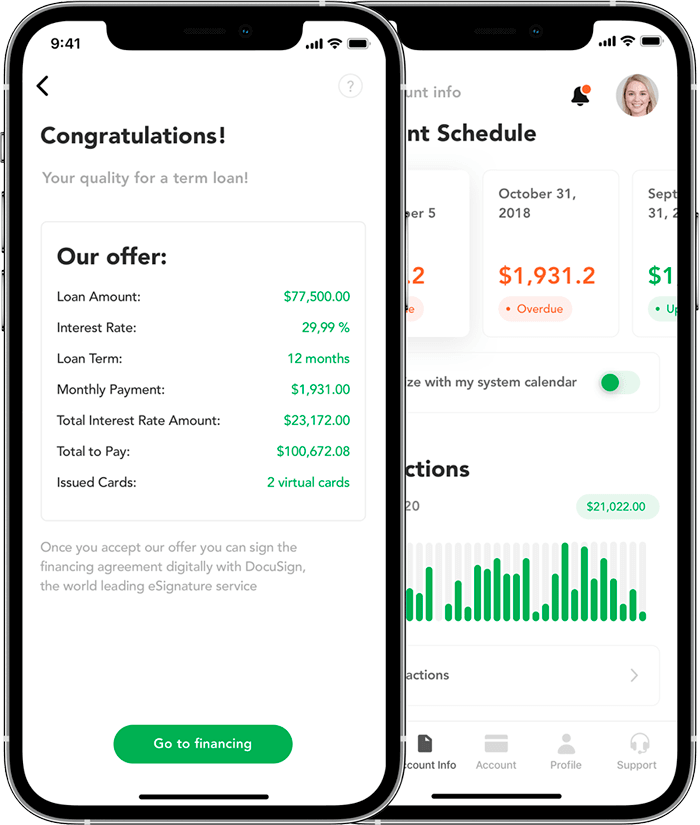

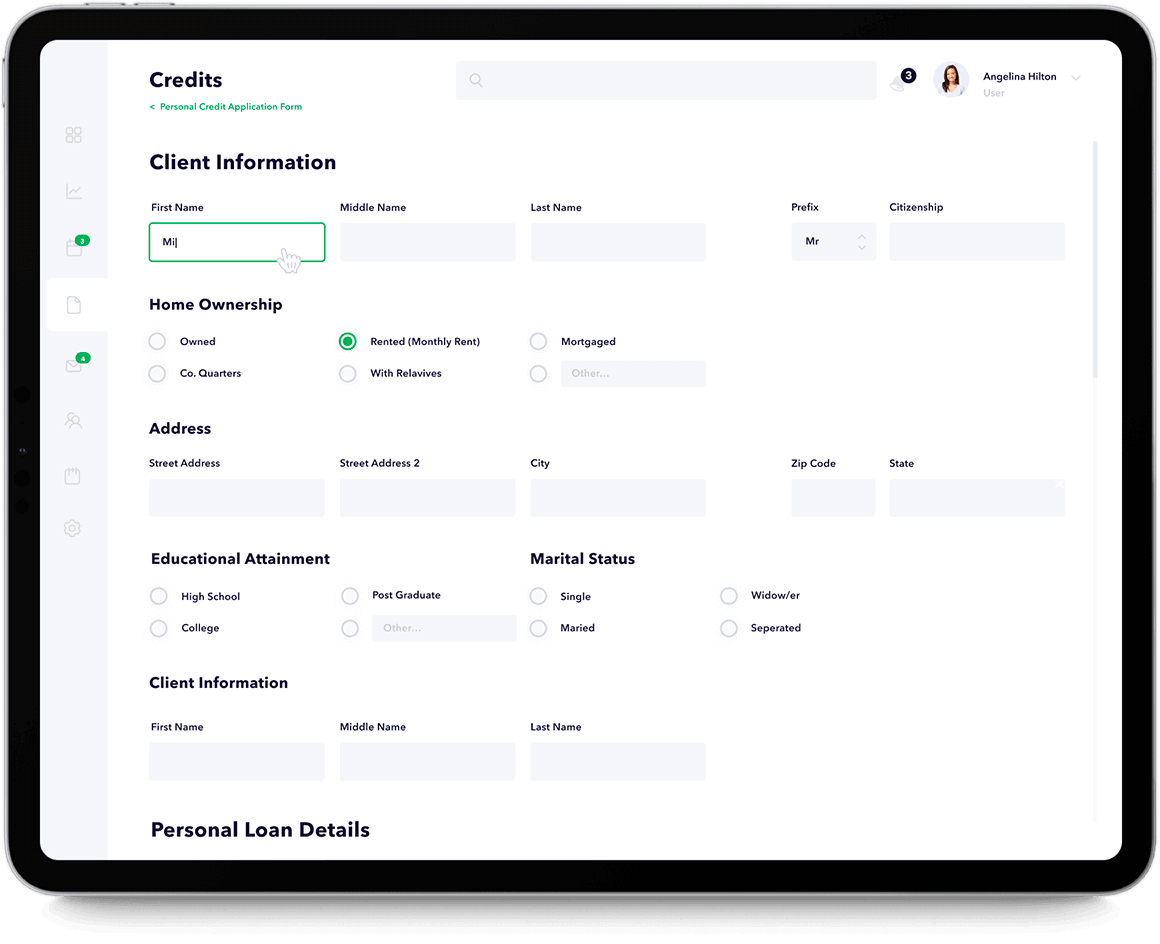

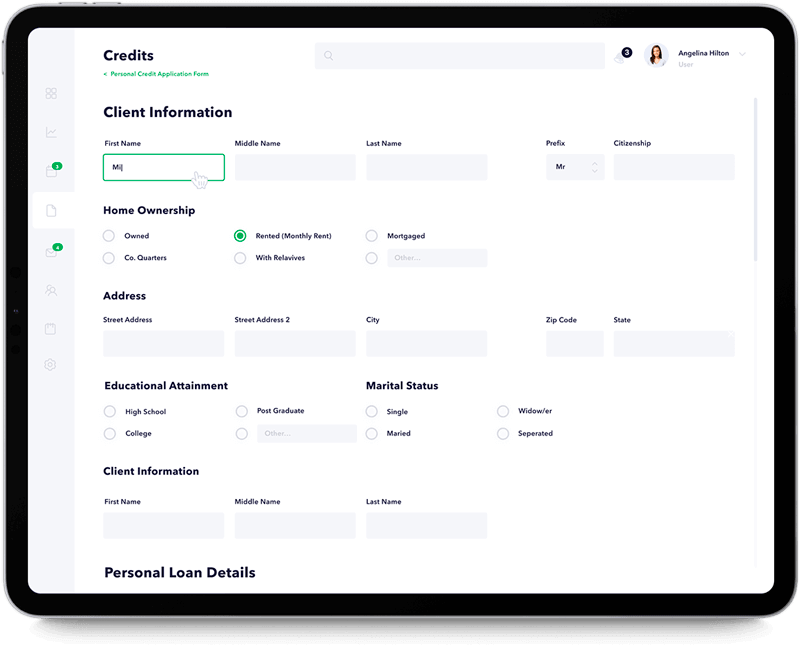

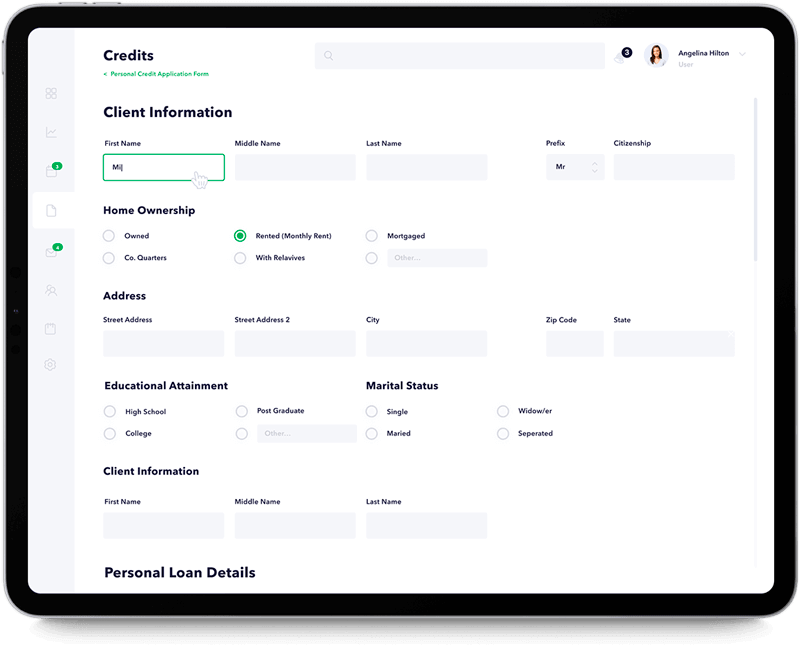

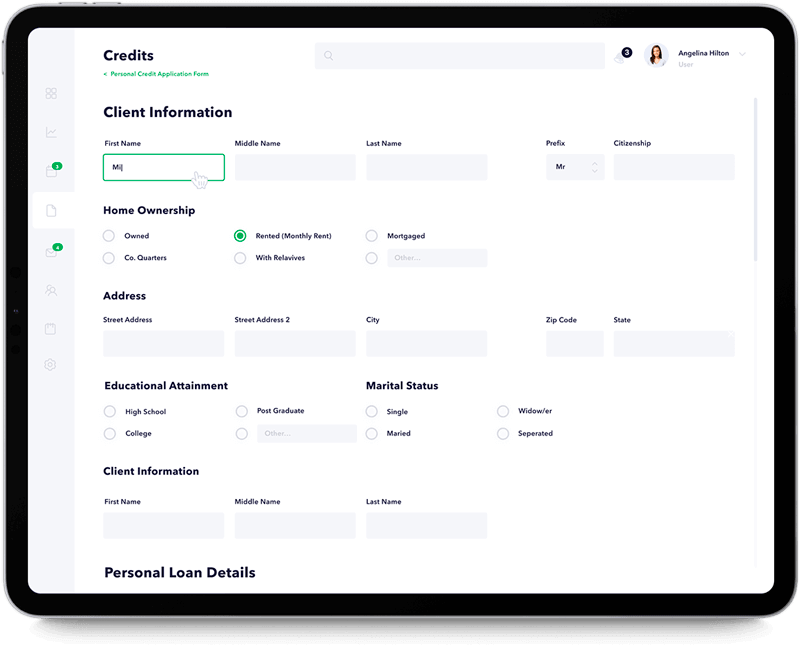

Loan Origination

Considering a large amount of information borrowers need to provide, designing a well-structured, convenient and hassle-free loan application process can be a difficult task. In Itexus, we design streamlined loan application processes providing a single point of data entry to enable automatic data flow throughout the solution.

Credit Score

Increase transparency, ensure borrower creditworthiness and protect lender interests by integrating a credit score bureau API.

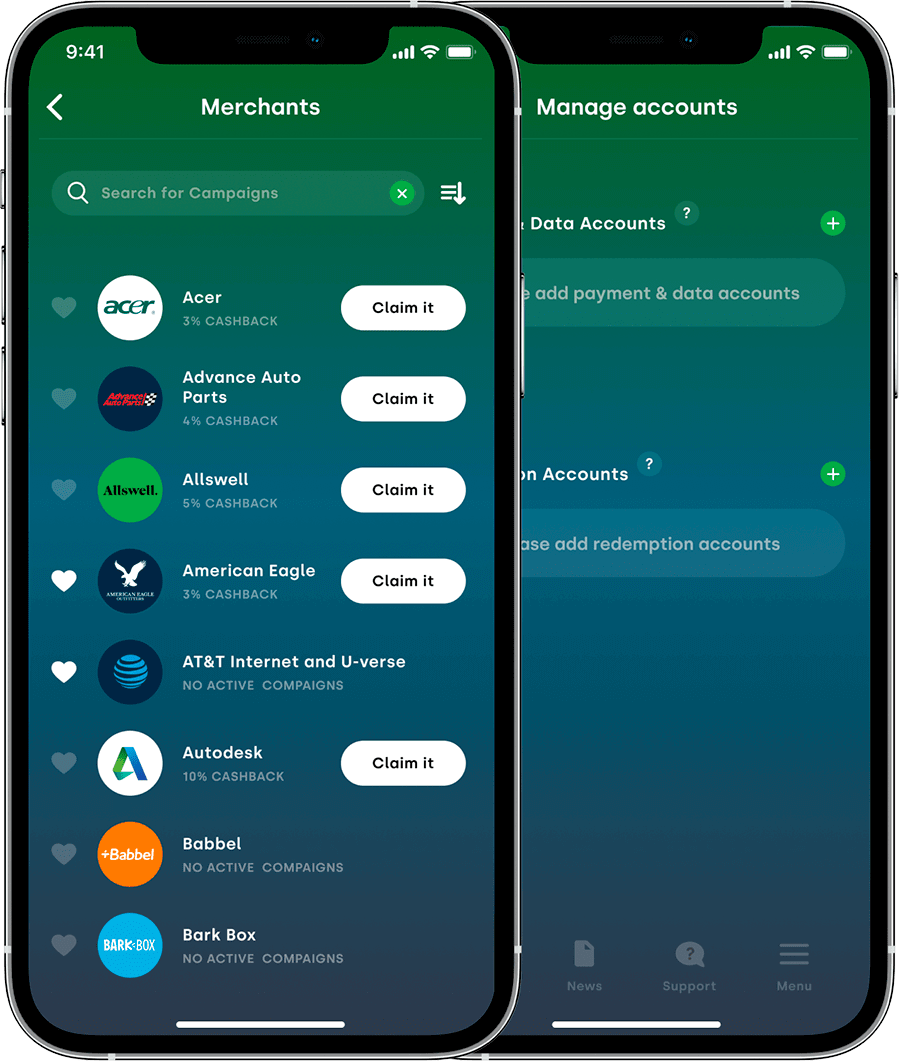

Loan Application Matching

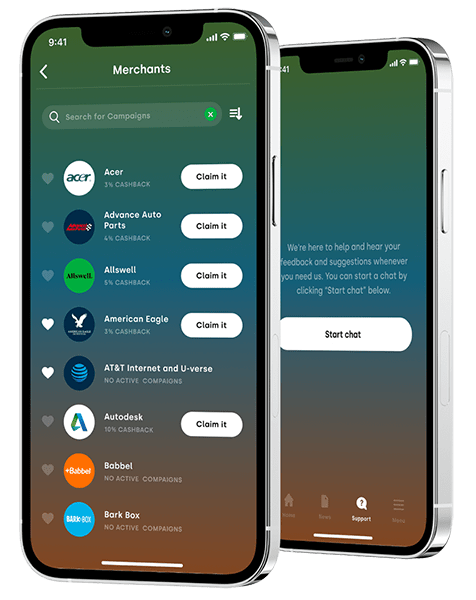

Increase platform efficiency and reduce operational costs by automatically matching borrower applications with lender preferences.

Auto Investment

Attract more investors to your platform with the AI-powered auto investment feature, which allows investors to intelligently diversify portfolios and make high-yield investments.

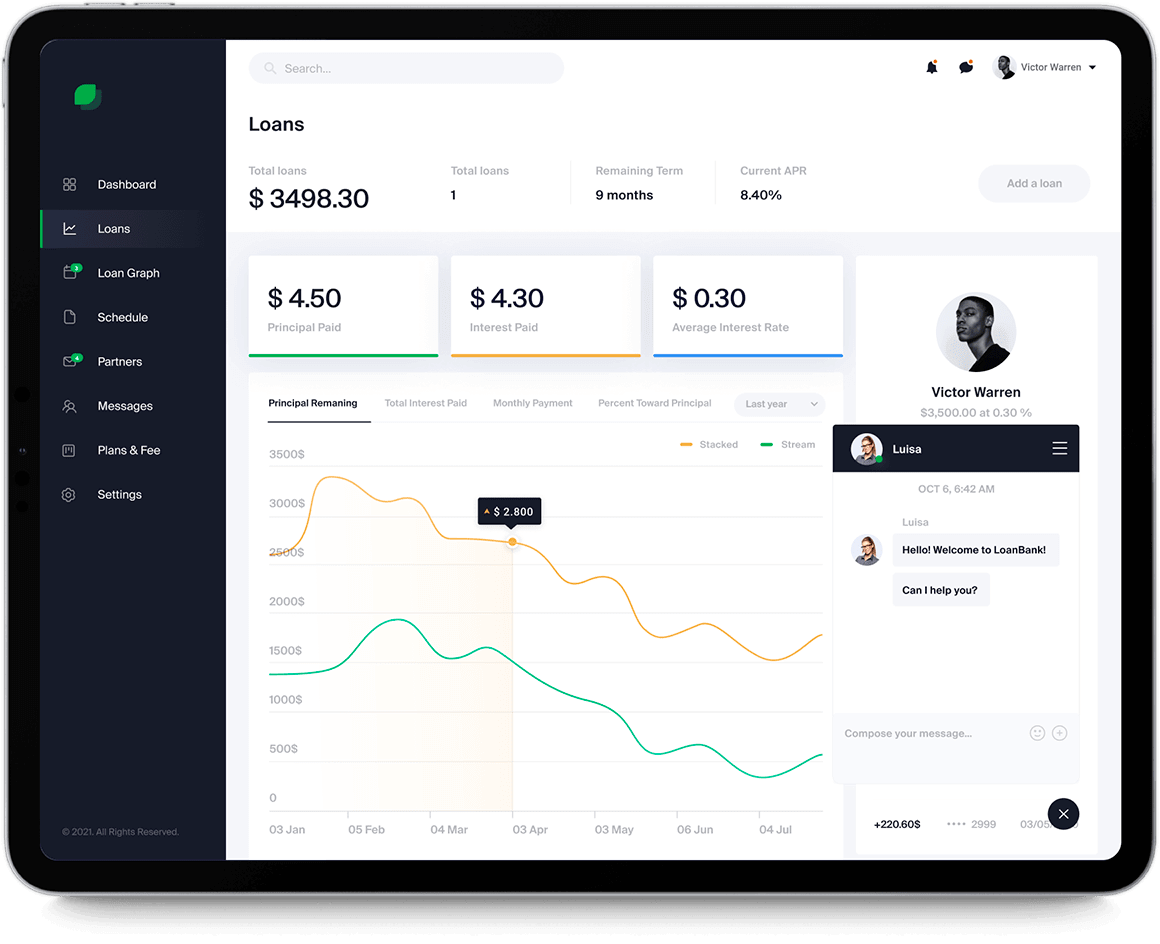

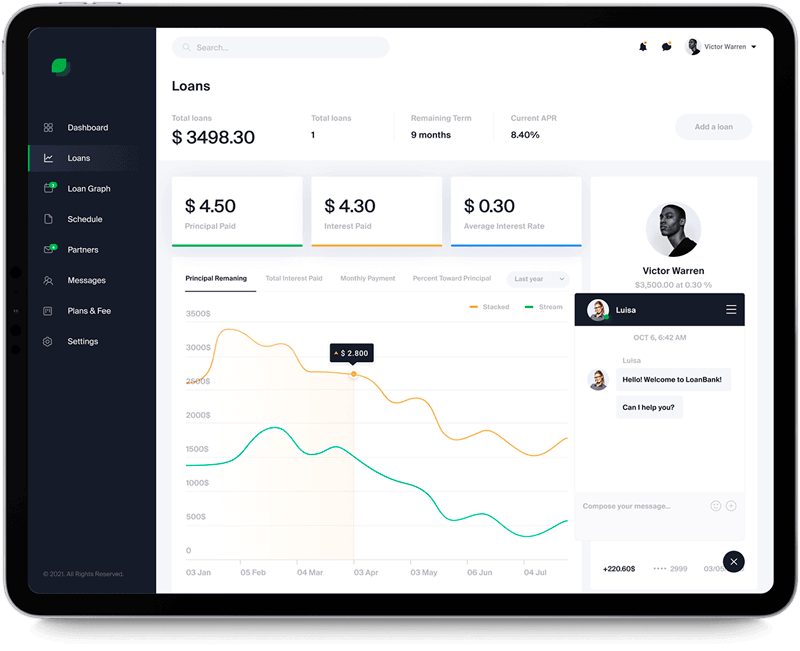

Loan Management

Ensure an excellent customer experience for both lenders and borrowers with the loan management feature that allows tracking loan details and generates reports on balance, payment schedule, etc.

Payments and Scheduling

Accepting more payment methods can help you attract new users and improve conversion. A repayment scheduler allows borrowers to make repayments easily and on time.

Document Management

Facilitate document processing, eliminate the risk of human error, and streamline the entire loan origination process with paperless document management.

Custom Notifications

Stay in touch with your customers using custom notifications about upcoming, due, and past installments, the latest activities on the platform, and the best offers and discounts.

Customer Support Chatbot

Ensure fast communication and round-the-clock support and offer your customers a personalized experience with an AI-powered chatbot.

Let’s build the future with AI

Development

Leverage tools like Cursor AI for code generation, optimization, and real-time collaboration, accelerating development cycles.

Use AI-powered design tools for rapid UI/UX prototyping, style suggestions, and accessibility enhancements.

QA

Deploy AI-based test automation to detect bugs, predict failures, and optimize test coverage with machine learning.

Automate CI/CD pipelines, monitor model performance, and optimize cloud costs with AI-driven anomaly detection.

Extract insights from contracts, invoices, and PDFs using OCR and NLP, reducing manual effort by 70% (as showcased in our fintech case studies).

Build GPT-4-powered assistants for customer support, sales, and internal helpdesks with natural language understanding.

Implement ML models for demand forecasting, risk assessment, and personalized recommendations (e.g., credit scoring, trading signals).

Governance

Ensure transparency with bias detection, explainable AI (XAI), and compliance frameworks for secure, responsible deployments.