The idea of investing free money in stocks and getting revenue later is not new – trading has been used as passive income for quite some time. Stock trading is a centuries-old, time-tested strategy for earning income. However, to make significant gains, investors spend hours evaluating exchange rates, developing trading strategies, managing deals, etc.

Before the rise of stock trading apps, this option was affordable only for wealthy people, because traders had to pay brokers, professionals with specialized degrees, for advice, in addition to the commissions paid for any financial manipulation. Stock market apps brought accessibility. They facilitate and automate complex trading and investing processes, give traders practical financial tools, and minimize risks for participants along with enabling anyone to enter the world of investing through built-in educational features.

Consider stock trading app development? Read on to learn how to build a stock trading app, how to monetize it, what features and integrations it should include, and what you need to consider before investing in app development.

Why Invest in Stock Trading App Development?

Stock trading apps have formed a considerable fintech market niche. In 2022, the estimated value of the stock trading app market was $13.6 billion, and experts predict it’ll grow to $89.8 billion by 2032.

There is also a huge user base for stock trading apps across all ages, geographies, and incomes. Compared to 2020, the increase in the number of trading app users is almost 50%, reaching around 130 million people in 2021 – and experts say the numbers will continue to grow. And it’s no wonder as stock trading apps offer users multiple benefits:

• Accessibility and convenience. Online trading apps provide real-time stock market data and help users access the stocks they want anywhere, anytime, as well as to be updated on how their portfolios are moving. Moreover, modern stock trading apps allow investing even with limited funds.

• No brokers are involved. Stock trading apps allow users to interact directly with the stock markets and bypass brokers who charge fees for their services. Any profit made with the app goes directly into the user’s pocket.

• Powerful analytics. Stock trading apps provide users with accurate stock market analysis due to the technologies used. Built-in chatbots, charts, live news, etc. help users get the advice they need on how to handle finances. And advanced technologies like AI and Big Data help users maintain full control over their investments, minimize risks, and benefit from automated algorithms.

How to Monetize Your Stock Trading App

Below, we’ll go over the main options that will help you earn revenue with your stock trading app.

Freemium

Your app can offer users a number of free features, but to access advanced functionality (e.g. additional stocks, advanced market analysis, more search filters, etc.), they have to pay. You could offer multiple subscription plans so that every user can find one that suits them. But even the free version should be viable and satisfy the basic needs of traders to prevent users from bailing out before they want to pay for advanced features.

Transaction fees

Most popular trading apps don’t charge per-transaction fees, but this monetization model is fairly common among fintech apps. It means that the app collects a certain amount as a transaction fee every time users make a transaction through the app.

Advertising

This revenue model isn’t only widespread in stock trading solutions, but in the entire app market. It allows you to earn in two ways: by selling advertising space to advertisers and by charging for ad-free use of the app.

Additional financial products

This revenue model involves selling various financial products – for example, you can offer your users mutual funds, gold ETFs, insurance, and so on.

Types of Trading Apps

There are three options available on how to build stock trading app – mobile, desktop, and web-based solutions. Let’s explore the specifics of each so that you better understand which option is right for your goals.

Mobile

Mobile trading apps are on the rise due to their convenience – they can be used anytime, anywhere. Users also appreciate them for their quick work and immediate access to their financial data, timely notifications, and smooth trading experience. However, if you decide to develop a mobile stock trading app, you should properly approach UI/UX design as the mobile format bring limited screen space. Also, your solution should meet AppStore and Google Play requirements to be listed in the app stores.

Desktop

Desktop solutions provide users with high performance and improved security and allow lower hosting fees for the owner. However, to cover wider audience, you may need to develop multiple types for different systems (macOS, Windows, Linux). Besides, desktop solutions need to be updated manually by users, which doesn’t add points to the user experience.

Web-based

Web apps provide instant access to trading functionality via a URL and are easy to update without compromising the user experience. Such apps run on most mobile and desktop devices. Still, they require a reliable Internet connection. In addition, web-based apps need to be optimized for different browsers, and there may also be performance issues.

12 Features of a Good Stock Trading App

We highlighted the key features of a good trading platform – explore them if you’re going to build a stock trading app. Of course, you can expand the functionality of your solution depending on your goals, your target audience’s specific needs, and other factors.

1. Login & authentication

Since the app deals with financial data, it’s crucial to ensure the highest level of security. But usability is also important, so it’s about balancing security and convenience. The best practice is to enable multi-factor authentication (MFA) when in addition to login and password, the app requires another verification factor. The most common verification factors include biometrics (touch ID, retina scan, etc.) and one-time passwords (OTPs) sent to the user’s phone number, email, or linked social media accounts.

2. Portfolio

The portfolio is the most important part of a stock trading app that allows users to see and analyze their performance. The real-time portfolio enables more balanced, data-driven investment decisions and helps users to adjust their strategy for more investment-wise deals.

3. Analytics

Analytics shows the performance of users, the results of their investment decisions, activities, and transactions. In addition to advanced analytics, modern technologies such as ML, AI, and Data Science enable robo-advisory, which is highly valued by traders.

4. Dashboard

A multitude of numbers is inevitable in a fintech app, so it’s best to present the information in an as digestible and understandable way as possible. This is where the dashboard comes in, allowing users to get updated on their affairs at a single glance and giving them an overview of what is happening on the market. The dashboard can include information about users’ savings, account balances, portfolio value, investment opportunities, etc.

5. Multiple payment options & transactions management

Enabling multiple payment options will make the trading account funding as smooth as possible along with ensuring convenience for a wider audience. It’s also important to record and monitor all transactions so that users can process their payments and view order executions securely.

6. Newsfeed

Trading involves intensive research, so the newsfeed feature, which lists all relevant news that could affect stock performance, is an essential part of a trading app. It provides users with a comprehensive overview of important information and prevents them from having to switch to other sources to get it.

7. Watch list

The watch list allows users interested in particular companies to track only their performance. As a handy database with information about selected stocks, a watch list is an indispensable tool for a successful trading app.

8. Comparative analysis of products

When it comes to choosing investment opportunities, investors get very picky. The comparative analysis feature, implemented as a separate section with alternatives where users can set criteria, provides users with a clear idea of distinctions and advantages, help to assess risks and make smarter investment decisions.

9. Algo trading

Algorithmic trading implies following a defined set of instructions to automatically place trading orders. It offers higher accuracy and lightning-fast execution speed and helps traders generate more income. There are some specialized solutions on the market, but an algo trading feature implemented in a stock trading app could be the differentiator that makes users choose your app among many others.

10. Notifications

Smart push notifications are a must for a stock trading app. Not only do they help you stay in touch with your users, but they also provide them with up-to-date information about their accounts, their portfolio, and the overall stock market. Make sure that users can manage notifications so that they’re as convenient as possible.

11. Sort and filter

This feature allows users to analyze stocks using the sort option, which filters the required details from the general ledger where trading records are stored. This allows users to navigate through the stock market without any hassle.

12. Education

With an educational module, you can expand your audience and target inexperienced investors and newbies. It’s advisable to implement at least basic investment tutorials and create a compilation of quality resources such as videos, books, blogs, trusted sources, etc.

Third-Parties to Integrate with a Stock Trading App

Integrations can save you a fortune when developing your stock trading app. Instead of implementing each new feature from scratch, you can integrate third-party services to enable multiple functions – from MFA and KYC to transactions and more. Here are the most sought-after third-party services for your trading app:

• brokers,

• payment providers,

• data aggregators,

• KYC providers,

• market news providers,

• communication services, and more.

If you need help with the selection of providers, our specialists will be happy to analyze the market and pick the most suitable third-party providers to meet your needs.

Regulatory Compliance in Stock Trading App Development

If you want to launch a stock trading app, you need to prepare for the red tape. Typically, you’ll need to make sure your app complies with the following regulations:

• KYC (Know Your Customer)

• AML (Anti-Money Laundering)

• CIP (Customer Identification Program)

However, it’s a good idea to first clarify the legal requirements in your target market, as they can vary from country to country. For example, in some countries, you’ll need to register as a broker-dealer, and in the U.S. market, broker-dealers are subject to SEC (Securities and Exchange Commission) and FINRA (Financial Industry Regulatory Authority). So to start a trading app in America, you need to register with SEC and then become a member of FINRA and SIPC (Securities Investor Protection Corporation), as well as follow the stockbroker regulations of your state. There are also other organizations you might have to deal with, such as the Municipal Securities Rulemaking Board, the National Futures Association, the Chicago Board Options Exchange, and so on. The good news is that you can hire a lawyer to take care of the paperwork while the development team works on the app.

Top 3 Trading Apps

What unites the best trading solutions is that all the apps listed below manage to pack a whole range of investment tools under the hood without making things overly complex. Let’s take a look at the 3 best trading apps that set the tone in the market.

Robinhood

After its launch in 2013, Robinhood became one of the most popular trading apps of the decade with over 13 million users. In 2021, the app generated $1.8 billion in revenue. Robinhood owes its popularity to the ease of use provided by its intuitive interface, commission-free trading, and crypto trading feature. However, users note that the app’s customer service is poor. Other drawbacks include the lack of support for retirement accounts and the impossibility to invest in funds and bonds.

E*Trade

E*Trade was founded 40 years ago and represents the beginnings of the development of online trading solutions. The platform offers a wide range of tools for both active day traders and long-term investors. Over 4.8 million users earn with E*Trade. What attracts people to this platform is that it doesn’t require any minimum deposit and charges no stock commissions, no ETF trading commissions, and no per-trade fees. And unlike Robinhood, it offers retirement planning guidance. However, the platform doesn’t support crypto trading and doesn’t provide access to international exchanges.

eToro

eToro is one of the most popular and trusted trading apps focused on crypto trading. The platform is excellent for beginners, who are guided through the basics of crypto trading in the eToro Academy. The app is known for its beginner-friendly content, ease of use, and social copy features that allow newbies to copy the portfolios of experienced traders. As for the cons, trading forex and CFDs at eToro is a bit more expensive than most of its competitors. Moreover, the platform doesn’t support algo trading strategies, and some of eToro’s advanced tools are available only to members who have reached higher club tiers. Nevertheless, eToro has over 3 million active users.

Itexus Experience in Trading Apps Development

As a proven finance software development company, Itexus has strong expertise in stock trading app development. Throughout the years, we created multiple trading solutions for our clients across the globe and would be happy to bring our skills and experience to the table and build stock trading app for you. You can check a couple of our recent projects in the domain to gain some inspiration for your stock trading app development project.

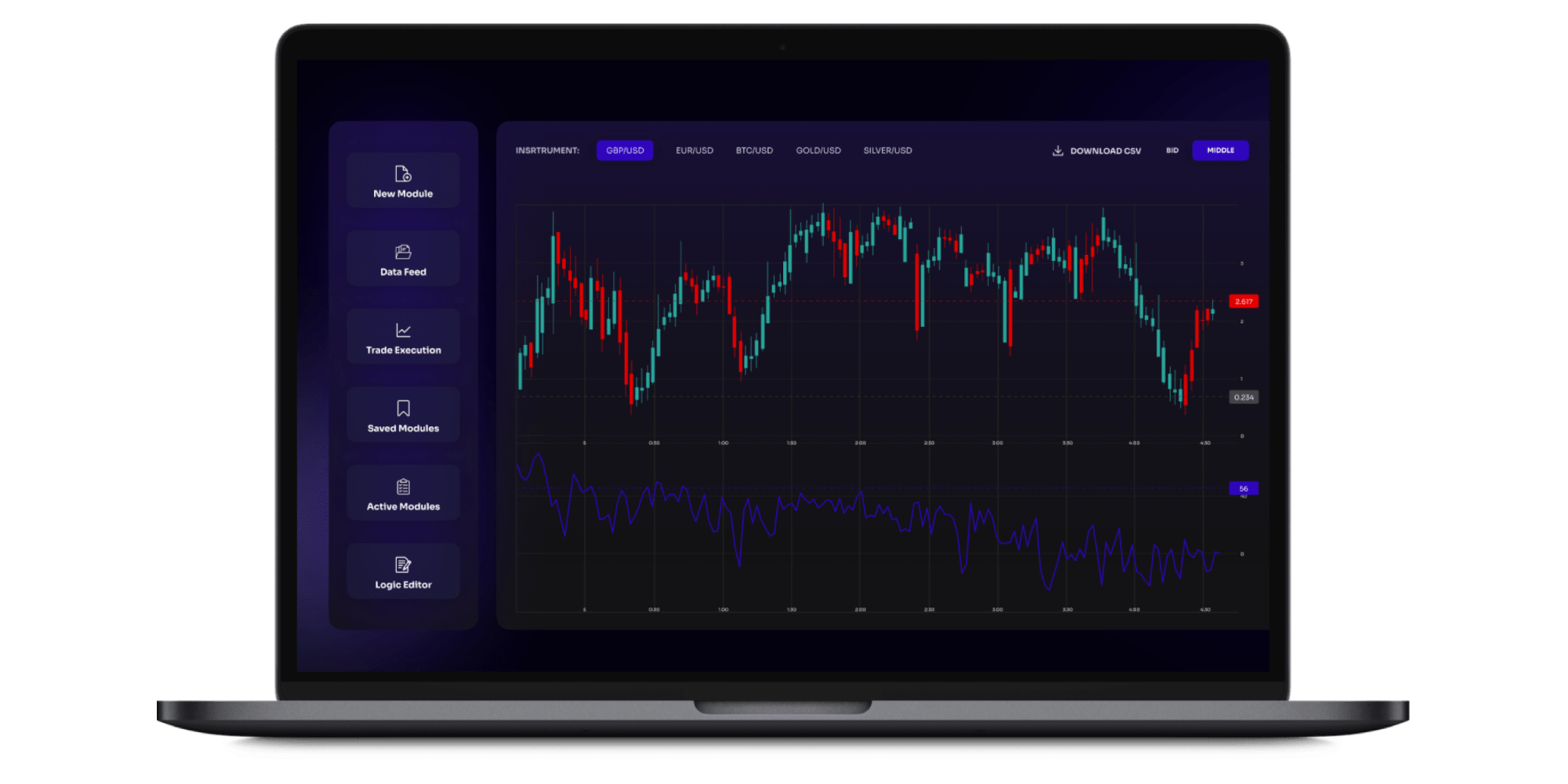

Automated Stock Trading Platform

We developed an automated real-time trading system for a global investment management company. The solution allows administrators to configure trading strategies based on various technical indicators, and investors to invest their money in the selected strategy. The platform is designed for different customer segments – from individual investors and traders looking to diversify their portfolios to institutional investors such as hedge funds, venture capital funds, and large investment firms.

For more details on this project, check out the case study.

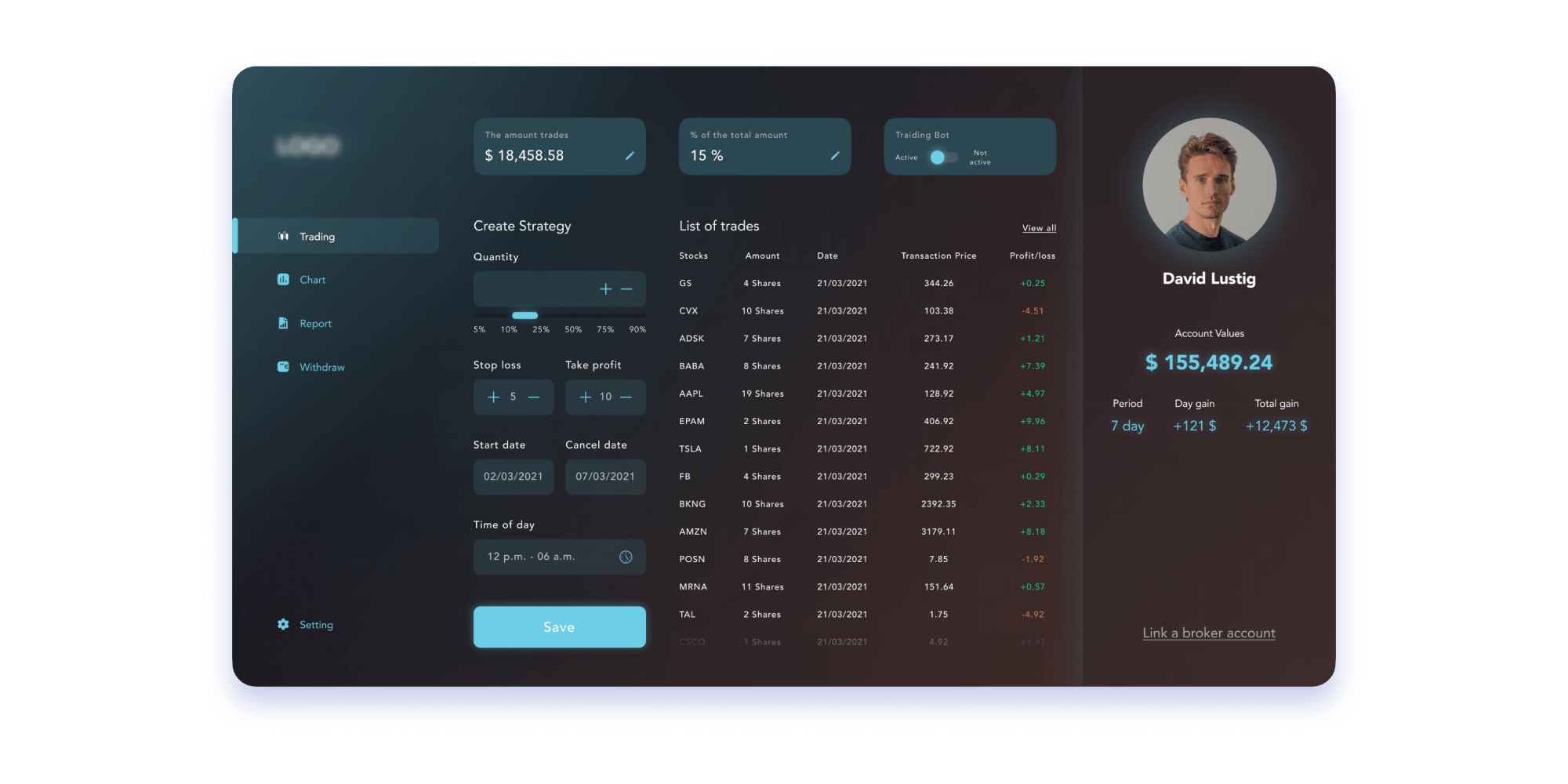

Stock Trading Bot

Another solution we developed is a cloud-based trading bot for an investment company that specializes in active stock trading. The bot is connected to a brokerage account via an API and automates stock trading by executing trades based on predefined criteria such as stock price, time of day, past trades in the week, and technical indicators such as RSI (Relative Strength Index). The bot tracks stocks throughout the day, looking for clues on when to buy.

For more details on this project, check out the case study.

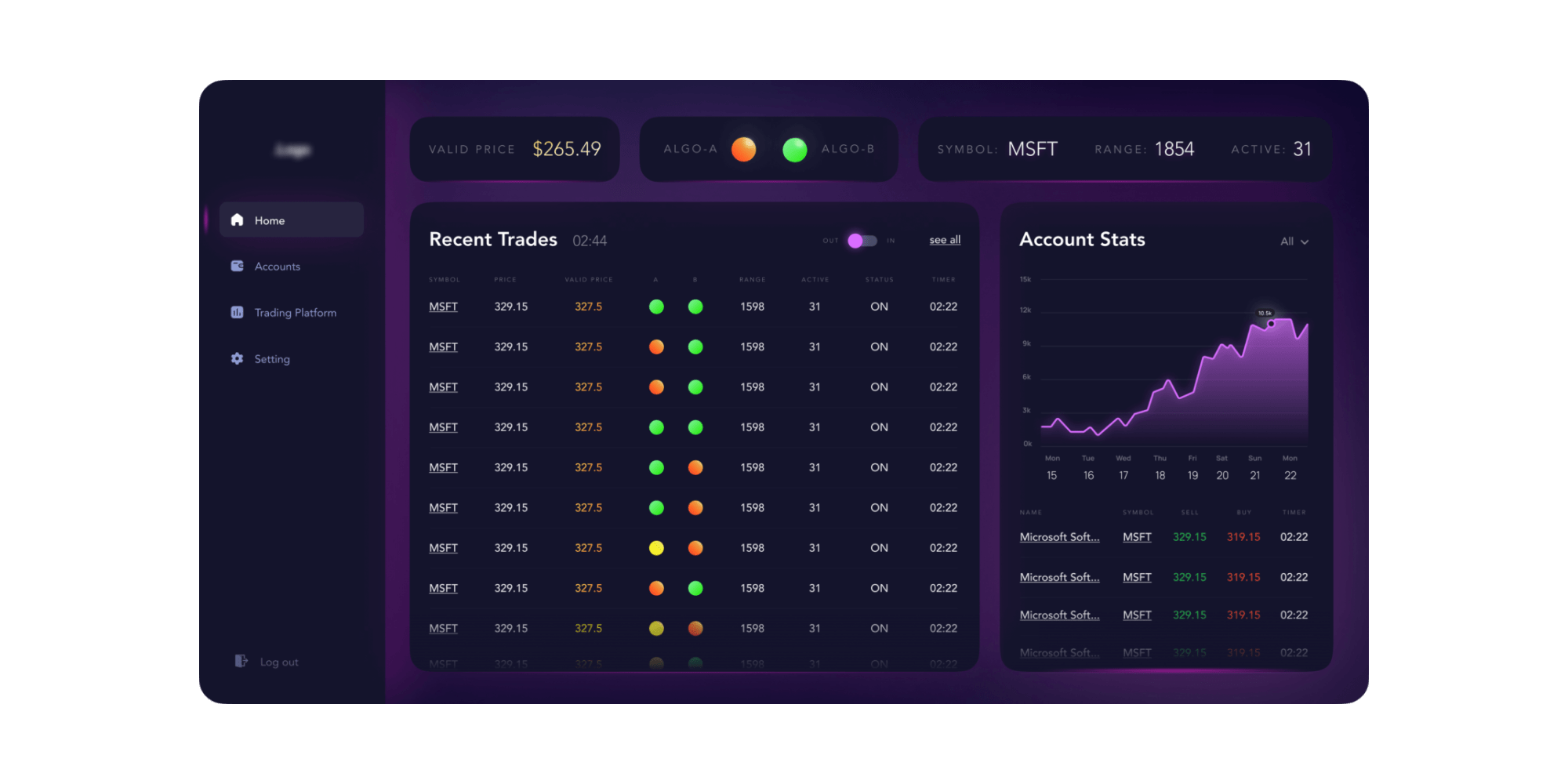

Stock Trading Signals Platform

One more trading solution delivered by our team is a stock trading signals platform for an investment company specializing in active day trading on the stock market. The platform serves as an intelligent investment assistant that performs technical analysis on a range of stocks, automatically tracks multiple indicators on the exchanges, and generates buy/sell and risk signals for a human trader.

For more details on this project, check out the case study.

Summary

Developing a stock trading app is a challenging process. You need to consider a variety of aspects – from the type of app and platform to legal requirements, third-party vendors, and the feature set.

However, the trickiest part of this journey is the app implementation itself, as developing such a solution requires solid technical expertise and a deep understanding of the ins and outs of the stock trading market. At Itexus, we have both. We developed dozens of fintech apps, including trading solutions, for our clients around the world and would be happy to build a stock trading app for you as well. Contact us to find out how we can help you.