The emergence of online payment apps has changed the way people conduct financial transactions. A smartphone with a mobile banking app allows to quickly resolve a variety of financial matters – in essence, it’s the bank in our pocket.

As mobile banking is becoming common, the traditional banking experience is fading away. According to American Bankers Association’s report, 39% of bank clients use mobile banking apps to manage their accounts. 32% use online banking via laptop or PC, and only 10% most often complete their transactions in person at their bank’s branch.

These are the three main reasons that drive the popularity of international payment apps:

1. The speed of transactions. Sending or receiving money through an app usually takes just a few seconds, while the same takes a few business days using traditional methods.

2. Affordability. Money transfer apps offer their users significantly lower fees compared to banks.

3. Accessibility. International payment apps provide access to financial services for the unbanked population.

In light of the above, money transfer apps is the tool of choice for migrant workers. Such apps promote financial inclusion among migrants by making it easier for them to send money to their loved ones back home in an instant. Moreover, online banking apps have a significant impact on rural areas. According to a study in the American Economic Journal, a year’s use of mobile banking apps led to a 26% increase in remittances from urban to rural areas. The introduction of mobile banking services enabled a 7.5% increase in rural consumption, reduced the rate of child labor, and improved hours of study.

Currently, mobile payment apps are the most common method to manage finances, and this trend will continue as new solutions emerge. Consider entering the fintech market with your own international money transfer app? Let’s clarify what makes a good app, what features are a must, and where to start international money transfer app development.

Benefits of International Money Transfer App

Here are some of the biggest advantages of mobile banking.

✅ Lower transfer fees. International payment apps charge lower fees compared to traditional banks because they do not have to spend money on maintaining branches.

✅ Instant transfer. Transactions are executed instantly, while banks take a few business days to receive the money in the recipient’s account.

✅ It’s easy to make transactions from any device. Leveraging international money transfer app features, users get access to a wide range of financial services and can perform transactions from any device they have available.

✅ Transaction history. This feature helps users manage their finances and better understand and allocate their spending.

✅ Customer support. Whenever users need help, customer support is available to quickly solve their problems.

Must-Have Features for Money Transfer App

Do you know what makes a good application? Check out our list of the most important features of an e-transfer app.

✔️ Fast and easy registration and onboarding

This is a basic but essential feature that must be included in your app. Too many steps during registration might irritate users. The best registration and onboarding practice is to keep these processes quick, easy, and intuitive.

✔️ E-wallet

Integrate eWallet functionality to the list of your international money transfer app features so users can easily pay and effectively manage their budget. This feature will greatly expand the scope of your app and become a competitive advantage, as a feature-rich app can replace several different apps.

✔️ Bill payment

Having a single app for sending money and paying bills is convenient. Users love convenience, they do not want to switch between different apps to perform similar tasks, so the bill payment feature would simplify users’ financial routines.

✔️ Spending statistics

With this feature, users can track, analyze, and manage their expenses to make rational decisions about their finances.

✔️ 24/7 Support

24/7 customer support is crucial for a money service app, as users entrust it with their money. The best way to organize round-the-clock customer support is to integrate a smart AI chatbot into the app. It can take care of simple customer inquiries, respond quickly, and ensure high customer satisfaction with your service.

✔️ Notifications and alerts

Push notifications keep users informed about recent transactions, important payments, and other information related to their money. And fraud alerts are crucial as they warn users about suspicious activity on their accounts and help prevent money loss.

✔️ Currency exchange

For international money service apps, it is important to provide users with real-time currency exchange rates. This feature helps users better manage their finances and access all the information they need in one place, which is very convenient.

✔️ Intuitive UI/UX

Providing the best possible user experience is crucial for an app’s success. According to CBI, 17% of startups fail because of an unfriendly product design. To avoid this, you should carefully consider the app’s user interface and navigation, keeping in mind the needs of your target audience. Your app should be user-friendly, visually appealing, and engaging so that users can easily interact with it. Need some practical tips for mobile banking app design? Read our recent article on best practices and trends in mobile banking app design.

And last, but not least, is data protection. When it comes to international money transfer app development, security and privacy must be the key concern. Ensure the ultimate protection of users’ sensitive data against all potential threats. For this, you can equip the app with multi-factor authentication and access management options, enable end-to-end encryption, real-time text alerts, user behavior analytics, etc.

International Money Transfer App Development – Case Study

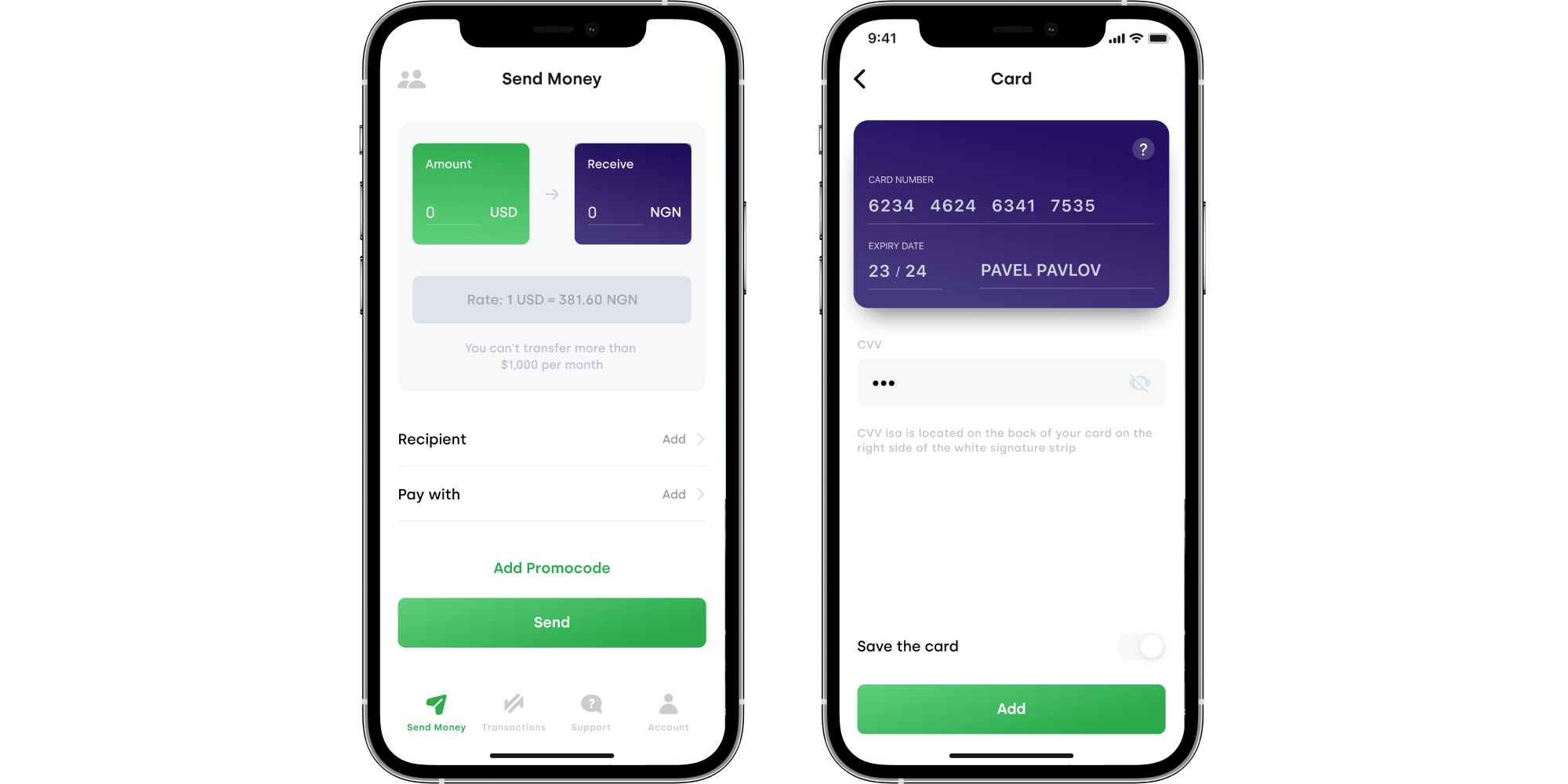

As an expert in financial software development, Itexus has an impressive track record in delivering both web and mobile FinTech solutions. That’s why our client, a U.S.-based startup, approached us to develop a money transfer solution that would allow its users to transfer money from U.S.-issued bank cards to Nigerian bank accounts. The main idea behind the solution was to provide Nigerian migrants with instant, affordable, and secure transactions.

After the discovery phase, we started the development phase. A team of project managers, business analysts, technical leads, iOS and Android developers, backend and frontend developers, QA engineers, and designers delivered a secure and feature-rich mobile app-to-bank transfer solution with the following functionality:

• Instant money transfer from any American bank card to any Nigerian bank account

• Payment of bills in Nigeria, e.g. for utilities, phone bills, etc.

• Connection of multiple US bank cards to one account

• Multilingual interface

• Robust KYC verification system

• The promo code system for running promotional campaigns

Now Nigerian migrants can send money back to their loved ones in a cost-effective and secure way. Want to learn more about the project? Check out the original case study.

Pre-Development Things to Consider

To make sure you are all set for the development phase, kick your project off by considering some principal points we have listed below.

✔️ Conduct market research

Exploring the market before entering it with a new solution will give you important insights into the industry, your users, and competitors, and help you identify new business opportunities.

✔️ Define TA

Your target audience is the biggest source of inspiration for your product. Determine exactly who your users are, research their needs, goals, and expectations, and ideate new product features based on your findings using the customer-centric approach. This way, your app is bound to succeed.

✔️ Consider foreign regulations

Depending on the country where you are launching your app, you will need to obtain different licenses and permits for providing online payment services. So, before you launch, check the local laws and regulations and make sure your product complies with them and has all the required licenses. Otherwise, your app will be deemed underground and outside the law.

✔️ Engage legal professional

Leave things to the professionals. A legal expert who knows your domain will facilitate legal issues, carefully draw up terms of use, privacy policy and other documents, and help you avoid mistakes that can derail the entire project.

✔️ Set aside a budget for a PR campaign

The modern world runs on a good first impression. A PR campaign would help you market your app in the right way, gain positive public opinion, project your brand image in an attractive way, and market the app to your target customers.

Summary

International money transfer apps are gradually displacing traditional banks. Their growing popularity is driven by their convenience, lower fees, instant transactions, and ease of use. The adoption of such apps will continue, and new money transfer solutions will emerge as there is still room for new products in the fintech market.

Money transfer app development requires experience in the fintech domain, a set of skills necessary to bring a high-quality product to market, and extensive preparatory work. But the effort is worth it, as the market is growing rapidly due to ongoing labor migration. Have an idea and want to develop an international money transfer app? Itexus’ money transfer app developers are at your disposal. Contact us to turn your vision into en engaging, robust, and secure money transfer app.