By integrating third-party services into your neobank solution, you can quickly add features and tools to your product that could take many months to develop on your own. Carefully selected third-party integrations add value to your product, help it compete in the highly competitive fintech market, and enable a seamless and consistent banking experience for your customers.

But those aren’t the only benefits of integrating third-party services into your neobank solution. In this article, we’ve covered the main arguments for integrations, explained which integrations are a must-have for any neo banking solution and how much they cost, and what you should look for when choosing an integration provider.

How Integrations Benefit Neobanks

Neobanks are valued for their convenience, accessibility, and security. Another point to which neobanks owe their success among customers is the wide variety of services that make most financial operations much easier and faster.

The convenience, accessibility, and versatility are made possible, among other things, by a wide range of third-party services that can be integrated with neobanks. The latter benefit from the integrations not only in terms of improved customer experience, but also in many other ways.

• Cost-effectiveness. In-house development of some complex features can cost a neobank a fortune. Now do the math on how many features your neobank solution must have to be competitive in the market, and you’ll see that you can save significant sums by integrating with third-party vendors.

• Versatility. Integrations allow neobanks to quickly develop new product lines to enter new markets and meet the needs of a much larger number of customers.

• Customer acquisition. More features often mean meeting the needs of more customers. Third-party integrations allow neobanks to offer a broader range of services, attracting more new customers whose needs haven’t been met before.

Integrations to Use while Developing Neobanking Apps

When it comes to neobanks development, the first thing that comes to mind is a great customer experience. Then it’s only logical that when choosing what features to add to your solution, you should understand exactly what your customers need and what problems they’re trying to solve with your solution. Otherwise, you run the risk of overwhelming your customers with an over-featured and overly expensive product.

That said, there are some integrations that every solution should have – let’s take a look at them.

KYC/AML Providers

Know Your Customer (KYC) is a mandatory process to identify and verify the identity of the customer when opening an account. Roughly speaking, KYC allows banks to ensure that their customers are who they say they are.

AML (Anti-Money Laundering) is a set of regulations, laws, and procedures that prevent criminals from disguising illicit funds as legitimate income. AML requires banks to collect customer information, monitor and audit their transactions, and report suspicious activity to financial regulators.

Fintechs are required by law to perform both of these procedures to mitigate the risk of being used as a vehicle for financial crime. There are a variety of KYC/AML providers on the market to help neobanks and other financial institutions comply with regulatory requirements, and below we have listed some of the most popular solutions.

Jumio

Jumio is an end-to-end platform that provides automated identity verification and AML solutions. Using technologies such as AI, biometrics, machine learning, liveness detection, and automation, Jumio helps organizations fight fraud, onboard customers faster, and comply with regulatory requirements such as KYC, AML, and GDPR.

Jumio offers products for the following purposes:

- Identity verification

- AML

- Document verification

- Authentication

- Video verification

- Transaction monitoring

Pricing

Pricing is available upon request. Contact the sales team to learn more.

Shufti Pro

The platform is an AI-based identity verification SaaS designed to eliminate the risks of identity theft, financial crime, and cyber fraud. Key benefits include a fast and accurate verification process, broad global coverage, and two-fold technology. Shufti Pro offers a variety of services that you can tailor to your needs or use all at once.

- KYC

- Background AML screening

- Facial biometric authentication

- KYB

- Video interview KYC

- OCR for business

Pricing

Shufti Pro offers the following pricing plans:

- Free trial

- Start-up — $1,250 (pay as you go)

- Enterprise — $4,500 (pay as you go)

- Premium — contact the provider to get a custom price.

A monthly commitment is also available.

Data Aggregators

Data aggregators pool customers’ personal and financial data from a variety of sources and make it easily and conveniently accessible in a single place. This information is then used by neobanks to provide a more personalized experience for their customers and generate additional income. For example, the data is collected and analyzed to develop new financial products. For this reason, demand for such services has grown tremendously in recent years and continues to this day.

Plaid

Plaid is the leading provider of financial data with over 11,000 financial institutions in its network. To access, cleanse, categorize and deliver customer financial data, Plaid uses screen scraping and APIs. Plaid ensures less fraud, simplifies bank account authentication, provides comprehensive transaction history, tracks geological transactions, validates user income, and offers a range of custom integrations.

Pricing

There are two publicly disclosed paid options – Launch and Scale.

- Launch means “Pay as you go”

- Scale is €200+/month

Truelayer

Truelayer offers a number of helpful APIs, including a data API that provides more engagement and a personalized user experience. TrueLayer’s data API helps create a unified view of finances that allows your users to manage their credit cards and accounts in a single view, giving them all the information they need to make data-driven financial decisions.

Pricing

Truelayer has three payment plans:

- Develop — free

- Scale — usage-based pricing

- Enterprise — custom pricing

Payment Gateways

A payment gateway is an online payment service designed as a channel for making and receiving payments. It ensures a smooth payment process by securely validating the customer’s card details and guaranteeing the availability of funds. Payment gateways encrypt sensitive credit card data and guarantee that the information is transferred securely from the customer to the acquiring bank.

Stripe

The service offers a fully integrated suite of payment products that enable users to accept money globally and ensures secure transactions. Stripe offers user-friendly reporting features, consistent service, and democratic and transparent fees, and works with all types of currencies, banks, and credit cards. In addition, Stripe makes it easy to cancel recurring monthly charges and refund customers.

Pricing

Stripe charges 2.9% plus $0.30 per successful online card charge. Customers pay the same price regardless of what type of card they process. For on-site card processing, Stripe charges 2.7% plus $0.05 per successful credit card transaction.

PayPal

This is another world-renowned payment service that is easy to use and offers customers a high level of security and fraud prevention. The service records all transactions, so creating and monitoring invoices is less stressful for your business. Besides, loyal customers who buy online through PayPal receive special discounts.

Pricing

Depending on whether you’re a merchant or a customer, you’ll incur different fees.

- Invoicing for a merchant is 3.49% + a fixed fee.

- Sending domestic personal transactions for a customer — no fee (if the payment method is PayPal balance or bank account), 2.90% + fixed fee (if the payment method is a card).

- International personal transactions — 5.00% (PayPal or a bank account), 5.00% + 2.90% + fixed fee (a card).

Communication services

These services help neobanks streamline communications with their customers to provide a better customer experience.

Twilio

Twilio is a customer engagement platform that offers a variety of tools to unify communications within your organization and personalize every step of the customer journey. Twilio offers tools for messaging, email, calls, video communications, marketing campaigns, and more. Whatever your communication goal is, Twilio has a solution to help you achieve it.

Pricing

Twilio offers simple and flexible pricing options for all of its products. Visit the website or contact the sales team for more information.

Plivo

The service is ranked № 1 for customer satisfaction in G2’s cloud communications category. Over 98% of customers rate Plivo with 4.5 or 5 stars. It offers SMS, voice, and MMS APIs.

- With the SMS API, you can send and receive text messages in over 190 countries worldwide.

- Voice API allows customers to integrate voice calling features into their applications.

- The MMS API enables sending and receiving images and videos with phone numbers in the U.S. and Canada.

Pricing

Charges vary by region and are available on the company’s website or upon request.

Brokerage APIs

A brokerage API allows neobanks clients to invest in stocks, options, futures, currencies, bonds and funds through a single integrated account and is a great add-on to help you reach a wider audience.

InteractiveBrokers

The service is equipped with a range of technologies that optimize clients’ trading speed and efficiency and perform sophisticated portfolio analysis. It offers free trading tools, more than 100 order types, and a comprehensive reporting system.

Pricing

Pricing depends on the type and version of the account – Pro or Lite. You can get detailed information on the official website.

Apex

The platform provides a set of APIs to facilitate the entire trading and investment lifecycle – from account opening to regulatory support. Apex enables trade execution across all major asset classes, including support for partial orders, bookkeeping, and equity allocations.

Pricing

Fees are available upon request.

All prices are as of the date of publication.

How to Choose the Integrations Covering Your Needs

As mentioned earlier, the choice of features you add to your solution should be based on the real tasks your customers are trying to solve with your solution. A deep understanding of your customers’ needs, wants, and painpoints can give you valuable insight into how to evolve your product.

To gain this deep knowledge of your target audience, you can try the Jobs to be Done framework (JTBD). In a nutshell, the idea behind this framework is to focus on the “job” that customers are commissioning your product to do. Customers simply need to get things done, and you need to understand what jobs regularly occur in their lives for which they need your services. Crucially, you need to define a “job” by its outcomes, not its functions – what is the ultimate purpose of using this or that banking service?

If you go beyond demographic and behavioral segmentation and focus on the job, you can gain many ideas for innovation. And when it comes to product development, JTBD can sometimes work better than other techniques.

Once you’ve decided on the third-party services you want to integrate into your solution, it’s time to shortlist the providers. Below are some key points to consider when looking for a third-party integration provider:

• Check the documentation of potential providers. Look for neobanks API providers with comprehensive documentation and detailed FAQs. Sometimes integrations have hidden costs or technical limitations such as scaling restrictions. We know that reading pages and pages of documentation is no walk in the park, but you don’t have to do it yourself. Our specialists will study the documentation for you from A to Z.

• Meet the legal requirements. We recommend that you bring a lawyer onto your team to verify that the data sharing process meets the legal requirements in your country. Make sure the vendors you have shortlisted for integration meet the security standards and legal requirements relevant to your target market.

• Customer service. Inquire if your provider offers custom pricing to make sure you’re getting a good deal. Also, inquire about technical support availability and pricing.

It can be a daunting task to explore the multitude of third-party providers on the market. Therefore, it’s advisable to seek professional help from a fintech software development company that has vast experience in neobank development. When you come to Itexus with an idea for your software, we discuss all your needs and requirements in the discovery phase and select the types of integrations and the best vendors to give your solution a competitive edge.

Use Cases: Integrations Itexus Used in Neobanking Development

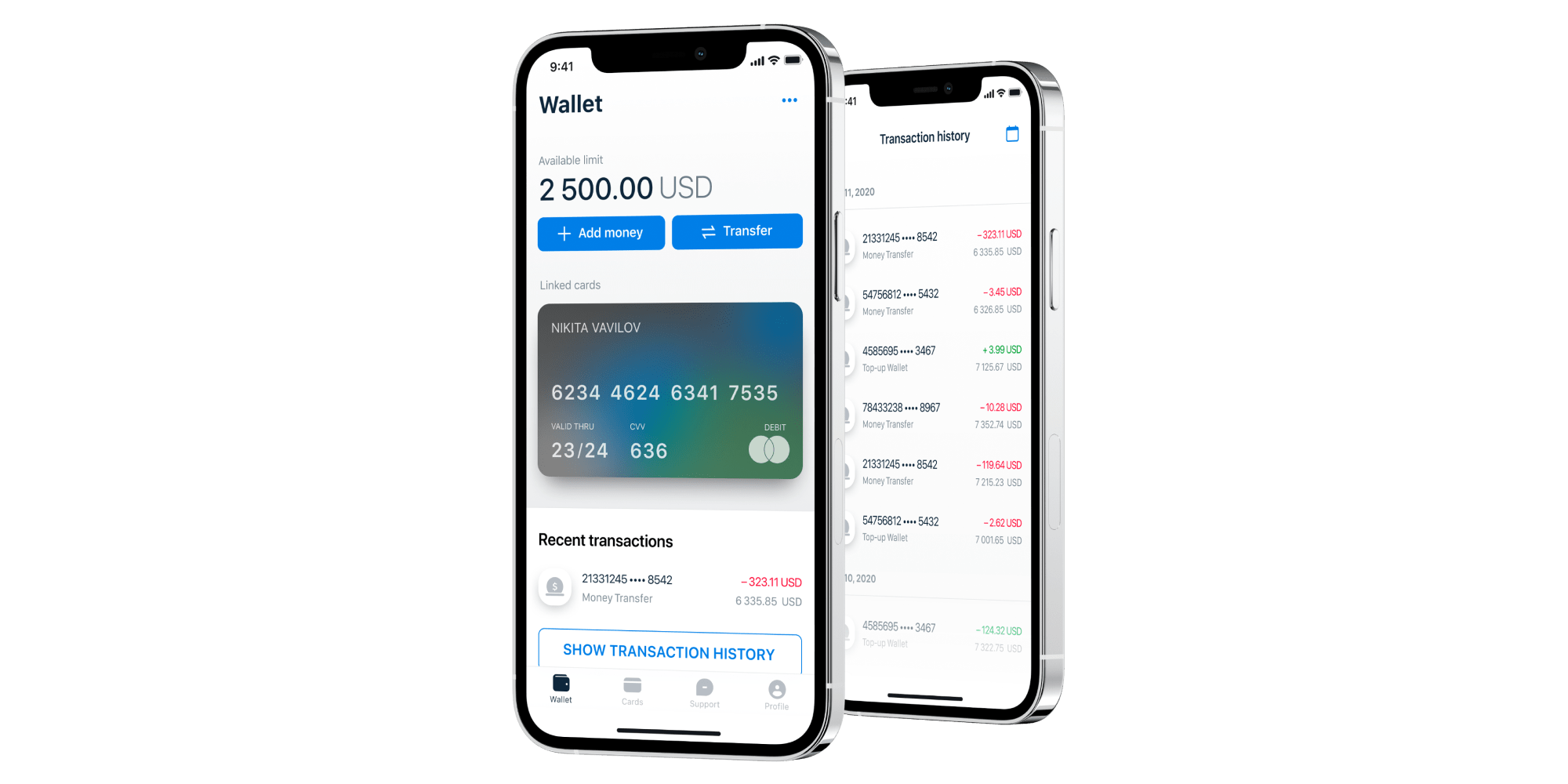

One of the projects where we worked extensively with integrations was a mobile banking app for migrants. It was designed to facilitate money transactions, such as financial help to families, getting paychecks early, microloans, etc.

Our client wanted to develop a fintech neobank that would serve a large segment of banks’ audience – migrants. In addition to the security issues and challenges of the regulated business environment, Itexus had to select and integrate a number of third-party neobank APIs. Our client chose the following integrations:

• Alloy, Iovation, Vouched — an AML/KYC provider

• Mbanq — a payment API

• Plaid, Argyle — data aggregators

• Twilio — communication service

Despite the need to integrate multiple APIs, we managed to get the job done in 12 months and develop a feature-rich application.

Another mobile banking solution with multiple integrations was developed for a US startup. It integrates with the following third-party providers:

• SendGrid (Twillio) – customer communication platform

• Authorize.Net – a payment provider

• Veratad – identity verification provider

We delivered the app in 7 months. However, if we had developed all the above features from scratch, the delivery time would have been much longer.

Summary

If we’re to give any advice on third-party integration for neobanks, it’s that any API should add value. Integrating third-party services that add real value to the targeted customer base is more important than sheer volume. Lots of third-party APIs will only lead to more confusion or, worse, solve a problem your customer doesn’t even have. That’s why it’s important to understand your real needs and shortlist the right third-party providers for integration. Contact us if you need help with this.