The FinTech industry is not just growing—it’s transforming how we think about money. From digital banks to blockchain-based ecosystems, FinTech innovations are rewriting the rules of finance. And guess what? 2024 is set to be a game-changer.

With global investments pouring into the sector, finding the right tech partner is more crucial than ever. Whether you’re building a banking app, an investment platform, or the next crypto wallet, you need a development team that gets your vision. That’s why we’ve put together this list of the top FinTech development companies for 2024—to help you cut through the noise and find your perfect match.

Why It Matters

Let’s face it: not all tech partners are created equal. A great FinTech development company doesn’t just write code—it collaborates with you, understands your niche, and builds solutions that wow your customers. The companies on this list are experts at making that happen.

They specialize in:

- Digital Banking: Turning traditional banking into digital-first experiences.

- Online Payments: Simplifying how people pay, anywhere in the world.

- Crypto and Blockchain: For those ready to dive into Web3.

- Wealth Management: Creating platforms that redefine how people invest.

We’ve Listed Top 25 FinTech Software Development Companies in 2024

1. Itexus

Since 2013, Itexus has been a trusted partner for startups and midsize businesses, crafting cutting-edge FinTech solutions that redefine user experiences. With over 170 successful projects, we specialize in delivering scalable, future-ready software for diverse financial sectors, including digital banking, wealth management, digital lending, alternative financing, online payments, personal finance, regtech, insurtech, and more.

Our comprehensive services cover every stage of development—from FinTech consulting and UI/UX design to robust DevOps and advanced engineering. At Itexus, we prioritize security, seamless functionality, and compliance with industry standards to ensure your solution is not only innovative but also trusted by users. Partner with us to transform financial technology into a competitive advantage.

2. ScienceSoft

ScienceSoft is a veteran in the software development industry with a remarkable track record in FinTech. Their expertise spans from building secure digital wallets and trading platforms to integrating AI-driven financial tools. The company emphasizes compliance with global financial regulations and develops solutions that are both user-friendly and robust. Trusted by top enterprises, ScienceSoft is the go-to partner for tackling complex financial software needs.

- Founded: 1989

- $/hr: $50–$99

- Services: FinTech development, AI-powered solutions, Big Data analytics, blockchain integration, mobile banking apps

3. Andersen Lab

Andersen Lab has earned its reputation by delivering bespoke FinTech solutions tailored to diverse business needs. Their services range from developing core banking platforms to deploying advanced blockchain ecosystems. With over 3,000 tech experts, Andersen ensures every project is scalable, secure, and aligned with modern financial trends. Their ability to integrate cloud-based solutions with financial platforms sets them apart in the competitive FinTech market.

- Founded: 2007

- $/hr: $25–$49

- Services: FinTech development, cloud integration, blockchain, regulatory tech, mobile solutions

4. EPAM Systems

A leader in global software engineering, EPAM Systems excels in creating FinTech ecosystems that combine innovation with operational excellence. They are known for building scalable solutions for digital banking, payment systems, and blockchain applications. Their strong focus on digital transformation helps financial institutions stay ahead in a rapidly evolving industry.

- Founded: 1993

- $/hr: $100–$150

- Services: Digital banking systems, payment gateways, blockchain solutions, cloud services

5. Intellectsoft

Intellectsoft crafts sophisticated yet user-friendly FinTech platforms. Their portfolio includes mobile banking apps, IoT solutions for finance, and blockchain-powered payment systems. With a focus on delivering seamless user experiences, Intellectsoft’s solutions are designed to meet the unique challenges of financial institutions while driving customer engagement.

- Founded: 2007

- $/hr: $50–$99

- Services: FinTech development, UX/UI design, blockchain, IoT in finance

6. Oxagile

Oxagile combines technical innovation with a deep understanding of the financial sector. The company develops tools like AI-driven risk management systems and real-time trading platforms. Oxagile’s commitment to security and precision makes it a trusted partner for financial institutions seeking cutting-edge solutions.

- Founded: 2005

- $/hr: $50–$99

- Services: Risk management tools, trading platforms, AI integration, Big Data analytics

7. Ciklum

Ciklum delivers FinTech software solutions that blend innovation with reliability. They specialize in cybersecurity, digital transformation, and software engineering for financial services. Ciklum’s expertise ensures that its clients can navigate the complexities of modern finance with confidence and agility.

- Founded: 2002

- $/hr: $25–$49

- Services: FinTech software engineering, digital transformation, cybersecurity

8. Exadel

Exadel brings a strong focus on blockchain technology, delivering secure and scalable payment platforms and mobile banking applications. Their commitment to innovation enables financial organizations to offer next-generation digital services that improve operational efficiency and user satisfaction.

- Founded: 1998

- $/hr: $50–$99

- Services: Blockchain integration, mobile FinTech apps, payment systems

9. Fingent

Fingent creates customized financial software that drives business growth. Whether it’s digital payment systems, FinTech consulting, or data analytics, Fingent’s solutions are tailored to meet the unique challenges of its clients. The company’s focus on innovation and customer-centricity makes it a trusted partner for businesses of all sizes.

- Founded: 2003

- $/hr: $25–$49

- Services: Custom software development, digital payment platforms, FinTech consulting

10. ELEKS

ELEKS is a powerhouse in predictive analytics and Big Data solutions for the financial sector. Their expertise includes developing advanced platforms for digital banking and fraud prevention. ELEKS’s solutions empower financial institutions to enhance decision-making and gain a competitive edge.

- Founded: 1991

- $/hr: $50–$99

- Services: FinTech development, Big Data solutions, predictive analytics

11. Zfort Group

Zfort Group excels in designing and building intelligent financial applications. Their offerings include AI-based trading platforms and blockchain apps that simplify complex processes. With a client-first approach, Zfort Group delivers solutions that drive innovation and efficiency in the financial domain.

- Founded: 2000

- $/hr: $25–$49

- Services: AI-based solutions, trading platforms, blockchain apps

12. Netguru

Netguru is a global leader in creating FinTech applications that are user-friendly, secure, and scalable. From neobanking platforms to payment gateways, their team excels in delivering solutions that cater to a global clientele. Netguru’s emphasis on design and innovation has made them a favorite among startups and enterprises alike.

- Founded: 2008

- $/hr: $50–$99

- Services: Mobile banking, payment solutions, UX/UI design, blockchain development

13. SoftServe

SoftServe blends technology and strategy to create transformative FinTech platforms. Their services include cloud migration, AI-driven analytics, and blockchain integration. SoftServe’s global presence and expertise make them a preferred choice for businesses looking to modernize their financial operations.

- Founded: 1993

- $/hr: $50–$99

- Services: Cloud migration, AI analytics, blockchain, digital transformation

14. Sigma Software

Sigma Software provides comprehensive FinTech development services, specializing in digital banking, investment platforms, and compliance tools. Their scalable solutions help businesses enhance customer engagement while maintaining regulatory standards.

- Founded: 2002

- $/hr: $25–$49

- Services: Digital banking solutions, investment platforms, compliance tools

15. Hyperlink InfoSystem

Hyperlink InfoSystem is renowned for its expertise in mobile app development, including FinTech solutions. They deliver high-quality applications tailored to diverse financial needs, such as personal finance management, lending, and payment processing.

- Founded: 2011

- $/hr: $25–$49

- Services: Mobile FinTech apps, lending platforms, payment processing

16. Itransition

Itransition specializes in building enterprise-grade FinTech software, focusing on digital transformation and seamless user experiences. Their services range from blockchain integration to fraud detection tools, making them a versatile player in the financial sector.

- Founded: 1998

- $/hr: $50–$99

- Services: Blockchain integration, fraud detection, digital transformation

17. Altoros

Altoros is a trusted name in blockchain and cloud-based FinTech solutions. Their expertise includes creating secure financial platforms and AI-driven tools to optimize business processes. Altoros is particularly known for its innovative use of smart contracts.

- Founded: 2001

- $/hr: $50–$99

- Services: Blockchain development, AI-driven tools, smart contracts

18. Belitsoft

Belitsoft delivers end-to-end FinTech development services, including mobile banking apps and financial analytics platforms. Their commitment to scalability and compliance ensures long-term success for their clients.

- Founded: 2004

- $/hr: $25–$49

- Services: Mobile banking, analytics platforms, compliance solutions

19. N-iX

N-iX combines technical excellence with a deep understanding of the financial industry to deliver tailored FinTech solutions. Their expertise includes digital wallets, cryptocurrency platforms, and advanced data analytics tools.

- Founded: 2002

- $/hr: $50–$99

- Services: Digital wallets, cryptocurrency platforms, data analytics

20. MindK

MindK specializes in creating robust FinTech applications, including wealth management platforms and online lending systems. Their focus on user-centric design and secure architectures has earned them a strong reputation in the industry.

- Founded: 2009

- $/hr: $25–$49

- Services: Wealth management, lending systems, UX/UI design

21. Cleveroad

Cleveroad develops scalable and user-friendly financial applications tailored to the needs of both startups and established enterprises. Their expertise spans mobile banking, trading platforms, and payment solutions.

- Founded: 2014

- $/hr: $25–$49

- Services: Mobile banking apps, trading platforms, payment gateways

22. SimbirSoft

SimbirSoft is a leading provider of custom FinTech solutions, focusing on building secure and scalable software for digital banking, investment management, and payment systems.

- Founded: 2001

- $/hr: $25–$49

- Services: Digital banking, investment management, payment systems

23. Appinventiv

Appinventiv delivers innovative FinTech apps, specializing in blockchain and cryptocurrency solutions. They are known for their focus on providing seamless user experiences across mobile and web platforms.

- Founded: 2014

- $/hr: $25–$49

- Services: Blockchain solutions, cryptocurrency apps, mobile FinTech apps

24. Aalpha Information Systems

Aalpha Information Systems focuses on delivering cost-effective FinTech solutions for startups and SMEs. Their services include mobile app development, cloud migration, and payment processing systems.

- Founded: 2007

- $/hr: $15–$25

- Services: Mobile apps, cloud migration, payment systems

25. Merixstudio

Merixstudio specializes in creating innovative FinTech applications that are secure, user-friendly, and scalable. Their expertise in web and mobile development ensures solutions that meet modern financial industry standards.

- Founded: 1999

- $/hr: $50–$99

- Services: Web and mobile FinTech apps, security solutions, UI/UX design

Why These Companies?

Each of these firms is at the forefront of the FinTech revolution. They bring expertise in cutting-edge technologies like AI, blockchain, and cloud computing while understanding the financial industry’s unique regulatory and security needs.

By partnering with the right team, you don’t just build software—you set the stage for long-term success in the competitive FinTech space.

Ready to Take the Leap?

2024 is the year to make your FinTech dreams a reality. Whether you’re launching a new app or scaling an existing platform, these companies can turn your ideas into digital gold. So, what’s your next move?

How to Choose a Fintech Software Development Company

Another question is how to choose a vendor – what to take into consideration, what the key points are, and what to look for. Luckily, we have a list of some essential issues to take into consideration while searching for a financial software development company.

Short Tips for Choosing Your Tech Partner:

- Look for industry expertise: FinTech isn’t just tech—it’s finance too.

- Prioritize security: With sensitive user data at stake, make sure your partner has strong compliance and encryption capabilities.

- Think long-term: Choose a team that can grow with you, offering ongoing support and innovation.

✅ Industry-Wise Expertise

For successful project delivery, it is advisable to look for a firm that has the relevant expertise in creating and launching financial solutions using the latest technologies and within various deployment ecosystems. Itexus’ fintech expertise ranges from simple personal finance assistants, mobile payments, and lending apps to complex enterprise-grade financial applications.

Got an idea for a fintech solution and looking for a reliable tech partner to bring it to life? We’ve got you covered! Take a look at a couple of our recent projects – these are just a tiny part of the wide range of complex fintech solutions Itexus has been delivering since 2013, not to mention a multitude of mobile apps of all kinds.

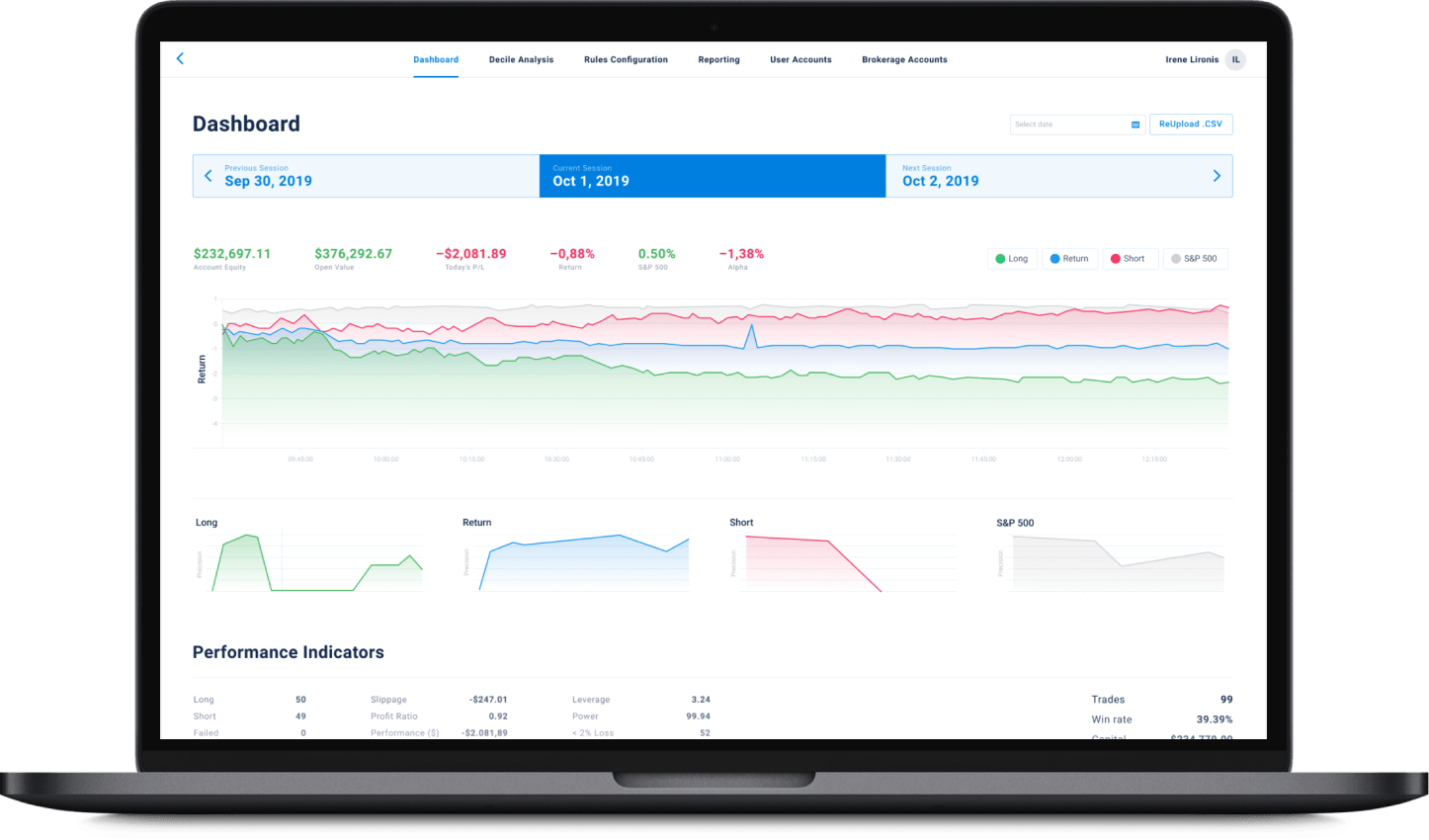

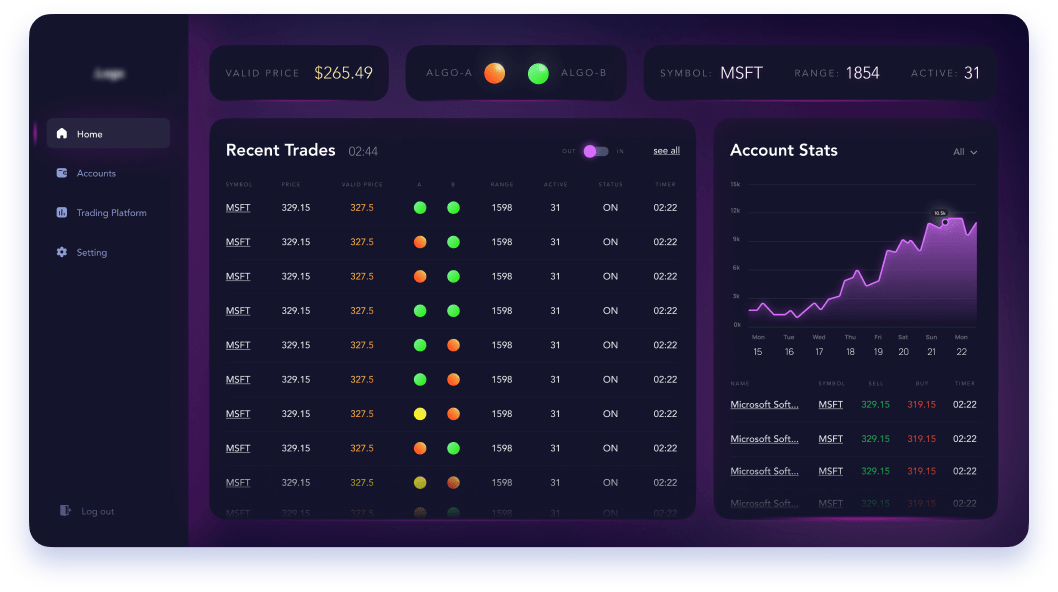

✔️ Stock trading bot

We developed an algorithmic intraday stock trading system for a wealth management company with 20 years of experience and its own active stock trading strategy. The system allows investors to connect their brokerage accounts and configure a robot to automatically trade stocks from their accounts for a commission and subscription fee.

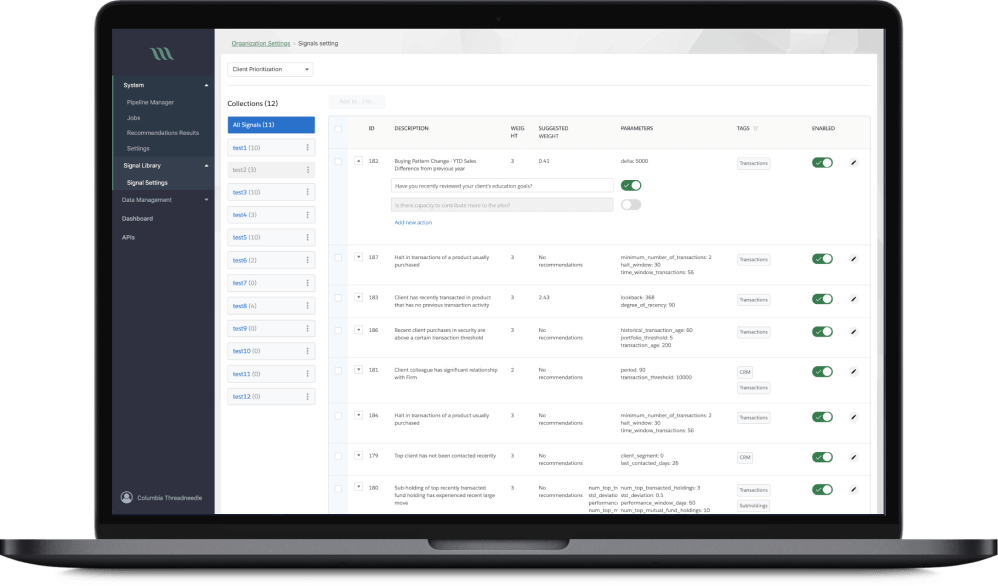

✔️ AI-powered financial analysis and recommendation system

Another notable project we completed is a financial analysis and recommendation system that uses machine learning techniques to process various content feeds in real time. The solution is designed to increase the productivity of financial analysts or account managers in areas such as wealth management, commercial banking, and fund distribution.

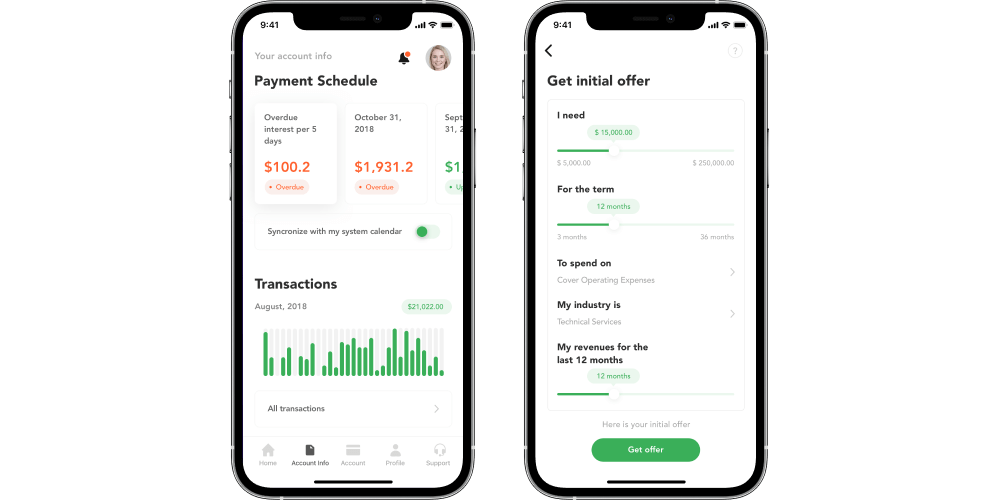

✔️ Online lending platform

A fintech startup with decades of experience in the financial services industry approached us to develop an online lending platform for small businesses. The solution we delivered automates the entire lifecycle of a loan, online loan application, KYC, credit scoring, underwriting, payments, reporting, and bad deal management. It also features a custom AI analytics and scoring engine and is integrated with major credit reporting agencies and a bank account aggregation platform.

✔️ Stock trading signals platform

For an investment company that specializes in active day trading on the stock market, we developed an intelligent investment assistant – stock trading signals platform. It automates technical analysis tasks and calculations according to the company’s strategies for different asset classes. The delivered solution enabled the client’s in-house trading team to identify investment opportunities faster, make decisions with fewer mistakes, and thus increase the company’s trading profits.

✔️ Mobile bank transfer app

For a U.S.-based startup, Itexus developed a mobile app-to-bank transfer solution. The app allows its users to transfer money from U.S.-issued bank cards to Nigerian bank accounts, pay bills in Nigeria (e.g., utilities, phone bills, etc.), and link several U.S. bank cards to one account. It has a multilingual interface (English, Spanish, and French) and is integrated with two payment service providers and a robust KYC verification system.

✅ Reviews on Trusted Resources

Nowadays, all mature companies have reviews on various websites. You can google the company’s reviews or research them on Clutch or Designrush. Usually, all the reviews on these platforms are verified by the sites’ administration so there is no possibility of faking the testimonials. Checking the reviews is very helpful when it comes to choosing between multiple vendors.

✅ Business Synergy

Synergy is the concept that the combined value and output of two companies is greater than the sum of their individual parts. It means that both companies should work towards one goal and strive to be successful in their project. It’s also about communication because that’s the best way to find out if you’ll be comfortable working on a joint project and being on the same page. Does the vendor understand your business needs? Is the company willing to work with you? Do you feel comfortable and secure on sync up meetings?

✅ Get Your Project Estimate

Project estimation includes scope, time-frames, budget, and risks and helps you determine the time and budget required to develop, test, and deploy the solution. To get an estimation of your project, contact us, sign the NDA, tell us your idea, and after a short conversation with our specialist, you’ll receive a full estimate with the hours and budget needed.

Itexus stays on top of things and keeps abreast with all the latest trends in FinTech software development. Over the years, we have gained a unique Fintech expertise by working with both the newcomers to the market and established players. Now we are ready to share this expertise with you. So, if you are aiming to go big in Fintech industry, don’t hesitate to reach out, and we’ll help you transform the idea into the product that is ready to take on the existing players and boom the market.