v.2 Rescuing Wealth Management App Ecosystem for Investment Advisory Firm

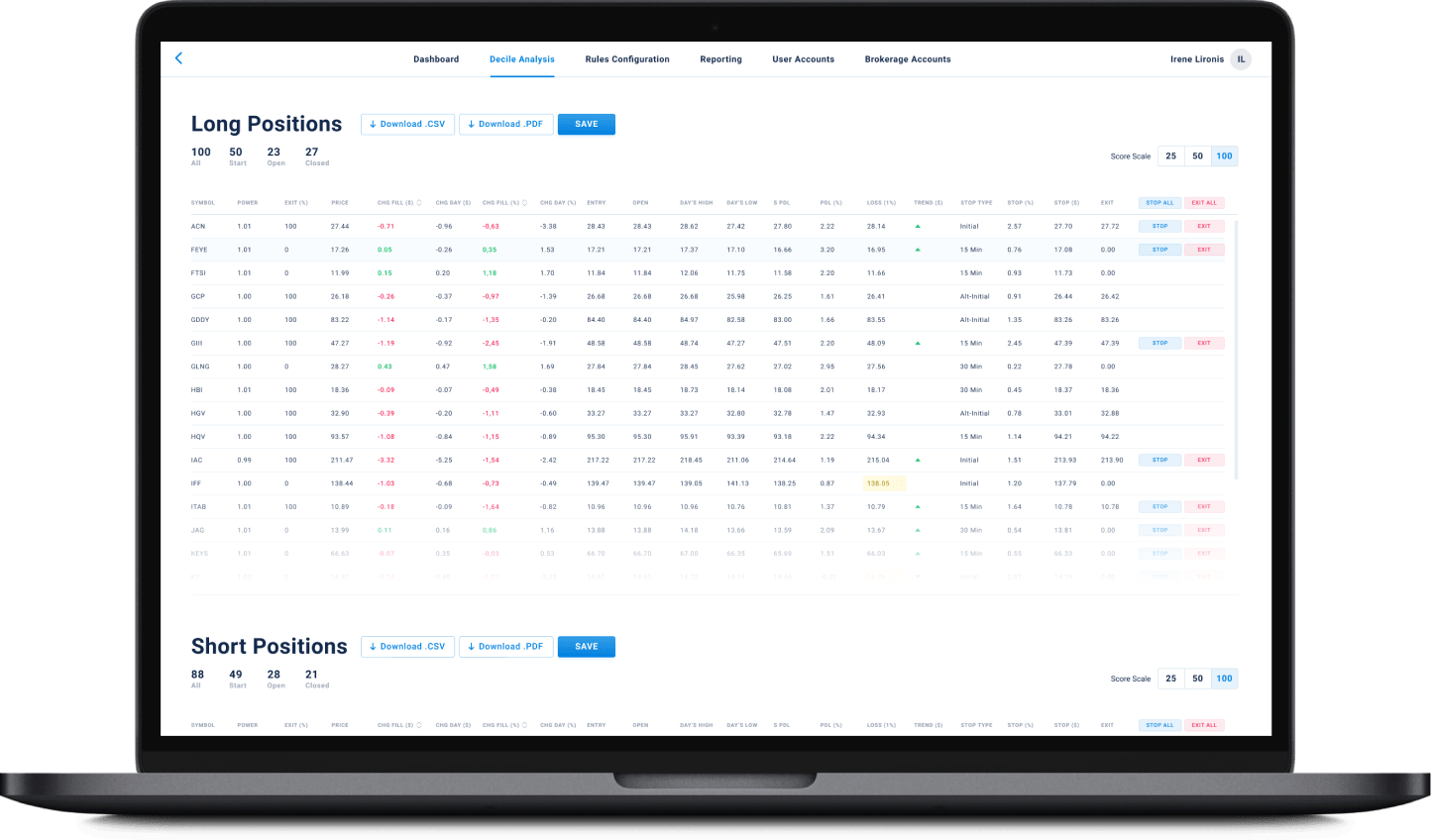

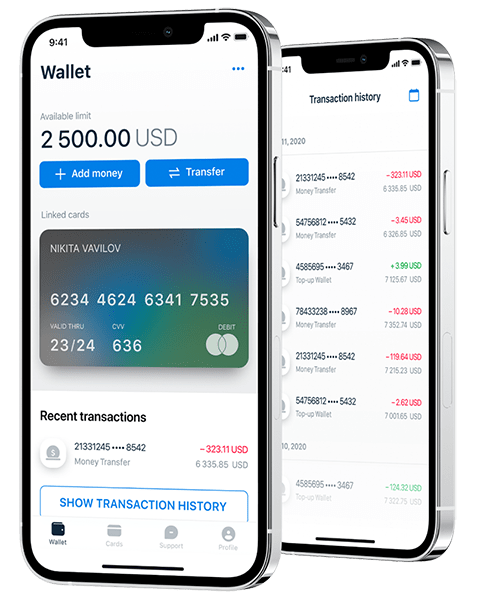

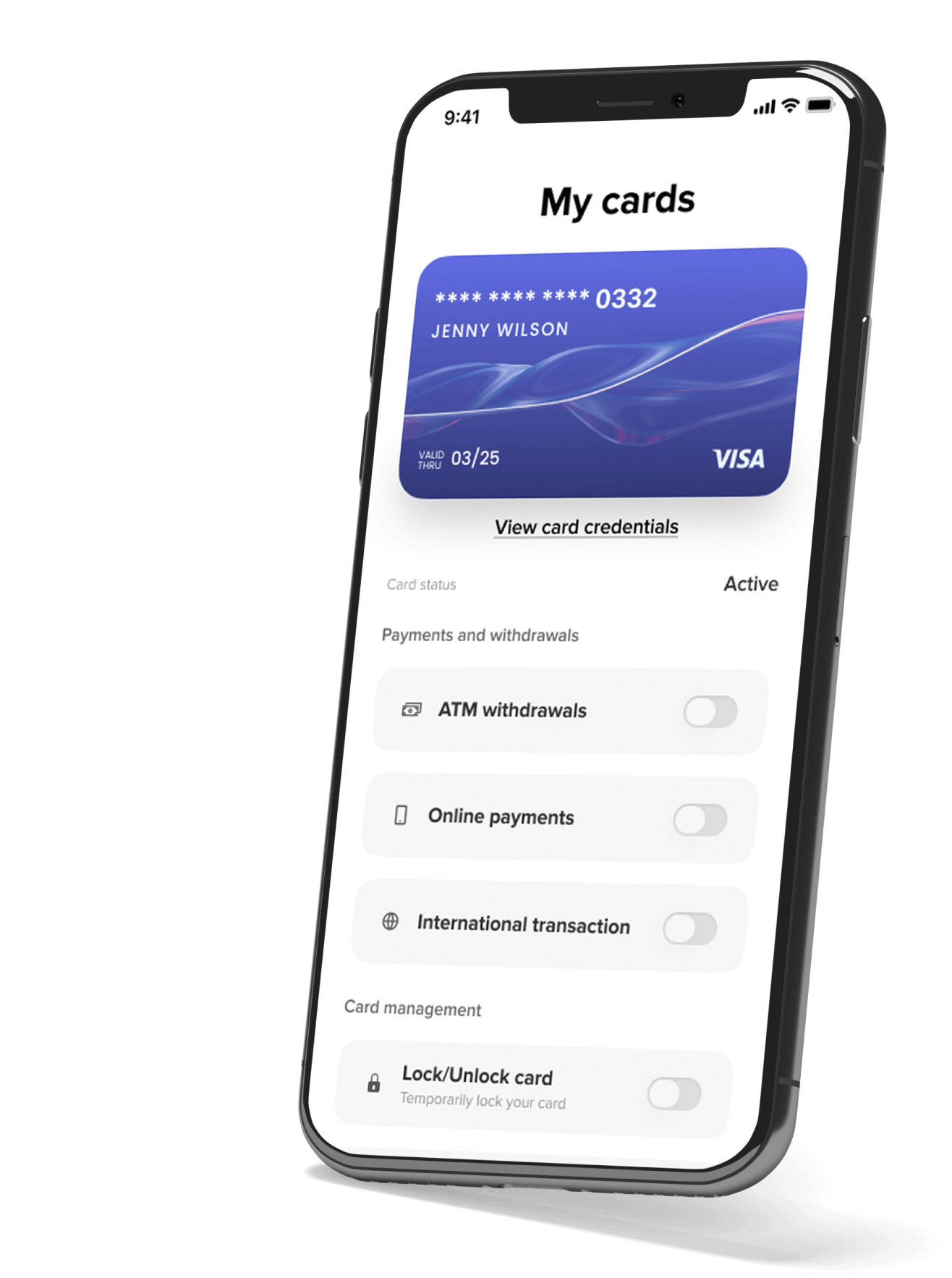

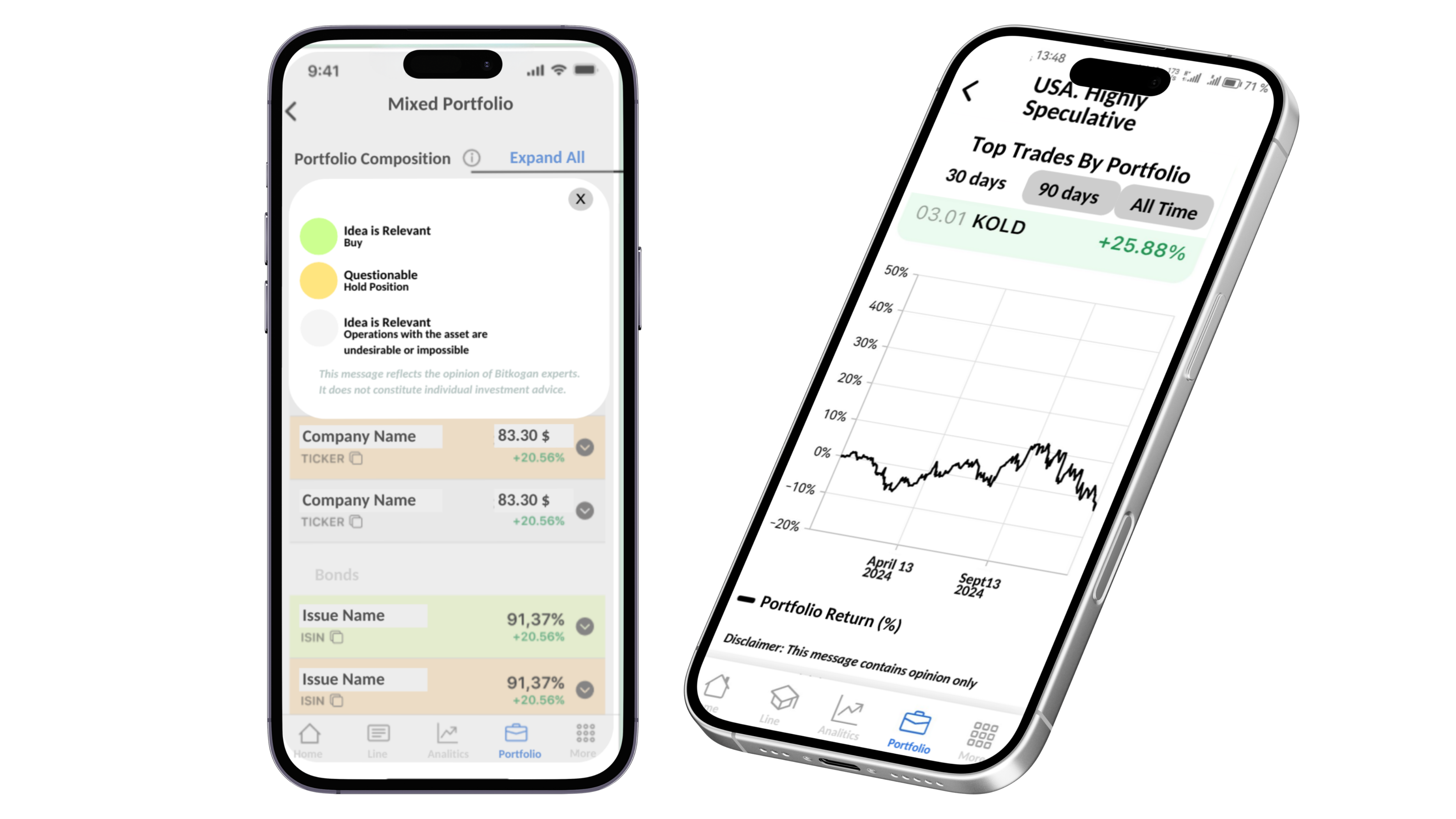

Transformed a struggling investment platform into a robust ecosystem by implementing mobile apps (iOS/Android), web interfaces, and integrated CRM/CMS systems. Key improvements included application stabilization, architecture simplification from microservices to modular monolith, enhanced subscription management, and automated reporting tools. The solution features real-time market data integration, streamlined CICD processes, and comprehensive error tracking mechanisms.

About the Client

The client is a investment advisory and wealth management company founded by a renowned investment banker and professor at the Higher School of Economics (HSE). The company aims to create a comprehensive ecosystem that facilitates investment management for its users. With over 450,000 subscribers, the business provides both paid and free analytical materials to keep users informed and educated.

Project Background

The project was launched to develop a software platform providing investment-based information services. Initially, a third-party vendor was contracted to create a Minimum Viable Product (MVP). However, after two years, the resulting application failed to meet performance and functionality expectations, suffering from severe instability, frequent crashes, and inadequate data management.

In response, the client sought an independent audit from Itexus to evaluate the project’s viability before its planned production launch. The audit revealed critical deficiencies, including outdated libraries and poor system architecture. Despite these findings, the client continued collaborating with the original vendor, which exacerbated unresolved issues and led to a decline in user engagement.

After a year of ineffectiveness, the client shifted to Itexus for a complete overhaul of the project. This transition was complicated by the problematic state of the application, where many components were poorly documented. Ultimately, the project illustrates the importance of effective project management, timely audits, and informed vendor decisions in achieving operational success.

Engagement Model

Time and Material

Project Team

From our side: 1 Architect, 1 Backend developer, 1 Mobile developer, 1 SA (part-time), 1 PM (part-time)

From client’s side: 2 Backend developers, 1 Frontend developer, 1 Mobile developer, 3 QAs, 1 BA, 1 Devops

Tech stack / Platforms

Solution Overview

Intitle: hire fintech developers

Intext: hire fintech developers

https://itexus.com/hire-financial-software-developers/

The solution is a comprehensive investment platform that has been transformed from a struggling system into a robust ecosystem, empowering users to manage their investment portfolios effectively. Through a complete architectural redesign and infrastructure enhancement, the platform now offers a diverse range of investment portfolios for American and Chinese securities, along with ready-made investment ideas managed by professional analysts. It tracks major global indices, stocks, bonds, commodities, currencies, and various financial instruments, providing users with a holistic view of the market.

User Functionality:

Investment Portfolio Management: Users can access diverse investment portfolios, including equities, blue-chip stocks, and penny stocks, with ready-made investment ideas managed by professional analysts. The platform tracks major global indices and provides real-time market news updates and expert analysis.

Educational Features: The platform offers simplified explanations of investment concepts and comprehensive resources to enhance user understanding of investment strategies.

Deals and Promotions: Users receive information on special deals related to investment products and services, enhancing their investment opportunities.

Analytical Tools: Daily analytics and performance charts help users track investments, with insights on how global and local news impact stocks and bonds. The platform also provides trading signals via push notifications for timely decision-making.

User Experience: A user-friendly mobile application interface offers personalized investment strategies, real-time market updates, and expert commentary to guide investment decisions.

Analytics Team Functionality:

Market Analysis: The team conducts in-depth analysis of market trends and investment opportunities, providing expert opinions and regular market insights.

Analytics and Reporting: Daily performance reports are generated, monitoring the impact of news on investments and offering detailed reviews of companies and industries.

Portfolio Management: The team enables users to create and manage diverse investment portfolios, curating and updating ready-made investment ideas.

Performance Tracking: Continuous monitoring and evaluation of investment portfolios are conducted, generating detailed reports on outcomes and strategies.

Data Interpretation: The team analyzes the impact of news on market movements, delivering actionable insights based on data trends.

Accounting Team Functionality:

Financial Management: The team monitors subscription revenues and expenses, generating financial reports to track profitability and ensure compliance with regulations.

Admin Functionality:

Content Management: The admin oversees educational content and resources, providing access to webinars and online courses for skill development.

User Support: The admin manages user inquiries and optimizes the user experience based on feedback and analytics.

Project Challenges

The project encountered several significant challenges that impeded its progress and effectiveness, including:

Vendor Issues: Initial collaboration with the first vendor resulted in a poorly executed product, leading to significant instability, frequent crashes, and unreliable data management.

Fragmented Architecture: Inconsistent implementation of microservices caused conceptual problems at the domain level, contributing to performance bottlenecks and complicating the integration of new features.

Infrastructure Shortcomings: Misconfigured cloud infrastructure hindered operational efficiency and overall system performance.

Inadequate CICD Management: The absence of a structured Continuous Integration/Continuous Deployment (CICD) process meant that builds were assembled manually, causing delays and inefficiencies in the release cycle.

Communication Lapses: Ineffective project management practices resulted in a lack of clear documentation and knowledge transfer, making it difficult to align development efforts with business needs.

Knowledge Gaps: The new team at Itexus faced significant challenges due to a limited understanding of the existing project mechanics, which complicated the transition.

Stabilization Issues: The existing application had numerous stability problems, particularly with push notifications and overall functionality, necessitating a complete overhaul rather than simple fixes.

Complex Payment Logic: The payment processing logic was poorly implemented, requiring extensive reworking to ensure accurate and reliable transactions.

Inefficient Incident Management: The previous system lacked a structured approach to incident management, resulting in delays in addressing critical issues, such as application crashes and downtime.

User Experience Challenges: The user interface was not intuitive, making it difficult for users to navigate the application and access the information they needed effectively.

Transitioning to a New System: Migrating from the old system to the new architecture posed challenges in data integrity and user adaptation, requiring careful planning and execution to ensure a smooth transition.

Resource Constraints: Limited resources and time pressures added to the complexity of the project, necessitating efficient prioritization and management of tasks to meet deadlines.

Managing Stakeholder Expectations: Balancing the expectations of various stakeholders while addressing technical challenges required effective communication and transparency throughout the project.

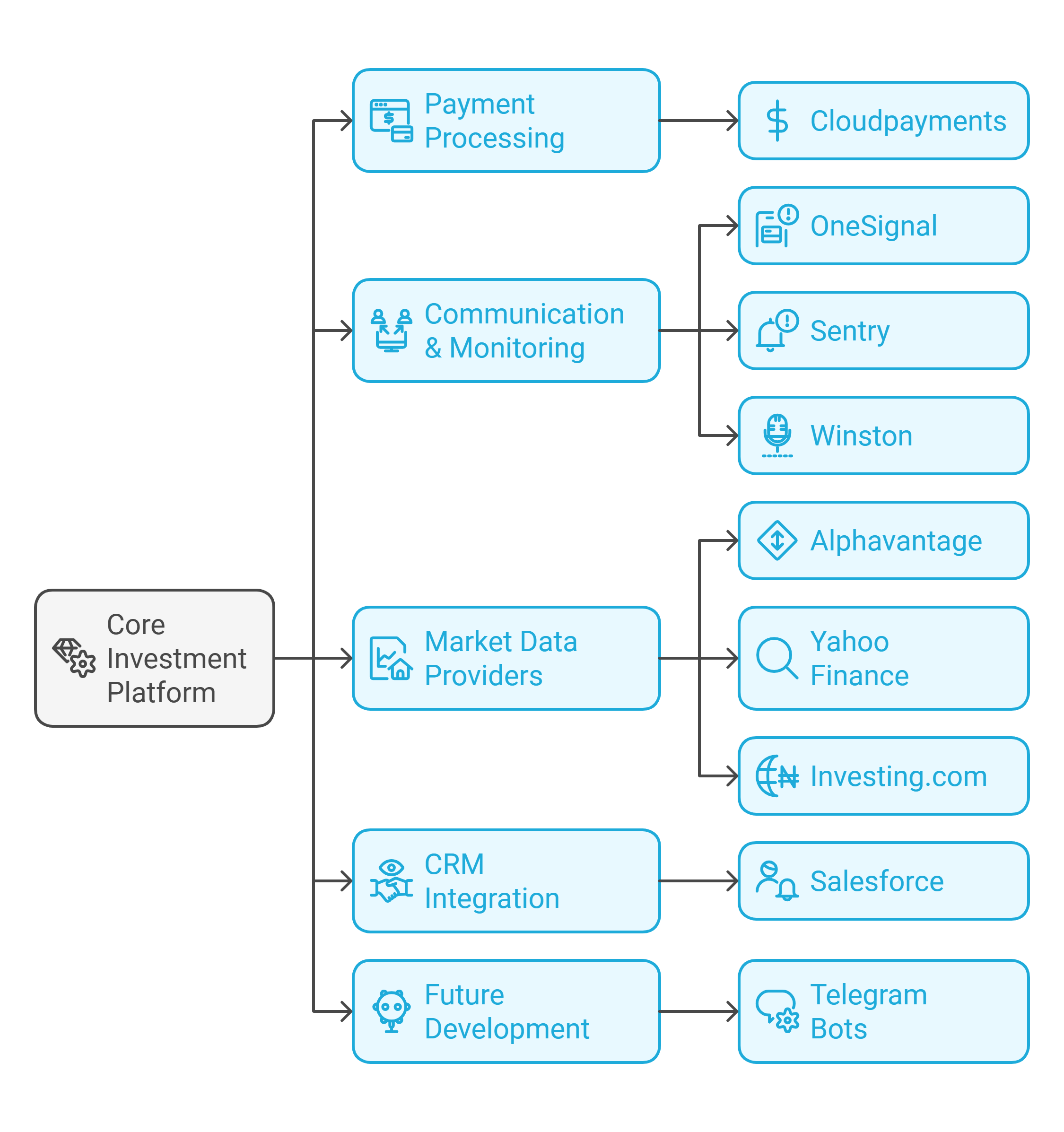

Third-party integrations

Project Scope

The project involved the development and stabilization of a comprehensive ecosystem that included:

Web application

Mobile applications for iOS and Android

CRM (Customer Relationship Management) system

CMS (Content Management System)

Integration Efforts

The team was tasked with integrating existing systems, which included:

Transitioning from OneSignal for push notifications to native push notifications.

Integrating with Salesforce for customer management.

Data integrations with financial data providers such as AlphaVantage, Yahoo Finance, Investing.com.

Payment processing integrations with Cloud Payments.

Architectural Changes

The existing microservices architecture was re-evaluated and transitioned towards a modular monolith approach to enhance stability and performance.

A new application was developed that utilized old code and data but was wrapped in a more stable structure, avoiding the pitfalls of the previous implementation.

Outcome

The solution led to a more stable and reliable application, allowing the client to continue operations with their in-house team effectively.

The project not only stabilized the existing systems but also laid the groundwork for future enhancements, including potential projects involving artificial intelligence to further improve customer engagement and operational efficiency.

Results & future plans

Throughout the project, the need for effective third-party integrations was a significant focus for the team. Initially, the existing setup included integrations with various services that were poorly designed and maintained, contributing to system instability. In the course of the stabilization efforts, it was determined that some integrations, particularly those with local payment providers, were no longer viable and needed to be phased out. Itexus proposed replacing these with more reliable global solutions, such as Cloudpayments, to enhance payment processing and improve overall functionality.

Additionally, the project team recognized the necessity of implementing communication channels for user notifications. While an integration with OneSignal for push notifications was already in place when Itexus assumed the project, the team suggested transitioning away from this service in favor of native push notifications. This change was in line with the client’s desire to reduce costs while increasing system stability. The reliability of application performance was further supported by incorporating Sentry for error logging and monitoring, enabling the team to swiftly identify and address issues as they arose.

For data services, the integration of multiple data providers such as Alphavantage, Yahoo Finance, and https://www.investing.com/ allowed the application to deliver real-time market data, enhancing the decision-making capabilities of users. Furthermore, to facilitate seamless customer relationship management, Salesforce was integrated into the ecosystem.

The goal of these third-party integrations was to create a more cohesive and efficient user experience while ensuring the application remained stable and reliable. The enhancements not only streamlined existing processes but also paved the way for future functionalities, such as the development of Telegram bots to support user engagement and automate notifications, indicating a commitment to leveraging cutting-edge technology in the investment management landscape.

Related Projects

All ProjectsFinancial Data Analytical Platform for a Large Investment Management Company

Financial Data Analytical Platform for a Large Investment Management Company

- Fintech

- Enterprise

- ML/AI

- Project Audit and Rescue

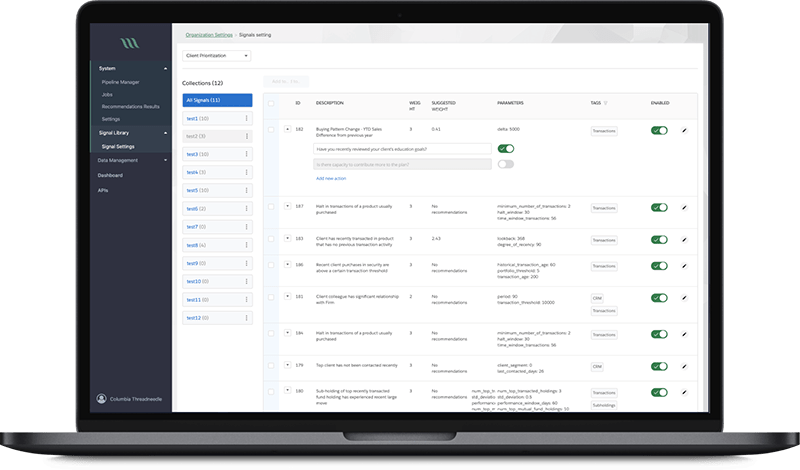

AI-based data analytical platform for wealth advisers and fund distributors that analyzes clients’ stock portfolios, transactions, quantitative market data, and uses NLP to process text data such as market news, research, CRM notes to generate personalized investment insights and recommendations.

App for Getting Instant Loans / Online Lending Platform for Small Businesses

App for Getting Instant Loans / Online Lending Platform for Small Businesses

- Fintech

- ML/AI

- Credit Scoring

Digital lending platform with a mobile app client fully automating the loan process from origination, online loan application, KYC, credit scoring, underwriting, payments, reporting, and bad deal management. Featuring a custom AI analytics & scoring engine, virtual credit cards, and integration with major credit reporting agencies and a bank accounts aggregation platform.

Wealth Management Platform

Wealth Management Platform

- Fintech

Wealth management platform connecting investors with a professional wealth-advisory company, allowing investors to answer a questionnaire and receive either a recommended model portfolio or a custom-tailored individual portfolio, that is further monitored, rebalanced and adjusted by a professional wealth-adviser based on the changing market conditions and client’s goals.

AI-Powered Financial Analysis and Recommendation System

AI-Powered Financial Analysis and Recommendation System

- Fintech

- ML/AI

The system uses machine learning techniques to process various content feeds in realtime and boost the productivity of financial analysts and client relationship managers in domains such as wealth management, commercial banking, and fund distribution.

Contact Form

Drop us a line and we’ll get back to you shortly.

For Quick Inquiries

Offices

8, The Green, STE road, Dover, DE 19901

Żurawia 6/12/lok 766, 00-503 Warszawa, Poland