They’re a great group of developers who really understand the reality of business.

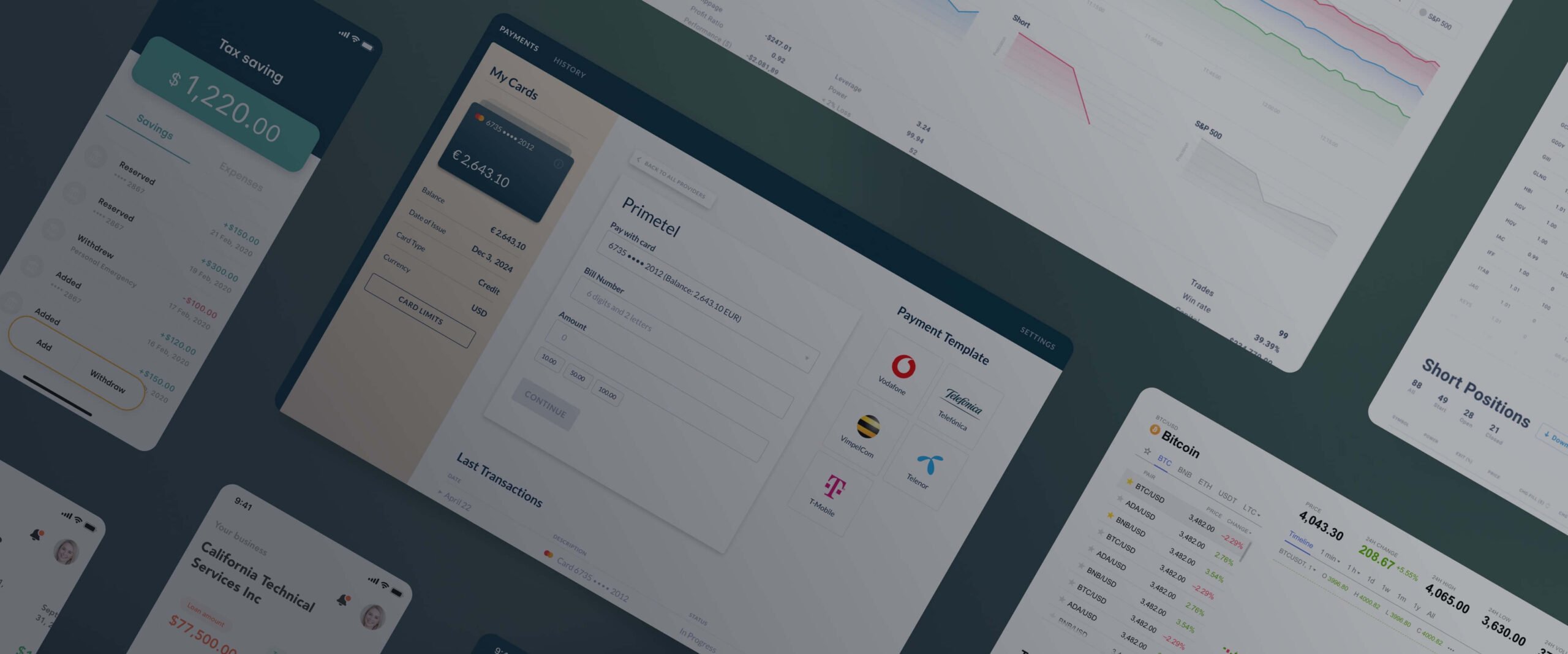

FinTech Software

Development Services

Itexus is a professional fintech application development and consulting company operating since 2013. Based on the immense expertise we have, our fintech app development company helps both enterprises and startups create their digital products, shorten go-to-market time, cut development costs and avoid the pitfalls that lead to project failures.

FinTech Software Development Expertise

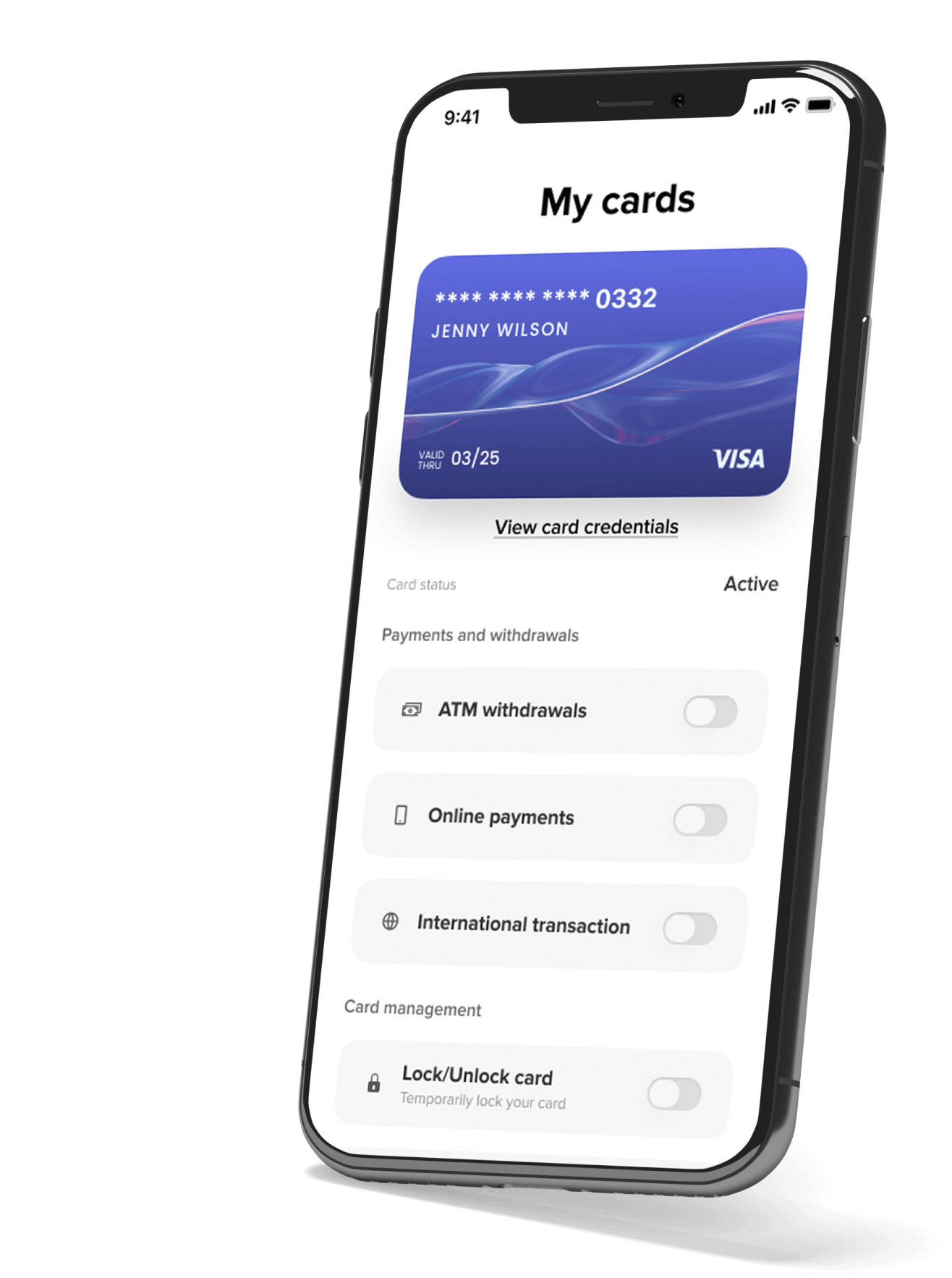

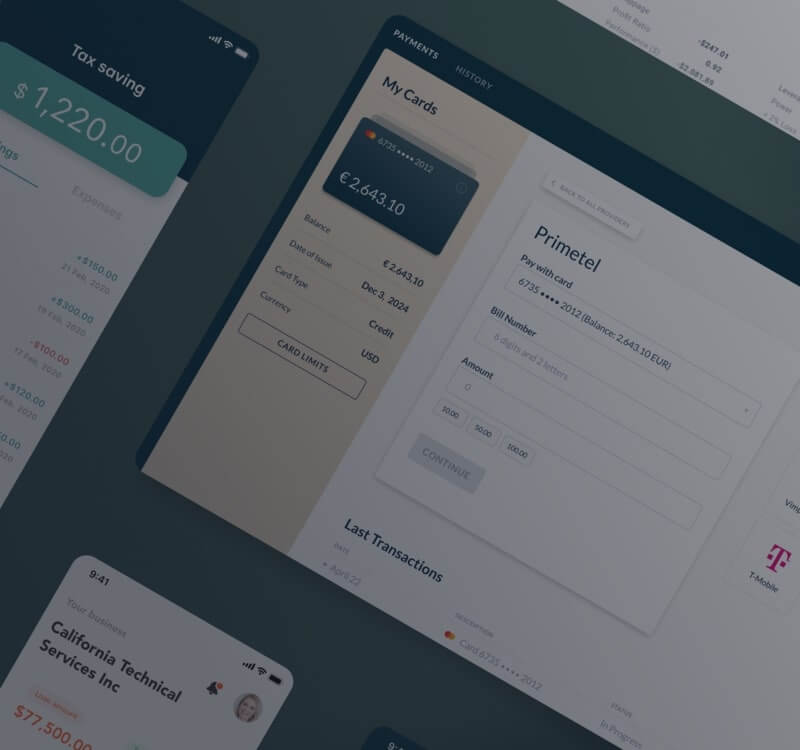

Digital Banking

At Itexus, we invigorate fintech application development services with AI algorithms, online access, and smart chatbots to strengthen customer loyalty and satisfy customers at every stage of their digital banking fintech journey. Our team is digitizing traditional banking through process automation, 24/7 access, and an omnichannel banking experience. We also handle fraud prevention and KYC/AML procedures and ensure full compliance with industry regulations.

- Legacy banking software upgrade

- Process automation and systems integration

- Empowered self-service transactions

- Mobile and online banking solutions

- Implementation of security and fraud detection tools

Digital Lending & Alternative Financing

Itexus builds intelligent lending platforms connected to credit bureau databases and account aggregation platforms. We automate all stages of a loan cycle, KYC, AML, and scoring processes, helping both banks and nonbank digital lenders increase their market reach, reduce default risks, and offer lower interest rates.

- P2P and lending marketplace platforms

- Mobile lending & loans management apps

- AI-based credit scoring

- Loan origination & comparison software

- Digital mortgage broker products

- Crowdfunding platforms

- DeFi Lending & Borrowing Solutions

- Invoice-based financing

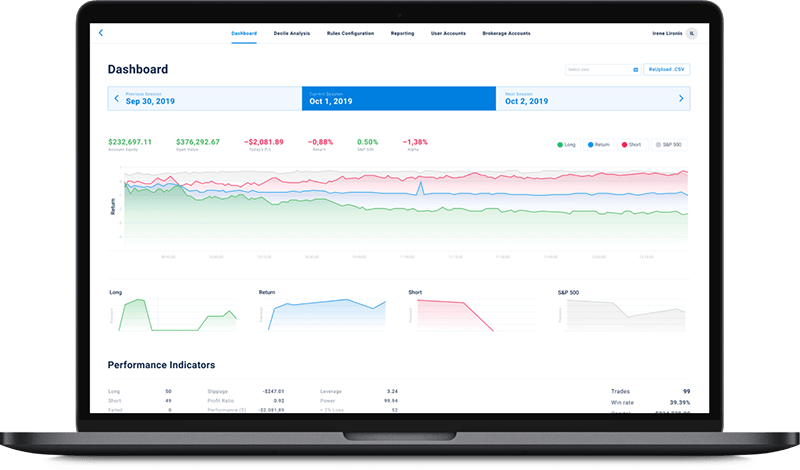

Stock Market Trading and Analytics

As part of our fintech app development services, we build secure, reliable and scalable trading solutions for prop shops, physical exchanges, hedge funds, brokers, and futures commission merchants. From simple trading bots to complex intelligent trading solutions, our fintech software developers go all out to deliver best-in-class trading software based on the latest fintech industry standards.

- Custom online trading platforms

- Mobile trading apps

- Programming and implementation of custom algorithmic strategies

- Trading data analysis solutions

- Liquidity management platforms

- Hedging software and brokerage systems

- Trading execution middleware

- Investment management frontend systems

- Currency exchange software

- Market monitoring & market news tracking software

Wealth Management and Investment

To meet the growing demands of the new generation of clients, our finance app development company builds digital wealth management solutions with built-in automated advisory functionality, data-driven stock market and portfolio analytics, automated transactions and trading. Our breakthrough solutions enable wealth management firms and startups to expand their market reach from HNW/UHNW investors to the vast, underserved mass affluent segment and emerging wealthy millennials.

- Stock market quantitative analytics

- Portfolio construction, analysis and optimization tools

- Real-time algorithmic trading and passive asset allocation strategies

- AI-based robo-advisors

- Mobile stock trading applications

- Financial data analysis and recommender systems

- Natural Language Processing

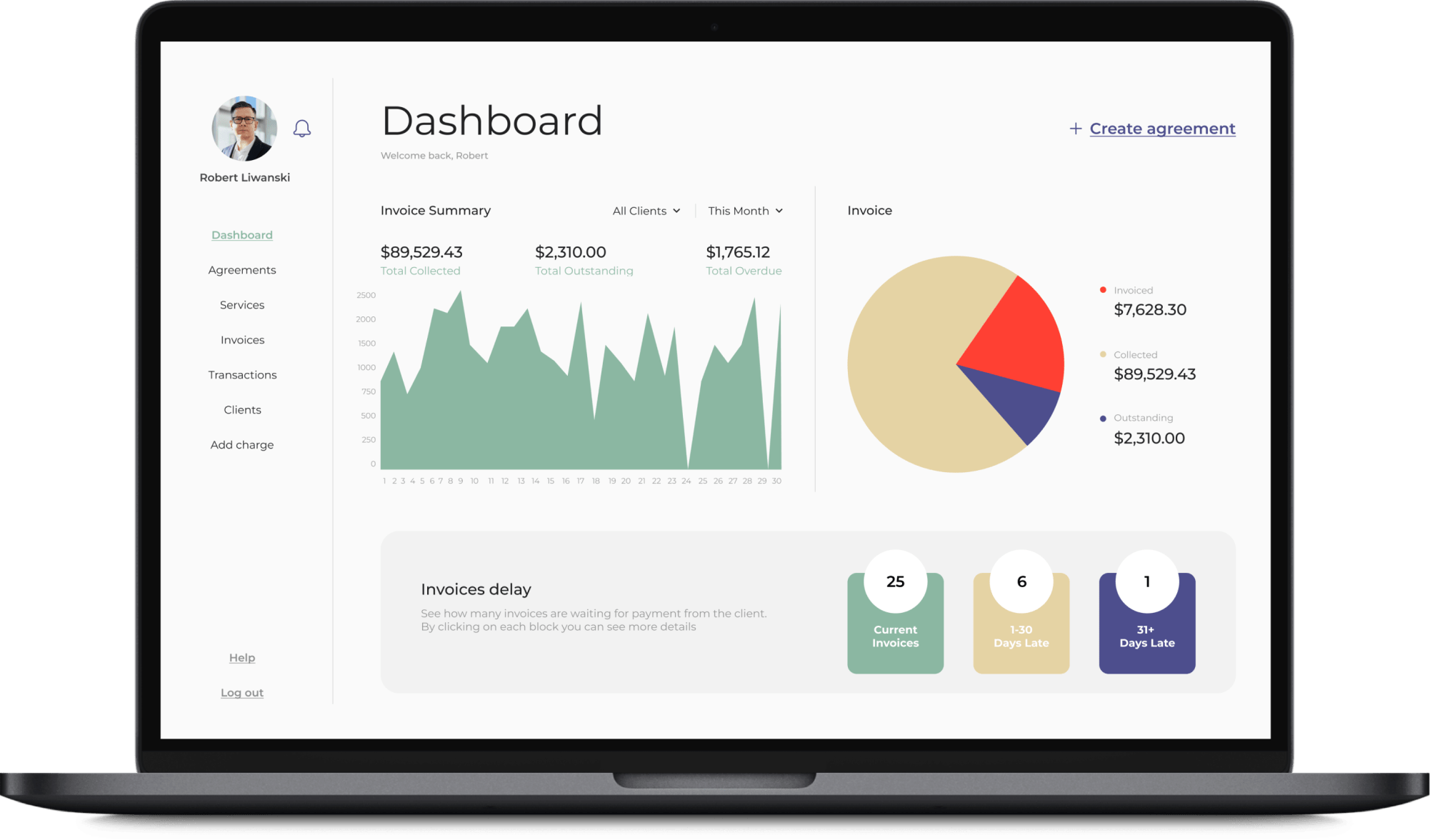

Personal Finance Management (PFM)

Our fintech software development company builds PFM solutions that seamlessly integrate with core banking systems and pull data from multiple bank accounts, credit cards and loans. On demand, we can develop a PFM solution that categorizes users’ spending with built-in AI algorithms, makes data-driven predictions and recommends decisions, automatically transfers money to savings or investment accounts through an online broker’s API to help users plan their financial goals, gives them recommendations for retirement portfolios, and even helps build healthy financial habits with engaging gamification features.

- Account aggregation and expense tracking

- Debt refinancing and optimization

- Financial goals and retirement planning

- Automatic investments and savings

- AI-powered virtual financial advisers

- Gamification and social features

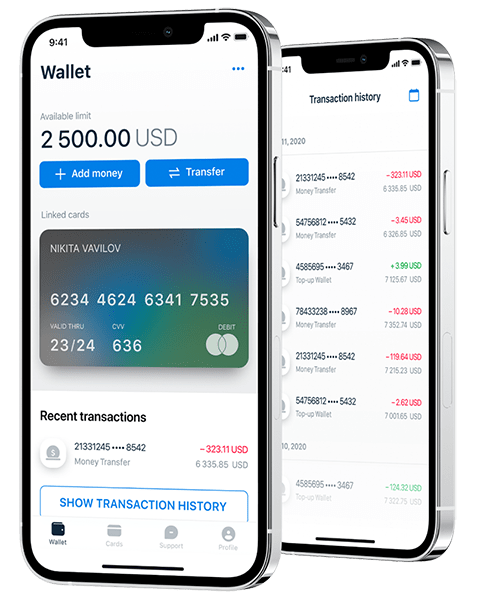

Online Payments

Since its inception, our fintech software development company has delivered a multitude of payment solutions, including mobile payments, B2B transaction platforms, and digital wallets that support millions of transactions per day. Our fintech software development company ensures smooth transactions and superior customer experience while maintaining data privacy, cybersecurity, AML/CFT, and KYC compliance, backed by robust encryption, multi-factor authentication, SCA/2FA/PSD2 authorization, and granular access control.

- B2C and B2B payment solutions, with advanced cash cycle and data management

- Money transaction and money transfer platforms

- Alternative payment methods: digital wallets, NFC-based mobile apps, net-banking solutions

- Compliance with industry-specific standards, threat analysis and fraud prevention

DeFi & Cryptocurrency

Driving the best approaches to implementing DeFi solutions for enterprises and startups, we help them cut out middlemen, ensure high transparency, reduce fraud risks, and make financial processes more efficient through automation with smart contracts. Our experts cover all the challenges that arise in crypto projects development and provide in-depth analysis of current business processes to determine the need for a decentralized ledger and assess the value of a DeFi application for your business.

- Dapp development

- Smart contract logic and development

- Wallet and crypto exchange development

- Decentralized crypto banking

- Decentralized fund management

- Initial Coin Offering (ICO) solutions

InsurTech

We help our insurance clients fully automate and digitalize their business. Cutting the operational costs by automating application, underwriting and claim management processes. Increasing the market reach by simplifying end-client access via mobile phones and online portals with on-demand insurance. Using AI/ML and big data technologies to increase the profitability of the insurance business.

- On-demand insurance solutions

- P2P insurance platforms

- Automated claim management systems

- Insurance AI-powered chatbots

- Client segmentation and analytics

- Insurance product recommendations